Article on: Life Insurance NI

‘Life Insurance NI’ Background

Northern Ireland has a proud long standing tradition and history with all types of insurance. Today, many leading Northern Ireland Insurance Brokers are also members of the Chartered Institute of Northern Ireland

From Lloyd’s insuring their mighty ships for over £1m, like the white star line Titanic, built in the great Harland & Wolff ‘s Belfast shipyard. To insuring their famous Samson and Goliath vast cranes in the Belfast shipyard for £9 million (equivalent £60 million in 2020’s).

With various ni insurance company laws applicable to the 6 Northern Ireland provinces of Antrim, Armagh, Down, Fermanagh, Londonderry and Tyrone.

The Northern Ireland Insurance Market today is still going strong. It also shows there are several leading Insurance NI Companies based there, Life Insurance Belfast & Ulster Insurance is active post Brexit & Pandemic 2020’s.

* 3 Reasons – Why get ‘Life Insurance Northern Ireland’?

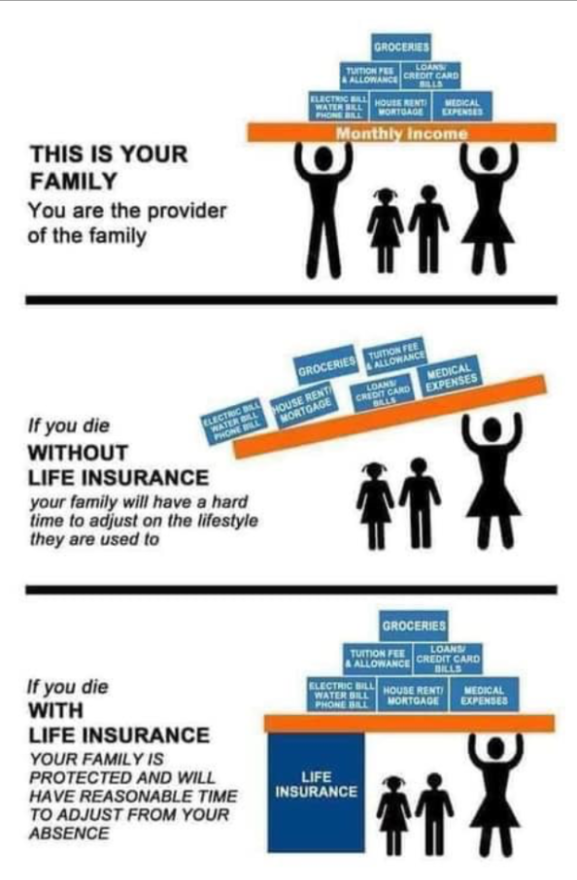

As Life Insurance Brokers, this simple ‘3 reasons formula‘ you may wish to consider in an ideal world as why to get life insurance if you live in Northern Ireland.

- LUMP SUM – repay your Mortgage / Loan / Debts – Often your largest outgoings

- INCOME – provide for your Family – To help cover ongoing monthly bills / lifestyle / holidays

- LUMP SUM – help cover Funeral & Legacy costs – Those final expense costs

How much ‘Life Insurance Northern Ireland’ residents need?

How much life insurance northern ireland residents need will all depend on your own family circumstances. The number of dependants you have, your overall commitments & outgoings, bills etc;

The Martin Lewis Life Insurance formula (Money Saving Expert) instead suggests just covering 10 x annual salary of the main breadwinner [after payment of any mortgage, loans & debts].

Using that principle, if you earned £28,500pa gross, Martin Lewis says you should maybe consider insuring yourself (after any mortgage, loans & debts are repaid) for £285,000 life insurance (ie; 10 x the annual gross income).

Following on from this simple Martin Lewis example formula above, if you then worked for the next 35 years until retirement, you could potentially earn around £1 million gross ie; £28,500pa x 35 years = £1 million [or more with any future inflation wage rises].

As such, unlike the 10 x £28,500 gross salary life insurance example – you could instead protect your family with either;

- Income = £2,375pm or £28,500 pa family income benefit lifecover policy

- Lump sum = £1 million level term life insurance policy [if invested @2.85 = £28,500pa]

- Or a mixture of the 2 policy types over the next 35 years – all dependant on your family circumstances.

Neither takes into account as mentioned, repaying any mortgages, loans or debts. Or if you have any company employee death in service benefits, savings or investments to also rely on.

- You can decide wether you want the cover to be level or inflation linked

- Single plan | 2 x seperate plans | Joint life insurance 1’st claim | Lump Sums or Family Income Benefits options

Apart from losing a loved one, this real hidden income threat is what could be lost if the main breadwinner died prematurely.

Types of ‘Life Insurance NI’

There are several main types of Life Insurance Northern Ireland broker deals:

1] Level Term Life Insurance NI

A Level Term Life Cover policy, means the amount of payout cover remains the same or level, from the start to the end of the plan. This means the payout risks to the Life Insurers remain the same from start to end.

In other words, if the level term life insurance was setup for £285,000 and you died in year 12, it would still payout £285,000.

However, as it runs for a specified term eg; 25/35/45 years, then any claims payout will only be within that time frame period. So if your plan ran for 20 years, but you died in an accident in year 20 and 2 months, then the plan has ended and so meaning it would not payout.

Note: You could choose a convertible or renewable life insurance lump sums option from outset within this plan, allowing the choice to either replace it with a whole life insurance or another plan, without health evidence.

You can take out this type of life cover until age 90. So, this is the best life insurance northern ireland plan for those who may not need their cover to be available beyond age 90. Note: The longer the insurance policy runs for, the more expensive the quote is.

Conclusion: Best life insurance ni plan for people on a budget

2] Increasing Term Life Insurance NI

Increasing Term Life Cover policy, the amount of payout cover increases annually from the start to the end of the plan (to help offset inflation). You can choose whether this increase is by RPI, Average Earnings, or a fixed rate ie; 5%. This means the payout risks to the UK Life Insurers also increases from start to end. Some Insurers therefore charge an extra premium from outset, to account for this increasing insurance risk & usually without asking for ongoing medical evidence at each regular increase.

In other words, if the increasing term life insurance was originally setup for £285,000 over 20 years but you died in year 7, it may now payout for example £300,000 (due to increasing by say RPI).

Conclusion: Best life insurance ni plan concerned about rising inflation

3] Decreasing Term Life Insurance NI

A Decreasing Term Life Cover policy, means the life insurance amount of payout cover reduces, from the start to the end of the plan. This means the payout risks to the Life Insurers also reduces from start to end.

Usually these plan types are used for Mortgage protection or Loan repayment ie; It follows the reducing debt over its term.

In other words, if the policy was originally setup for £285,000 over 20 years but you now sadly died in year 11. This decreasing plan may now payout around £140,000, meaning it should have decreased inline roughly with what you owed on your mortgage.

Conclusion: Best life insurance northern ireland homeowners need for repayment mortgages

4] Whole of Life Insurance NI

A Whole of Life Cover policy, means the amount of lifecover will always payout, whenever you died (as long as the premiums have been paid & policy terms fulfilled) ie; unlike a term life policy upto age 90.

In other words, if the policy was setup for a sum of £285,000 and you then lived amazingly upto aged 195…it would still payout ie; £285,000 death benefit is essentially guaranteed & always available.

Note; there are both reviewable & non-reviewable premium whole life plans available. Also, there are ‘medical’ evidence plans which may offer cover terms once fully underwritten & ‘no medical’ evidence whole life plans like those advertised over 50 life cover. Those over 50’s life cover schemes usually do not insure you fully for upto initial 2 years, & are popular with those looking to just help cover funeral or legacy costs.

Conclusion: Best life insurance ni cover payouts whole life guaranteed. Usually the most expensive

Family Income Benefit Monthly Insurance

A Family Income Benefit plan [FIB] is an insurance that pays upon death a tax-free monthly income, within the agreed policy term. Some FIB plans you can opt to be paid the benefits quarterly or annually at claim, rather than monthly.

Most FIB plans will also include free ‘terminal illness’ cover. You may also have the option to include critical illness cover FIB benefit.

With a family income benefit policy, the Insurers risks decreases monthly ie; the income payout risks to the Life Insurers also continually decreases from policy start to end. In essence, it therefore works abit similar to mortgage decreasing cover.

For example, you insure yourself for £28,500 pa (£2,375pm) over 20 years. You die in year 12. So, the FIB insurance policy will now payout £28,500pa (or £228,000) for the remaining 8 years. It will then end.

Conclusion: Best life insurance ni plan worrying how to invest a lump sum for a regular income

Critical Illness Insurance NI

Critical Illness Insurance pays out a tax-free amount to help protect you should you suffer a critical illness & become seriously ill – as specified by the Insurers & during the policy term.

It may pay out upon a claim crucially upon initial diagnosis and then survival of that specified serious illness ie; a claim means you need to survive to claim, not die. Note: If you also include lifecover, then if you did not survive, it would still payout.

The top 3 claims for critical illness most northern ireland insurance payouts are for types of cancer, heart attack and stroke.

Conclusion: Best insurance ni plan for those wanting payout on a critical illness

Northern Ireland Insurance Companies

Northern Ireland Insurance Companies

Since the rise of the web, many traditional life insurers have lost a physical presence in Northern Ireland, or are still based on the mainland uk.

However, these major insurers are all listed under Northern Ireland Insurance Companies, as they still have a bricks & mortar status in Northern Ireland. Life Insurance Belfast business is still going strong in the 2020’s.

- Allianz Insurance

- Axa Insurance Belfast | Axa Life Insurance NI

- Aviva Life Insurance Northern Ireland

- Metlife Uk

- NFU Mutual

- RSA Northern Ireland

- Zurich Insurance

Broker FAQ

Compare Life Insurance Northern Ireland

As a broker for ‘whole of market’ – we can compare life insurance northern ireland options. This is ideal if you truly want to compare the marketplace, rather than go via 1 provider eg; ulster bank life insurance just use AIG Aviva.

Often ‘Go Direct Providers’ may offer more basic protection products to sell to their client base and without advice ie; makes it easier for them to just offer a pared down range.

How much does ‘Life Insurance NI’ cost?

- Often average prices can start from as low as £5pm (for 1 product)

- But your monthly or annual premium costs will vary in a few ways

- Premiums will depend on your ages, health, lifestyle, amount of cover, policy term

- It could be you are offered standard costs or have to pay abit extra insurance price risk

- Eg: Extra premium risks if smoking, have raised BMI Kg or Diabetic

- Any paid for extra features (like critical illness) you want will also affect the cost

- Is the lump sums cover to remain level or increasing to offset inflation rises ?

- Remember cheaper here, doesn’t necessarily mean better

Joint or 2 x Single Lifecover?

The benefit of having 2 x seperate plans (known as dual life insurance) if in a relationship & one partner claims, then the surviving partner still has their own seperate plan. That single life insurance will cover just that 1 person only. It then pays out the chosen amount of sum-lump cover if that person dies, or is terminally (or critically ill if benefit chosen) during the term of the policy.

A ‘joint’ names policy means it jointly covers 2 lives but crucially then pays out on ‘1st death or claim’ lump-sum basis. This means once the chosen amount of cover is paid, the policy benefits would then end. This is usually the cheaper option for Insurers (as it only pays benefits once) but conversely leaving the surviving partner without any cover. You pays your money & takes your choice.

Terminal vs Critical Illness

- NO is the simple but important answer.

- Terminal Illness is often included for ‘free’ as part of a life insurance policy cover.

- It usually means a doctor or consultant has advised you may have less than 12 months to live.

- Once agreed by Insurers, they may then payout a life insurance ni death claim but in advance.

- Critical Illness as explained, may pay out claims crucially upon diagnosis and survival of the specified illness

- So Critical Illness means you will live, survive & claim. It is also underwritten.

- Terminal Illness means you will not survive long term after a claim ie; incurable illness

- Critical illness cover and life insurance plans are often combined anyway

- Don’t get confused between critical illness & terminal illness cover

Conclusion: Compare life insurance northern ireland with terminal illness or optional critical illness

What’s Waiver of Premium?

- Waiver of premium helps protect your insurance policy premiums if off work re accident, sickness or hospitalisation

- Some UK Insurers may also waiver your premium if off work through pregnancy or redundancy for 6 months

- Premiums are usually waived after deferral period of 4/8/13/26 weeks

- Some cheaper plans may only offer this benefit after 26 weeks which is a long time waiting

- The Insurers then pay your premium until you get back to work or potentially until a claim to plan end

- So it works similar to income protection benefit on the life insurance ni policy

- Many Insurers may charge you extra for this benefit, however for some its standard inclusive

- The cost for this benefit is often small, in relation to help protecting the large amounts of lifecover

What does putting Life Insurance in Trust mean?

- It tells the Life Insurers who you want to get the lump-sum money if you sadly died

- Ensures it should go direct to you nominated beneficiaries via the trustees

- Putting your policy into ‘trust’ may also help to avoid probate delays & inheritance tax

- Without a trust the policy could fall back into your northern irish estate

- This applies even if you have made a valid uk will

- Most Insurers do supply free a good range of generic life insurance trusts, ideal for many client situations

Covid-19 Coronavirus & ‘Life Insurance NI’

- Insurers will ask in the last few months have tested positive or had recent contact with anyone with symptoms

- If so you may have to await your full recovery and be fully OK before you can re-apply

- Standard rates may apply after any self-isolation period & assuming no other health issues

- Any refusal to be vaccinated, will not affect consideration payment of a claim

- Receiving a COVID-19 vaccination or side effects will also not impact on your life insurance ni

- Should Covid 19 in Northern Ireland insurance claim lead to death, Insurers will approach any claim as normal

Importance of Disclosure & Insurance Claims?

All UK Insurers are in business to protect, insure & payout. NI Insurance cover is therefore based on your full disclosure at the time you took the original policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying.

The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying. If so, it may not payout ! eg; If you vape, then you must tell them you are still smoking (even if it may cost the same as having quit smoking cigarettes).

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details. They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details.

If you look at most Insurers recent claims payout eg; aviva life insurance northern ireland claims, you will see that it is Good (but like most Insurers cover life insurance is not 100%).

What if my health changes after taking the NI Insurance policy out?

Any health or lifestyle changes since, usually does not void your existing life policy ie; if it wasn’t relevant at the time of initial underwritten insurance application. It maybe the Insurers requested GP reports when you originally apply, to check any health details disclosed. Likewise they may not.

So take care to doubly re-check on your application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original T&C’s.

Restart smoking after taking out Insurance NI?

If you had legitimately not been smoking for over 12 months at that time of original insurance application, you may wish to advise the Insurers you have started smoking again. Note: This should not affect the original policy terms, which should still stand, as you were being honest. Also maybe suggest letting your GP know if this is the case.

Article review on ‘Life Insurance NI’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Life Insurance in UK & Northern Ireland.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'