Article on: UK Companies Check Insurance

'UK Companies Check' Life Insurance Top Deals

| 0 |  | 0 | 0 |

TOP Life Insurance: Check Company House Name Brands

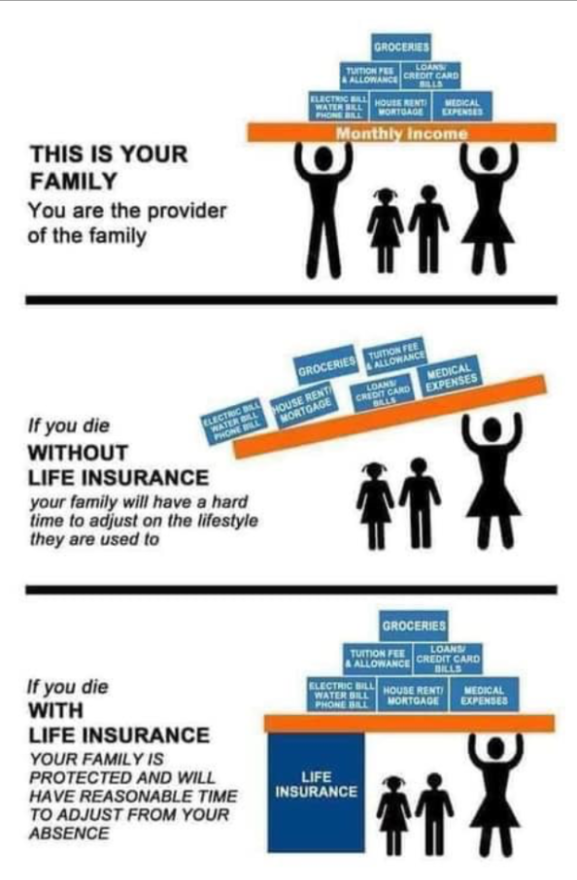

Comparing any Top 10 UK Companies check on either Life Insurance, Critical Illness & Income Protection, could save you both time & money and protect yourself, your family or business.

As whole of market Life Insurance Brokers, we compare leading Insurance Companies house name brands in the 2020's we currently work alongside with.

We understand as Financial Advisers that having insurance protection is the bedrock of any sound financial planning. Therefore, we are committed to help protect you, if and when you, your family or business may need it most.

These 'check company by name' listings are all in alphabetical order here of some leading life insurance companies in the Uk. This Top Companies Checker for life insurance are then listed into their various protection insurance areas they may all specialize in. There are 'Defaqto' star links across each insurance sector.

Note: Our UK broker companies name check recommendations will always depend upon your own individual circumstances, and so should not be taken as personal advice.

Top Insurance Companies Checker

Top Insurance Companies Checker

Check UK Companies 'Term Life Cover' Quotes >

Check UK Companies 'Income Sickness' Quotes >

| | |

Check UK Companies 'Critical Illness' Quotes >

| AIG | |

| Aviva | Exeter |

| Guardian 1821 | Legal & General |

| LV= | Royal London |

| Scottish Widows | Vitality Life |

| Zurich |

Check UK Companies 'Whole of Life' Over 50 Quotes >

| AIG | |

| Aviva | Legal & General |

| LV= | One Family |

| Royal London | Vitality Life |

| Zurich |

Check UK Companies 'Business Life Cover' Quotes >

| AIG | |

| Aviva | Legal & General |

| LV= | Royal London |

| Vitality Life | Zurich |

BROKER FAQ:

What are usual Life Insurance Companies Checks?

What are usual Life Insurance Companies Checks?

When you apply for insurance protection cover - what checking companies normally do to underwrite your insurance application?

Most Life Insurance Companies checks are usually as follows to assess underwriting insurance and fraud risks & to calculate premiums:

- Full Name & Address

- Date of birth

- Gender (although rates are Neutral)

- Occupation

- Height / Weight BMI Kg

- Smoking status

- Alcohol consumption

- Recreational Drugs use

- Health current or pre-existing problems eg; raised blood pressure or asthma

- Family History eg; familial heart or cancer

- Hazardous Pastimes

- Overseas Travel

Are Life Insurance Companies checking your Medical Records?

Are Life Insurance Companies checking your Medical Records?

If you are applying for either life insurance, critical illness, income protection etc; your uk life insurers might ask to access your personal medical information. However, they might not.

This will be based upon a standard uk company check on your answers to their medical questions eg; You advise about familial history of raised cholesterol.

With your permission under data privacy, they can then request your GP medical records when you apply.

This allows them to have more specific information about all your health background.

Your medical records request could be for;

- All your medical history

- Or just last 5/10 years

- If you recently had illnesses or health treatments or been clear

- Maybe specific information only eg; blood test results for an underactive thyroid

- Quit Smoking health status check as this affects insurance premiums

- Family health history

What insurance companies are checking into, may be also due to the amount of cover being requested ie; More medical company checks for a £10 million life insurance policy (than say life insurance coverage for £10,000).

They could also request that you attend a personal medical health nurse screening, as well as a GP report.

This may all depend on a companies number check for their overall underwriting risks eg; Insurers may check more if your aged over 50, that the total sum assured limits you applied for is say over £250,000, that you want a life insurance policy upto age 90 etc; etc;

Do Insurance Companies check Medical Records at Death?

Do Insurance Companies check Medical Records at Death?

Sometimes Insurance Companies can check your medical records after someone dies (if they are concerned about a claim).

For example, this could happen if they died from a heart attack...but it was only just several months after taking out the policy. Or they died of excess alcohol poisoning (but claimed they only ever usually drank moderately).

However, they must seek permission from an authorised legal representative to do so. These checks also touch on the much vaunted & debated contestability period. This legal time frame period is still to be fully decided about setting ...as to how far back any Insurers can go, to then contest any insurance claims.

This also means that most UK insurers have not paid out 100% of death claims but average 98% stats according to ABI.

Note: Most Life Insurance Companies checks include a basic initial 12 months suicide exclusion clause. Or no medical Over 50's life cover plans apply a 1/2 year natural death causes exclusion. This means you cannot claim within that time frame anyway.

Do Insurers do UK Company Check Name for Fraud?

Do Insurers do UK Company Check Name for Fraud?

Yes. Insurance Companies & Brokers will also cross-check anti money laundering & fraud registers ie; insurance companies name checker against your details.

Scams unfortunately apply to life insurance also (like many financial products)

For example: John Darwin aka Canoe Man pretended he had died to make his life insurance death claim.

Him & his wife were both put in prison for this offence for defrauding both the Insurers, Police & Coroners ....but also sadly their children and family who went to his funeral!

These Insurance companies check name, will apply for both personal & business life insurance cover.

Importance of Full Insurance Disclosure

Importance of Full Insurance Disclosure

All Insurance Companies are in business to protect, insure & payout. Insurance cover is therefore based on your full disclosure at the time you took the original insurance policy out ie; being 100% as honest & accurate as possible.

It is not always easy to remember all your historic health details when applying. The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying. eg; Not disclose if you have a familial history of high blood pressure or raised cholesterol (even if it costs more). If so, it may not payout !

It maybe the Insurance Companies check your application and request GP reports when you originally apply, to check any health details disclosed. Likewise the Insurance Companies may not.

So take care to doubly re-check on your insurance application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original uk life insurance company T&C's.

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details. They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details.

If you look at any best life insurance companies recent claims payout, you will see that it is Good (but like most Insurers - not 100%).

Business Insurance do they check Companies House Names?

Business Insurance do they check Companies House Names?

For Business Life protection re mainly for Limited Companies then Insurers & Brokers will then do a GDPR regulatory check companies house name.

Whether it is a tax efficient relevant life policy, which it's another way for smaller Limited Companies checking to provide individual death-in-service benefits for their employees.

Or many smaller uk company check directors who may wish to top up any life insurance benefits they get from their existing group life scheme (which may typically cover 4 x annual income)

Business Loan, Key Person or Share Protection is also available before qualifying limited companies check companies house will still be done.

Do Insurance Companies Check House Financials?

Do Insurance Companies Check House Financials?

Dependant on the reason for the application & amount of life cover, most Insurance Company check house financials by requesting the following:

- Family Protection – employed evidence of earnings (eg; P60)

- Self employed - a copy of latest accounts or notice of assessment from the Inland Revenue

- Private Residential Loan Protection – copy of their loan offer letter

- Inheritance Tax Protection – countersigned by an independent 3rd party professional (eg;accountant, solicitor or bank manager) with a statement of their net worth

- Business Protection - may require the last 2/3 years financial reports & accounts (limited companies house check names)

- Copy of a new business loan offer letter to check uk company name

- Latest statement of business loan interest on any in-force loans - to check companies details

- Breakdown of all assets, liabilities, net worth, Inheritance Tax liabilities

Can you change your Insurance Company policy?

Can you change your Insurance Company policy?

In terms of changing your insurance policy, often you can request some of the following:

- reduce or perhaps extend the period of insurance cover

- decrease or increase the amount of cover

- check out if it has a guaranteed insurability option

- remove any specific paid for policy features eg; indexation option

- changing the collection date of your usual direct debit premiums

- remove a life assured from a joint policy eg; if a unmarried couple or new parents sadly split up

- put the policy into trust if not done so already

These changes could be subject to medical underwriting, based on your circumstances at the time & may well affect your premiums.

Please contact your Insurers to let the companies check out if these options are possible.

Trusts & Companies paying out at Death

Trusts & Companies paying out at Death

Who the life insurance maybe actually then paid out on death can be complicated. Many people wrongly assume it is a simple process when the insurance companies checks out a death claim.

If it is a joint life 1'st death policy or if it single life policy owned by another person "life of another" then it will just be paid to the survivor.

However, if it is a single life policy it can be more complex. Check if the policy was setup & written into a trust.

If so the Insurer will pay the life insurance via the trustees named to the nominated beneficiaries directly. Sometimes there are a named beneficiary & others times a list of potential beneficiaries.

The life insurance paid out doesn’t have to be included in the legal documents sent for probate and potentially it won’t be liable for inheritance tax either.

When an insurance policy isn’t written into trust, it will be paid to the executors of the deceased’s estate.

They will handle the administration, known as probate in N Ireland, England, Wales and confirmation in Scotland. If not, the benefits will fall into your estate if you died prematurely.

If you have not made a will, this can then cause further complications with the insurance companies checking off process.

Until probate is fully granted, no monies can be paid out to those named in the will. On average, this can take upto 6 months. By not placing the plan into trust may also swell up the total estate values, leading to potentially Inheritance Tax IHT issues.

So placing a policy in trust can help to ensure that the policy proceeds go to the correct beneficiaries you decide to nominate at that stage. It can also help avoid possible probate delays & IHT costs.

Most of the insurance companies kindly provide their available standard protection trust form wordings. Seek out professional legal advice if unsure.

Article on what ‘UK Companies Check’ for Insurance by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women - we review many of the best Life Insurers selling Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'