Article on: underwriting in Insurance

What is Underwriting Insurance?

What is underwriting Insurance? In short, 'underwriting for insurance' is all about calculating or balancing the risks of an exposure loss against making a profit for the insurance company. From this risk calculation, the insurance company can decide whether taking on that particular risk (or not) is worthwhile in 2025.

To Under-write | A Short Background History

The term to 'under-write' derives back into the 1650's when Lloyd's of London was first founded in London, England.

The name Lloyd's was also short for the Edward Lloyd's coffee shop in London, down by the river Thames. Coffee shops in London were very popular gathering places back then, as indeed now, with each one specialising in groups of different types of trading merchants.

The Lloyd's coffee shop in particular became the intelligence gathering hub for marine shipping merchant traders. It was here that the foundations for the modern british insurance industry slowly began.

The beginnings of Insurance however were established well prior to this & they can be traced back to ancient Greeks & Romans times ie; the art of people collaborating together to spread their business risks. Moving forwards then with insurance into the middle ages, and we see guild members paying into a spread risk pot, to mainly help their fellow traders cover their business losses.

After the Great Fire of London, it was in these best coffee shops of their day that these London traders after the devastating fires, founded modern property or fire insurance.

Risk takers (or wealthy Financial backers) would discuss & chat over a coffee, or other beverage, their ongoing different business interests. They would discuss whether or not to accept part of the risk on any given business venture.

These business ventures in the Lloyd's Coffee shop were historically discussions about sea voyages, perhaps leaving London or another port. The traders would review the inherent dangers & associated likely risks of a shipwreck, and therefore total maritime loss. It became a type of high stakes betting game.

In exchange for any given sum of money (or premium), these financial risk takers would literally 'under-write' their names under that particular risk information. This risk assessment was written on a Lloyd's paper slip, created specifically for this purpose.

A typical risk analysis to under-write then, may have included the following questions;

- What was the value of the cargo being shipped?

- Which part of the new world were they going to?

- Was the ship's captain and all his crew skillful, fit, trustworthy & experienced?

- Was the ship well built & robust hence 'seaworthy'?

- How long was the journey?

- Was the weather, storms or rocks going to cause impending disaster?

- How about pirates?

Ultimately, wether to 'under-write' a person or a business risk and so be profitable for that Risk Taker or Wealthy Financial backers.

Over the years, all that information & reliable intelligence gathering whether or not to under-write, all slowly became the start of the 'insurance underwriter' job. Trending onto more modern times with insurance risk rate tables, into what is nowadays the Insurance Company.

The first British Life Insurance company was called ‘the Amicable Society for a Perpetual Assurance Office' founded back in London 1706.

5 Risk Types 'Underwriting Insurance'

- Preferred: offers a good or lower risk than average = charged a lower premium

- Standard: offers a standard risk = charged a standard premium

- Rateable: offers an above average risk = charged at a higher premium

- Postponed: offers a higher risk, so postponed = until they get more information

- Declined: offers the highest risk, so uninsurable = Decline

In practise, each Insurer will have a different stance to these 5 risks. As brokers, we often see one Insurer may decline to under write and accept a life insurance case eg; Family history of heart disease. So instead, we represent the same case to another Provider and they may decide instead that they are willing to accept this higher risk, but under-write it on rateable terms ie; Standard rate was £20pm but now £65pm.

'Insurance of Interest' | Insurable Interest

What's the insurable interest that a person has in something particular such as another person or property?

Insurance of interest means that the person would suffer a financial loss should that person or property be damaged. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest.

The reasoning behind insurable interest, is so that the death of an insured person or damage to a property, may not create personal financial gain (rather than financial loss) for a policyholder, if the event insured against should occur.

The 1774 Life Assurance Act, the 1906 Marine Insurance Act & the Scots common law all provide that any insurance contract 'without insurable interest' is therefore void. Various historic case laws also provides grounds to any insurance contracts that are illegal.

What is 'Insurance Underwriting'?

'What is insurance underwriting' re insurable interest? Let's look at 2 examples on 'what is insurance insurance' of interest regarding life cover, which may explain this better.

Examples of 'What is insurance insurance' re Insurable Interest

Example 1: You & your partner have just taken out a new joint £195,000 mortgage together. You both need to arrange a joint £195,000 mortgage life insurance policy to help cover this joint £195,000 mortgage debt.

The reason being, if your partner sadly died first, there would now be a £195,000 financial debt that would be passed onto you, as you were held jointly liable.

Under the laws of insurable interest, both of you could be adversely affected financially if one died re this £195,000 joint mortgage debt. The surviving partner (who may also not be the main breadwinner), could now be in financial trouble. The insurance company would be correct to underwrite me in this situation as you both have insurance of interest.

Also, both parties must consent to this arrangement. You can’t take out a life insurance for a couple (online or not) without either knowledge, whether it is joint policy or single life.

Example 2: You are a young couple age 20 studying at the same university in London. You both still each live separately at your own parent’s homes, when back from university term time. You have been together for nearly a year & are in love, and now thinking of getting engaged when you finish your university degrees.

Once engaged, you would still intend to live separately at each of your parents home, due to high rental living costs. Instead, you will each start to save money up to hopefully buy a house together sometime in the future when you both qualify & start work. You are looking to hopefully take out a joint life insurance policy, as you both would be devastated if the other partner died, so you enquire about taking out joint lifecover.

At this stage, you would NOT be adversely affected financially (but certainly emotionally affected as you both love each other) if your partner died ie; you do not have insurance of interest.

Technically, right now the broker & insurance underwriter would advise you both shouldn't be taking out any joint life insurance policy. So they would not under write this particular case.

Being young anyway, life insurance should not be a priority yet (maybe critical illness that includes some lifecover or income protection insurance instead) but your situation can be reviewed & your circumstances may change.

'Underwriting in Insurance'

Underwriting in insurance is a compulsory process when you are applying for most types of coverage for life insurance, buildings & contents, private health insurance or holiday travel cover, whether online or paper based. We will concentrate here mainly on life insurance underwriting.

Insurance Underwriters are the Uk Life Insurance Companies risk assessors. They may help to decide whether or not to accept insurance cover but also balancing this with offering competitive terms.

a) Medical Underwriting

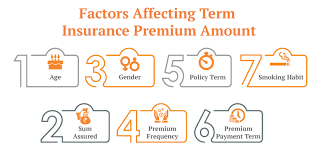

The life insurance underwriter calculates how much of a risk you are to underwrite & insure, by evaluating various mortality factors that may affect your average life expectancy or mobidity for health related insurance.

b) Financial Underwriting

The insurance underwriter needs to ensure the total amount of insurance cover being taken, is balanced in line with both the companies overall risk profile & your families needs. If the cover is above a certain amount for your age eg; £1.5 million at age 21, then the Insurers will ask you more questions why you are requesting such high levels of cover.

'Meaning of Underwrite' Life Insurance

The meaning of underwrite when applying for a life insurance is best explained when you look at these typical Insurers questions below. A life insurance application will usually ask these questions & more for their underwriting process.

The number of questions may also increase or decrease, dependant upon the risk & your answers to Insurers. If you advise you have issues re blood pressure, diabetes or cholesterol, the Insurers will want to then know more, not just Yes or No answers to help them under write the cover.

If the policy is for income protection or critical illness coverage, the chances of claim are higher than life insurance (as you can see above) so the premiums are also correspondingly higher. Therefore, the Insurers will ask different underwriting risk questions than for life insurance underwrite meaning alone ie; the health risks are higher, so the questions become more specific.

- Amount of cover, type of life insurance policy & term

- Age | Date of birth

- Gender

- Marital status

- Weight | BMI kg

- Personal health history

- Smoking & Drinking alcohol habits

- Family health history

- Doctors details

- Occupation & Income

- Hazardous Pastimes

- Ride a Motorbike, scooter or moped

- Amount of insurance already in place

- Banking details

From these answers & dependant on various insurance underwriting factors, the insurers may either offer insurance underwritten terms at standard rates, offer at non-standard rates, postpone or just decline to under write the case and offer terms.

Underwrite 'Insurance Medical Conditions'

The Insurers will assess any pre-existing insurance medical conditions before offering any terms eg; Crohns, Epilepsy or Multiple Sclerosis. Alternatively, these maybe simply defined as any illness, accident or serious injury you had before you take out the insurance policy.

These for life insurance medical conditions will include the any critical illness factors such as Cancer or Heart disease and your various Organs. Brain & Neurological Systems, Muscular Skeletal & Mental Health.

Disclosure to Under Write Claims

All Insurers are in business to protect, insure & payout. Insurance cover is therefore based on your full disclosure at the time you take the original policy out ie; being 100% as honest & accurate as possible, to enable them to fully under-write insurance meaning the cover is correctly assessed. For example, if you have rheumatoid arthritis life insurance companies must be aware.

It is not always easy to remember all your historic health details when applying. The Consumer Insurance Act 2013 however says you must also not be acting careless, deliberate or reckless when applying. For example, if you vape then you must tell them you are still classed as a smoker (even if it costs more & you disagree it's a similar insurance risk as smoking cigarettes). If so, it may not payout!

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details eg; now diagnosed with Multiple Sclerosis or had a stroke.

They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details eg; not disclose a family history of breast cancer or prostate cancer. If you look at most Insurers recent claims payout, you will see that it is Good (but like most Insurers – not 100%).

Motorbikes & Life Insurance Underwriting

UK Insurers all vary their underwriting stance on people who ride them. Some just ask do you ride a Motorbike, scooter, or moped? Or, have you done so in the last 12 months?

If so, those Insurers will under write the application by applying a higher risk rating for the motorbike riders life insurance premiums from their standard cost, as they view them as a higher insurance risk & analysing uk government statistics.

Alternatively, some other Insurers only ask for their motor bike riding life insurance terms, if you take part in any form of motor bike racing only ie; this is higher risk.

As such, they do not apply any normal risk ratings if as a motor bike rider it is your normal means of daily transport, although there are higher fatality risks.

Underwriting Insurance once Health ailments are diagnosed?

Whereas perhaps many people could have qualified for "standard" insurance premiums 10 or more years ago, reportedly the UK population is now getting more obese.

As such, the numbers possibly facing a higher-risk insurance loading has also correspondingly increased. Increasingly, it seems some UK life insurers only seem to want the best risks to offer their standard terms.

In the past, some customers could be just loaded for conditions such as diabetes for a life insurance policy. However, now some insurers have specialised & setup specialist white labelled adverse "impaired or substandard life" policies.

Some are also tightening up on your family history. Insurers have always taken family history into consideration, and would have been concerned if several immediate family members ie; Mum, Dad, Brother or Sister were struck down by the certain conditions before certain ages.

As such, if you are taking out critical illness cover they may now increase or rate your premiums for underwriting if your mother or father, say, had a specific named types of cancer and before certain ages.

This could lead to further problems, because some consumers could possibly receive a black mark after applying to a cheap life insurance or budget deal only to be refused.

If they applied elsewhere, they could be asked: 'Have you ever been turned down for insurance?' Now they would have to reply 'Yes' to that question.

Insurers should ideally judge each risk on a case by case basis. This could lead to possible non-disclosure if a consumer does not honestly disclose their correct answers.

As the UK life insurance marketplace continues to shrink, & once health ailments are diagnosed, finding a good competitive life insurance deal for some is getting harder than ever.

What if Health changes after Underwriting on Insurance?

Any health or lifestyle changes since the original policy was under written, usually does not void your existing cover, if it wasn't relevant at that time of initial application eg; suffer from depression after having a child.

It maybe the Insurers request GP reports when you originally applied, to check any health details disclosed eg; hepatitis, colitis or Parkinsons. Likewise they may not.

So take care to doubly re-check on your application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original T&C's.

'Underwrite me' for Insurance | Broker FAQ

Under written Term Life v Whole of Life Insurance

Term Life offers protection for a fixed period of time or 'term' eg; cover your mortgage term 33 years, up to retirement age 65, back up plan to age 90, or say a child is independant age 18. The cover can be level, increasing or decreasing. Paid out as either Lump Sums or Family Income Benefits options.

You can take some term life insurance plans upto age 90. Whole of Life Insurance however runs indefinately ie; no set term, so if you lived to 195 it would still payout!

Term life & Whole of Life cover are both 'under written,' meaning your application will ask you medical & lifestyle questions before offering any deals. It may also require GP reports & nurse medical tests.

Some budget life insurance basic offerings may ask you less questions or on Over 50's lifecover no medical under written questions at all (apart from smoking status). So their underwriting for insurance is less intrusive. However, often they are budget for a reason eg; Initial 2 years exclusions before any full death claims when underwriting, means they can offset their risks.

Term life insurance are easy policies to operate, if you died or terminally ill within the set 'term', your family will receive the set insurance payout tax free (or optional critical illness benefit if included). They usually have no cash in values.

Because term life insurance runs a set term, it may have affordable premiums than whole of life cover [as you may live out that nominated term]. The longer any life policy runs for, the more expensive it also is, as you are more likely to claim ie; a plan for 25 years maybe less than 1/2 the premium cost of one over 50 years. Note; a term life policy upto age 90 maybe typically still 50% less cost than a whole of life cover.

Whole of life cover is usually the most expensive life policy, as it will payout whenever death occurs, so the insurance underwriting risk is higher (subject to full premium payments & any T&C's).

How much Under written Cover?

As Insurance Brokers in an ideal world - we suggest this simple formula.

- LUMP SUM > Repay any mortgage & debts, cover funeral costs

- INCOME > Help cover your monthly bills

- LUMP SUM > Back up for holidays, education, emergencies

Martin Lewis on Life Insurance best formula instead suggests covering 10 x salary of the main breadwinner.

Using that principle, if you earned £26,000pa gross, Martin Lewis says you should maybe consider insuring yourself (after any debts, mortgages & loans are fully repaid) for say £260,000 (ie; 10 x the annual gross income).

Following on from this simple Martin Lewis example formula above, if you then worked for the next 40 years until state retirement, you could potentially earn over £1 million gross ie; £26,000pa x 40 years [or more with any future inflationary wage rises].

As such, unlike the 10 x £26,000 gross salary example above – you could instead protect your family with either;

- Income Option = £26,000pa family income benefit policy

- Lump Sum = £1 million level term policy [if invested @2.6% return = £26,000pa]

- Or a mixture of the 2 policy types over the next 40 years – all dependant on your family circumstances.

However, as Financial Advisers we are not saying this 'Money Saving Expert formula' 10 x salary is therefore a 100% one size fits all scenario ie; This formula is not applicable for everyone's own personal situation or budget.

- You can also decide wether you want the under written cover to be level or inflation linked

Under write Joint Life vs Single Life?

- A joint life 1'st death plan pays out on the death or claim on 1'st plan holder. Then it ends.

- Joint life 2'nd death plan pays on last death eg; used for Inheritance Tax IHT cover

- Single life plans are setup on the sole life | death of the plan holder

- Some may setup a joint life plan to repay their joint mortgage

- Family life cover may be setup either joint life 1'st death or 2 x single policies or 'dual life'

Re Underwriting on Insurance Policy

Many Insurers allow you to change your policy midstream, without further medical evidence or re underwriting of insurance and under a special option. This is called the guaranteed insurability option. Often people are unaware of this life insurance medical conditions free increase feature, but many life insurance plans may automatically include this.

It can be very useful if you have had health issues since the original insurance underwritten policy was agreed eg; you have recent breast cancer life insurance now would be declined more cover.

It can be used when someone for example is increasing their mortgage, large rent increases, getting married or into civil partnership, having a new born child or adoption, IHT tax changes etc; Typically this inclusive benefit ends around age 55. These optional increases will all be subject to the Insurers policy limits & will require proof within a nominated time scale, as they are being allowed without medical evidence.

Often with the best life insurance policies you can also choose to...

- reduce or perhaps extend the period of cover

- decrease or increase the amount of lifecover

- remove indexation option or any specific paid for policy features

- change the collection date of your usual premiums

- take off a life assured from a joint policy eg; if a couple seperate

These changes above however could be subject to new or re underwriting for insurance purposes, all based on your circumstances at the time & may well affect your premiums. We suggest you seek professional advice, before taking any course of action.

Covid 19 & Insurance Underwriting?

The Covid 19 Pandemic was a costly exercise for most Life Insurance Companies worldwide with many many death & health claims & the virus has still not gone away (UK stats change daily)

For example in the 2020's, Aviva state they paid out over £1 billion in individual protection claims or Legal and General paid over £760 million in Covid related claims.

Most UK Life Insurers in 2020’s have confirmed that nothing major has changed with their existing protection products re Covid 19 underwriting. All their protection plans will continue to do what their customers are paying for and claims honoured.

However, some shorter waiting periods for new health & sickness income policies may be temporarily unavailable due to higher risks for some providers.

Likewise, any Life Insurers underwritten insurance terms maybe harder to obtain currently for those with perhaps adverse health or risk issues.

'AI' and Underwriting on Insurance?

Artificial Intelligence (AI) has helped Insurers to accelerate their underwriting process for buying insurance since the millennium. People now want quick decisions for most of their the day to day purchases. They don't understand or indeed want to, any complex buying processes.

The process of underwritten insurance from start to end, is now often reduced to a few minutes. The vast majority of underwriting is now automated, being supported by a combination of vast risk data and analytics providers.

All this information enables insurers to make quicker decisions regarding their underwriting and also pricing aligned to their customer’s risk profile and coverage needs. Several early business under-write adopters like underwrite me have taken this task on board and are working alongside brokers & insurers to help speed up their under written insurance processes.

AI may well mean that instead of talking to an experienced underwriter person in the not too distant future, you will talk to an experienced AI underwriter instead. To make insurance more affordable, Insurers will use AI and technology together to help them make more informed, better and quicker underwriting decisions.

Under Write Insurance Conclusion

In conclusion, looking at all the factors above, as brokers it is fair to say underwriting for insurance still differs between most UK Life Insurers.

What is best under written cover for one person, isn’t always the best for another, as it could be unsuitable to individual case circumstances or budget.

Providers may all still cost up differently if you have health issues, of a certain age, have a particular job, travel abroad for a time period, or any risky pastimes. Dependant on their market segment, all these factors are considered different risks for their underwriting in insurance.

My advice would be always feel free to do your own research but always speak to a broker, as they are experts. Let them decide from their daily professional expertise, what is the ideal 'insurance underwritten' deal for you.

When underwriting for insurance I still believe that good 'Advice Matters'.

Article on 'Underwriting for Insurance' by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women - we review many of the best brand Life Insurers UK selling under written Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'