Article on: life insurance vs life assurance

Life Insurance vs Life Assurance

| …VS… |  |

Difference between Life Assurance and Life Insurance?

As Life Insurance Brokers, we are often asked ‘what’s the difference between life assurance and life insurance‘.

Back in the 1500’s, the word ensurance was contrived from Latin & French into the English language, meaning “engagement” or “betrothal”.

Soon ‘ensure’ or ‘assure’ & ‘insure’ expanded their meanings & definitions to cover all different types of assurances & pledges of all kinds.

The leading e of the word also became used in language with an a or i. Then a meaning of “financial security against loss” emerged by the mid-1600’s, giving us our modern words of insurance & assurance.

However, in Europe the business meaning of the word Life Insurance vs Life Assurance often has a different association than in other parts of the business insurance world, like America.

Indeed some old UK Insurers have created modern mis-naming issues eg; people called Royal Liver Assurance (Royal Liver Insurance) or London & Manchester Assurance (London & Manchester Insurance).

As such, Google UK search results often mistakes life insurance vs life assurance, and therefore sometimes produces search topic results that are very similar.

However, there are distinct & important differences between both life insurance and life assurance policies in the UK for 2025.

In this article, we will therefore examine those;

- Main UK key features for these 2 types of protection cover

- Life assurance and insurance advantages and disadvantages

- Reasons for taking out a life insurance versus life assurance policy

- The definition of insure & assure

- Different underwriting risk terms

- Impact on their price costings

Is life insurance and life assurance the same? NO, They are not the exact same thing for the UK Life Insurance market.

Insurance vs Assurance

The key differences between insurance vs assurance are as follows:-

* Definition of Insurance = ‘May Happen’

So the simplest definition of insurance in the UK is that you are insuring there is cover in place – on a person, property, object or event – that ‘may happen’ over a certain time period.

eg; You insure your building & contents annually – ‘if ‘ there is damage, accident or loss from fire, storm or flood – within that time period.

* Definition of Assurance = ‘Will Happen’

So the simplest definition of assurance in the UK is that you are assured or guaranteed that there is protection cover in place – on a person or an event – that ‘will happen’.

eg; You assure full cover for the rest of life – ‘whenever’ you die – to help towards funeral & burial final expense costs.

‘Insurance vs Assurance‘

Insurance or Assurance?

Let’s have a look at a few examples to explain what is the difference between life assurance and life insurance.

* Insure Meaning | ‘Life Insurance’ Example:

Case Study 1: You are a young couple recently married & now looking to buy your new 1st time home. You have just had approved a new £225,000 joint repayment mortgage over 35 years.

You are both concerned about your joint finances if something may happen to either one of you, over that 35 years. You are both worried if one of you died or was terminally ill, then the other then has their joint £225,000 repayment mortgage debt repaid.

So you decide to both take out a £225,000 joint decreasing term life insurance for the mortgage over that 35 years ie; if the worst may happen. These life insurance policy premiums are also paid for 35 years, until the mortgage ends.

However, if either of you died in year 36, then this joint mortgage term life insurance will have ended, or run its term …but hopefully so should your mortgage now be repaid also!

Insure Meaning = There is NO need to jointly insure here anymore than just 35 years.

Case Study 2: You are both self employed working parent family, who have 3 young children all under the ages of 5. You rent your 3 bedroom property.

So currently you are all dependant upon each other in some form both financially, physically & emotionally. In the future, you would like your 3 children to hopefully to all go college or university.

Given rising house prices, you feel it could be that some or all of children may still be living at home well into their late 20’s / early 30’s.

You are both concerned about the joint financial impact if something may happen to either of you over the next 30 years & one of you died. This would also be until around you are both likely to retire anyway & probably move abroad to Spain.

So you want to insure then the other has sufficient to help cover the regular £2,500pm ongoing rent and bills. You also want to jointly help cover any future children’s college or university costs. You also want the plan inflation linked over the next 30 years against rising costs & prices. However, you have a limited budget.

You therefore both decide to take out 2 x level term budget life insurance plans, both index linked over 30 years: a joint Family Income Benefits term plan for £2,500pm + £100,000 a joint lump sum term life insurance.

Insure Meaning = There is NO need to insure here anymore than just 30 years.

‘Life Insurance vs Life Assurance‘

* Meaning Assured | ‘Life Assurance’ Example:

Case Study 1: You are retired & sadly widowed. You now wish to leave a £100,000 lump sum legacy to your family dependants, whenever you eventually die, and this not be subject to uk IHT inheritance tax.

You are concerned that as your death will happen – then any £100,000 lump sums life policy will always be available for your family.

So you decide to take out a £100,000 whole of life assurance. The life assurance will pay out the legacy as required & whenever you die, as this event will happen. To help avoid IHT tax, it is also setup in a IHT trust.

The whole of life assurance policy premiums are usually paid for ever (or until you die), even if this was age 195!

Meaning Assured = We all will die eventually. Legacy payouts are therefore always required.

Case Study 2: You & your domestic partner both have some poor health problems re raised BMI kg, raised blood pressure and heart issues.

Having sadly attended some friends funerals recently who died from Covid 19, you were both discussing rising funeral costs during the pandemic 2020’s,

You have been watching those TV adverts about over 50 life cover with free gifts that mention covering potential funeral costs.

So you both decide each to take out a ‘no medical’ over 50’s life insurance cover – as you don’t think you will get affordable whole life assurance that asks medical questions.

Having read the small print, you understand if you died within the first few years, this no medical policy will only payout upon accidental death. Thereafter, you would be fully covered for death via natural causes.

Meaning Assured = Must always help toward cover Funeral costs. Payout is therefore always required.

Life Insurance or Assurance

Life Insurance vs Assurance

The Difference between Life Assurance and Life Insurance

* Whole Life Assurance = LIFE ASSURANCE

Whole Life Assurance stands alone in the UK life assurance vs insurance marketplace. The reason being…

Key Facts

- It guarantees to pay out a lump sum ‘whenever you die’

- Has no set or fixed time frame, unlike term life insurance

- You are covered even if you live to 350 years old !

- Check your whole life assurance plan T&C’s.

5 Key Reasons for Whole Life Assurance v Insurance

- Life assurance advantages of always a payout – whenever that maybe

- Help toward Final Expense costs

- Assure against possible Inheritance Tax IHT liabilities

- Cover a Lifetime Interest Only Mortgage

- No Future Health Issues continuous ongoing life cover

Whole Life Assurance Types?

- Guaranteed: Medical questions, non-reviewed premiums & no investment element

- Investment: Medical questions, reviewed premiums with investment element *

- Over 50’s: No medical questions, fixed premiums & no investment element

In other parts of the world, whole life assurance can also be called universal life insurance or permanent life insurance.

‘Life Assurance vs Life Insurance’

3 main types of whole life assurance

* ‘Guaranteed’ Whole Life Assurance | Medical Questions

- Policy is fully underwritten

- Insurers ask medical lifestyle questions before offering assurance cover

- eg; Do you have or family history of raised cholesterol

- May involve nurse medical tests & GP reports

- Option of own life, joint life 1’st death or 2’nd death

- Premiums are fixed and paid for rest of life ie; until a claim

* ‘Investment’ Whole Life Assurance | Medical Questions

- Investment linked assurance plans are much more complex than guaranteed

- Premiums are invested into a Life Insurers investment fund, which can go up & down

- Life Insurers can review premiums regularly assessing both age & fund value etc;

- The savings value can be setup on ‘Maximum’ or ‘Standard’ used to navigate the plan through life

- Reviews could mean your premiums increase regularly to help cover life sum assured

- Investment backed plans we may refer you to a suitably qualified IFA

* ‘Over 50’s’ Whole Life Assurance | NO Medical Questions

- There are usually no in depth medical & lifestyle questions to qualify

- Initial 1 or 2 years exclusion before assurance of full natural death claims

- Smoking & Vaping status affects premium costs

- Insurers may stop taking premiums from age 90/95 but maintain your cover

- Lower cover levels generally offered for a fixed cost than other 2 whole life assurance

- Martin Lewis is not a big fan of Over 50’s no medical style schemes.

- Many use Over 50’s plans | Over 60’s plans toward Funeral funding than a prepay funeral plan

‘Difference between Life Insurance and Life Assurance’

* Term Life Insurance = LIFE INSURANCE

This is the most common type of Life Insurance as it runs for a set term, time frame or period. It is often the cheapest insurance v assurance, as it’s often cheap & cheerful.

Key Facts

- Asks you medical & lifestyle questions eg; any asthma or under active thyroid issues before offering rates

- They are simple policies to operate; if you die within the nominated ‘term’, your family will receive the set life insurance payout

- Because it runs a set term, it may have affordable fixed premiums [as you may live out that nominated term]

- Often includes terminal illness (advanced death claim) & optional life cover and critical illness cover

- Options of level cover, decreasing cover, increasing or income cover from outset

- The longer it runs the more expensive it is & you can take out a term life insurance upto age 90

Main types of Life Insurance versus Life Assurance

* Level Term | Life Insurance

- Level Term cover means the amount of payout cover remains level or the same, from the start to the end of the plan

- This also means the payout risks to the Life Insurers remain level or the same from start to end

- So, if the level term life insurance was setup for £255,000 and you died in year 13, it would still payout a £255,000

- However, as it runs for a specified term eg; 22/33/44 years, then any claim payout will only be within that time frame

- If your plan ran for say 22 years, but you died in an accident in year 22 and 2 months, then the plan has ended

Note: level term insurance vs assurance difference is financially clearer here

* Convertible | Life Insurance v Life Assurance Option Conversion

- Convertible life insurance allows you ‘convert’ or trade in your life insurance vs assurance whole life

- This policy trade in conversion comes at an additional upfront cost at the outset against ordinary level term

- Convertible allows to trade it also without further health underwriting or medicals

- Typically this life assurance life insurance trade swap must usually happen before age 55

- The cost of this conversion at that time will depend cover levels required, age and life expectancy

Note: If the ‘life insurance life assurance’ switch never happens then you have overpaid for your life cover

* Decreasing | Insurance for Repayment Mortgage

- The decreasing life insurance amount decreases from the start to the end of the plan at a set percentage

- Usually this means the decreasing cover roughly follows the repayment mortgage debt over its term

- If the policy was originally setup for £189,000 over 25 years to help cover a £189,000 repayment mortgage

- You now sadly died in year 24 & the cover may now have reduced to say only £8,000 value

- However this should help repay & mirror your remaining £8,000 mortgage

Note: The difference between life insurance and life assurance here is you cannot take decreasing whole life assurance

* Income Benefit | Regular Insurance Payments

- A Family Income Benefits term insurance pays on death a set regular income

- The monthly income upon a death claim is then just paid for the remaining fixed term of the plan

- Example: £2,500pm FIB policy benefit over 15 years. A death claim comes in year 9

- So it then pays £2,500pm for upto 6 years upon a death claim and then the insurance ends

- This means you could setup plan until say children are independant or upto retirement

Note: Like decreasing life insurance the amount owing on death reduces over the term

Life Assurance and Insurance Advantages and Disadvantages?

* Life Assurance Advantages | 5 Key Benefits | WHOLE LIFE

- Guaranteed to payout whenever death occurs once deal agreed

- Cannot be cancelled by Insurers due to poor health, illness or hospitalisation

- Lifetime peace of mind – ideal assurance for those over age 50, age 60 or age 70

- Some plans offer early access due to old age illness like early onset dementia

- Ideal for inheritance tax planning or funeral funding

* Life Assurance Disadvantages | 5 Key Negatives | WHOLE LIFE

- Usually much more expensive than term life insurance

- May offer much less life assurance for your money

- With investment-backed reviews premiums could increase to cover mortality risks

- If you cancel non-investment backed plans there are no cash in surrender values

- The assure vs insure underwriting maybe stricter here as the policy will payout

* Life Insurance Advantages | 5 Key Benefits | TERM LIFE

- Good for those on a fixed or limited budget

- Guaranteed to payout if death occurs within term once deal agreed

- Life insurance and life assurance difference is term life often cheaper for cover

- Cannot be cancelled by Insurers due to poor health, illness or hospitalisation

- Ideal for family, mortgage & debt protection

* Life Insurance Disadvantages | 5 Key Negatives | TERM LIFE

- Difference life insurance and life assurance it will just run for the set term

- Insurance vs assurance meaning no guaranteed death payout once policy ends

- If you have bad health interim you maybe unable to get life insurance again

- Premiums may also increase when you re-buy more insurance as you are older

- If you cancel there are no cash in surrender values

How much ‘Life Assurance vs Life Insurance’?

The key difference between life insurance and life assurance uk brokers find, is how much cover people insure for. As life assurance is whole life cover, it is usually alot more expensive, as it will payout.

So when comparing the difference between life insurance and life assurance underwriting risk on premium costs, it sometimes could be more than double the premium cost comparing ‘like for like cover’ amounts.

For example: A person aged 40, smoker, fit & healthy: A term life insurance for £250,000 upto age 90 could cost around £100pm OR for £250,000 whole life assurance £300+ pm.

The reason being simply put – The life assurance and life insurance cost difference here is = Whole life cover will payout BUT Term life cover may not, as you may possibly live beyond age 90.

The question you need to ask yourself and look at is ….Do you need to have any specific life insurance needs beyond age 90?

Note: The average life expectancy in the UK is around age 80.

Assuming you are alot younger & reading this article, then that may seem a lifetime away anyway. ![]() So let’s look at what’s the difference between life insurance and life assurance ideal cover amounts.

So let’s look at what’s the difference between life insurance and life assurance ideal cover amounts.

Is it Life Insurance or Life Assurance I need?

As UK Life Insurance Brokers in an ideal world – we would suggest following this simple formula.

- LUMP SUM > Repay any mortgage & debts, cover funeral costs

- INCOME > Help cover your monthly bills

- LUMP SUM > Back up for holidays, education, emergencies

Martin Lewis Best Life Insurance formula however is to aim to cover 10 x the Annual Income of the Highest Earner or Main Breadwinner until any kids have finished full-time education.

Using that principle, if you earned for example £38,500pa gross, Martin says you should maybe consider insuring yourself (after any mortgage, loans, credit card debts are repaid) for £385,000 life insurance (ie; 10 x the annual gross income).

Interestingly, he simply recommends insuring your gross income of £38,500pa – but not net after tax income in this Martin Lewis 10 x rule example.

Following on from this simple Martin Lewis example formula above, if you then worked for the next 26 years until retirement, you could potentially earn over £1 million gross ie; £38,500pa x 26 years = £1 million [or more with any future inflationary wage rises].

As such, unlike the 10 x £38,500 gross salary life insurance example above – you could instead protect each other with either;

- Income = £3,208pm or £38,500pa family income benefit term cover until retirement

- Lump sum = £1 million (But is it a life insurance or life assurance policy you take out?) if then invested @3.85% = £38,500pa

- Or a mixture of the 2 policy types – all dependant on your family circumstances

Neither takes into account repaying any mortgages, loans or debts.

- You can decide wether you want the life assurance or insurance cover to be level or inflation linked

- 2 x seperate plans | or Joint life insurance 1’st claim

- Check cost differences between life assurance and life insurance before deciding best approach or talk to a broker

- Premiums may depend on your age, health, lifestyle, cover levels, policy type

- It could be you are offered standard costs or have to pay abit extra insurance health priced risk

- Any paid for extra feature benefits (like critical illness, premium waiver) you want will also affect the cost

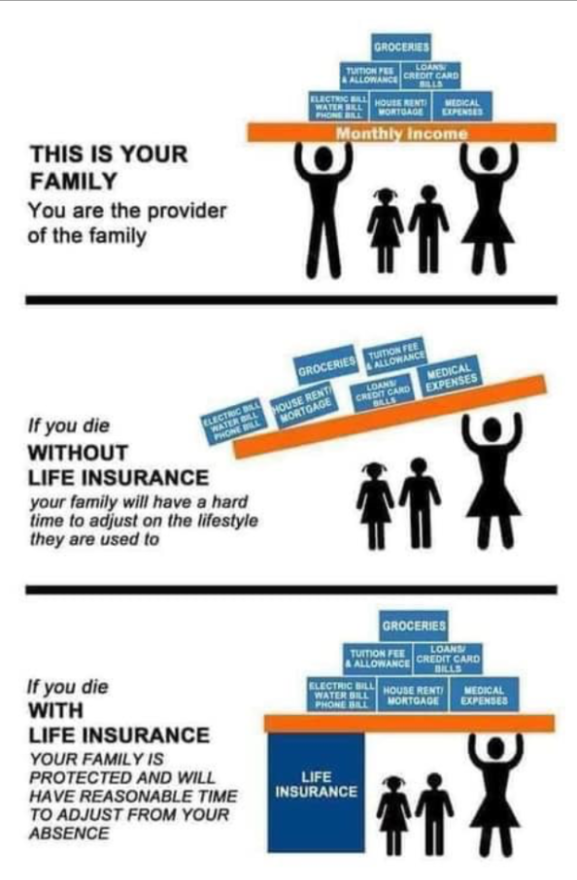

Apart from losing a loved one, this real hidden income threat is what could be lost if one of a main breadwinner died prematurely.

Broker FAQ Top Tips

Terminal Assurance vs Insurance Critical Cover

Terminal Illness is often included for ‘free’ as part of a life cover

- It usually means a GP consultant has advised you could have less than 12 months to live

- Terminal Illness means you will not survive long term after a claim

- Once agreed by Insurers, they may then assure you will be paid out your policy death claim but in advance

Critical Illness coverage is policy, that helps protect you if you are diagnosed critically ill (but crucially not terminally ill) more likely to survive & as specified by Insurers. The top 3 benefits most Uk Insurers cover are for types of cancer, heart disease & stroke* ABI.

It pays out a tax-free sum that you can use, however. To help repay the mortgage, some lost income whilst you recover (although income protection maybe a better longer term policy in that respect).

- Critical Illness as explained, may pay out claims crucially upon ‘diagnosis and survival of the specified illness’

- It means you may live, survive & claim

- Some plans may also provide some cover for your children

- Note:lifecover and critical illness plans are often combined anyway

Putting your Policy Into Trust?

- Ensures it should go direct to your nominated beneficiaries via the trustees

- It tells the Life Insurance Companies who you want to get the money if you sadly died

- Putting your policy into ‘trust’ may also help to avoid probate delays & inheritance tax

- Without a trust the policy could fall back into your estate, This applies even if you have made a valid will

- Most Insurers do supply free a good range of generic life insurance trusts, ideal for many client situations

Importance of Disclosure re Claims?

All UK Insurers are in business to protect, insure & payout. Life is therefore based on your full disclosure at the time you take the original policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying.

The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless manner when applying. If so, it may not payout ! eg; If you vape, then you must tell them you are still smoking (even if it costs more & you feel that it’s wrong and you should not pay the same premium as a cigarette smoker).

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details.

They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details. If you look at most Insurers recent claims payout, you will see that it is Good (but like most Insurers – not 100%).

What is the difference between life insurance and life assurance here is the same. Misrepresentation could cost your family & dependants at the worst time possible!

What if health or lifestyle changes after starting the Plan?

Any health or lifestyle changes since, usually does not void your existing life policy, if it wasn’t relevant at that time of initial underwritten insurance application. It maybe the Insurers request GP reports when you originally apply, to check any health details disclosed. Likewise they may not.

So take care to doubly re-check on your application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original T&C’s.

The key difference between life insurance and life assurance here is with whole life assurance this need not concern you, as you have potentially locked into the deal forever.

However, with term life insurance, it could be you are unable to get more affordable cover as your existing policy ends or even declined underwritten terms. This may not concern you if it was say mortgage repayment cover only

Conclusion on ‘difference between life assurance and life insurance’

I hope that gives a brief background as to what is the difference between life insurance and life assurance & why you should consider each. Please check out & Compare Online Broker only deals here.

If family members are also dependant upon you, then you know it makes good sense ![]()

Article on ‘Life Insurance vs Life Assurance’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best brands selling Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'