Business Life and Insurance Protection.

'Business Life Insurance for Owners'

Business Life Insurance - Protection Cover Types

Business Life Insurance - Protection Cover Types

Business life insurance protection - can help support your business financially should something sadly happen to yourself, directors, partners, or employees.

There are several different types of business protection insurance. All those business owner life insurance options may help provide the support your company could need & at a vital time.

We will therefore examine here some of the various types of 'Business Life Insurance for Owners' currently available in the UK.

Don't leave it to chance if someone important to your business becomes seriously ill or dies..... Consider 'Life Insurance in Business' as part of your work tools.

Post Brexit, Pandemic & New Government 2020's

Is your Business Life more volatile?

Business Protection Insurance aims to Provide Stability

'Business Life Insurance Policy'

Here are the main protection types of business life insurance policy available in the UK marketplace for your company:

1] Business Loan Protection

To insure company related debts, business loan protection can help cover: any director’s loans, mortgages, overdrafts or debts, credit cards or guarantees.

Note: A business is classed as a separate legal entity. Business life claims are usually paid back to the business - instead of a family member.

Policies for Business loan protection can be taken out for business owners, directors or employees. The levels of business protection cover usually mirrors the amount of company debt as set out in their loan borrowing terms.

This cover can help protect the main players should they die, become terminally or critically ill.

- The business loan life insurance premiums are paid for by the company

- The policy however is also owned by the company ie; business owned life insurance

- In the event of claim, the proceeds would be paid directly back to the business (unlike personal life insurance pay-outs)

Business Life Insurance. Get Quotes here and Broker help.

2] Key Person Insurance

Most Businesses have several key people who make them tick & so stand out from the crowd. This policy is aimed at protecting your business against losing these star 'key personnel' (Keyman or Keywoman).

You can either take this policy out to cover if that key person died, or alternatively is diagnosed with a serious critical illness.

How would the business survive if its income dropped dramatically because of this?

- Key person insurance is paid for and owned by your business ie; corporate owned life insurance policy

- The business would then also be the beneficiary.

- Premiums are calculated by working out how profitable (or costly) that key personnel loss is to your business.

To ensure business life continuity or survival, the policy proceeds could be used to help; Protect any dip in profits or losses, cover liabilities or capital.

So for your business life assurance definition here, which man or woman in your business is that star performer?

3] Relevant Life Insurance

Relevant Life policy is a tax efficient way of offering employees 'Death in Service' benefits. As a LTD Company, or small business owner or Partnership with perhaps less than 10 employees, relevant life insurance policy could offer a simpler alternative to a group life insurance scheme. It maybe a cost effective life insurance small business owners solution.

Unlike the first 2 schemes mentioned above, here this type of Company Directors life insurance lump sum benefits can be made payable to family dependants.

Note; this insurance is not meant to be paid direct back to the company on death - for example usage by family to then repay any directors business loans. Technically, HMRC may raise a point here that tax relief and relevant life policy proceeds were used incorrectly - thus causing UK tax implications (Please seek your own correct tax advice).

They can use the funds instead to maybe help repay a domestic mortgage or cover ongoing family bills & expenses. In essence, this can also be a type of business life insurance for employees of their own family Ltd Company.

The maximum amount of relevant life insurance cover available - may depend on the employee’s age & income for qualifying life policies and may vary between UK Insurers.

This relevant business term life insurance usually must end before age 75 ie; it is not a business whole life insurance cover and which may not be needed anyway?

*Small Business Life Insurance

In essence, this relevant life policy maybe an ideal small business life insurance for employees. But this may also depend on any other life cover that is in place for their staff. Remuneration can include salary, bonuses, benefits in kind & share dividends within the employer’s group of companies.

Typically relevant life policies cover levels allowable could be calculated as follows; based upon age & annual income: (Each Insurer will calculate this differently and only a few UK Life Companies offer this type of business policy)

| 18>40 age | to 30 x income | 40>50 age | to 25 x income | 50>60 age | to 20 x income | 60>70 age | to 15 x income |

- Relevant Life business life insurance premiums tax deductible as a business expense rather than classed as a benefit-in-kind

- Is potentially tax-deductable ie; life insurance business expense (always refer to your accountant or relevant life policy HMRC for guidance)

- Any payout from the relevant life policy will not count towards an employee’s lifetime pension allowance

- The policy must be written ‘into a business trust’ from outset, which can help direct proceeds to intended beneficiaries ( Insurers usually provide standard trust forms)

- This company directors insurance trust could also help protect against personal inheritance tax payments

- See how much typically your company could save: Relevant Life Calculator via life insurance through business & check out any business life insurance taxation savings

What is Relevant Life Insurance Cover ? Ageas Protect now AIG

4] Shareholder Protection Insurance | Business Partner Life Insurance

Life insurance on business partner. If you run your company as a partnership or a Ltd Co with shareholders, what could happen if one of you died prematurely?

If someone dies, their business assets could go to their dependants eg; shares in the business. However, what they receive may not be what the surviving partners business may want and so may cause the business to struggle or even survive.

A shareholder protection policy simply enables a cash sum to be paid to those surviving shareholders. This can then be used to purchase the deceased owner’s shares.

A Shareholder Protection Policy should be coupled with an appropriate signed agreement alongside their companies memorandum of articles of association ie; detailing what they want to happen for their business partner life insurance.

Business Life | Double Option Agreement

It is also relevant that the business considers that a 'double option agreement' maybe in place. Insurers often help provide a generic form.

This business life insurance policy legally enables the living owners to then help buy these shares from the deceased’s family estate should they wish to. It also legally allows the deceased’s family or executors to perhaps force the sale of shares to the remaining owners if stipulated.

Business Life | Single Option Agreement

Alternatively, in the event of a critical serious illness claim, a 'single option agreement' may potentially force the remaining shareholders to buy their shares. However, it usually does not allow the remaining shareholders to then force the sale of shares as they could hopefully return to work once they have recovered.

Note: There are various protection options you can choose from for this business owner life insurance policy eg; Shareholder Protection, Partnership Protection, Company Shares Purchase Protection or Limited Liability Protection.

5] Life Insurance for Partnerships | Partnerships Insurance

Life Insurance for Partnerships protects your business against loss of control of the partnership in the event of the partner being diagnosed with a terminal illness or if they died. The surviving partners may now want to buy their interest in the business partnership to help keep control. A life insurance for partnerships policy will provide money for those surviving partners to buy the interest in the partnership from their estate.

Alternatively, if a business partner now wants to or has to retire early if they are diagnosed with a critical illness instead, the remaining partners may now want to purchase their interest with suitable partnerships insurance.

Note: There are 2 main types of partnerships, limited liability partnership (LLP) & traditional. A LLP will continue onwards following the death of a partner & any retained profits will be paid to the deceased’s estate. If there is no legal Partnership Agreement for a traditional partnership, it will dissolve on death and the deceased partner’s estate and beneficiaries will be entitled to their share of the business.

Note: If your partnership is legally split say 70/30 then you may wish to insure yourself % split wise accordingly with correct partnerships insurance distribution.

Taking out life insurance for partnerships gives those surviving partners the financial support they may need, helping them keep their business running & retaining control in that difficult time.

In a standard partnership, each partner writes their life insurance for partnerships into trust for the benefit of the other partner(s). If there are 2 partners, they can each set up a life of another policy.

This means those individual partners pay their own premiums with life insurance cover taken to reflect each partner’s share for any small business life insurance policy.

6] Executive Income Protection

A specific type of business income protection policy arranged to help cover a key member of your staff. Designed to provide an income replacement in the event of them being unable to work due to accident, illness, hospitalisation or injury. You choose the requested initial waiting period before policy cover starts, which could be after say 4/8/13/26 weeks.

This corporate life insurance policies for income protection on any executive employees is underwritten insurance so asks health & lifestyle questions eg; diagnosed high cholesterol or heart disease.

Typically cover is allowed upto 75% of gross annual income. This calculation may include any dividends, P11D benefits, performance related bonuses.

Should a claim happen, any benefit is paid directly back to the business. The business may then use the money to provide the director or staff with a replacement of any lost income due to being off work. The business could then pay this benefit to their employee being taxed under PAYE at this point along with the relevant National Insurance Contributions.

An executive income protection plan is owned by the company, so therefore can be treated as a corporate expense. It is usually arranged on a ‘life of another’ basis.

*Own Occupation

The ideal Executive Income Protection plan is with an ‘own occupation’ definition of incapacity.

This pays out if you are simply unable to perform your current job role, rather than requiring you to do an alternative job role of which you are capable eg; definitions of ‘suited occupation’ or ‘any occupation’.

*Claim Periods

The waiting/deferral period may also affects the costs ie; potentially the shorter the initial wait time, the more expensive it could be, as the risk is higher

There are usually a few claim period options; The most expensive is 'unlimited in claim' ie; benefits paid if you are potentially unable to work ever again until the policy term ends. Alternatively, there are cheaper shorter term options eg; upto 1/2 years or 5 years per claim instead.

*Executive Income Protection v Personal Income Protection?

- Executive income protection is funded by the employer's gross profits

- The employer can apply to receive tax relief on their premiums

- Personal Income protection is funded by after-tax income [So unable to reclaim tax relief]

- However, Personal Income protection does allow Tax free benefits in claim

- Benefits paid via an executive income plan are paid back to the company

- But then become subject to income tax and national insurance

- Is company life insurance taxable here for Executive income protection? No

- In the event of a claim on executive income policy there is no further tax upon the company (provided benefits are used to fund employee sick pay)

- The company can also receive a corporation tax deduction for the monthly amounts given to their employee

Business Life Insurance vs Personal Life Insurance?

What's the main difference between Business life insurance vs Personal life insurance?

Looking from the various options above, the 2 main key differences between these types of life insurance is firstly who pays for it?

Secondly, who may directly receive any insurance claim benefit paid (ie; Is either the business or the individual).

From this, you may establish whether their is any tax implications or benefits and savings that may then result.

Business Life | Other Commercial Issues

Some UK Business Life Insurance Companies often build some helpful additional FREE Rider Benefits into their business products. These could well support your daily business life.

As Independent Life Insurance Brokers - Contact us for which Insurers can best offer help here on any life insurance new business deals.

- Offering helpful guidance re: Business Tax, VAT or Commercial Legal advice

- Have you considered a Business Will

- Do you have a business continuity plan

- Small Business Insurance cover

- Professional indemnity insurance

- Employers liability insurance

- Public liability insurance

- Loss of Profits Interruption

- Do you know what your business is worth?

Helpful Guidance | Valuing your Business

Business & Valuation

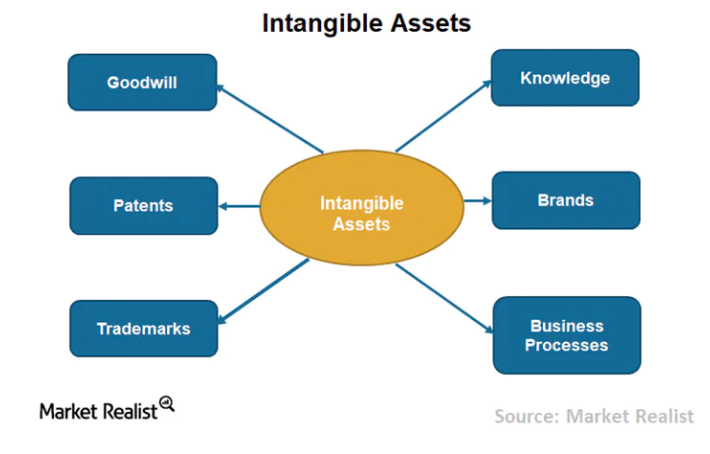

Tangible things like your fixed assets & stock ( ie; buildings or machinery) usually have clearer value. So some companies you can more easily value. Others are much harder eg; those 'intangible assets'.

- Goodwill?

- Patents?

- Trademarks?

- Knowledge base of management?

- Brand Values?

- Business Processes unique?

So all this makes new business value life insurance calculations harder.

In conclusion: These various intangible assets can make it harder to assess an accurate valuation. Insurers may offer additional support & helpful tips via their products.

'Business Life Cycle'

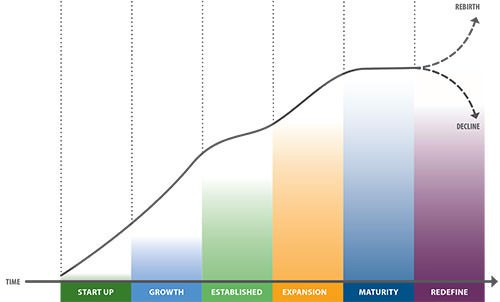

A Business Life cycle is usually made up of several main life stages or cycles. These various the business life cycle stages are the progression of a business into its various phases over its lifetime.

However, unlike human average life expectancy toward their end, a business life may have opportunity of rebirth again, rather than decline ![]()

It is commonly divided into 6 stages: Start up launch, Growth, Established, Expansion, Maturity, and finally Redefine or Decline.

1] Business Change Life Cycle | Start Up Launch

- Each business usually starts its operations as an idea, about either a unique product or service, or maybe around existing ones. During the start up phase, sales may start slowly but hopefully steadily begin to increase.

- Businesses in this start up phase tend to focus heavily on marketing to their target consumers & audience, by advertising their comparative benefits and propositions.

- Nowadays, if it's via the internet only your brand new website may need to use pay per click via search engines. Alternatively, promote the business via the various social media platforms.

- Cash flows during the start up phase is also usually negative. It may dip even lower than profits and this is due to the capitalization costs of the initial startup.

- However, as income revenue is perhaps low and any initial startup costs are usually high, many businesses are prone to therefore incur losses during this start up launch phase.

2] Growth

- During the growth phase, a business may experience rapid sales growth. As the sales increase rapidly, it may start seeing profits once they pass the break-even point.

- These profits may still lag behind the sales turnover, as profit levels are not as high as them. You may over promise services but sadly under deliver, due to lack of staff at this stage of growth.

- During this phase, the cash flow finally becomes positive, or the income exceeds expenditure.

3] Established

- During the established phase, sales will continue to increase, but perhaps now at a slower rate. This maybe because of the entry of new market competitors or market saturation.

- Business Profits also start to stabilize. This growth in sales and stable profits may represent an opportunity to expand or alternatively just stand still & tread water.

4] Expansion

- Many businesses may expand their life cycle during this phase, by continually reinventing themselves. An opportunity to increase sales, profits and cash flows again.

- They may re-brand their business, reinvest profits into newer technologies or into a new marketplace. This allows a business to reposition themselves and thus refresh their growth into the marketplace.

5] Maturity

- When it matures, sales may begin to decrease slowly. Cash flows can be relatively stagnant, while the Profit margins begin to get smaller.

- You maybe able to under promise services and now over deliver, due to a full team of staff at this stage of growth.

- As businesses approach maturity, any major capital expenditure can be largely behind the business. Business Life may seem a bit easier, so the bosses relax but be aware, don't rest on your laurels, as the competition certainly won't be.

6] Business | Redefine or Decline

- In this final stage of the business cycle, profits, sales & cash flows all begin to decline. The Business may start to lose any previous competitive market advantage.

- During this phase, a business can either accept their failure or alternatively take a deep breath, and extend their business life cycle. They could redefine themselves again by adapting to the changing environment or just give up and finally exit their market.

Business Life Conclusion

Understanding this life cycle is important for all professionals in the financial services industry ie; whether it's a Bank, Finance Lender or an Insurer.

However, these 6 stages are not an automatic progression in any business life plan. Life can often interrupt the best laid business plans.![]()

Plans that can all be affected by the sudden critical illness or death of a business owner, director and any key employees. Plans impacted by any liability and indemnity issues or property damage, causing the business to unexpectedly falter. Contact us below for help and advice.

Sorting out your ideal business life insurance cover may seem a difficult task, so don’t do it alone. It’s a good idea to get professional advice from an expert – we’re here to help.

'Business Life Insurance' Article by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women - we review many of the best insurers selling cheap broker deals on Life Insurance in UK (inc NI)

Get Business Life Insurance deals here.

Business Life

QUOTE For | 'Business Insurance Cover'

*For products with any investment element we may introduce you to an FCA authorised adviser after any further review. We may also introduce you to other selected professional partners for other protection, finance (such as a whole of market mortgage broker) or legal products as deemed appropriate. By completing our enquiry form you ‘may be introduced to another lender/provider’.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'