Article on: IHT Inheritance Tax in UK

Life Insurance Inheritance Tax Uk .

Life Insurance for Inheritance Tax IHT

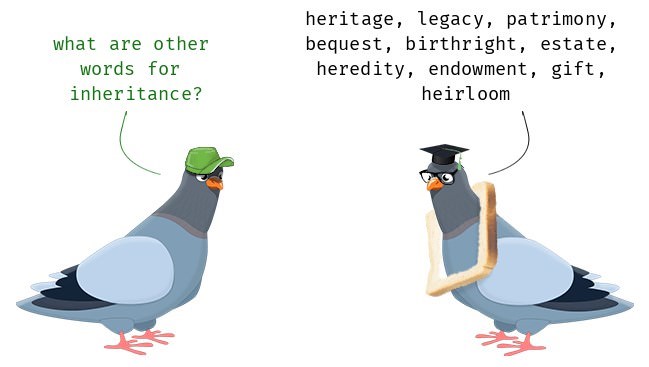

In this article, we will look at Inheritance Tax in the UK (IHT) rules and how you can use Life Insurance for Inheritance Tax purposes.

You will see that there are several valid IHT allowances, which could be used to help reduce a person's potential IHT Tax Bill.

We will examine these first, before then delving into the different types of Life Insurance for IHT available in the UK marketplace.

Note: We do not provide legal advice or any matters in valuing an estate to calculate IHT, so recommend you seek professional advice first.

'How Much Inheritance Tax'?

Background History

Inheritance Tax in the UK perhaps dates back to the end of the 1600's. In 1694 a new probate duty was introduced, a tax on personal property in wills and proved in court to probably help finance England's involvement in the 9 years war.

In 1796, the Government then introduced a new tax on estates, perhaps to help fund the coming wars against Napoleon or not. In the 1894 Budget, another new tax was setup on the capital value of land & called it Estate Duty. Like all taxes, they were introduced in a bid to raise money and to help pay off government deficits at that time.

Moving forwards several hundred years & today Inheritance Tax in UK (IHT) is still paid on a person's estate when somebody dies. It is paid on their estate related to any property, money & possessions someone accumulated during their lifetime.

'Inheritance Tax Thresholds' (IHT)

- £325,000 per person is threshold for Inheritance Tax in the UK

- Inheritance Tax IHT rate charged is 40%

- How much Inheritance Tax charged is only based on an estate that’s 'above this threshold'

- For Estates worth over £2 million there is a tapered allowance

What is Inheritance Tax Threshold in UK?

'What's inheritance tax threshold' in UK? Well, as mentioned estates begin having to pay any Inheritance Tax only once they are valued above this £325,000 'inheritance tax thresholds' UK limit.

Example: Your sole estate upon death is worth £750,000 & your current 'tax-free threshold' is £325,000 > (£750,000 - £325,000 ) is the basic Inheritance Tax calculation = £425,000 @ 40% Tax = £170,000 liability... So your Estate now has a duty to pay that HMRC Tax Collector Person - £170,000 re IHT Tax Bill ![]()

Due to the enormous Pandemic economic costs in the 2020's, Inheritance Tax in the UK has always been a hot potato to perhaps help future Governments reclaim much needed revenue?

IHT Tax Threshold for Married Couples

Apart from the legal status, there are valuable financial benefits re UK Inheritance Tax Threshold for married couples or in a civil partnership.

In many cases, there is no UK inheritance tax to be paid should you leave everything to your legal spouse or civil partner. However, if you did make some official bequests in a will to other people, then the unused portions of your nil rate band are then transferred over to the surviving spouse. It is important to note the benefits of making IHT efficient wills, which we will touch on later.

Example: A civil partnership couple called Alan & Stephen. If Stephen were to die first he has left various bequests in his will to family members (other than Alan) of £125,000 and within the tax free allowance of £325,000. That leaves £200,000 unused threshold that can be then added onto Alan's tax-free allowance, bringing the total IHT exemption figure on Alan's death to £525,000.

HMRC Guide | Calculate IHT | UK Inheritance Tax Rules

Wills, Executors & IHT

The importance of making a valid will doesn't only relate to ensuring your family are looked after when you die. It may be possible to reduce the amount of IHT tax payable on any inheritance, if legal advice is taken well in advance and a correct will is made to reflect this. We will examine some of these tips & options later on.

The 'Inheritance Tax Calculator' is that person/person's dealing with the deceased persons' estate. These people doing the IHT calculations are called ‘executors’ (if that deceased person made a valid will).

Executor's could be professionals like solicitors, accountants, banks. Alternatively, they could be trusted family members that you believe maybe financially, morally and ethically in a position to deal with such important matters. The key words being used here are trusted, ethical, moral & financial.

The last thing you or family would want is to be let down by their executors incorrect or inappropriate actions, at their time of need eg; They misuse the funds.

If it is family members being used, it is also best that they don't live abroad or miles away ie; as it could be very difficult for them to fly backwards & forwards?

Note: If only using professional executors, then to help cover their business time & expenses, they will charge a fee, which could be fixed or variable. We recommend any deal agreed is ideally upfront, to know where you are & to help avoid costs mounting.

To settle a deceased person's estate is often very time consuming ie; sale of their property, investments & any business interests. The Executor's have to delve into that person's financial affairs, that maybe prior to their death, it could be they were totally unaware of. Sometimes, secret hidden bank accounts or secret hidden debts may come out at that time, these could be good or bad?

Often settling an estate, especially if complex, could be months before things are finalised for the beneficiaries. However, maybe that HMRC Inheritance Tax Collector person is that unknown beneficiary & is usually the first in line in your Will ![]()

Valuing an Estate | 'Calculate IHT'

To find out if Inheritance Tax is due, the executors must be first start by Valuing an Estate to 'Calculate IHT' (at date of death).

A person’s UK estate means adding up all the Assets in the estate

- Main Home

- Other Properties, Buildings or Land

- Money & Investment in banks, building societies or ISAs

- Stocks & Shares

- Household items, including Furniture, Paintings & Jewellery

- Cars, Caravans, Boats

- Business Interests

- Foreign Assets & Property Abroad

- Money owed

- Death in Service

- Life Insurance & Death in service (if not in trust)

Deduct any Liabilities in the Estate to then help toward Calculating Inheritance Tax bill due.

- Mortgages, Loans & Credit cards

- Unpaid Bills & Debts

- Any other amounts owing or due

'Calculating Inheritance Tax' 2025

To assist here re calculating IHT bills due, please use our *HMRC Calculator above active link.

Note: There’s an additional inheritance tax allowance to be aware of when calculating IHT – the UK property residence nil-rate band.

An estate may also include the deceased's share of any jointly owned assets & the value of any assets held in trust.

You should also evaluate any gifts that the deceased may have made in their lifetime to see if they are exempt.

If they aren't exempt, include them in the overall value of the estate to calculate IHT to see if they are over the threshold for Inheritance Tax in the UK.

From all this information after Calculating Inheritance Tax likely due, you should now be able to then move forwards into looking at Probate.

'Inheritance Tax in the UK' & Probate

Probate is basically the legal authority to deal with the assets of a deceased person's estate ie; Legal authority over their bank accounts, property, shares, mortgage and debts.

The UK probate process involves getting a grant of representation or grant of probate or in Scotland grant of confirmation. This confirms the legal authority to administer the deceased's estate. It is done after valuing the entire estate of the deceased, and to calculate any Inheritance Tax then due. It can often take an average 9 months to get this grant of probate fully approved.

Part of the grant of representation process for Inheritance and Probate, you must show them either that that 'there is no Inheritance Tax to pay' or that 'there is IHT to pay' after calculating IHT on an estate. Their correct forms can be either completed online or via post.

With Inheritance and Probate, IHT Undercalculation means the Executors could be held personally financially liable![]()

Overcalculation of IHT in probate, you may risk the estate paying more to the HMRC Inheritance Tax Collector person!

Probate Life Insurance

How would you know if somebody had a life insurance policy?

People often keep all their old paperwork shoved in the back of drawers somewhere. This can make it hard to establish if they still have life insurance policy or not?

Also, to make it more confusing, many Life Insurance Companies in the UK have been taken over eg; An old life policy with London & Manchester Insurance is now dealt with via Aviva.

- Look among their paperwork for the Insurers actual Policy Document (not any old quote)

- Any Life Insurance Trusts

- Do any family members remember agreeing or signing to being trustees

- Check the policy start date and end dates ie; Is it still going or ended several years ago

- Is it Term Insurance that has an end date or Whole life insurance that just goes on until you died

- Emails from Insurers

- Check their bank statements

- Any Insurers name appears

- Check any bank direct debits are still being paid either monthly, quarterly or annually

- Reference numbers tie up

- Note: Some Life Insurance plans were 'one off' payments

- Or they stop at a certain age, like many Over 50's Lifecover plans eg; no more regular payments are made after age 90

How long does Life Insurance Claim take?

You can make any death claim with their Insurers via the phone or online. This is the typical information they need...

- Deceased's Full name & Date of birth

- Home address & Life Policy ref number

Then abit about you, the person making this death claim...

- Your Name & Relationship to the person who’s died

- Contact details

- Grant of Probate or Grant of Confirmation

Plus information about the person who died...

- Cause & Date of Death

- Valid Will

- Marital status & Any children

Speed of Life Insurance Claim?

There is no exact timescale here. It all depends on the Insurers looking at all the information they need, before being able to decide on making a valid claim. This must be taken into account if calculating IHT (should for example the insurers unfortunately reject a death claim).

Example: Life Insurance Policy is for £250,000 and cause of death on the certificate is heart attack but likely associated re their smoker status. The Insurers check their original application form and see the client said they were a none smoker at the time. So, the Insurers may now need to investigate further to establish the validity of the claim re disclosure.

This maybe a strong example. However, as you can appreciate, if asked how long does a life insurance claim take, then each death claim is treated on a case by case basis.

Once the Insurers agree to pay a death claim, and they have everything needed, the payment could take as little as a week.

If the Life Insurance policy was set up into a Trust (see section below) it isn’t counted as part of their estate on death. So the trustees can transfer the death payment to the beneficiaries before grant of probate is granted.

Unclaimed Life Insurance?

Having checked all the above, some life insurance policies do remain unclaimed.

There’s no time frame for a life insurance claim. If a payout is due, it can still be claimed. But there is a limit to how long an insurer can hold on to a policy, once they know the policyholder has died.

- Insurers hold plans for average 2 years

- Check Unclaimed Assets Register

- Whole life plans only get added after age 100

- If 15 years unclaimed money goes Government Dormant Assets then to charity

Inheritance Tax Payment

You must pay Inheritance Tax by the end of the 6th month after the person died. Example: If a person died in July, you must pay Inheritance Tax by 31 December.

HMRC Inheritance Tax Collector person will charge interest if you don't pay by the due dates. Note: Different due dates apply if you make payments on a trust.

Life Insurance written into Trust?

Life Insurance is not currently subject to income tax or capital gains tax at the point of payout. BUT how it is treated there afterwards for IHT is entirely different ie; once the proceeds are paid over.

If the deceased has any life insurance plans - then the Life Insurers are obliged to also notify HMRC.

If any Lump Sums Life Insurance written into Trust are not in place, then for Inheritance Tax purposes, this could unnecessarily increase their estate to calculate IHT. It could therefore potentially cost or waste 40% of the life insurance payout to the family in need !

Example: £250,000 life insurance pays out onto a deceased estate. Policy NOT set into trust. The Estate settled is over the IHT threshold and so the amount finally paid is not £250,000 but just £150,000 after 40% IHT tax ie; £100,000 went to the HMRC Inheritance Tax Collector person.

A life insurance written into trust from outset, or even once it's in place, is one simple way a family can help avoid a big IHT surprise bill on any death claim payout.

Life Insurance Trusts

Most UK Life Insurers do provide various free standard worded protection trust documents. These could be suitable for most people's situation, when setting up Life Insurance for Inheritance Tax purposes.

The trustees (like the executors) are people that you believe maybe financially, morally and ethically trusted in a position to deal with such important matters.

A trust usually comprises 3 parts:

- The Settlor/s ie; Yourself

- Trustee/s ie; Ideally 2 or more people

- Beneficiary/s

Typically Insurers offer 3 trust styles applicable here...

- Discretionary Trusts

- Flexible Trust

- Absolute Trust

However, this is potentially a complicated area and if these standard insurers trusts are not satisfactory, then it could require advice from either your legal adviser or solicitor.

But either way, when taking out life insurance for IHT planning it is very important that you should write your life insurance plan into a trust from the outset.

That way any proceeds from the policy go directly to your beneficiaries (so do not re-form part of your estate for tax purpose) otherwise this may defeat the object of the inheritance tax exercise !

When does Inheritance Tax kick in? Above £325,000 in the UK at 40%.

Inheritance Tax Estate | Intestacy

Complications come if the person dies intestate ie; the deceased had not made a will or the will made was invalid. Nearly 60% of people in the UK have not made a will.

Assets left to any surviving spouse or a registered civil partner are free from IHT. However, under the intestacy rules, which apply when someone dies without a Will, not all of the deceased's estate will necessarily pass to their surviving spouse.

If someone is married or legal civil partnership & there are surviving children, grandchildren or great grandchildren of the person who died and the estate is valued at more than £270,000, the partner will inherit:

Citizens Advice says The rules are often complicated and can sometimes result in unnecessary IHT sadly being paid at the time ![]()

Advice for helping avoid unnecessary IHT bills here? Make a Valid Will that looks to address any Inheritance Tax issues you believe may arise.

Increased IHT Tax Allowance | Married couples & Civil partners

Since 2007, married couples & registered civil partners can effectively increase the threshold on their estate when the 2'nd partner dies - to as much as £650,000 ie; £325,000 nil allowance x 2.

Their executors or personal representatives must legally transfer the 1'st spouse or civil partner's unused Inheritance Tax threshold UK or 'nil rate band' to the 2'nd spouse or civil partner when they die.

IHT on Property | Tax Threshold Relief

From 2017 - there was also the new personal domestic only main IHT on Property tax allowance relief. These 'inheritance tax for property' rising figures went as follows...

- £100,000 in 2017 to 2018

- £125,000 in 2018 to 2019

- £150,000 in 2019 to 2020

- £175,000 in 2020 to 2021

This means that alongside the £325,000 IHT threshold per person - this new 'inheritance tax on property' now includes potentially £175,000 main domestic property relief. Totals therefore £500,000 per person or £1 million overall nil rate allowance for Inheritance Tax for couples.

If you downsize in the future, this IHT Property calculation is also still valid. We suggest you seek legal advice here & document any transactions for HMRC purposes.

Inheritance Tax on Gifts

How to avoid Inheritance Tax in the UK?

Inheritance Tax in the UK

'How to Avoid Inheritance Tax' UK

7 Top Tips on how to avoid Inheritance Tax in UK

- Gift away Money & Assets = Survive 7 years

- Pass on a Business = Survive 2 years

- Leave Money to Charity or Political Party

- Make a Valid Will

- Set up Suitable Trusts

- Gifts out of Earned Income

- Life Insurance for Inheritance Tax into Trust

'Inheritance Tax Exemptions' and Reliefs

Death in Active Service

People in 'high risk' roles are exempt from paying inheritance tax if they died during active service.

These frontline people may include: Police, Armed Forces, Fire Fighters, Ambulance Paramedics, Aid Workers.

This active death on service exemption applies if that person injured on active service, then sadly later died as a result of their original injuries, even when no longer in active service.

Inheritance Tax | Care Fees Scams?

Since tax is levied at 40% on death, many people are naturally keen to hear of ways to avoid this Inheritance Tax! HOWEVER......Check for Scams

Protection Trusts

Life Insurance Inheritance Tax trusts (also knows as Assets, Property, Lifetime, Family, or Universal Protection Trusts) are types of generic trusts into which some companies maybe encourage you to transfer your main domestic property or other properties you own.

This is sometimes also explained with a view to potentially avoiding paying care fees, as by using Property Protection Trusts, the main home can't be used in a calculation? It could also include your savings & investments.

However, in so doing you could be firstly put into difficulties re social care services, if your Local Government & Care Home disagree. They instead state, you deliberately did this to avoid care fees.

Likewise, any care home you may then get put into anyway.....due to a 'lack of funds', may not be what you may would want in the final years of your life?

NOTE: Secondly, these actions could trigger a HMRC ‘lifetime chargeable transfer’ for inheritance tax (IHT) purposes. It may also trigger a chargeable disposal for Capital Gains Tax (CGT). If a trust is not registered correctly to HMRC then it could also lead to a fine.

'Inheritance Tax in UK' and Capital Gains Tax (CGT)

Inheritance Tax is a charge on the value in a deceased persons estate. Capital Gains Tax (CGT) is a charge made on capital profits on gifts in this situation.

Beneficiaries are not usually be liable to pay CGT at the point of their inheritance. However, the situation is different if these assets eg; a property or shares are transferred to them from an Estate.

Later on, if they then sell the property or shares onwards for a profit, they may become liable for Capital Gains Tax at this stage.

Capital Gains Tax paid at the time of inheritance receipt upfront, rather than paying Inheritance Tax later probably does not make financial sense. ie; 2 tax charges.

Either way, get advice from a professional tax adviser. Note: the need for life insurance cover maybe still required !

Inheritance Tax on Gifts

Some 'Inheritance Tax on gifts' are exempt. There’s no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime, as long as they are UK domiciled & are legally married or in a civil partnership.

There’s also no Inheritance Tax on gifts you may give to any charities or political parties. However, after this the rules for IHT on gifts are less generous.

IHT on Gifts | 7 Years Rule

The IHT 7 Year rule: Inheritance Tax on Gifts charge applies - if you don't survive for 7 years afterwards.

So the estate may still be taxed via special IHT rules. (But only if that lifetime gift given tips you over the £325,000 limit).

There is a sliding 7 years HMRC tax scale (see below) on the amount of tax due ie; depends on when you gave a gift.

| Years between Gift and Death | Rate of IHT Tax on the Gift |

|---|---|

| 0 to 3 years | 40% |

| 3 to 4 years | 32% |

| 4 to 5 years | 24% |

| 5 to 6 years | 16% |

| 6 to 7 years | 8% |

| 7 or more | 0% |

Example: You have an estate value of £575,000. So you decide to help avoid IHT to now give away some of the following gifts to your children...

- Money, Stocks and shares

- Property, Land or Buildings

- Furniture, Jewellery or Antiques

You then give lifetime gifts worth £250,000 to your children and die in 'Year 5'. The first £325,000 is Nil rate band for tax. Then the potential IHT Tax payable on the £250,000 gift x (60% at Year 5 Death of the 40% IHT rate) = £60,000 IHT payable to HMRC Inheritance Tax Collector person. Life Insurance may of helped to cover this IHT liability.

It gets more complicated also if you decide to say make several gifts over a period of time. You must make a documented note of each gift time frame. It could be if not, then HMRC may question the gift dates to the executors.

Conclusion

Some People you give gifts to might have to pay Inheritance Tax, but only if you give away more than £325,000 threshold and die within 7 years.

Your beneficiaries (the people who finally inherit your estate) do not normally pay tax on things they inherit.

As this article is also about life insurance for inheritance tax, we will now start to discuss here several ways to help legitimately prepare for any liability re IHT.

Gift InterVivos Insurance Inheritance Tax

The Gift Inter Vivos Life Insurance is a tailored specific 'IHT 7 years rule' decreasing term assurance policy offered by a few UK insurers. Other Insurers may instead structure a Gift Inter Vivos Term Insurance via several plans to mirror this.

On a Gift Inter Vivos Policy, the sum assured decreases to mirror the UK IHT regulations. It is designed to offset the IHT liability on any lifetime gifts made, paying out a guaranteed, tax-free lump sum if you die during the policy term. It must be written into trust from outset to avoid the lifecover falling back into the estate again.

This inter vivos gift policy cannot be written on a joint life basis. So, you can only do a single life gift inter vivos insurance quote.

Another alternative, is if you intend to do several lifetime gifts over say the next 15 years time frame. Instead, maybe consider one level term insurance for 15 years from outset?

This may help to avoid lots of policies & paperwork covering each gift. Should your health change adversely during this period also, this could be a useful approach, meaning suddenly you could not get anymore lifecover offered.

'In this World Nothing is Certain BUT Death & Taxes'

President USA. Ben Franklin from 1789

* BPR Insurance | AIM Life Insurance Inheritance Tax

The government currently allows you to potentially leave trading businesses to your family on death but (without the penalty of currently 40% inheritance tax).

This concession is known as business property relief BPR. It is designed to make sure people don’t have to sell a business just to pay inheritance tax eg; A farming business.

BPR provides relief from Inheritance Tax (IHT) via a 2 year rule on the transfer of relevant business assets at a rate of 50% or 100%.

To benefit from BPR, you must have owned the company, or your shares, for at least 2 years at the time of your death. BPR doesn’t also just apply to family businesses.

You could simply have shares in a small, privately owned company. As long as it’s a trading business, the HMRC may decide it qualifies for BPR. Some of the stocks listed on AIM (the smaller companies’ arm of the London Stock Exchange) may also qualify for this BPR.

So, if you don’t have a business of your own, you could decide instead to use a specialist provider, who are set up specifically to help investors legitimately manage their IHT situation using BPR. So, another BPR option now available is the AIM ISA , which allow direct holdings in AIM market.

However, please be aware these AIM & IHT Investments are usually at the higher end of the risk scale. They should only be entered into after good advice from a qualified professional.

Note: We don't advise on any Inheritance Tax Planning for Investments. We suggest you seek out professional advice from an Accountant / Solicitor / IFA / Tax Adviser in these areas re your specific circumstances. Then, begin looking at any suitable life insurance for inheritance tax plans.

As such, if you go ahead with these options BUT still died within 2 years there is potential for both 40% IHT charge. So, the need for BPR Insurance or AIM Life Insurance over 2 years maybe still required !

BPR Insurance | AIM Life Insurance for Inheritance Tax in the UK

Life Insurance for Inheritance Tax | Lifecover Types

Life Insurance to cover IHT, aims to put enough money aside to potentially pay the tax bill on death. We say potentially, because one often does not know the exact amount needed, at the exact date of death, to calculate the exact IHT liability.

Example 1: In 2010, your Estate is valued at £750,000. So you then setup a level whole life insurance for inheritance tax based on this situation back then. Interim, your property & investment values rise. You die in 2020, but you are now worth £1 million.

Your Executors now find firstly that the IHT tax bill is bigger than you anticipated 10 years ago. Secondly, the original life insurance cover plan does not 100% fully cover the IHT liability. In this instance, indexation on the life insurance policy could have helped offset the rise in estate values.

Example 2: In 2010, your Estate is valued at £750,000. Interim in this example, you go into Care Home. You have to sell your property & some of the investments. You die in 2020, but you are now only worth £500,000.

Your Executors now find firstly that the IHT tax bill is much less than you anticipated 10 years ago. Secondly, the original life insurance cover plan now more than fully covers the IHT liability. In this instance, your beneficiaries will end up with more than anticipated, via the excess life insurance policy proceeds.

Health Issues & Underwriting

You need to be in fairly good health when you take out the underwritten insurance inheritance tax policy. It could be GP reports are required & also medicals, dependent on the overall cover levels.

If one or either person has adverse health risks eg; age onset diabetes, raised blood pressure & cholesterol, then it could be the Insurers may not offer you standard rates.

Sometimes, clients decide (due to budget reasons) to only insure perhaps say 75% of the likely IHT liability problem. Or in other words, some IHT cover is better than none.

Single Life Insurance or Joint Life Insurance for IHT?

If you are single or unmarried, then you may only wish to take out a life insurance for inheritance tax on your single life only.

However, if you are married or civil partnership, then you maybe able to use an exemption to pass all your assets tax-free to your partner on your death. While this avoids tax to begin with, the Inheritance tax for the 2'nd person to die could still pay tax then.

If this applies to you, then you need to take out a plan which pays out on the second death ie; when the tax becomes due. Remember to take into account all the assets of both spouses. Make a valid will that takes account of your wishes here.

Note: to work 100% effectively for IHT - plans should be ideally whole of life insurance to work properly.

Whole Life Insurance for IHT in UK?

A Whole of life policy is as it sounds ie; this life insurance inheritance tax plan will run for the whole of your life eg; age 190. This is of course because you do not know when you or your partner may die !

To operate correctly for IHT, you will ideally need a Joint Life 2nd death life insurance for whole of life ie; It just pays out when the 2'nd person dies, not 1'st person. A valid will needs to take account of your wishes here. Note; A Joint life 1'st death whole life plan will probably be insufficient here.

Also do not use term Insurance, Over 50's No medical Lifecover or Over 60's Life Insurance for IHT planning, as they may not offer sufficient levels of protection.

The policy must be setup into a suitable trust from outset, to avoid it falling back into the estate ie; Death benefits subject to tax when you calculate IHT.

Term Life Insurance for Inheritance Tax in the UK?

When calculating your average UK life expectancy which is around 81 (excluding Pandemic 2020's), this type of plan is probably going to be insufficient eg; if you then live to 195.

However, any existing term life insurance that is setup in a suitable trust (for reasons other than planning for Inheritance Tax solely) may still help solve the IHT problem, if the insured unfortunately died but only during that plan term.

For reference, you can actually take out a Term Life Insurance upto age 90 from Leading UK Insurers ![]() . This term life insurance can be in sole names or set up in joint names on 1'st or 2nd death.

. This term life insurance can be in sole names or set up in joint names on 1'st or 2nd death.

Martin Lewis on Life Insurance comments on value this and also discusses the subject of how much Inheritance tax on Money Savings Expert.

Martin Lewis Inheritance Tax

Money Saving Expert (MSE) on Inheritance Tax Martin Lewis also comments that it can potentially cost your loved ones £100,000's when you die.

He also said in a BBC interview several years ago that 'Inheritance tax planning isn't dodgy' & warned that there is a danger of people being castigated for using everyday tax saving methods.

Yet as MSE state, if checking Martin Lewis IHT tax planning views, it is possible to legally plan & avoid huge amounts of IHT on your estate, or possibly pay none at all.

The various rules around UK Inheritance tax as they point out, can be hard to understand at first. However should this concern you & your loved ones, then as they say it is important to get your head around the subject.

We would agree and say like Martin Lewis on Inheritance Tax, if unsure then always seek professional or specialist legal advice.

Conclusion - UK Inheritance Tax & Life Insurance

A Life Insurance for Inheritance Tax is a policy only taken out 'if you really love your family'. In other words, you care about them enough to want to leave more to them when you die, than leave to that Tax Collector Person.

You cannot avoid both Death & Inheritance Tax ...unless you Live Forever !!!

Advice on Life Insurance For Inheritance Tax in UK

Article on 'Inheritance Tax in UK' by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women - we review many of the best brands selling Life Insurance in United Kingdom (inc NI)

NOTE: Any reference we make to UK taxation & rates are based on a generic understanding of current legislation and HM Revenue & Customs practices, which can change from time to time.

We suggest you seek more specialist personal IHT guidance surrounding your own legal & financial situation beforehand for individual inheritance tax calculations & estate issues.

Broker advice is provided on the appropriate IHT protection products only (once any valuations have already been professionally calculated & detailed.)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'