Article on: Critical Illness Coverage

'How much critical illness coverage do I need' ?

What is Critical Illness Coverage?

Critical Illness Coverage Insurance is a policy that pays out a tax-free sum to help protect you should you suffer a critical illness & become seriously ill - as specified by the Insurers plan & during the policy term.

It may pay out upon a claim crucially upon initial diagnosis and then survival of that specified illness ie; a claim means you need to survive to then claim. If you also include lifecover, then if you did not survive, it would still payout.

ie; If you just died of a heart attack, then some plans may not payout if you died, as you did not survive to claim. As such, 'life insurance with critical illness coverage' is an option to therefore consider.

The Top 3 Claims

Somebody's Life could change in just a Few Seconds.....

* Stats Timeline AIG

Every few seconds, somebody in the UK is sadly diagnosed with 1 of these 3 health issues.

'Critical Illness Coverage' meaning

Critical illness insurance helps to protect you & your family against the financial impact serious illness can have on your weekly or monthly finances.

Loss of income or business through anyone suffering a critical illness, is unfortunately more than likely. Plus the regular visits to the hospital. Then the closer impact poor health could have on your partner, your family, your dependants or your friends.

This impact maybe physically ie; if they have to help lift you. Then psychologically, with the stresses and strains to helping care for you perhaps 24/7.

The taking time off to perhaps help you out & any knock on financially. This ripple effect sadly of those suffering any critical illness, are oft forgotten.

Most UK Insurers therefore base their insurance critical illness coverage around the severity of these above top 3 claims - Cancer, Heart Attack & Stroke.

How much Critical Illness Coverage do I need?

Critical Illness Coverage 'Tax Free Payment' could help you pay off.......

- Mortgage

- Debts, Credit cards or Loans

- Adjust your Lifestyle & Home

- Pay toward any urgent Private Medical Treatment

- Holidays of a Lifetime when you fully recover

- Put away just for that rainy day

From this basic list above, you can therefore decide how much critical illness coverage insurance do I need?

Main Types of Critical Illness Coverage Insurance

All Uk Insurers do vary their critical illness coverage terms ie; shop around as cheaper here does not always mean better...

However, most UK Life Insurance Companies also abide by ABI minimum standard rules*. This helps to ensure that their products should be clear, fair and not misleading. Also that people’s reasonable expectations of how much critical illness coverage is enough are met.

- Basic critical illness cover for just 1 area like female cancers eg; well woman cancer

- Or just 3 core conditions - types of cancers, heart disease & stroke

- More comprehensive policies - covering 40 + illnesses or 60+ illnesses or 90 + illnesses

- Policies that cover just 1 main critical illness claim and then end

- Or Severity based plans enabling multiple or part payments upon diagnosis

- Fixed Policy Premiums or Reviewable Premiums policies

- Policies that include free child cover or as a paid for extra from outset

- Ignore those Life Insurance with Free Gifts, often their critical illness plans are basic

- Generally these free gifts could cost £1,000’s more lifetime expensive

What other help can the Insurance Company give at diagnosis & claim?

- GP 24/7 services. This is virtual access to a specialist by your phone or web.

- Best Doctors Services give access to top medical specialists or a valuable 2nd medical opinion for peace of mind.

- Open Private Referral if an NHS consultant is too busy to see you immediately.

- Note: some services are policy inclusive & others maybe paid for.

- Rehabilitation services via Red Arc nurses or similar are often used

- Mental health specialists that can assist family members also.

- Premium waiver benefit means the Life Insurers can help pay your premium whilst in claim.

- This is useful if your insurance policy enables multiple claims.

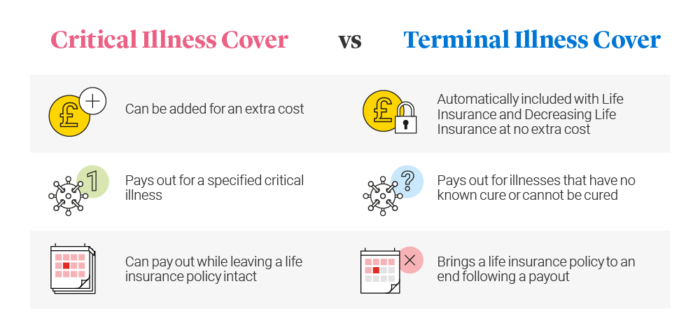

Is Critical Illness the same as Terminal Illness?

- NO is the simple but important answer

- Terminal Illness is often included for 'free' as part of a life assurance policy cover.

- It usually means a doctor or consultant has advised you may have less than 12 months to live ie; incurable illness.

- Once agreed by Insurers, they may then payout this life insurance policy death claim but in advance.

- Critical Illness as explained, may pay out claims crucially upon diagnosis and survival of the specified illness

- So Critical Illness means you will live, survive & claim. It is also underwritten.

- Terminal Illness means you will not survive long term after a claim

- Critical illness cover and life insurance plans are often combined anyway

- Be careful. Don't get confused between critical illness & terminal illness cover

Broker FAQ

* Top Reasons Critical Illness may not pay out?

- According to Association of British Insurers ABI stats - @ 91% paid out, then 89% of critical illness claims therefore did not payout.

- Possible reasons that UK Insurers do not consider a critical illness claim. Policy definitions & Non Disclosure

- 1] Policy definition: It doesn't cover the benefit you claimed. eg; it pays only on aggressive types of cancer but you are diagnosed with less advanced stage 0 cancer

- 2] Non disclosure: You haven't told Insurers your correct health history at the time of application eg; familial history of raised blood pressure or cholesterol

- So Insurers then find this out upon claim & refuse a payout re how much critical illness coverage

* Can my Children get Critical Illness coverage ?

- Some Plans will include valuable child critical illness cover for free

- Other plans you have to pay extra to include this benefit at plan outset

- Any child benefit claim (usually a lower % amount) won't affect the main adult policy benefits

- These may often cover children upto age 21 higher education

- Insurers may also payout a lump sum sadly upon the death of a child

- Some Insurers allow you to enhance the child critical illness cover

- Also if a child was critically ill, then if covered under 2 x single adult policies, both would payout

- If you have a child - consider at least a policy that includes free cover

* Do I need Critical Cover & Income Protection?

- Income Protection PHI helps cover your monthly outgoings

- PHI pays a tax free income if you are unable to work due to accident, illness or hospitalisation

- Income protection cover is subject to usually a maximum calculation of 65% of gross income

- Employees may find work already provides some sort of long term sickness scheme

- This could mean more PHI is either not needed as you may be over insured initially

- How much coverage for early critical illness is then paid out, before any income protection benefits

- Critical Illness Coverage is not income assessed

- It may still pay out a tax free lump sum + help repay a mortgage, loan, debts or adjust your lifestyle

* Should I get a Single or Joint Critical Illness Coverage?

- A joint critical coverage insurance may just pay out on claim of the 1'st policyholder - but then ends

- Insurers may setup for example a joint life 1'st claim earlier or accelerated critical illness plan to repay a joint mortgage

- If one partner was critically ill, you may then still need to make adaptions to your home?

- This payment could help reduce the stress & reliance then on the other partner.

- For family insurance cover however, you may therefore wish to consider setup of 2 x single plans rather than joint plan

- The cost difference benefit for 2 x plans maybe less than you think

- How much critical illness coverage do I need? Choose Lump Sums or Family Income Benefits options

* Trusts & Critical Illness Coverage

This Trust section is only relevant if you have chosen 'life insurance with critical illness coverage'.

- Writing a policy in trust is way to protect your family’s future in the event of death eg; You sadly died in an accident first, rather than making a critical illness claim.

- If coverage for life insurance is present, then you would only ideally want the critical illness cover benefits paid to yourself.

- So, there is specific type of protection trust used in this situation. It splits out the critical illness cover away from the life insurance (which is why it’s called a Split Trust).

- It also ensures any remaining death benefits are held in trust for your beneficiaries if you died first. It helps avoid probate delays & Inheritance Tax IHT issues

- Trusts are a legally acknowledged HMRC arrangement. The trust should be managed by ideally more than one trustee eg; direct family member, trusted friends, or a legal professional.

Covid 19 & Critical Illness claims

- Covid 19 is not listed under most Insurers critical illness cover

- However, if Covid 19 required continuous mechanical ventilation & intensive care, then a claim could be considered

- Only more comprehensive Critical Illness policies may payout under their 'Intensive Hospital Care 7/10 days duration'

- Note: if you died of Covid 19, then if your plan was also combined with lifecover, it should still payout

Importance of Disclosure & Claims

- All Insurers are in business to protect, insure & payout.

- Insurance cover is therefore based on your full disclosure at the time you took the original policy out ie; being 100% as honest & accurate as possible.

- It is not always easy to remember all your historic health details when applying.

- The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying.

- If so, it may not payout ! eg; If you vape, then you must tell them you are smoker (even if it costs more).

- Should you make a claim, your Insurers will send you a claim form for you to complete.

- Once received back, they will usually contact your GP to confirm any health details.

- They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details.

- If you look at most Insurers recent claims payout, you will see that it is Good (but like most insurance critical illness coverage at claim - not 100%).

What if my health changes after I have taken the policy?

- Any health or lifestyle changes since, usually does not void your existing life coverage insurance, if it wasn't relevant at that time of initial application

- It maybe the Insurers request GP reports when you originally apply, to check any health details disclosed. Likewise they may not

- So take care to doubly re-check on your application what you initially disclosed to the Insurers

- This underwritten insurance information then stands now and in the future. Please check your original T&C's

Which is the Best Critical Illness Coverage 2025?

- There is no set answer to this question re best 'life insurance with critical illness coverage'

- The UK Critical Illness cover marketplace never stands still

- The critical illness market awards shows the devil is really in the detail.

- Plans maybe paid on one claim only & then end.

- Others enable multiple claims and where you may get a % of sum assured amount

- A cheap critical illness insurance coverage may only cover just a few conditions

- Or it could have cheaper reviewed premiums that increase in the future so not guaranteed

- Neither is the most comprehensive policy always the best, it could be unsuitable to your individual case circumstances or budget

Martin Lewis on Critical Illness Coverage states, he is not a big fan of these policies perhaps mainly due to the large number of different listed illnesses that different UK Insurers may use. He therefore queries should you even take it out, as this makes working out their different claim terms harder to assess.

Not exactly sure why, other than it is not a ‘catch all illness’ plan. We believe however they are a valuable protection insurance asset & should the worst happen. Speak to a financial adviser for best advice here.

Article review on ''how much critical illness coverage do I need' by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women - we review many of the best brands selling Critical Illness & Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'