Compare Top 10 Uk Life Insurance Companies

Life Insurance in United Kingdom. Broker deals from £5pm. Advice and help. Quotes Online 15 secs on Life Insurance in UK.

...After Good 'Life Insurance in the UK' Policy Deals?

...After Good 'Life Insurance in the UK' Policy Deals?

In this review, we will look at past & current Good Life Insurance Companies UK history. What caused many to disappear & what the future may hold? Also, compare types of Good Life Insurance Policies via the UK Providers that we work alongside.

Best Life Insurance Companies in Uk

Top 10 Uk Life Insurance Companies

Compare Online "Good Life Insurance Company"

UK Policies

Best Life Insurance in the UK

Best 'Life Insurance in United Kingdom' | Brands History

The history of Life Insurance in the United Kingdom started in London 1706. The first UK Life Insurance company was founded ‘the Amicable Society for a Perpetual Assurance Office’.

Wind the clock forward several 100 years, to more modern times. Read in our timeline from the 90's to date, 'how many once great Brands offering Life Insurance in the Uk sadly disappeared'.

Brand names for those of a certain age, may fondly (or not) remember, all set alongside some other Uk and World events. Events that help shape how & why many of these iconic names maybe went.

Let's go back to 1990's

The previous decade, the 1980's, saw the rise of the "yuppie" & then Stock markets crash in Black Monday. It now starts with the news of German reunification.

This decade also began after Tim Berners-Lee had published a formal proposal for a World Wide Web called the Internet. Freddie Mercury died. The Spice Girls formed. Friends on TV. Clinton & Mandela elected Presidents & Tony Blair becomes Prime Minister. The Channel Tunnel. Small Banks crisis & BCCI. Mobile phones getting smaller. Texts. Man Utd kids. Dot-Com bubble. Titanic movie.

Princess Di. The Gulf War. Rwanda & Bosnia Conflicts. USSR breakup. Hubble Telescope. Harry Potter is first published. Dolly the Sheep. Hong Kong. The Euro. Google & Ebay founded.

best life insurance in uk best life insurance in uk

Ask the Man from the Pru ...about getting us a 'Good Life Insurance Policy'

Life Insurance in the United Kingdom

The 90's and 'Life Insurance in the UK'

"Life Insurance in United Kingdom" at that stage, there was maybe over 250,000 financial advisers or sales agents operating? They were all working for what they believed was their 'Best Life Insurance in UK'.

The man from the Pru however was no longer going to take your cash, going from door to door to get you a 'Good Life Insurance Policy'. It was direct debits now mainly, for your dear Nan's old penny style insurance plans.

In the previous decade, critical illness insurance was invented in South Africa. This continued to slowly develop by most life insurers, covering originally maybe 4 conditions i.e. heart attack, cancer, stroke and coronary artery by-pass surgery.

'The Best Life Insurance in UK' Plans typically sold?

Banks, Building Society or Insurance Companies Advisers all thought they were selling their own good life insurance policy offering they said 'the best life insurance in uk' deals, or pensions, or savings to their customers.

Product deals like endowment policies, flexible whole life cover, PEPS' or Payment Protection Insurance ie; PPI.

The Banks tended to include these expensive PPI (payment protection insurance) onto all their creditor products. It was often missold, whether it was required or not. The PPI future scandal was already brewing here to explode into the next decade.

The Insurers called their plans exotic sounding names like Eagle Star's rainbow universal life plan. Or more affluent sounding Abbey Life's Wealthmaster or the Allied Dunbar adaptable life plan. Axa Equity and Law multiplan covered several protection areas under one policy.

Many of these plans typically combined life insurance with an investment element. This was very popular back then but soon was to cause many future problems ie; the endowment mis-selling scandal lasting well into the next decade. For some the impact is ongoing now with those whole life assurance with an investment element...

Life Insurance in United Kingdom

Life Insurance Sales Sales Sales!!!

There was hot competition amongst all these Providers and Advisers, then regulated by the PIA for 'commission sales sales sales' above all else.

Unfortunately as the decade progressed, stock market dips, changing economic conditions and various tax laws meant people were often told their 'best life insurance policies uk' were now unfortunately not on target. Either the Insurers or Advisers had failed to properly explain the pitfalls ?

Many insurers endowment mortgage policies matured well below their target value. This left very stressed homeowners with very hard decisions to now make about what best to do. ![]()

Something had to give for these companies UK operations & their large sales forces. Mis-selling Complaints, Mergers & Takeovers became the name of the day.

Inflation dropped from 14% to 8%. New internet finance brand names also emerged & prospered like Egg, Cahoot & First Direct. Turbulent end or a new start to the millennium for the Life Insurance sector.

Some 'Good Life Insurance UK' Providers | Old Brands disappeared in the 90's

To track an old 'life insurance in uk' policy via above Insurers - then click on their names to see who deals with them now

Compare Cheapest Life Insurance in UK. Broker deals from £5pm. Life Insurance in United Kingdom

Year 2000. The Start of the New Millennium

So the previous century ends and the new millennium started with a bang, not a bug. These following events maybe helped to shape life insurance in the Uk for this millennium.

We had the long awaited Dome & various millennium bridges. Nokia 3310 phone, 3G and ipod. You Tube and Facebook. 9/11 and Iraq invasion. Economic China. Tsunami & Hurricane. Global Recession and more Banking Crisis at the end of the decade. Northern Rock. Posh and Becks. Bend it like Beckham. Avatar.

George W. Bush elected US President & David Cameron becomes Prime Minister. Big Brother. Pop Idol, X Factor and Simon Cowell. Tiger Woods. Roger Federer. Concorde last flight.

Iconic Names that once flew high sadly disappear

Life Insurance in United Kingdom

The Noughties. UK Insurance Regulation & Consolidation

Into the 2000's and for life insurance in the uk, this industry was now being regulated by the Financial Services Authority (FSA). They started to introduce much stricter regulations into the sector for both advisers & insurers.

Advisers now needed higher qualifications for both tied advisers or IFA's to continue to practise. Advisers were now better qualified as professionals, alongside accountants & solicitors to better understand financial services and tax rules like IHT. This meant some people started to leave this industry in the 1000's. Things were getting tougher and Insurers sales forces were dwingling rapidly. In their place came Insurance Networks, absorbing the departing financial advisers. Meanwhile, Inflation dropped from 8% to 4%.

Online Comparison Sites continued to develop. Some people even started to buy & compare their life insurance online & without speaking to anyone !

Many insurers therefore decided to close to new business, while others merged or were acquired by banks or so-called market consolidators. These consolidators, like Phoenix Life & Windsor Life began to acquire the closed book business of some once best known providers offering 'the best life insurance UK' policies that were available back in the day.

Correspondingly, some Insurers setup new brand names like Royal London with Bright Grey. Or the parent company name only like Aviva or Aegon.

Some 'Good Life Insurance UK' Insurers | Brands disappeared in the Noughties

|  |  | ||

| Royal SunAlliance | Axa Equity&Law | Abbey Life | United Friendly | |

|  | |||

| Norwich Union | CGNU | Equitable Life | Cornhill | |

|  |  | ||

| Scottish Amicable | Scottish Equitable | Scottish Mutual | J.Rothschild |

To track your old good life insurance policy via above Insurers - then click on their names to see who deals with them now

Compare Top Life Insurance Companies in Uk

The 2010's Decade

This world decade was characterised by nature's own events. Eruptions with an Icelandic Volcano & then ends with the beginnings of a Pandemic. These events all helped to shape life insurance in the Uk.

London Olympics. Chile mine rescue. Haiti earthquake. Japan Tsunami. Arab spring. Syrian war. Terror attacks. Ebola & Zika virus. Black lives matter. Protests. Donald Trump. Brexit. Technology. Hacking.

Malaysian plane. Charlie Hebdo. Global Warming. Sustainable. #MeToo. North Korea. Oscar Pistorius. Gangnam Style. Adele. Michael Jackson. Usain Bolt. Sepp Blater. Avengers movies. Boris.

Life Insurance in the UK | More Regulation & Consolidation

Into the 2010's, and the insurance industry switches from the FSA, to now being regulated by the Financial Conduct Authority FCA. They continued to introduce more tougher regulations & rules onto both advisers, banks & insurers. Against this backdrop, interest rates were low and house prices rose.

Adviser numbers reportedly dropped. What was once perhaps 250,000 people involved in regulated sales of life insurance cover several decades ago, this had probably dropped to around 30,000 in the 2010's.

The market was also splitting between 'advised' sales & 'non advised' sales. Martin Lewis Life Insurance advice says, be careful between the 2 different sales routes when buying life insurance.

People began to find it harder & harder to find out who was now looking after their existing or older plans.

More & more Insurers close to new business, merged or were consolidated. Insurers or indeed other large companies customer services often went offshore. It could be you were even being charged for the call also on 0870 & 0345 numbers. Press 1, then Press 5. "Please hold the line, your call is important to us".

Maybe 20 minutes later, after having a choice of music to listen to, you finally get hold of someone to actually talk to. However, it was only to find that they could find no trace of your olden good life insurance policy !

I just want.To talk.To someone. About my Life Insurance

in UK !!!

Some Best 'Life Insurance in the UK' Providers | Brands that disappeared in 2010's

To track an old life insurance policy via above Insurers – then click on their names to see who deals with them now

Life Insurance in United Kingdom

The 2020's Life Insurance UK Industry?

Since entering into the Pandemic 2020's, the cost of living crisis or ongoing Ukraine & Russia issues - many advisers & 'life insurance UK best' operations then began to work from home. This was either permanently or maybe visiting their main offices once a week or month.

This situation continues & has also driven many people to now interact with their financial advisers none face to face, via Zoom style meetings, or just over the phone.

The life insurance business market is still changing. As such, some more old brand name Insurers such as Canada Life & Aegon Life Insurance have also decided to no longer contend for life insurance in united kingdom protection sector. These changes may well continue.

Main Types of Life Insurance in UK

There are 2 main types of good Life Insurance policies in UK available in the marketplace:

1] Term Life Insurance

Term Life Insurance is a simple plan that pays out a cash sum if you die during the fixed time period your policy runs for.

The sum paid on death insurance stays level for family life cover or decreasing for mortgage protection. The premiums remain level whether you are near the policy beginning or end. Most plans also include free 'terminal illness' cover.

You can choose on many good term life insurance rates of a choice on lump sum or family income benefit options. Another option is if you want your cover to be level or inflation proofed - to offset rising costs.

The longer the level term insurance runs, then the more expensive it costs ie; 40 years term maybe double or more the cost than 20 years, as the insurance risks are higher as you get older.

Note: You can take a term insurance plan upto age 90, which may offer good life insurance rates in comparison to whole of life cover because it will then end.

2] Whole of Life Assurance

Whole of Life Insurance policy, always pays out if you die ie; whenever (as long as you’re kept up with monthly payments). This maybe the most expensive compared to term life insurance, as it will always payout.

Note: most good life insurance for Over 50 asks no medical in depth questions to underwrite or qualify for insurance terms, other than smoker status, so could always be a choice if you have bad health issues.

Consider any good life insurance for seniors by placing the policy into trust, to help avoid probate delays or Inheritance Tax IHT issues.

Compare Good Broker Deals on Life Insurance in UK 2025

Compare Good Life Insurance Policies for Term Insurance Quotes >

Compare Good Life Insurance Policies for Term Insurance Quotes >

| Good Life Insurance Company > Term Life | |

Compare Good Life Insurance Policies for Critical Illness Quotes >

Compare Good Life Insurance Policies for Critical Illness Quotes >

| Good Life Insurance Company > Critical Illness | |

Compare Good Life Insurance for Over 50 Whole Life Assurance Quotes >

Compare Good Life Insurance for Over 50 Whole Life Assurance Quotes >

| Good Life Insurance Company > Whole Life | |

Compare Good Life Insurance Policies for Income Protection Quotes >

Compare Good Life Insurance Policies for Income Protection Quotes >

| 'Good Life Insurance Company' > Income Cover | |

How much is Good Life Insurance?

How much is any good life insurance policy or policies cover, will naturally all be relevant upon where you maybe in your life family journey in 2025 ie; married, single, mortgage, kids etc;

The Money Savings Expert Martin Lewis on life insurance basic formula suggests considering as a rule of thumb their "10 x Rule"....

ie; you cover 10 x the annual salary of the main breadwinner (after repayment of mortgage & debts) until at least any children may leave full time education.

As such, how much is good life insurance will all be depend on what type is currently needed now and for the future.

For example, a good term life insurance for the family whilst they are all still dependant? Should the policy be a single life or in joint lives? Or after mortgage cover? Or a good life insurance for Over 50 s etc;

Consider also our simple Brokers ‘Top 3 Reasons - Finance Formula’ general guide:

Consider also our simple Brokers ‘Top 3 Reasons - Finance Formula’ general guide:

- LUMP SUM – Repaid Mortgage / Loan / Debts – Often your largest monthly outgoings

- INCOME – Provide for Family – To help cover ongoing bills or rent, lifestyle & holidays

- LUMP SUM – Help to cover Final Expense Costs or leave a Legacy

Problems buying any Good Life Insurance in UK without advice?

People will continue to buy any life insurance, critical illness & income protection without advice, sometimes not understanding what they are buying, whether good or bad. Future problems may arise therefore at a claim.

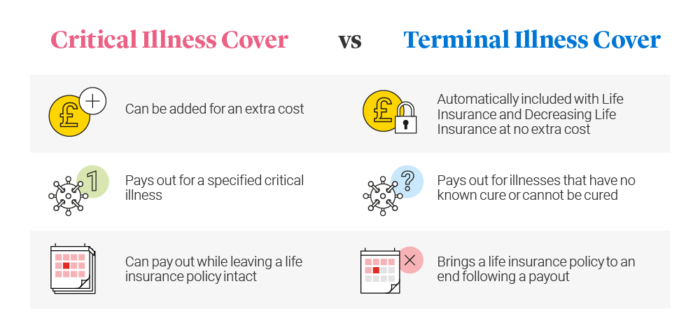

A typical example is when people do quotes off our website. They seem to get confused between Terminal Illness Cover & Critical Illness Cover.

Some automatically assume they are the same things, believing if suffered a critical illness, then their life insurance policy with terminal illness will still pay out (See explanation below).

Critical Illness vs Terminal Life Insurance in UK

Alternatively, include critical illness with life cover into all their quotes and then wonder why it was so much more expensive, so just give up altogether.

We can see a rise in the best uk life insurance providers perhaps selling cheaper white labelled insurance plans during the cost of living crisis - but with low start premiums.

Often these are confusingly labelled as having guaranteed premiums for those looking for a good life insurance policy. However, all that is guaranteed is the price rises to follow an insurers age based price chart.

This enables someone to buy a policy perhaps 50% cheaper initially. However, over the longer term the costs rise annually, such that in the future it could become too expensive to even maintain ?

Life Insurance in United Kingdom

'Good Life Insurance Company' TV Advert - Unsung Hero

'Good Life Insurance Companies' UK Brands emerge?

At the start of this decade, we already have LV= insurance involved with Bain capital about a potential sale. This fell through rather dramatically & then Royal London, a fellow mutual, possibly re-involved in future discussions. Will it be that we have a new Royal Victoria Insurance or London Victoria Insurance brand happens in the 2020's ?

I can see further consolidation of life insurance companies in the uk, as more merge for economies of scale. This leaves maybe even fewer traditional insurers & good life insurance companies offering protection insurance cover.

Hopefully, you will still have several types of providers offering good life insurance policies to their customers, either small or large. Financial Mutuals & Friendly Societies big or small like The Exeter or One Family, Life Insurers, Banks, & Building societies.

Both the Over 50's life insurance market & Over 60's life cover also will continue to grow. Covid 19 is not going away anytime soon in the 2020's, as new variants emerge. The Pandemic will no doubt impact life insurance in the UK for many people dealing with life after Covid, and hopefully we all start to live a little longer.

The United Kingdom Life Insurance industry still operates as one of the world’s biggest financial markets. It is still a major employer & leader and will continue to be heavily regulated. According to Statista, businesses involved with life insurance in the Uk, had a 70% market share of the total UK insurance market, providing a large range of financial services products.

However, I still see a great future for Brokers & Agents as the uk financial services market continues to evolve. People (Human beings) need to still understand what their chances are of making an insurance claim, and the big impact it may have on their finances.

Just like machines, we do break down. In this event it could be catastrophic for them & their families both financially, emotionally as well as physically. If nothing else, the 2020's Pandemic proved that nobody is invincible.

Chances of claim on Life Insurance in UK Policies

Moving forwards, there will also be the continued growth of Artificial Intelligence (AI) upon both Financial Services and the business marketplace in general.

AI will likely impact both 'good life insurance UK'' underwriting, risks and advisers. Could AI also....way way into the future, replace us all & further reduce good life insurance company offerings?

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'