‘Coverage for Life Insurance’ ?

‘How much Coverage for Life Insurance’?

Why do people look for a ‘Life Insurance Coverage’ policy?

A Life insurance is designed to financially help those sadly left behind then cope with their day to day money worries & stress that may happen when losing a loved one. We all have to pay bills.

For many families a suitable ‘Cover for Life Insurance’ = Peace of Mind.

We all may think we are invincible….. But

As Life Insurance Brokers in an ideal world – we suggest this simple formula as to ‘how much coverage for life insurance’.

- LUMP SUM > Repay any mortgage & debts, cover funeral costs

- INCOME > Help cover your monthly bills

- LUMP SUM > Back up for holidays, education, emergencies

Martin Lewis Life Insurance formula instead suggests life insurance years of coverage of 10 x annual salary of the main breadwinner.

Using that principle, if you earned £35,000pa gross, Martin says you should maybe consider insuring yourself (after any debts, mortgages & loans are fully repaid) for say £350,000 cover life insurance (ie; 10 x the annual gross income).

Following on from this simple Martin Lewis example formula above, if you then worked for the next 30 years until state retirement, you could potentially earn over £1 million gross ie; £35,000pa x 30 years [or more with any future inflationary wage rises].

As such, unlike the 10 x £35,000 gross salary life coverage insurance example above – you could instead protect your family with either;

- Income = £2,916pm or £35,000pa family income benefit lifecover policy

- Lump sum = £1 million level term life insurance policy [if invested @ 3.5% return = £35,000pa]

- Or a mixture of the 2 policy types over the next 30 years – all dependant on your family circumstances.

However, as Financial Advisers we are not saying this ‘Money Saving Expert formula’ 10 x salary life insurance years of coverage is therefore a 100% one size fits all scenario ie; This life coverage insurance formula is not applicable for everyone’s own personal situation.

- You can decide wether you want the cover to be level or inflation linked

- Single plan | 2 x seperate plans | or Joint life insurance 1’st claim

Apart from losing a loved one, this real hidden income threat is what could be lost if the main breadwinner died prematurely. Or gives you an idea if someone was off long term ill – the potential income loss.

There are many different types of ‘coverage for life insurance’, all set up to suit all different sorts of needs. A Lump Sum or Income Plan? Single or Joint Life Plan? Level or Increasing Plan?

From term cover life insurance, mortgage protection, family income benefit to whole lifecover types of policies. Unsure how to choose the right coverage of life insurance? Let’s look at your options.

Types of Life Insurance Coverage?

* Term Life Insurance | Level Family

- Term Life Insurance coverage are simple plans to operate

- If you die within the set ‘term’, your family will get the set life insurance lump sums payment.

- Cover is ‘underwritten’ meaning Insurers will ask you medical & lifestyle questions before offering terms

- A Life Assurance term policy will offer cover for a fixed period of time or ‘term’. eg; 25/35/50 years

- You could set up plan upto retirement, any child is independant or even upto age 90

- Because it runs for a set term, it may have more affordable premiums [BUT you may live out that nominated term]

* Life Insurance with Critical Illness Coverage

- Designed to pay out on diagnosis & survival of a specified Critical Serious illness where benefits are currently paid out tax free upon claim

- Insurers plan terms vary & may cover between 25-100 different types of serious illness benefits

- Critical Illness coverage usually all include these main 3 claims:- Cancer, Heart Attack & Stroke

- Designed to pay out usually as a lump sum upon diagnosis of dread disease

- Medical evidence may be required & a medical examination for based amounts of cover or those with health issues

- Premiums on life insurance with critical illness coverage may be fixed guaranteed or reviewable

* Decreasing Life | Mortgage Coverage Insurance

- Decreasing term life insurance will reduce over the mortgage loan term but the premiums remain level

- It is designed to usually help repay your mortgage, loan or other debt – where that amount owing will reduce over the term

- You can set the % at which the plan reduces at outset eg; If your bank loan is fixed at say 5% for 15 years, then so could the policy

- Level term a life insurance coverage plan may suit if you have an interest-only mortgage ie; the amount owing stays the same.

- Ideal repayment mortgage coverage for life insurance as it decreases

* Term Life | Family Income Benefit

- A Family Income Benefits [FIB] term policy pays on death a set monthly income

- The monthly income upon a death claim is then just paid for the remaining fixed term of the plan

- Example: £1,500pm FIB policy benefit over 13 years. A death claim comes in year 7

- So it pays £1,500pm for upto 6 years upon a death claim, afterwards the policy ends

- Like decreasing term life cover, as amount death reduces over the term eg; protect child maintenance costs

- FIB is designed to avoid complications & stress of how best to invest a lump sums for income

- Some Insurers allow FIB coverage of life insurance to be commuted to lump sum option upon claim

* Whole Life Insurance Coverage

- Whole of life insurance is unique in the Life Insurance marketplace.

- It guarantees it will pay out a lump sum whenever you die or diagnosed terminally ill.

- It has no set or fixed time frame unlike term life insurance.

- You are covered even if you live to 350 years old !

- Help toward Final Expenses costs ie; Typically sold via Over 50’s plans

- Insure against possible Inheritance Tax IHT liabilities

- Cover Life insurance to always payout whenever that maybe

- Continuous No Future Health Issues coverage for life insurance

‘Coverage for Life Insurance’ | FAQ

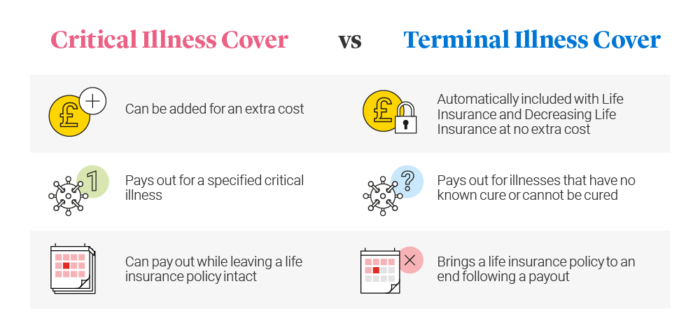

Is Critical Illness the same as Terminal Illness?

- NO is the answer. Terminal Illness on a Life Assurance Policy – means you sadly have less than 12 months to live

- Terminal Illness is often included for free as part of your life insurance years of coverage benefits

- Once agreed, the Insurers claim team will then payout the life insurance earlier ‘death claim’ in advance ie; incurable illness

- Critical Illness however is ‘paid for’ underwritten benefit, claimed upon survival & recovery. It often covers a large range of benefits

- Benefits for lifecover and critical illness payouts may include types of cancers, heart disease, stroke, multiple sclerosis, diabetes, parkinsons etc;

What’s Waiver of Premium on a Insurance Policy?

- Waiver of premium helps protect your policy premiums if off work re accident, sickness or hospitalisation

- Some Insurers may also waiver your premium if off work through pregnancy or redundancy for 6 months

- Premiums are usually waived after deferral period of 4/8/13/26 weeks

- The Insurers then pay your premium until you get back to work or potentially until a claim to plan end

- So it works similar to income protection benefit on the life insurance policy

- Many Insurers may charge you extra for this benefit, however for some its standard inclusive

- The cost for this benefit is often small, in relation to help protecting the large amounts of cover life insurance

Joint | Dual Life vs Single Life Insurance?

- A joint life 1’st death insurance policy may pay out on the death or claim on that 1’st policyholder. Then it ends.

- Joint life insurance 2’nd death policy pays on last death eg; This may usually be used for Inheritance Tax IHT cover

- Single life insurance plans are setup on the sole life & death of a policyholder

- Some people may often setup a joint life plan to repay a joint mortgage

- Family life Insurance cover may be setup either joint life 1’st death or 2 x single policies or ‘dual life’

What does putting a Life Policy Into Trust mean?

- Putting a life policy into ‘trust’ may help to avoid probate delays & inheritance tax – by falling outside your estate.

- Ensures it should go direct to you nominated beneficiaries via the trustees

- This applies even if you have made a valid will.

- Without a suitable trust, the policy could fall back into your estate re IHT

- Inheritance tax is currently 40%. So it could be for larger estates, the life insurance payout is then reduced by this amount.

- Most Insurers do supply free a good range of generic life insurance trusts, ideal for many client situations

Level or Increasing Life Insurance?

- Level term policies always stay at that fixed amount & so will the premium

- Increasing cover plans may adjust annually to help offset increasing yearly living costs & rising bills

- The cover increase maybe via retail price index RPI; annual earnings AEI; a fixed amount eg; 5%

- Another benefit of increasing cover life insurance is Insurers may increase without further medical evidence.

Covid-19 & ‘Cover Life Insurance’

- Insurers will still ask in the last few months have tested positive or had recent contact with anyone with symptoms

- If so you may have to await your full recovery and be fully OK before you can re-apply

- Standard rates may apply after any self-isolation period & assuming no other health issues

- Any refusal to be vaccinated, will not affect consideration payment of a claim

- Receiving a COVID-19 vaccination or side effects will also not impact on a life insurance coverage terms

- Should Covid 19 lead to death, Insurers will approach any claim as normal

Which is the Best Life Insurance Coverage 2025?

- There is no set answer to this question, as given this type of life insurance, the devil is really in the detail.

- What type of policy is actually required ie; cover for your Mortgage, Family, Car Loan, Funeral Costs, Inheritance Tax etc ;

- Or if you have health issues, your job or pastimes are all considered high risk then each Insurer may cost this differently

- So the cheapest policy quote isn’t necessarily the best, as it may have age costed annually reviewed increasing premiums

- Ignore advertised Life Insurance with Free Gifts deals, as they generally could be £1,000’s more lifetime expensive

- Likewise the most expensive policy isn’t always the best, it could be unsuitable to your individual case circumstances or budget

Importance of Disclosure & Claims?

All Insurers are in business to protect, insure & payout. Any cover for Life Insurance is therefore based on your full disclosure at the time you took the original policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying.

The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying. If so, it may not payout ! eg; If you vape, then you must tell them you are still smoking (even if it may cost the same as having quit smoking cigarettes).

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details. They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details. If you look at most Insurers recent claims payout, you will see that it is Good (but like most Insurers cover life insurance is not 100%).

What if my health lifestyle changes after I have taken the policy out?

Any health or lifestyle changes since, usually does not void your existing life insurance years of coverage. If it wasn’t relevant at that time of initial underwritten insurance application. It maybe the Insurers request GP reports when you originally apply, to check any health details disclosed. Likewise they may not. So take care to doubly re-check on your application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original T&C’s.

Life Insurance for the Disabled

What happens if you are now after life insurance for disabled people? It could be you have lost a limb or damaged part of your body. Do you now have to use a wheelchair for example?

Dependant on what is unfortunately physically wrong with you may well then affect how affordable life insurance for the disabled is. Will the Insurers offer standard priced rates or health rate the policy?

Each Insurers coverage for Life Insurance maybe different, so it is best you speak to a broker here for help.

Article on ‘Coverage for Life Insurance’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers UK selling Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'