Article on Womans’ Life Insurance

Life Insurance for Women

‘Womans Life Insurance’ | Help & Plan for a Secure Future

Women’s Life Insurance Types. Broker help & Quotes.

Women the Great Multi-Taskers?

Women are often the Great Unsung Multi Taskers in their Family? It took the ‘Stay at Home Pandemic 2020’s,’ for some partners left at home, whilst others go out to work, to perhaps finally ask “So what would happen to our family unit…if something sadly happens”

Some Women are the Corporate Boss, the Business Entrepreneur or Manageress, as well as running their Home Business. Other’s are hard working Front line Nurses, Social Workers, Teachers or Secretary.

Or life may dictate that as a Woman in 2025, nature’s role instead is for you to be the stay at home caregiver or nurturer within the family. One minute looking after your other half, caring for the kids, taxiing service, head chef, helping your parents or just a close confidant to your best friends.

Spinning the plates, changing the hats, the glue that sticks the family all together or whatever you may want to call it for some women.

All sounds abit patronising….but maybe in your own day to day life, some of it’s possibly true ?

‘Womens Life Insurance’ Don’t Undervalue your True Worth

Women help play a vital role in the day-to-day operations of their families, abit like you being that corporate boss. This makes having the right type of women’s life insurance & the right amounts, all the more important.

Average Life Expectancy in the UK usually also means women naturally may outlive men by an average 4 years. However, due to old EU pre 2012 gender insurance rules, men and women now pay the same gender neutral premiums for life insurance female or male rates.

So if you are checking up why is life insurance cheaper for females, then this rule no longer applies since 2012 in the UK ie; life insurance for wife and husband is the same price.

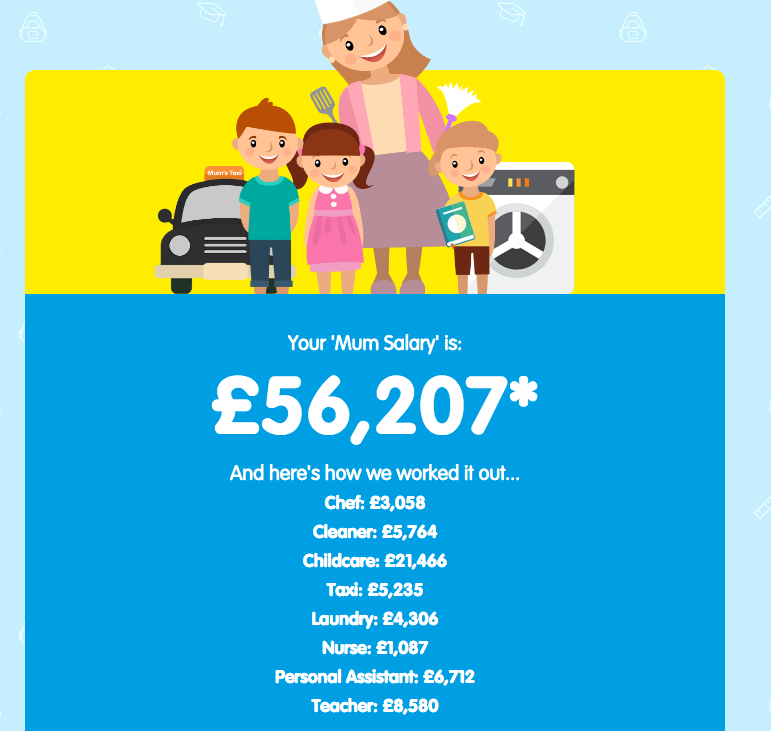

Martin Lewis Life Insurance Formula is 10 x salary of the main breadwinner. What happens if ‘on paper’ you are not a main breadwinner. How do you therefore value a Mum’s salary when calculating Womans Life Insurance ?

How do you value a ‘Mum Salary’?

Interflora says being a mum is a full-time unpaid job. It’s a 24 hour, seven day a week job, minus holiday, sick pay or any other benefits other than having yoghurt smeared into the carpet on a regular basis.

So, Sun Life Insurance came up with this calculation below of your typical annual ‘Mum Salary’ of £56,207pa*. The Mirror News instead calculates a ‘Mum Salary’ to be nearly double as much, at £108,837pa!

That ‘Mum Salary’ is similar to an airline pilot or city bankers. Not sure about that one, but as stated don’t under estimate your true worth.

‘Mum’s Life Insurance’ or ‘Housewife Life Insurance’?

Let’s get this right. No Housewife Life Insurance policy can ever compensate your family for the loss of you, their mother. What a life insurance mother back up plan may help with is providing your children or life partners’ with a financial safety net.

A financial safety net that allows them at their worst times…help to pay their ongoing bills or repay a mortgage.

The situation is more complex if you are also a single parent with dependants, whether young or old ![]()

So, if you are a Woman looking to take out a Life Insurance female or not, there are just 2 Main Options in the UK Life Insurance marketplace. 1] Lump Sum Payment or 2] Monthly Income Benefit.

OPTION 1: LUMP SUM PAYMENT

Looking for best insurance for housewife? Spouse life insurance deals from £5pm.

There are 3 main sub-types of Lump Sum Payment Life Insurance for Women:

- Level Term Life Insurance

- Decreasing Term Life Insurance

- Whole of Life Insurance

Let’s now look at each different types of Womans’ Life Insurance policies & how they may potentially benefit you…

Level Term Life Insurance | Family Cover

Life Insurance for Woman

Level Term Life Insurance is a simple plan that pays out a level cash lump sum if you die during the fixed time period your policy runs for. The lump sums paid out on death stays level, whether you are near the policy beginning or end. Most plans also include free ‘terminal illness’ cover.

Typically, this ladies life insurance policy maybe used for family protection. The longer the level term insurance runs, then the more expensive it costs ie; 40 years term maybe double or more the cost than 20 years, as the insurance risks are higher as you get older.

Pros | Level Term Insurance

- A Level Term Life Insurance policy will offer cover for a fixed period of time or the ‘term’

- If you die within that set ‘term’, your family will receive that set lump sum life insurance payment

- For example – it may run for 20 or 30 years until retirement or say your children are independant

- Ability for the term life insurance to run upto age 90 – which maybe sufficient term for most?

- They are simple policies to operate & pay for, usually with monthly set premiums

- Because it runs a set term, it may have more affordable premiums

- Cover is ‘underwritten’ meaning Insurers ask medical & lifestyle questions before offering terms

- If your health changes adversely during the policy, it doesn’t matter as the terms already agreed

- Option to make cover index linked or inflation proofed – but premiums may then go up annually

- Critical Illness is often a valuable available rider option & is underwritten asking health questions

- Waiver of premium protects your policy premiums if off work re accident or sickness

- Can be setup into trust to go to your nominated beneficiaries

Cons | Level Term Insurance

- You have to invest the Lump Sum to best provide you a stable monthly pension income

- As it runs for a set term, you may live out that nominated term

- Level cover means with inflation then over time may affect your policy cover benefits

- No cash in surrender values, cheap & cheerful on this women’s life insurance uk policy

Decreasing Term Life Insurance | Mortgage Cover

Decreasing Term or Mortgage Life Insurance, pays out a decreasing cash lump sum over a fixed term. Typically, this policy maybe used to repay a mortgage or loan. As the amount of lifecover reduces monthly, usually similar to your mortgage or loan as it also decreases monthly but still has fixed premiums. Most plans also include free ‘terminal illness’ cover.

Pros | Decreasing Term Insurance

- A Decreasing Term Life Insurance policy will offer cover for a fixed period of time or ‘term’

- If you die within that set ‘term’, it pays out that set decreasing lump sum life insurance payment

- For example – it may run for 25 years to follow your 25 years mortgage period

- They are cheaper policies to operate than level term, as the cover risk reduces

- Cover is ‘underwritten’ so Insurers will ask you medical & lifestyle questions before offering terms

- If your health changes adversely mid term, it doesn’t matter as the terms were agreed beforehand

- Ability to rate-fix which the policy decreases, to reflect current or future mortgage loan rate rises

- Critical Illness for mortgage cover is often a valuable available rider option

- Can be setup into trust to go to your nominated beneficiaries

Cons | Decreasing Term Insurance

- If your mortgage terms change, you may have incorrect lifecover amounts & for the wrong term

- If the policy decreases on a fixed rate, this maybe inflexible to any big future mortgage rate rises

- You maybe unsure the amount of decreasing lifecover you may have, unlike level term lifecover

- It may not pay off a repayment type mortgage or loan on death if you switched to interest only

- No cash in surrender values, cheap & cheerful female life insurance policy

Whole Life Insurance | Legacy or Funeral Cover

Whole of Life Insurance policy, always pays out if you die ie; whenever (as long as you’re kept up with monthly payments )

Pros | Whole Lifecover

- Whole of life Insurance always payout ‘whenever death occurs’ eg; Even if you were age 195!

- Ideal as Help toward Final Expenses or provide a Legacy

- Insure against possible Inheritance Tax liabilities

- Cover and protect a lifetime interest only mortgage as level cover

- Life insurance to always payout whenever that maybe

- Continuous No Future Health Issues whole life coverage

Cons | Whole Lifecover

- Generally The Most Expensive Policy – as it will always payout

- Some whole lifecover plans don’t have guaranteed but reviewable premiums

- Reviewable costs could work out even more expensive into the longer term

- Only so many Insurers offer this type of policy & usually via advice only

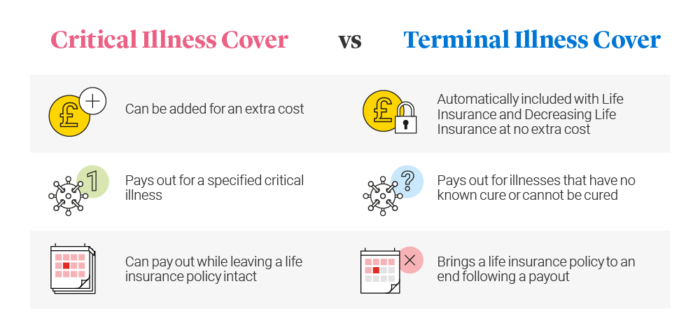

What’s Terminal Illness v Critical Illness?

- Terminal Illness on a Life Insurance means you sadly have less than 12 months to live ie; incurable illness

- Terminal Illness is often included for free as part of your life assurance policy benefits

- The Insurers claim team will payout the cover earlier as a ‘death insurance claim’ in advance

- Women’s Well Woman Insurance or Critical Illness however is ‘paid for’ or standalone benefit

- It is claimed upon survival & recovery. It often covers a large range of benefits

- Benefits for lifecover and critical illness may include types of cancer, heart disease, stroke, ms, diabetes etc;

- The chances of claim for critical illness are 1 in 3. Income Protection 1 in 4. Life Cover 1 in 10.

Life Insurance for Woman Monthly Income options.

OPTION 2: MONTHLY INCOME

Family Income Monthly Benefit

A Family Income Benefits [FIB] term policy pays upon death a monthly income or sometimes annually, within the agreed plan term.

In essence, it is a decreasing style family lifecover so perhaps ideal life insurance for a woman looking to protect the family. Most plans also include free ‘terminal illness’ cover.

Pros | Family Income Cover

- The monthly income upon a death claim is then just paid for the remaining fixed plan term

- This means you could setup plan until any children are independant or upto retirement

- Like decreasing term life cover, the amount owing on death reduces over the term

- eg; used to protect child maintenance fees upto say age 21

- FIB helps to avoid complications & stress of how best to invest a lump sum for income

- During the payout period, it therefore acts similar to regular monthly pension

- Some Insurers do allow FIB to be commuted to lump sum option upon claim

- Generally initially cheaper than level term insurance policies, as a reducing style cover

Cons | Family Income Cover

- Family Income Benefit FIB is a decreasing style life insurance plan

- This means the lifecover amount paid out at claim is a reducing balance

- Example: £1,500pm FIB policy benefit over 15 years. A death claim comes in year 12

- So it then pays £1,500pm for upto 3 years upon a death claim and then the policy ends

‘Life Insurance for Women’ | FAQ Broker Questions

‘Life Insurance for Women’ | FAQ Broker Questions

Can you make changes to a Womans’ Life Insurance policy?

In terms of changing your life insurance for female or indeed male policy, often you can request some of the following:

- reduce or perhaps extend the period of cover

- decrease or increase the amount of lifecover

- remove indexation option or any specific paid for policy features

- change the collection date of your usual premiums

- take off a life assured from a joint policy eg; if a couple or parents split

These changes could be subject to new medical underwriting based on your circumstances at the time & may well affect your premiums.

We always suggest you seek professional advice before taking any course of action re best life insurance policy for a woman.

Should I put my ‘Women’s Life Insurance’ policy into Trust?

When your ‘womens life insurance’ policy isn’t written into trust, it will be paid to the executors of the deceased’s estate. They will handle the administration, known as probate in N Ireland, England, Wales and confirmation in Scotland. If not, the benefits will fall into your estate if you died prematurely. If you have not made a will, this can then cause further complications with the life insurance monies.

Until probate is fully granted, no monies can be paid out to those named in the will. On average, this can take upto 6 months. By not placing the plan into trust may also swell up the total estate values, leading to potentially Inheritance Tax IHT issues.

So placing a policy in trust can help to ensure that the policy proceeds go to the correct beneficiaries you decide to nominate at that stage. It can also help avoid possible probate delays & IHT costs. Ask the Insurers to kindly provide their available standard trust form wordings & seek legal advice if unsure. Unsure, then seek professional broker advice re best life insurance policy for woman.

Importance of Disclosure & Claims re ‘Life Insurance for Women’?

All Insurers are in business to protect, insure & payout. Insurance cover is therefore based on your full disclosure at the time you took the original womans’ life insurance policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying.

The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying eg; don’t advise a familial history of say heart disease, blood pressure or cholesterol

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details. They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details.

If you look at most Insurers recent claims payout, you will see that it maybe good but often not 100% on any best women’s life insurance.

What if my health or lifestyle changes after I had taken the Life policy out?

Any health or lifestyle changes since, usually does not void your existing ‘Woman’s Life Insurance’ policy, if it wasn’t relevant at that time of initial underwritten insurance application.

For example, you are now pregnant. As such, your pregnancy and life insurance terms should not be affected.

It maybe the Insurers request GP reports when you originally apply, to check any health details disclosed. Likewise they may not.

Take care to doubly re-check on your application what you initially disclosed to the Insurers, as this information then stands now and in the future.

For example, you gave up smoking or vaping for a year or more before the policy but started again afterwards. Please check your original ‘life insurance woman’ T&C’s.

Article review on ‘Womens Life Insurance’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Womens’ Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'