Martin Lewis Advice on Critical Illness Cover?

MSE Review: 07/2025

*5 Mins Read

Article on: MSE Money Saving Expert Martin Lewis Critical Illness Cover Life Insurance

*What does Martin Lewis say on Critical Illness Cover?

In this Martin Lewis Money Saving Expert Critical Illness review we will look at - these key areas & more...🔸 What's Critical Illness Cover? 🔸 Does MSE thinks Critical Illness is worth it? 🔸 How much Critical Illness do you need? 🔸 Top Tips re Life and Critical Illness cover Money Saving Expert 🔸 Whom Best to Buy from...

Mse Martin Lewis on Critical Illness Cover

'Critical Illness Cover worth it: Martin Lewis'?

Does Martin Lewis recommend Critical Illness Cover?

Looking for what's his Money Saving Expert opinion is on Critical Illness Cover benefits in 2025?

Well firstly, Martin Lewis says Critical Illness Cover is a 💯 '100% TAX FREE' Lump Sum payment AND you can use that Insurance Money for anything you like.

For example, MSE advises whether it’s to pay off your mortgage, cover lost income, any day-to-day expenses or health-related costs.

Critical Illness 100% Tax Free Sum

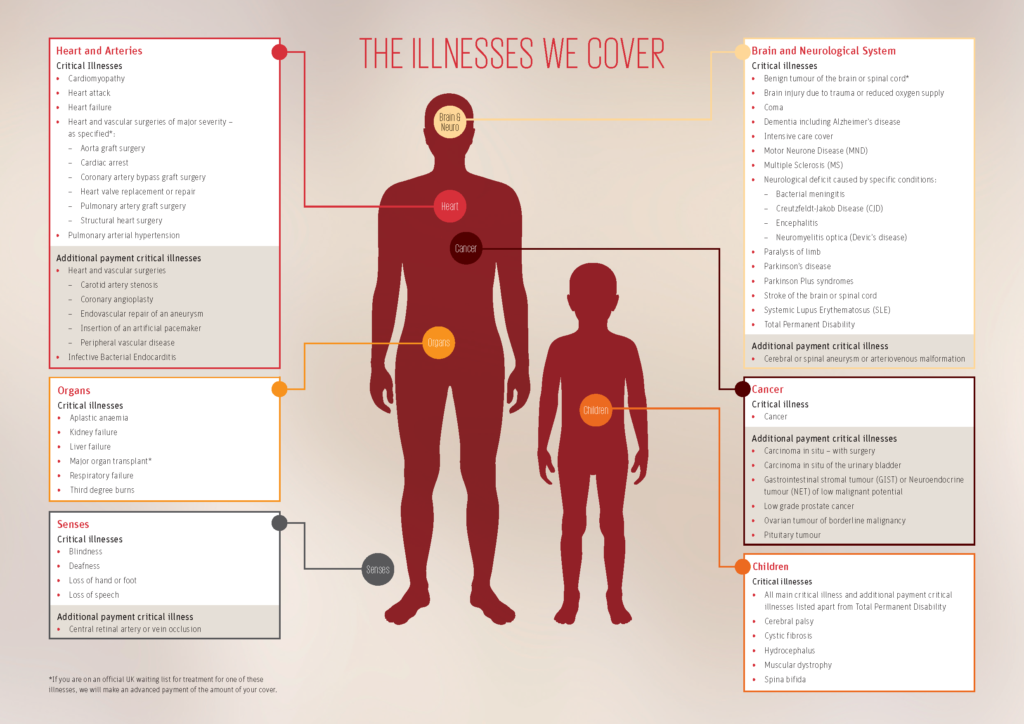

Most Critical Illness Insurance plans MoneySavingExpert states will typically cover you for some life-threatening conditions such as a heart attack, stroke and cancer types.

So critical illness cover is therefore designed to work and protect you IF you're diagnosed with a specific illness that the insurance policy lists he says ie; you do get a serious illness or injury and therefore can't work.

We say as brokers, that critical illness cover may become that valuable financial lifeline should the worst happen (like Martin Lewis says on life insurance). Whereby you are sadly diagnosed with a serious illness and therefore unable to earn a living.

MSE Martin Lewis illness guide here, also points out many critical illness policies do also include some cover for your children.

These typically pay out, if your child is diagnosed with a critical illness via that main adults policy (as a percentage % cover); Or they have to spend over a certain amount of time in hospital.

Martin Lewis on Critical Illness Insurance also says for a 💯 '100% good rule of thumb' in 2025, his Best Critical Illness Cover Formula is "NEVER BLINDLY BUY DIRECT" expensive policy offers either via your Bank or one Insurer ie; Shop around or use a Broker.

MSE Martin Lewis illness reviews however comments here that - it isn't always easy to know exactly what certain plans if comparing Critical Illness cover protect you for.

Some people MSE says also think that they MAY cover all & every Critical Illness type...BUT They Don't (unlike Income Protection - which doesn't list out various specified serious illnesses).

As brokers, we agree he has a point here. Especially if those Insurers don't clearly describe in more laymans language, their various critical cover definitions ie; what is or isn't covered on their policy.

Money Savings Expert on Life and Critical Illness Insurance indicates how much critical illness cover you will ideally need via their general '10 YEARS RULE' ie; aim to cover 10 x Annual Yearly Outgoings.

Then to carefully weigh up whether the monthly costs are all worth it for you? This is also a common subject if reviewed on their MSE forums.

To simplify this process, MoneySavingExpert as always suggests seek advice if looking into both Life Insurance and Critical Illness cover, and you are unsure what maybe relevant for you.

Martin Lewis recommends that it can also be worth using a Specialist Critical Illness Cover Broker or Independent Financial Adviser to help advise and choose on best deals.

Reviewing what Martin Lewis similarly said about the importance of life insurance, we say as Brokers 'Thinking about how your family may cope financially if you were critically ill isn't a very cheerful topic, BUT it is an Important One'.

In this 2025 review, we will therefore look at their critical illness insurance Money Saving Expert comments more here & to understand better what this all means, as professional brokers.

Plus as they say, the value of getting critical illness comparison quotes from a range of leading insurers, not just one and which we can help provide Online > 15 secs.

In their 'MSE Critical Illness Cover' guide they explain what to typically look out for. How to decide if Critical Illness Cover is right for you. Lastly then how to best buy it.

'Life & Critical Illness Cover Martin Lewis'

Life and Critical Illness Cover Martin Lewis Insurance Review on This Morning:

'Martin Lewis Illness' Critical Review - Money Saving Expert

Background: Who is the highly respected Martin Lewis OBE & CBE? He's a very successful Financial Reporter & all round Money Expert, and the founder of the well known UK consumer website Money Saving Expert.

He also has his own current affairs TV Money Show on ITV first broadcast after all the London Olympics back in autumn 2012.

Martin Lewis is now often seen on TV commenting on current financial matters & affairs. Or daytime TV like This Morning Martin Lewis being the popular go to person for sound advice.

In 2012, his popular Money Saving Expert website was also sold to The Money Supermarket.Com group for reportedly £87 million. Since 2015, Martin Lewis remains executive chairman and in these challenging 2020's all round UK Consumer Champion & Finance Guru.

However, his undoubted success today in 2025 hides a very sad story from his past, which he emotionally & honestly explains further in this BBC Podcast.

*What happened to Martin Lewis as a Child?

Martin Lewis has sadly told of his own life story, where he unfortunately lost his late Mother Susan Lewis at only aged 11, in a tragic road accident.

What happened to Martin Lewis as a Child then reportedly left him emotionally unable to sometimes leave his own house - for upto 6 years (Times Newspaper Article).

Except for going to school, this emotional impact left him he said looking back with both extreme anxiety & trauma. As such, Martin Lewis illness mentally as a teenager back then & during some darker days says he sometimes “struggled to even get out of bed”.

The tragedy on the longer term impact of someone losing a parent so young in their lives, whether this be financial, psychological or both.

As such today he says 'Financial problems and mental health issues are locked together — it’s about time treatments were linked too', urges Money and Mental Health Policy Institute & its chair founder Martin Lewis.

This then means that he can also speak now with some authority around the subject of mental health and & where he also explores the link with money management.

Some of these Martin Lewis' Money Management books shown below are all therefore well worth a read, especially in this ongoing cost of living crisis.

Important Note: This overview on Money Saving Expert Martin Lewis on Critical Illness Cover is not a scam fake advert re Martin Lewis recommending our own broker services. As you may be aware he & MSE are fully impartial. Therefore, he does not endorse or support any particular products or providers. Any Martin Lewis Money video's or images shown may also have some out of date information on them - due to the ongoing cost of living crisis. Often these Money Saving Expert life and critical illness insurance articles may no longer be personally updated or written by Martin Lewis himself. MSE do state he oversees site content, especially the MSE weekly email. Naturally, although MSE is an independant website finance allows no advertising nor subscription, it may receive a revenue via 'affiliate links' to the top products or providers (which we aren't mentioned)

MSE Martin Lewis Illness Cover Guide

What is Critical Illness Cover Martin Lewis?

MSE Martin Lewis explaining in a nutshell on Money Saving Expert critical illness cover it 💯 '100% pays out a lump sum' if you are diagnosed with one of the 'critical illnesses' that the Insurers policy covers pays out a lump sum.

Critical Illness Cover

As they say, most critical illness policies will typically cover you for various serious life threatened illnesses' such as having a heart attack, stroke or cancer types.

For example, these following stats also show the chances of sadly getting some type of critical illness within your lifetime are very high;

- 1 in 2 people will get some type of cancer in their lifetime but may survive.

- British Heart Foundation states 1 person has a stroke every 5 mins in UK and survive.

- Around 1.4 million people alive in the UK today have survived a heart attack.

- Over 7.5 million people in the UK have heart or circulatory disease problems.

- All these health incidents could mean your lifestyle and families also may well change irrevocably both physically, emotionally and financially.

As brokers we would add here that the chances of you, me or a family member being sadly diagnosed with one (or more) of the main 3 type of serious illness & being critically ill within our lifetime are high; see below infographic.

UK Insurers top 3 claims payout - are for specified cancers, heart disease or stroke

MoneySavingExpert asks how does Critical Illness Cover work?

'MSE Critical Illness Cover' says you will firstly need to choose how much you would want for the policy to pay out, and also how long you'd like the cover to last.

They suggest for example, you could choose to perhaps only keep cover until your mortgage is paid off. Or alternatively, leave it running until the upper age limit when the cover automatically ends eg; typically around age 75.

As brokers we would also add that the longer a critical illness policy runs for, and whether you want the cover for example on mortgage decreasing protection or family life protection, then typically the more expensive it is.

The insurers for critical illness cover money saving expert says will usually ask you to complete a full in depth health questionnaire during the application process.

As MSE rightly point out, it is important to declare all pre-existing health conditions when you apply. They may also wish you to attend a medical or just to review all your health records.

The Insurers will then consider all your details as submitted to then determine the appropriate monthly premium you'd need to pay. They add that the riskier you appear for insurance (eg; you have a very active or stressful job and/or a family history of critical serious illness), the higher the likely your monthly premium costs.

For all this you decide how much cover you want, and how long the policy will last.

What are Claims for Critical Illness Cover MSE asks?

Once the policy is active, Money Saving Expert suggests you can then make one claim if you are diagnosed with a specific illness that the policy lists.

They also state that most critical policies only pay out once, so if you do have to claim then the policy will potentially then end. This MSE observes also extends to joint policies too ie; whilst two people can be covered, only one would be able to claim or setup on 1'st claim basis.

Technically, as brokers we would also add that the marketplace does actually divide into those Insurers offering their just more basic & cheaper critical illness schemes ie; those that may only cover 3 critical illness types - like the Big 3 ie; cancer, heart disease or stroke.

There are also more comprehensive schemes (Note: sometimes those are only available mainly via broker only deals & not direct).

More comprehensive serious illness plans - whereby the Insurers may actually allow several seperate partial payment claims and say for different types of cancers.

For example on an extensive serious illness policy, one or both partners could be diagnosed with different cancers in situ of lower malignant potential that then requires surgery. In this instance, the Insurers may then pay you out the partial policy payment claims several times.

In these cases, the best critical illness cover Martin Lewis points out you’d then expect to get the payout and that policy to ideally remain active. Subsequently, getting diagnosed with specified less severe illnesses you then get a more serious advanced case of cancer & whereby Insurers then make the full policy payment.

MSE also says a critical illness plan though won't pay out if you died but then add that is what life insurance is for.... Again, being brokers we would state that what MSE are actually referring here to are known as standalone critical illness plans. This means it would not include both life and critical illness cover Martin Lewis actually comments on here.

So be aware therefore that a standalone critical illness policy would not payout if you died of an accident or natural causes, that means you never survived long enough to make a valid critical illness claim.

Many policies for life insurance critical illness money saving expert however do state are tied into with life insurance. Although as they rightly point out re life insurance and critical illness Martin Lewis says you can also get standalone critical illness cover - should you choose not to include any lifecover also.

Once you receive the lump-sum payment (which is tax-free), you can then use those money proceeds for anything you like. This could be for example used to pay off the mortgage. Alternatively, it could help cover lost income, day-to-day expenses or health-related costs.

Note: we would add that a critical illness policy could also be setup and paid out via a regular tax free family income benefit - other than a lump sum, which they don't go into any detail on.

Martin Lewis Advice on Critical Illness Cover Conditions?

Money Expert Martin Lewis advice on Critical Illness cover conditions is that he states many people believe that all critical illness policies will pay out if you get ANY serious illness and then can't work. BUT as he points out - this isn't true.

He advises that the definition of a 'critical illness' can be a minefield and does vary widely between UK Insurers schemes. Some critical illnesses might not be covered at all, or if you get that specific illness being defined by the terms of that policy.

MSE gives an example whereby someone losing one leg is not considered a critical illness, but losing two legs is.

He also clearly points out here, do not think I'm covered for cancer ie; all cancers & at all stages of severity, as most critical illness policies may only cover a limited range of cancers (and usually at a higher stage of severity).

As always, he suggests getting advice from a broker if unsure and MSE provides a link via the British Insurers Brokers' association BIBA website.

Being brokers, we would agree that it’s important to read the T&Cs carefully before taking out any Critical Illness cover policy.

Note: We would also again point out that the UK marketplace divides into those Insurers offering just more basic & cheaper critical illness schemes. For example, basic schemes that may just cover cancer only like Well Woman insurance, next upto those that cover the 3 main human critical illness's like cancer, heart disease or stroke.

Then, those Insurers that may cover 40+ critical illness types, upto those that now offer well over 150+. Typically, the more the comprehensive critical illness cover is the more expensive it is, with several insurers offering both basic, standard or comprehensive versions ie; you pay's your money and takes your choice

We agree therefore that don't assume that all critical illness plans are the same...because they aren't, even if they are all called critical illness insurance.

In their review, Money Expert Critical Illness Cover UK Martin Lewis maintains these are the most common inclusions & exclusions to look out for on Insurers policies...

*Common Inclusions on Critical Illness Policies:

- Cancer of certain types & stages

- Heart attack

- Stroke

- Multiple sclerosis

- Parkinson's disease

- Alzheimer’s disease

- Loss of a limb

- Deafness

- Blindness

Noting that the Insurers product wording is 'suffered a critical illness' as specified by that Providers plan T&C's & not just any 'lesser forms' of the headline critical illness.

EXAMPLE Critical Illness Claim: Cancer is graded from 0-4 as explained by NHS*.

You are maybe told you have early Cancer stage 0, which indicates that the cancer is still where it started (ie; in situ) or small & so fortunately it hasn't spread.

Note; you may not be entitled to therefore make here any full policy critical illness claim, as this is not considered to be 'critical' for either the Insurers, or yourself. A swift procedure may hopefully remove the offending cancer & all is good healthwise again.

Alternatively, you have now been advised that the cancer is unfortunately a stage 3 or 4 and so larger, hence more serious. It may have sadly spread to the surrounding tissues and/or the lymph nodes. Or, to at least one of your other body organs (also known as "secondary" or "metastatic" cancer).

You could now require ongoing chemotherapy or radiotherapy, and the resultant affect onto your lifestyle, time and finances. The Insurers may therefore consider this valid for a full 100% critical illness claim payout.

*Common Exclusions to watch out on Critical Illness Policies:

There are often stipulations where a critical illness policy won't pay out at all. This can include

- Severity of illnesses you need to be diagnosed with eg; need permanent symptoms to be allowed to claim on the policy

- Insurers could also withdraw cover for some conditions after you reach a certain age

- You were aware of symptoms before taking out the policy.

- Claims where the illness is a result of self-harm, alcohol and/or drug abuse

- Taking part in risky or extreme sports

- Time limits ie; not being able to claim in the first 90 days of the policy

- Claim rejected if you died within a month of being diagnosed with a critical illness (assuming no lifecover is included)

Note: there is often a requirement for example to be diagnosed with permanent ongoing symptoms to be allowed to make a valid claim on the critical illness cover insurance policy eg; permanent deafness or blindness...NOT just temporary symptoms

There is therefore also the severity of any illnesses you need to be diagnosed with to make any valid claims ie; as mentioned above and a cancer staging example. So some cheaper critical illness cover schemes may not payout fully but confusingly some more expensive severity based plans may allow a partial claim.

However, as mentioned above nearly 70% of UK providers critical illness insurance claims payout are for specified cancers, heart disease or stroke. So, being brokers we observe that you should ensure as a minimum these 3 benefits are covered. Most UK Insurers now abide by ABI minimum standards guide.

Martin Lewis Critical Illness Cover Tips (2025)

What is Martin Lewis critical illness cover policy? The Money Saving Expert critical illness cover guide also points out the following Hints & Tips issues to consider...

*You might already be covered via your Employer?

If you, a spouse or a civil-partner are employed, MSE asks that it is always worth checking out if your employer(s) maybe offers critical illness cover.

However, they suggest that this can sometimes be an option you may choose to pay for as part of the work benefits scheme, and usually via your pay. Maybe for some others, it's a no-cost standard benefit (though you might have to pay tax on it).

Again, being brokers we add for clarity don't get confused between being off work ill with a critical illness and then getting paid sickpay by your employer. That is not the same as receiving a tax free sum via your critical illness cover scheme to perhaps help repay a mortgage or a secured loan.

Be aware though, money saving expert life insurance critical illness advice here is that if you were to change jobs or be made redundant, then your next employer may not have a critical illness scheme to offer the same cover.

You usually lalso can't transfer this type of employment benefit, they point out that you would need to arrange any future cover directly yourself. And more importantly, if you have suffered any significant health problems in the interim, this could be expensive (something we often see as brokers).

They also say it is worth double checking if you, spouse or a civil partner already have a life insurance policy that includes critical illness cover before buying a new policy.

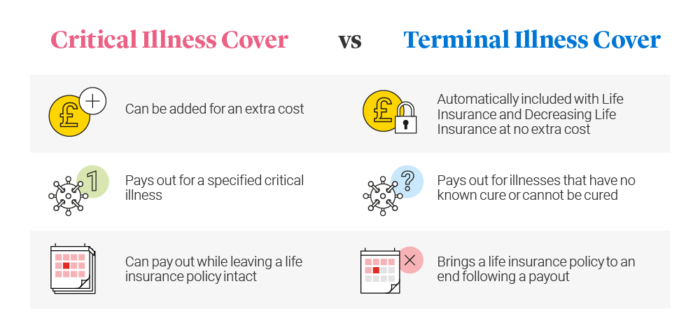

However, we add people often get confused between a life and terminal illness v life and critical illness benefits - so explain this a little further here.

What's Critical Illness vs Terminal Illness Cover?

Critical Illness is also not to be easily confused with Terminal Illness cover. This is usually a free and inclusive automatic life insurance policy benefit see above infographic (which MSE don't comment on).

Terminal Illness means the policy will pay out usually if you have been told your illness is sadly terminal, so may have less than 12 months to live ie; An advanced death claim.

Therefore inclusive terminal Illness is unlike a Critical illness policy option - which instead means you will likely survive and hopefully slowly recover. Note; You can decide if you wish to separate critical illness cover from the life insurance, so that it can payout whilst also leaving the life cover intact.

Remember, if you had a critical serious illness eg; heart attack and the plan paid out, it's unlikely you would be able to then get a standard price affordable life cover again in the near future.

*Not reliant on Employment Income = Less likely to need Cover?

MoneySavingExpert critical illness cover on this point remarks that those with a partner or other family members who may earn enough to help support the household, could decide to save on their insurance premiums by not taking up critical illness cover?

They also say that same might be true if you have enough investments & savings to help fall back on.

We would add as brokers here that often the critical illness of any family member, whether adult or child will have an ongoing psychological and financial impact across the whole family.

For example, the other person may now require to take time off their work for helping visits to hospital. It could be the NHS are also unable to immediately facilitate your health needs, due to their own workload pressures and as such you may have to seek more urgent and expensive private medical treatments.

MSE do note there are also various state benefits that you may be able to claim. Although they caveat this by saying these tend to be under £160 per week (and only if you qualify). See their Money Saving Expert Benefits checklist for further details here.

On their point raised also, we would add therefore that even if you are not reliant on employment income but for example are still jointly covering a mortgage or other loans, then it may still be worth insuring yourself here to help protect your partner?

Policies into Trust?

Martin Lewis says many critical illness plans are tied in with lifecover. So if you died with an active life-insurance policy, then that payout can form part of your estate.

Which all could mean - it is then hit with a "huge whack of Inheritance Tax" - BUT we would add maybe unwittingly...

Yet, in many cases Martin points out that it is possible to avoid further potential IHT tax bills by writing the policy in trust - especially if it is done with the correct split trust to ensure the critical illness benefits remain with you - ideally all at the time the insurance plan is taken out.

If the policy is written into trust, the insurance pays out directly to your dependants - so we would add here if you died for example in an accident ie; before even making a critical illness claim.

SO it never becomes part of your estate, which avoids both inheritance tax and often speeds up the payout re probate delays.

*Martin Lewis on Income Protection Insurance vs Critical Illness?

What's Martin Lewis say on Income Protection vs Critical Illness?

Money Saving Expert Martin Lewis says its worth 💯 100% looking at Income Protection also, which is a totally separate type of policy to Critical Illness cover because it covers a greater range of illnesses.

Income Protection Insurance (also called Permanent Health Insurance or PHI by brokers) as it sounds protects & pays you a regular tax free income (not usually lump sums), if you are unable to work due to illness or disability for a set period.

As brokers, we sometimes get people who are confused here and think that Income Protection or Critical Illness also covers unemployment if you're unable to work. Yes, you may lose your job because of serious ill health or accident - but NOT due to redundancy.

Re sickness insurance types, Money Saving Expert says that generally this income payout is just for a year or two - BUT this is not fully correct here, unless they mean you maybe off work for a year or two?

Being brokers, we find that the UK income protection marketplace divides into those offering cheaper PHI insurance for either 1/2/5 years per each claim. Or more costly, over the full term (which is the most expensive ie; you could never work again so the Insurers could be paying out for a very long time).

Income Protection they advise will usually pay a proportion of your salary, for example 2/3rds, so that essential spending is covered.

We would add that some insurers base their plans on your gross salary if employed or net profits (not turnover) if self-employed. Remember, your employer sickpay may not be enough...

However, as brokers be aware if some PHI insurance plans appear much cheaper when quoted.

So we would add, check if any income protection plans quoted are cheaper reviewable age-costed premiums or guaranteed non-reviewable ie; their premiums could go up yearly. Also, if paid out on being unable to do your 'own occupation' (the better option) or just unable to do 'any occupation' (the worse option).

Martin Lewis on Income Protection Insurance vs Critical Illness says it generally covers a far greater range of illnesses than critical illness cover which is more specified eg; mental health but MSE indicates that it can also be more expensive.

*Martin Lewis Critical Illness cover Mental Health?

Critical Illness Cover policies mainly exclude mental health conditions such as anxiety, stress or depression. However, you can still apply for Critical Illness cover - if you are someone who has perhaps experienced difficulties with your mental health.

Martin Lewis says that a few years ago, he had his eyes opened when a gentleman came up to thank him for the MoneySavingExpert.com website.

When he asked him if he had saved much money, and his responding answer then really surprised him...

"I don't use MSE website for myself. He said that I'm a mental health case worker, and almost every one of my clients has debt issues. It is tough for them to control many areas of their life. I use your website to help them sort through their problems."

It was one of the reasons why MSE had written the booklet mainly for friends, family & their carers who want to help them tackle their finances. In this cost of living crisis currently - this is especially important.

In other words, be aware reviewing the particular differences between these plan types, that you may not be able to claim on critical illness insurance cover, for any mental illness related time off work. However, you could do on income protection insurance ie; if it stops you working for example performing your own occupation ...thus potentially stop you getting into debt.

When it comes to deciding between these 2 types of insurance, critical illness or income protection money saving expert or indeed life insurance and critical illness cover Martin Lewis suggests it could be worth speaking to a Financial Adviser and we would also agree.

We would advise here instead, that in an ideal world you would have both protection insurance schemes to compliment each other, budgets & affordability permitting.

Ultimately, critical illness insurance money saving expert advice here is abit like MSE life insurance advice, in that they point out you don't need to have critical illness cover (like they say you don't need to have life insurance). In other words, you take on those risks financially yourself - if you sadly had a critical illness or indeed had a serious accident.

How much Critical Illness Cover do you need: Martin Lewis?

Well firstly, if we look at MSE on Life Insurance alone, Martin Lewis says for a good rule of thumb in 2025, his Best Life Insurance formula is 'THE 10 x RULE' ie; aim to cover 10 x the Annual Income of the highest earner or the main breadwinner until at least any kids have finished their full-time education or other dependants.

So then Money Saving Expert on Critical illness cover remarks IF you do then decide to include critical illness cover and it is for you, then now you will need to decide on the lump sum amount you also want to insure?

Martin Lewis asks how much Critical Illness cover do you need - will all be largely determined by your own personal circumstances, alongside the monthly payment you can realistically budget for.

A good starting point they say is to calculate any current monthly outgoings that you may need to cover, then add on a reasonable buffer for any additional costs that might crop up relating to a critical serious illness

MoneySavingExpert advice on critical illness cover here maintains this should then give you a rough ballpark figure to work out how much you may need from...

Example: MSE Critical Illness Cover how much is needed?

For Money Saving Expert Critical Illness Cover needed calculation - MSE advises you can multiply X by the number of months you would ideally like any payments to then last, to work out a lump sum amount. As an example, they then give how much cover do I need?

- Monthly Outgoings Amount = £2,000pm

- Number of months/years needed to cover = 120 months/10 years

- Critical Illness Cover needed = £240,000

So Martin Lewis says for a good rule of thumb in 2025, consider MSE Best Critical Illness Cover Needed Formula 'THE 10 YEAR RULE' ie; aim to cover 10 x Annual Yearly Outgoings.

'The 10 YEAR RULE' = Formula For Success

Once you receive the critical illness claim payment (which is tax-free), you can then use the monies for anything you like. This could be to for example - pay off your mortgage, help cover any lost income, those regular day-to-day expenses or health-related costs.

These medication health costs or higher utility bills could be to help run medical equipment. Or travelling to and from, or staying overnight near to any specialist treatment centres which nowadays we would also add, may tend to be further away than where you live.

So, as Financial Advisers we are not saying this basic 'Martin Lewis Critical Illness formula' 10 Year Rule is therefore a 100% one size fits all ie; not applicable for everyone's own personal situation.

You may also feel this is either not enough critical illness insurance cover, or perhaps too much protection for your own circumstances.

The important question also to consider is whatever Critical or Serious Illness you may suddenly have, how long will you be Incapacitated for...Several months, Several years or unfortunately Permanently and Totally Disabled?

Of course, relevant on this time frame what impact this may also then have on your surrounding family, dependants and resultant finances.

Again here, we would also add that the chances of getting a critical serious illness are much higher than claiming on life insurance for risk purposes. As such, Insurers typically charge for critical illness cover around 4/5 x price of a life insurance quote alone.

So, we would therefore simply re-summarize the basic 'Martin Lewis Critical Illness Cover' formula.

That is to ideally 'Protect 3 Things'...

That is to ideally 'Protect 3 Things'...

- LUMP SUM > Repay any mortgage & debts

- INCOME > Help cover all your regular monthly bills

- LUMP SUM > Back up for holidays, education, emergencies

This basic critical illness formula (maybe alongside income protection also) is naturally dependant on whether you are married or cohabiting, have younger or older dependants, retired or both working still. Perhaps instead have sufficient backup funds already in your savings & investments.

Ultimately, enough critical illness cover is also balanced down to what you can afford to comfortably pay for it ie; within your affordable budget both now & into the future.

For best critical illness cover Martin Lewis suggests if unsure speak to a Broker or IFA. Or, refer you if you know what critical illness cover you want here to either Cavendish Online, Money Minder or Moneyworld.

Note: This general critical illness money saving expert calculation could also be made harder due to any pre-existing health, family history & lifestyle issues. This could mean possibly higher ‘rated premium’ insurance costs. Unsure about your options for serious or critical injury cover? Contact us for personalized advice.

'Money Saving Expert Critical Illness Cover' FAQ

*Can you get Insurance for Pre Existing Health Conditions?

For getting the Best Critical Illness Cover Martin Lewis implies it is very unlikely you would be covered for health problems you knew you had before you took out the insurance plan.

All your previous medical complaints or doctors' recommendations including visits must be fully disclosed (even if they seem unrelated they add).

MSE do point out, if you don't accurately share all your full medical history, then the insurers will argue that had they known of the prior health conditions, they may not have offered you critical illness cover in the first place.

This can then result in any claims being usually rejected on the grounds of insurance "non-disclosure". In other words as brokers we say re your honest disclosures…‘Tell the Insurers the truth, the whole truth & nothing but the truth’

If a critical policy does cover existing medical conditions, this could also make it cost more, and there may also be extra conditions attached to the policy.

Note: Your insurers should make this clear to you before you buy it. Or we add, they could offer the critical illness cover but just exclude that pre-existing condition.

*How many Critical Illnesses can I claim on?

MoneySavingExpert says the number of benefits you can claim on really does depend on the Insurers type of critical illness cover policy you choose.

Being brokers we would agree, because like most insurance you can get the cheaper/basic or more expensive/comprehensive plans.

Insurers they comment will generally cover between 20 and 60 benefits in their critical illness policies. There are others that offer 100+ benefits. They advise most policies will let you claim once, after which that policy will end.

However, they do caveat that by then saying the payout amounts can also vary. Some insurers better schemes may allow smaller partial payments eg; whichever is the lower of 25% of your total cover or £25,000.

This usually applies if you get diagnosed with various specified less severe illnesses. In these cases, you would expect to get the payout and the policy to still remain active.

*Can you amend the levels of cover during the policy term?

Some insurers will automatically let you increase the levels of critical illness cover you have during the policy term, with no health checks.

We would add this is usually called the guaranteed insurability option - which may also allow you amend the levels of cover and without any further medical underwriting but it's not a free cost.

MSE asserts it is worth checking the policy terms & conditions when applying so you know if your insurers will let you do this, or if any exclusion periods will apply before you get the new level of cover.

Conversely, given the cost of living crisis you may wish to amend the levels of cover lower on your critical illness plan to help save money.

Most Insurers will allow this if you contact them subject to underwriting terms. However, if you should wish to increase again they will probably require new medical underwriting.

*Can you get Critical Illness Cover on your children?

Many plans for critical illness money saving expert observes do also include some cover for your children. We would add this child cover can be either free inclusive or paid for option on critical illness cover.

MSE remarks typically plans paying out if your child is diagnosed with a specified critical illness it covers or they spend over a certain amount of time in hospital.

More importantly, they state if you do make any claims for a child (upon the main adults policy), it will generally still stay active. You would then be able to claim again if you were then diagnosed with an adult critical illness.

The amount of money you will get if your child becomes seriously ill will generally be lower than your total cover on your adults policy, typically a proportion or set value. For example, 25% of the main amounts you are insured for or alternatively a flat £25,000.

*What's Life Insurance and Critical Illness Cover Martin Lewis?

Martin Lewis says many Critical Illness Cover policies are often taken out in a combination with life insurance also.

This could be set up in a couple of ways, either as combined / integrated or additional cover. They explain that they work differently in terms of how they pay out:

*Combined / Intergrated Critical Illness Life Cover

This critical illness combination will only pay out once - upon the earlier claim if you are firstly diagnosed with a critical illness or alternatively if you died of an accident.

This means that if you are unlucky enough to get a critical illness and it then pays out (but then you pass away after that a few years later) that policy style would only pay out just the once.

However, for the cheapest broker deals we would add that this is often the cheaper way to take out life and critical illness cover policy. We often see this combination used to help protect a mortgage.

*Additional Critical Illness Cover & Life Cover

This seperate critical illness & life insurance could pay out twice - both if you are either diagnosed with a critical illness and/or if you then died whilst the policy is still active.

Because it has the potential to pay out more than once, these additional life insurance and critical illness cover Martin Lewis remarks tend to be more expensive than cheaper combined covers.

*Just Critical Illness Cover Martin Lewis?

This means there is no life insurance payout here - just critical illness cover also known as a standalone critical illness policy, which Martin Lewis mentions.

As brokers, we find this could be a little cheaper way of buying just critical illness cover benefits ie; without any life insurance combined - and so maybe an option for a single person with no dependants or family needs.

However, if this option of just critical illness cover alone was used for say mortgage protection & someone died in an accident for example - this means the policy may not payout.

*How to cut Critical Illness cover costs & get the right policy?

Martin Lewis advice on critical illness cover here suggest a few options....get quotes from a number of insurers.

OR to simplify the process, MSE says it can be worth using an Independent Financial Adviser IFA or Specialist Brokers to buy it.

Option 1:

Getting Advice from a Broker – "Best if you need help choosing"

Money Saving Expert asserts that this is best if you are not sure what kind of critical illness policy you need.

Alternatively, if you have complicated medical conditions or other circumstances, they recommend it is best to get some advice before you buy.

Doing this means the financial advisor will take some commission, so they claim it is not the always the cheapest way to buy – though as MoneySavingExpert advise it should result probably in the 'most suitable' critical illness policy.

Option 2:

Buying via a Discount Broker – "Best if you know what policy you want"

MSE notes that if you feel confident here that you know exactly what you want, then you can go via a specialist discount broker.

They indicate this is generally the cheapest way to buy critical illness insurance, rather than buying direct from a Bank or Insurers BUT it does rely on you knowing exactly what sort of policy you want to buy.

Money Saving Expert life insurance critical illness advice here declares that they would suggest checking at least two and maybe add in the third if you have time.

As always they comment that, if you are not sure what you are doing or if a policy is suitable, it is always better to get expert advice before buying.

Martin Lewis on Illness Cover

Critical Illness Advice or Guidance?

Money Saving Expert notes that if you do pick up the phone to speak to any of these companies before you buy, then make sure you are 100% clear on whether you are actually getting 'advice' or just ‘guidance’

They say please ask the person you are speaking with what is their professional status. For the novice we say it can be most confusing here...Note: we are brokers who do give whole market advice

*Advice

If they are fully advising you, they will need to do a full check on your financial and medical circumstances and insurance needs - before suggesting any critical illness policies to you.

*Guidance | Non Advised Only

If they are just giving you information about critical illness policies they provide or only just answering your questions, that is fine or some; BUT here you should not be pressured into taking one policy over another.

MSE asks How to Complain about Insurance?

MSE Money Saving Expert Martin Lewis is always about helping to look after consumers and their rights. As FCA fully regulated brokers we also understand the importance of this.

In their 'Martin Lewis Critical Illness Cover' guide, they finish off with information about how to complain if you have a problem with either your critical illness life insurance cover and some things to look out for.

Finally they remark, the insurance industry does not always have the best reputation sometimes for their customer services. Plus, while some UK Life Insurers may be good for some people, it can also be hell for others.

MSE suggests common problems may include claims either not being paid out on time or at all, unfair charges, or exclusions being hidden away in the small print.

Should you have to unfortunately complain, Money Saving Expert contends it is always worth trying to call your provider first. However if not, then you can use their free complaints tool Resolver.

The tool helps you manage your complaint, and if the insurance company does not play ball, it also then helps you escalate your complaint to the free Financial Ombudsman Service.

Martin Lewis Money Saving Expert - Background History

Martin Lewis like my own family, grew up originally around the Manchester area.

On one of his appearances on ITV This Morning on life insurance he told some of his own life story whereby he sadly lost his Mother at only aged 11. She was involved in a tragic road accident whilst out horse riding with his sister. This reportedly then left him emotionally unable to sometimes leave his own house for upto 6 years (Times Newspaper Article).

Except for going to school, this emotional impact left him he said looking back with both extreme anxiety & trauma. As such, Martin Lewis may be able to speak now with authority around the subject of the impact of losing a parent so young, whether this be financial or psychological.

Around a similar age then to Martin, my own Uncle was also sadly killed in a tragic road accident. This left my young and devastated widowed Auntie with 3 young children to care for both emotionally & financially.

I remember my own Mother in tears on the phone late at night back then, whilst her younger sister telephoned her to explain her terrible family news. I woke up in my bedroom to hear my Mum crying. I was listening upstairs and looking through the stair banisters in confusion as Mum cried & cried. She just said to me 'Martyn please go back to sleep and don’t worry'.

My Mum at that time, like all families would naturally do, asked her “is there anything I can do to help?”

However, once this reality settles in, the effects to the whole wider family unit are both highly psychologically stressful but then ultimately also become financial. This applies whether someones sadly dies or is diagnosed with a life threatening critical illness.

Unfortunately & as is all too often, only then once the worst has happened do more practical questions get asked....'How are we going to manage financially? ’ or ‘Will our critical illness insurance cover this?’ or ‘How long will any work sickpay cover my income?’.

In today’s uncertain world, more and more people are seeking professional advice from people like Martin Lewis on the Best Critical Illness Cover advice or similar financial answers to their questions.

Conclusion on 'Critical Illness Cover Martin Lewis'

As brokers, we found the Martin Lewis on Critical Illness Cover Money Saving Expert summary very good, with their various informative and useful hints & tips.

He has commented before that often picking a good critical or serious illness insurance policy, could take both a doctor and financial nerd combined. Not sure about that one, but he does have a point - IF Insurers don't clearly explain their offerings.

Also bear in mind their website is called Money Saving Expert. So the first question they will always ask will relate to saving you money, not spending it if you don't have to ie; They say ultimately you do not 'need' to have critical illness cover, which is fair enough.

However, despite what the Money Saving Expert Martin Lewis illness comments about Critical Illness cover policies, I believe they are an important protection to have in your back-up family or mortgage protection plans.

The chances of a critical illness claim for any of us is sadly high in our lifetime. The immediate & ongoing impact then on our family and finances eg; pay off all or some of your mortgage if you are critically ill.

Bottom line though as always, you pay’s your money and takes your choice of perhaps one or all protection product area combinations. How much can you afford to set aside each week to help protect yourself, your lifestyle and finances?

If you can afford it, my own thoughts aside from what does Martin Lewis say about critical illness insurance, are ideally following the same principles mentioned above.

- Lump Sum > Repay any mortgage & debts, cover funeral costs

- Income > Help cover your monthly bills & expenses

- Lump Sum > Back up for holidays, education, emergencies

Article on 'Martin Lewis Critical Illness Cover' by Martyn Spencer Financial Adviser (July 2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Critical Illness Life Insurance in UK (inc NI)

"Take Care of Yourself"

*Any comments & views expressed on this Critical Illness Cover Martin Lewis Money Saving Expert review are for generic information only. They are not personalized advice or necessarily reflect MSE views.

Martin Lewis talks about Finance & MSE Beware LIAR Fake Scam AI ads >

Important Note: This overview on Money Saving Expert Martin Lewis Critical Illness Cover is not a scam fake advert re Martin Lewis recommending our own broker services. As you may be aware he & MSE are fully impartial which means never putting his name or face / logo to anything. Yes, they mention individual products and services on their site, but they don't 'support' them. Any Martin Lewis Money video's or images shown may also have some out of date information on them - due to the ongoing cost of living crisis. Often these MSE Money Saving Expert life and critical illness insurance articles may no longer be personally updated or written by Martin Lewis himself. MSE do state he oversees site content, especially the MSE weekly email. Naturally, although MSE is an independant website finance allows no advertising nor subscription, it may receive a revenue via 'affiliate links' to the top products or providers (which we aren't mentioned)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'