Article on: ReAssurance Life Insurance

Life Insurance ‘Re Assure’ Yourself & Family

| 0 |  |  |  |

Re Assure in 2025 get ‘ReAssurance Life Insurance’

People are looking for the financial reassurance life insurance gives them in these difficult Pandemic 2020’s times. It makes good sense to regularly review your finances & life insurance needs.

- Have a Mortgage, a Family or your own Business ?

- Get the ‘ReAssurance Insurance’ covers & Protect the Key Things in Life that matter most

- Seek Professional Broker advice & re assure yourself with their best cover tips & hints

- Pre-existing Health issues or Family Health History? Don’t worry let us try & still help you out

- Find Reassurance & Peace of Mind from the various choices life insurance may bring

How much should you ‘ReAssure Life Insurance’?

How much you should be insured for or get to ‘reassure life insurance’ when buying protection cover is a good question. It is one we are often asked as Life Insurance Brokers & for those looking to be re assured by having the right cover in place.

However, with rising household bills & squeezed monthly family budgets in Post Brexit UK & post Russian invasion of Ukraine, people are also naturally looking to save money where ever they can. This is understandable.

Usually therefore people are trying to fair strike a balance & to be reassured quotes for life insurance are enough cover & affordability. Our Broker deals are competitive and many plans can start from a low £5pm via Leading UK Insurers.

However, we will go onto examine here also how getting the cheapest insurance life cover, maybe also costly in the longer run and so not the smarter insurance move.

But let’s turn the question around…and ask instead the advice of Money Savings Expert Guru via its well known founder Martin Lewis.

ReAssurance Insurance

What is Martin Lewis’ re assuring Life Insurance Best Advice?

The Money Saving Expert (MSE) Martin Lewis is one re assuring person. He was appointed both CBE & OBE in the Queen’s UK Honours list.

He has become Britains ‘reassure adviser’ for all matters financial. His general insurance advice and guidance is often followed by many people.

For Martin Lewis on Life Insurance, his sound advice is for a good rule of thumb use the ‘THE 10 x RULE’.

His basic MSE cover formula is to therefore aim to cover ’10 x the Annual income of the highest earner or main breadwinner – until any kids have finished full-time education.

Using that principle, if you earned say £36,500pa gross, he says you should get life insurance reassured (after any mortgage, loans & debts are repaid) for @ £365,000 life insurance (ie; 10 x the annual gross income).

Interestingly, he recommends just to re assure insurance on your gross income of £36,500pa – but not get complicated with calculating any net after tax incomes.

Following on from this basic ‘MSE’ example formula above, if you then worked for the next 27 years until retirement, you could potentially earn over £1 million gross ie; £36,500pa x 27 years = £1 million [or more with any future inflation wage rises].

| 0 |

As such, unlike the 10 x £36,500 gross salary life insurance example – you could instead protect your family with either;

- Income = £3,041pm or £36,500pa family income benefit lifecover policy

- Lump sum = £1 million level term life insurance policy [if invested @3.65% = £36,500pa]

- Or a mixture of the 2 policy types over the next 27 years – all dependant on your family circumstances.

Neither takes into account repaying any mortgages, loans or debts.

- You can decide wether you want to reassure life insurance policy is inflation proofed to help offset rising bills or just to be level

- Single plan | 2 x seperate plans | Joint life insurance 1’st claim | Lump Sums or Family Income Benefits options

Apart from losing a loved one, this real hidden income threat is what could be lost if the main breadwinner died prematurely.

Note: 2 x separate life insurance plans are often more costly BUT they may payout twice.

The Money saving expert Martin Lewis on critical illness life cover also says never blindly buy direct from a bank or insurer as could be expensive

So, as Brokers we are not saying this ‘Martin’s MSE formula’ 10 x salary is therefore a 100% one size fits all reassure now ie; not applicable for everyone’s own personal situation.

You may also feel this is either not enough cover, or perhaps too much for your own circumstances, if looking for a budget life insurance? So, I would re-summarize Martin’s formula.

Reassure Review | That is to ideally ‘Protect 3 Things’…

Reassure Review | That is to ideally ‘Protect 3 Things’…

- LUMP SUM > Repay any mortgage & debts, final expenses costs

- INCOME > Help to cover all your monthly bills

- LUMP SUM > Back up Plan for holidays, education, emergencies

Our reassure for advisers formula is naturally dependant on wether you are married or cohabiting. Have young or older dependants, retired or you are both working still. Have sufficient backup already in your investments & savings.

Ultimately, the ideal life insurance amounts to cover are also down to your budgets’. This calculation could also be made harder due to any pre-existing health history or lifestyle issues eg; history of raised blood pressure or cholesterol.

This could mean possibly a higher or rated reassurance life insurance premium costs. Contact us for personalized advice.

2 Main Types of Insurance Cover

1] Term Insurance

Term Life Insurance is a basic plan that pays out a cash sum if you died during the fixed time frame period your policy runs for.

The sum paid out upon death stays level for family life cover or decreasing for mortgage protection. The premiums remain level whether you are near the policy beginning or end.

Most plans also include free ‘terminal illness’ cover. You can also choose options of a lump sums or family income benefits. Also if you want your cover to be inflation proofed to offset rising costs.

The longer any level term insurance runs, then the more expensive it becomes ie; 30 years term maybe double or more the cost than 15 years, as the insurance risks are higher as you get older.

You can take a term plan upto age 90 as a long term back up plan but then your reassurance ltd to this time frame ie; if you died age 92 your cover will have ended.

2] Whole of Life Insurance

Whole of Life Insurance policy will always pays out if you die ie; whenever (as long as you’re kept up with monthly payments). So you can be reassured life insurance cover will payout.

For those on a more limited budget, this can be the most expensive policy compared to term insurance, as it will always payout.

Note: Over 50’s Lifecover asks no medical questions, so could always be a choice if you have bad health lifestyle issues. Martin Lewis is not a big fan of these no medical types of plans

Consider placing the policy into trust as a ‘reassurance in insurance’ to help avoid probate or Inheritance Tax IHT issues.

Broker FAQ

What’s Terminal Illness & Critical Illness?

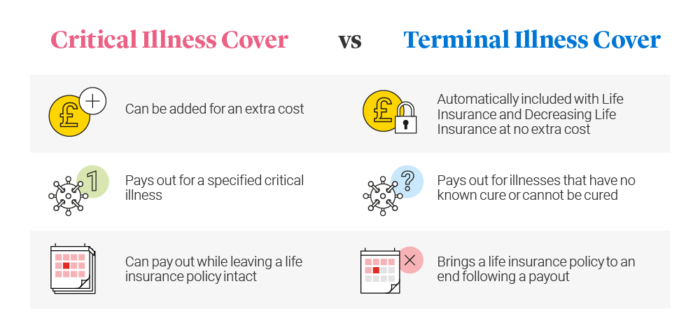

Terminal Illness is often included in plans for free but is an oft forgotten re assuring life insurance policy feature.

Terminal illness means that you have an incurable illness. On a life insurance it also means it will now payout (or accelerated death benefit) if you sadly have medically confirmed you have less than 12 months to live. ie; an incurable illness.

Note; It is also not to be confused with Critical Illness coverage, which is an underwritten policy that pays out instead upon survival of diagnosis of a specified critical illness. eg; Cancer, Heart disease or Stroke etc;

However, many life insurers won’t pay out until their chief medical officer agrees medical proof that you have less than 12 months to live. Once agreed, the Insurers claim team will then payout the lifecover earlier ‘death claim’ in advance.

Not all Providers terms & conditions are the same. Some life insurance reviews in the recent past, several providers have also excluded this benefit into the final 12/18 months of the plan.

Warning Note:

You thinking you are on a comparison website & are reassured quotes are going to save you money on your existing life insurance policy, as the existing premiums sound expensive against what your friends advise they pay.

Your policy however includes critical illness benefit (which sounds like the same as terminal illness benefit)? You look online & see much cheaper premiums for a life insurance (with FREE terminal illness) which you think has the same meaning.

So you go ahead and cancel your old critical illness plan. Only upon being diagnosed with a cancer of the thyroid do you then sadly find out that your old critical illness plan may then have actually paid out.

Your new life insurance plan may only payout if you are diagnosed terminally ill ie; have less than 12 months to live, so you receive no payment. Unfortunately, as brokers we say people often can misunderstand insurers jargon terminology.

Note: To include critical illness coverage onto your policy is on average 4 x the costs of life insurance. Terminal illness is usually included automatically free.

|  |  |

What is Waiver of Premium?

Waiver of premium is a very important insurance product feature that is often overlooked when doing your compliance reviews.

It will help protect your life insurance premiums if off work re an accident, sickness, critical illness or hospitalisation. Some UK providers also cover redundancy.

It can reassure adviser & customer that your premiums are waived or paid by the Life Insurers. They will pay it either until you get back into work, or potentially to the policy end.

Often UK Insurers may charge you extra for this benefit & with varying waiting periods before the benefit applies. Some people wrongly associate this benefit with PPI insurance.

However, check companies if comparing life insurance plans if waiver is standard inclusive or paid for extra. Many Insurers recognize its importance in offering long term peace of mind, as it runs alongside any life insurance policy. Note, some Insurers may not offer to reassure life insurance feature above a certain age eg; over 55

Consider if you suddenly had a serious heart attack or were diagnosed with cancer, and was then off work for along period of time. How could you pay your ongoing life insurance premiums?

If you had to then cancel the life policy because of this, then it could be you may never be able to get affordable life insurance again.

CONCLUSION: Premium Waiver we think is a very valuable benefit. Don’t risk your life insurance policy cancelling, as you may never get to reassure life insurance again.

Note: The costs for having waiver of premium benefit is often small, in relation to help protecting the large amount of those life insurance best deals.

Importance of Disclosure for ‘Re Assurance Insurance’ Claims?

Life insurance agents are sometimes asked….How will the Insurers even know if I socially smoke?

What if I just have the odd cigarette a weekends or maybe occasionally vape, when their ‘smoking rate premiums’ are that much more expensive – if I tell them I don’t anyway?

What happens if I didn’t tell the Insurer anyway about having any familial diseases (what ever that means) as they are asking about me, not anyone else? “I just need to get reassured life insurance deal is issued asap, as I am going away”.

”I am a busy bloke so don’t usually bother seeing my doctor if I had a health issue, I just get on with it…but I am sure everything is all okay, so I don’t need to worry’.

The Insurers may not necessarily request any medical nurse tests or even write to your GP upfront, to query your underwritten insurance application when you apply.

However, they will probably do so if an insurance claim comes in, to fully assess the validity of your situation re a claim.

When buying any type of insurance, it is always based upon your honest disclosures at the time.

Note; Most Insurers should always send you a copy application (by hard copy or e-mail) of what you initially disclosed, for you to then carefully recheck. If you think anything is wrong, then you need to advise them asap.

The original death certificate once requested by the Insurers may then highlight that it was caused by ‘smoking related factors.’ Alternatively, it may point to the fact that a heart attack from someone at such an early age in their early 40’s was likely due to their ‘hereditary health history’ issue of familial heart disease.

The last thing your family & dependants would ever want, at their worst moments, is to have to be told by the Insurer the your death claim is now sadly invalid.![]() That the information you gave at the time was then found inaccurate & so sadly no reassurance life insurance was infact classed as misrepresentation. Most Insurers do not have a 100% claims payout because unfortunately some people think they can try & beat the system like bogus Canoe Man John Darwin.

That the information you gave at the time was then found inaccurate & so sadly no reassurance life insurance was infact classed as misrepresentation. Most Insurers do not have a 100% claims payout because unfortunately some people think they can try & beat the system like bogus Canoe Man John Darwin.

Remember, if you were paying £27pm to be then be reassured quotes are ‘correct’ or just £17pm ‘maybe incorrectly’ for £300,000 life insurance. Who has the GREATER RISK ?

The Life Insurance Company who may re assure your Family at their worst time and pay out a £300,000 death claim …..or your Family because they unfortunately didn’t !!!

What if my health changes after taking the Life Insurance out?

Any health or lifestyle changes since, usually does not void your existing insurance cover. If it wasn’t relevant at that time of initial application, then there is no need to reassure life insurers again of any updated health issues..

It maybe the Insurers request GP reports when you originally apply, to check any health details disclosed. Likewise they may not.

So take care to doubly re-check on your application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original T&C’s.

What does putting an Insurance Policy into Trust mean?

Putting the policy into ‘trust’ may help to avoid probate delays & Inheritance Tax IHT – by falling outside your estate. You can then be reassured insurance benefits should go direct to you nominated beneficiaries via the trustees.

This applies even if you have made a valid will. If in doubt ‘re assure’ yourself and always seek legal advice. Without a trust the ‘reassurance in insurance’ means the policy could fall back into your estate.

Inheritance tax is currently 40%. So it could be for larger estates, and also larger life insurance payouts is then reduced by this amount. It therefore makes sense for the reassurance life insurance should be put into trust ideally from outset.

Most Insurers do supply free a good range of generic life insurance trusts, ideal for many client situations.

Conclusion

Speak to a Financial Adviser. Let them discuss your individual case circumstances & re assure you about the peace of mind and reassurance life insurance can bring.

Article on ‘ReAssurance Life Insurance‘ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Life Insurance in United Kingdom (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'