If sadly diagnosed with a Critical Serious Illness

‘CRITICAL ILLNESS COVER UK’ = TAX FREE SUM £££

Critical Illness Cover Uk advice & help

Critical Illness Cover Insurance Review MSE

What’s Critical Illness Cover Life Insurance?

What is a UK Critical Illness Cover? It’s a specific insurance policy type that pays out a 💯 ‘100% Tax-Free’ sum to help protect you and your family, should you suffer a critical illness & become seriously ill, as diagnosed and specified by the UK Insurers during the policy term.

It can be also known as serious illness insurance or sometimes colloquially as a ‘Critical Ill Insurance’ policy. Use our ‘Critical Illness Cover Calculator’ to work out Best Broker deals > 15 Secs.

Many UK insurers offer this plan type but as we will find out in this review, these can vary from the most basic cancer only critical cover to some fully comprehensive broker only critical illness cover schemes.

“Critical Illness Calculator”

Critical Illness Cover UK ‘Tax Free Sum’ could help pay off…….

- Mortgage

- Loan or Credit cards

- Adjust your Home & Lifestyle

- Pay for urgent Private Medical Treatment

- Holiday of a Lifetime when you recover – or just be put away for that rainy day

‘Is Critical Illness Worth it’?

As brokers were are sometimes asked ‘is Critical Illness worth it‘? because it doesn’t cover and insure for many different types of illness that say an income protection or accident & sickness policy may perhaps do.

In this article we will examine why we believe it is & what does a Critical Illness Cover Life Insurance policy insure? Plus those high chances sadly of making a claim.

3 Reasons – You & Me should have Critical Illness Cover?

3 Reasons – You & Me should have Critical Illness Cover?

Most UK Critical Illness Insurance policies cover at least 3 core conditions that a man or woman is most likely to get in their lifetime; Vitality Life stats*

These 3 core critical illness apply across most UK Life Insurers re Male & female claims:

Aviva | Legal & General | LV= | Royal London | Scottish Widows | Vitality Life | Zurich |

*Does Martin Lewis recommend Critical Illness Cover?

The Money Saving Expert Martin Lewis comments that Critical Illness cover is designed to pay out a lump sum ‘100% tax free’, if you do get a serious illness or injury and therefore can’t work.

Most Critical Illness Insurance plans MoneySavingExpert states will typically cover you for some life-threatening conditions such as a heart attack, stroke and cancer.

Martin Lewis on Critical Illness Cover also states that he is not a big fan of some of these policies….Why? Well, he raises this point only because some people think these plans may cover all and every illness.

He has a point here therefore as he says it is not a ‘catch all illness’ plan, unlike say income protection insurance.

This could be also due to the wide range of different benefits to compare UK insurers exactly like for like, by a non medical lay person?

MSE Martin Lewis also points out many critical illness policies do also include some cover for your children.

The MoneySavingExpert also says that as many critical illness cover plans are also tied in with life insurance, MSE does 💯 ‘100% Recommend Life Insurance’, especially if you have any dependants.

Martin Lewis says ‘Thinking about how your family may cope financially if you were to die isn’t a very cheerful topic, BUT it is an Important One’.

MSE says its a cheap financial lifeline but the ultimate choice is always yours if the cost’s worth it.

So Martin Lewis agrees life insurance is important if anyone is reliant on your Income & would struggle financially without you around ie; an insurable interest.

He doesn’t comment here similarly, if you were diagnosed critically ill.

So we say as brokers ‘Thinking about how your family may cope financially if you were critically ill isn’t a very cheerful topic, BUT it is an Important One’.

Martin Lewis top tips for Critical Illness Cover…

- You might already be covered: (Check if your employers offers any critical illness cover)

- Don’t rely on income from work then you’re less likely to need it: (Another family member may earn enough or savings to fall back on)

- Worth looking at income protection insurance: (When deciding between the two insurances speak to a financial adviser)

Martin Lewis also suggests being the Money Expert “NEVER BLINDLY BUY DIRECT” expensive offers either via a Bank or One Insurer ie; Shop around or use a Broker.

Lastly, MoneySavingExpert also said generally remember, not all insurers plans are featured on insurance comparison sites. As brokers, we would also agree here – so let us help you shop around for your best broker deals.

Let’s examine what a critical illness policy is – and why we believe they are still a valuable protection asset because the stats above show the chances of sadly making a critical illness are high in your lifetime.

In terms of the large range of Life & Critical Illness Insurance products available, Money Saving Expert are fully impartial with all their best buy reviews. As you maybe aware, neither Martin nor MSE never endorse products.

Note: Yes, they mention individual products & services on MSE site, but they make it very clear don’t ‘support’ them.

Critical Care Insurance Cover Illness Definitions?

- This cover is ‘underwritten’ so Insurers ask medical & lifestyle questions before offering terms or exclusions.

- eg; Any familial history of raised blood pressure or cholesterol? It may also involve GP reports & tests.

- Critical Illness cover benefits, terms & conditions all vary between UK Insurers.

- Very simple Insurers critical illness plans may only cover 1 area, eg; certain types of well woman cancer, as this is a common condition.

- Other basic plans cover just the most common 3 core conditions – types of cancers, heart disease & stroke.

- Then there are more comprehensive critical illness plans for life and body cover insurance

- More comprehensive critical illness or core plus plans typically cover the 3 core conditions plus a far wider range of conditions.

- eg; Multiple Sclerosis, specified lower grade Cancers, Motor Neurone, Benign brain tumour, Liver & Kidney Failure, Major Organ Transplant, loss of speech, hand or foot, hearing & sight, total permanent disability, Parkinson’s & Alzheimer’s diseases or serious accident etc;

- On average these plans can cover from 40+ benefits or 60+ benefits, upto the most at 100+ benefits. Some plans are more severity based thus enabling multiple claims.

- These will be severity assessed, so may initially only pay a % of total amount insured on a lower severity claim. The balance may follow on a higher severity claim.

‘Critical Illnesses List’

What are the 36 Critical Illnesses?

What is the 36 Critical Illnesses listed which are a typical critical illness insurance policy from countries like Malaysia & India (not the UK).

In the 2020’s as mentioned, many UK Insurers may now offer 40 > 100 critical illness disease list – of which some would include a full payout or a partial claim (dependant on severity).

Note back in the 1980’s on those original main critical illness insurance policies many Insurers sold, were just to cover 4 illnesses – types of Cancer, Heart Attack, Stroke and Coronary bypass surgery.

Here below is a typical critical illness cover list for an average UK policy 2020’s.

| Alzheimer’s disease or pre-senile dementia Aorta graft surgery Aplastic Anaemia Arteriovenous malformation (AVM) of the brain Bacterial meningitis Benign brain tumour Benign spinal cord tumour Bladder removal Blindness | Cancer Carcinoma in situ of the breast Carcinoma in situ of the cervix Carcinoma in situ of the testicle Cardiac arrest Cardiomyopathy Cerebral aneurysm Coma Coronary artery bypass grafts Creutzfeldt-Jakob disease Crohn’s disease | Deafness Devic’s disease Encephalitis Heart attack Heart valve replacement or repair Intensive care Kidney failure Liver failure Loss of hand or foot Loss of speech Low grade prostate cancer |

| Major organ transplant Motor neurone disease Multiple sclerosis Multiple system atrophy Non-malignant pituitary tumour | Paralysis of a limb Parkinson’s disease Pneumonectomy Primary pulmonary hypertension Progressive supranuclear palsy Pulmonary artery surgery Removal of an eyeball Rheumatoid arthritis | Severe lung disease Spinal stroke Stroke Structural heart surgery Systemic lupus erythematosus Terminal illness Third-degree burns Traumatic brain injury Ulcerative colitis |

CONCLUSION: UK Insurance Companies offer different Critical Illness List Coverage

‘What is considered a Critical Illness’?

What is considered a critical illness often varies between UK Insurers definitions and policies. Noting that the word is a critical illness not just any illness.

However, the Association of British Insurers ABI guide have agreed to a common theme amongst UK Insurers and a minimum standard rule applies for critical illness cover. This should be Insurers base line but can be exceeded.

If we look at the main 3 critical claims they are for types of cancer, heart disease & stroke. The ABI state in their guides the following minimum critical illness wordings should be met by Insurers;

Cancer: Any malignant tumour positively diagnosed with histological confirmation and characterised by the uncontrolled growth of malignant cells and invasion of tissue.

The term malignant tumour includes leukaemia, sarcoma and lymphoma except cutaneous lymphoma (lymphoma confined to the skin).

Heart Attack: Death of heart muscle, due to inadequate blood supply, that has resulted in all of the clear evidence of acute myocardial infarction.

Stroke: Death of brain tissue due to inadequate blood supply or haemorrhage within the skull resulting in permanent neurological deficit with persisting clinical symptoms.

The ABI also state in their summary that Human Medical science advances also mean that many critical illness conditions may now be picked up more frequently and hopefully at earlier stages, where they are less severe. Naturally due to NHS pressures, this may not always be the case and also if the person does not visit their doctor to get checked up either re any serious illness symptoms.

This the ABI points out clearly has implications for the types of condition that critical illness cover uk policy aims to insure for and also for the way in which Insurers conditions are defined.

For instance, conditions which were maybe considered life-threatening or extremely severe perhaps 10+ years ago may now be diagnosed much earlier and so with appropriate treatment, have a good prognosis.

The severity of some conditions has also changed to the point that they can no longer be considered “critical” in terms of their life expectancy eg; they mention HIV Aids serious illness symptoms.

In conclusion here, be careful if comparing an older uk critical illness cover plan, as it could be that a payout re older wordings is valid vs a new plan is invalid claim for ‘what is considered a critical illness’.

Life and Body Cover Insurance

What other help can Insurers provide at diagnosis & claim?

- GP 24/7 services. Best Doctors Services give access to top medical specialists or a valuable 2nd medical opinion for peace of mind.

- Open Private Referrals if a NHS consultant is too busy to see you immediately. Note some services are policy inclusive & others paid for.

- Red ARC nurses are another & offer rehabilitation services or Mental health specialists that can assist family members also.

- Premium waiver means the Insurers can help pay your premium whilst in claim. This is useful if your policy enables multiple claims.

CONCLUSION: Many Insurers offer additional helpful services at diagnosis & claim

Serious Illness vs Critical Illness?

What is the difference between serious illness vs critical illness? Serious illness cover means the Insurers that offer this policy type will payout but based on its severity ie; not every serious illness is a critical illness.

Critical illness cover often pays out for fewer conditions but then may pay 100% of the claim. Also for some Insurers, once their critical illness cover has then paid out in full, the policy ends.

Serious Illness Cover however pays out an amount based on:

- The severity of that condition

- May cover a much wider number of illnesses

- Can often payout earlier than critical illness cover

For example: Let us take your eyesight. If you went blind in both eyes (including significant visual impairment), a typical critical illness insurer will then pay out 100% of your policy. Note; the wording often being permanent and irreversible.

But what happens if you only went blind in one eye not both? Then with many critical illness plans, usually you would not get any payout, as not considered 100% critical.

However a ‘serious illness insurance’ policy could potentially pay out on your permanent sight loss in your one eye (based on the severity).

For some UK Insurers this also means you may have money left in your policy available to then claim for or a different condition or that same condition again.

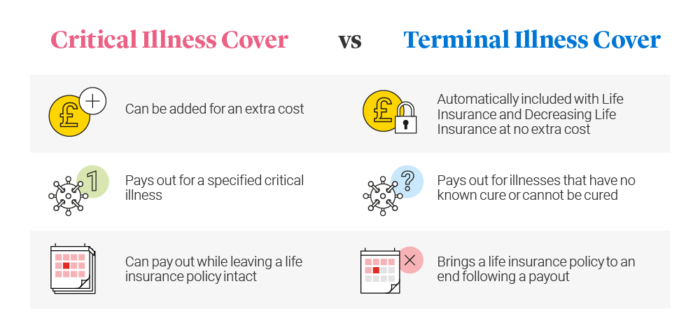

What’s Life Insurance with Critical vs ‘Terminal illness’?

- Terminal Illness is often included for ‘free’ as part of a life insurance policy cover.

- It usually means a doctor or consultant has sadly advised you may have less than 12 months to live.

- Once agreed by Insurers, they may then payout this advanced life insurance policy death claim.

- Critical Illness as explained, may pay out claims crucially upon diagnosis and survival of that specified illness

- So life insurance with critical illness cover means you will live, survive & claim.

- Life insurance with terminal illness benefit means you will not survive long term after a claim ie; incurable illness

- Note: Critical illness cover and life insurance plans are often combined anyway

CONCLUSION: Be careful & get confused on Terminal illness vs Critical Illness cover

Just Critical Illness Cover?

We are sometimes as brokers asked by some people – that they only want ‘just Critical Illness Cover’ – so not combined with Life Insurance.

Although for some Insurers this maybe just a little bit cheaper, for others strangely it’s all priced at similar costs to having life insurance combined / included.

Should you choose to have just critical illness cover alone – This also means if you died in an accident or didn’t survive the Insurers initial time period before a critical care claim,

then the policy would not payout. As such, please bare this in mind if you choose that route alone.

Will UK Insurers payout or refuse a Critical Illness Claim?

- Here are some claims statistics from Association of British Insurers ABI 2022*

- The average Critical Illness payout was around £68,000

- Around £1.2 billion was paid in ‘critical ill insurance’ claim payments

- Many UK Insurers to help assist a more common theme, follow ABI standards

CONCLUSION: 91% of Critical Illness claims were paid out by Insurers (ABI*2022)

Top 2 Reasons Critical Illness Cover may not pay out?

- Let’s look at the above claims statistics. We can see that in 2018 according to the ABI – If around 91% paid out, then 9% of critical illness claims therefore did not payout.

- Possible 2 reasons that UK Insurers do not consider a life insurance vs critical illness cover claim. Policy definitions & Non Disclosure

- 1] Policy definition: It does not cover the benefit you claim for. eg; it pays only on aggressive forms of cancer but you are diagnosed with less advanced stage 0 cancer

- 2] Non disclosure: Not told Insurers correct health history at the time of underwritten insurance application. eg; Insurers then find out on a claim & refuse payout

Note: Typically most insurance plans do not insure critical illness cover diabetes type 2 in their definitions. Likewise, if you have this at application stage it can make it harder to find affordable cover.

CONCLUSION: Double check your Medical History…Always tell the truth

Can my Children get Critical Illness cover also?

- Some life insurance with critical illness plans may also include valuable child critical illness cover for free

- Other Insurers you have to pay extra to include this benefit at plan outset

- A child benefit claim (usually a lower % amount) won’t affect the main adult policy benefits

- These may often cover children upto age 21 or into higher education

- Insurers may also payout a lump sum upon the death of a child

- Some Insurers allow you to enhance the child critical illness cover

- Also if a child was critically ill, then if covered under 2 x single adult policies both would payout

CONCLUSION: If you have Children consider a policy that includes Free cover

‘Critical Illness Cover vs Income Protection’?

- Income Protection PHI helps to cover your monthly outgoings & bills.

- It pays if you are unable to work due to accident, illness or hospitalisation

- PHI cover is subject to usually a maximum calculation on your gross income, However, in claim it will then pays a tax free income if paid for personally.

- Employees may find work already provides some sort of long term sickness scheme. This could mean more PHI is not needed as you may be over insured

- Critical Illness Cover is not income assessed. It may still pay out a tax free lump sum + help repay a mortgage, loan, debts or adjust your lifestyle.

CONCLUSION: Ideally you would have both protection plans to help cover shortfalls

‘Critical Illness vs Life Insurance’ & why it costs more?

- Critical Ill Insurance cover is for a larger number of risk conditions. Life Insurance however pays out if you just die or terminally ill

- In the UK for example 50% or 1 in 2 of people will be diagnosed with cancer in their lifetime [ according to Cancer Research UK ]

- Medical advances means luckily survival rates are now far higher than years ago. But either way one would still need time to fully recover

- It is often nearly as cheap to include life cover benefit within the plan.

- This ensures it will payout if you did not survive a full diagnosis waiting period

- Likewise, it also makes sense to have additional life cover and critical illness – so that you may still retain protection if claimed upon

CONCLUSION: Life Insurance & Critical Illness cover means more likely to claim on

‘Critical Illness Cover’ UK

Is a Critical Illness payment taxable?

If you are diagnosed with and then paid out a critical illness claim payment – then the money is currently paid to you as critical illness is 💯 100% tax free sum. However, if not all spent and you then died, your overall estate could be subject to inheritance tax rules instead.

*Is Critical Illness payout taxable UK payment?

No, The payment sum you receive from a critical illness claim is not currently classed as income, so it’s tax-free.

*Is Critical Illness insurance tax deductible UK benefit?

Generally Yes – if your business employer is all or part paying the critical illness cover as an employee benefit.

Alternatively No – to are critical illness insurance premiums tax deductible, if it’s your personal policy with monthly premiums which are paid via your own personal account.

Should I get a Single or Joint ‘Critical Illness Cover’?

- A joint life insurance critical illness cover may just pay out on claim of the 1’st policyholder but then ends, so maybe not what you want

- Insurers may setup for example a joint life 1’st claim earlier or accelerated critical illness plan to repay a joint domestic mortgage

- If one partner was critically ill, you may then still need to adapt your home

- This can increase the stress & reliance then on the other partner.

- For family insurance cover however, you may therefore wish to consider setup of 2 x single policies rather than joint plan

- The cost difference benefit for 2 x plans maybe less than you think

- Also do you go for Lump Sums or Family Income Benefits life insurance vs critical illness options

CONCLUSION: Cost benefit wise 2 x separate critical illness plans could payout twice

Split Trusts & ‘Critical Illness Cover’

This Trust section is only relevant if you have some life insurance included within part of your critical illness cover policy.

Writing a policy in trust is way to protect your family’s future in the event of death eg; You sadly died in an accident first, rather than making a critical illness claim. If life insurance is present, then you would only ideally want the critical illness cover benefits paid to yourself.

So, there is specific type of protection trust used in this situation. It splits out the critical ill insurance cover away from the life insurance (which is why it’s called a Split Trust).

It also ensures any remaining death benefits are held in trust for your beneficiaries if you died first. It helps avoid probate delays & Inheritance Tax IHT issues

Trusts are a legally acknowledged HMRC arrangement. The trust should be managed by ideally more than one trustee eg; direct family member, trusted friends, or a legal professional.

|

| “At the Point of Diagnosis, you are told the Worst Possible News… It is a Serious Critical Illness. You may now face ongoing Physical, Mental & Financial Challenges For you & your family“. |

Quotes for Critical Illness Insurance

Which is the Best ‘UK Critical Illness Cover’ 2025?

- There is no set answer to this question, as in the critical illness market awards, devil is really in the detail.

- Plans maybe paid on one claim only & then end. Others enable multiple claims and where you may get a % of sum assured amount

- So the cheapest critical illness cover life insurance policy isn’t necessarily the best, it may only cover just a few conditions

- Or it could have cheaper reviewed premiums that increase in the future so not guaranteed

- Neither is the most comprehensive critical ill insurance always the best, it could be unsuitable to your individual case circumstances or budget

CONCLUSION: The ‘Critical Illness Cover UK’ marketplace never stands still

How do I make a ‘Critical Illness Cover’ claim?

- When you are diagnosed with a suspected Critical illness, you should tell Insurers as soon as possible to start off the Insurance claim process

- If you are too seriously ill to enable you to complete a claim, then a family member can usually assist this process, subject to GDPR rules

- The Insurers will then assess your claim based on information provided & then rechecked via your GP, Hospital or Consultant

- Subject to Insurers approval – you may then receive the appropriate sum assured from your policy

CONCLUSION: Let’s help arrange your ideal Critical Illness via leading UK Insurers

Covid 19 | Life Insurance vs ‘Critical Ill Insurance” claims?

- Covid 19 is not listed under most critical illness cover Uk Insurers as a specified illness on critical illness quotes

- However, if Covid 19 then required continuous mechanical ventilation & intensive care, then a claim could be considered

- Only more ‘comprehensive’ Critical Illness policies may payout under their ‘Intensive Hospital Care 7/10 days duration’

- Likewise, if a child also required similar assistance, then under more comprehensive child cover, it may be a claim

- Note: if you died of Covid 19, then if your Critical Ill Insurance plan was also combined with lifecover, it should still payout

CONCLUSION: Life Insurance with Critical Illness. Get a Comprehensive Policy

Article on ‘Best Critical Illness Cover UK’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best brands selling Critical Illness & Life Insurance in UK (inc NI)

Unsure? Complete our no obligation quote form and speak with a Professional Financial Adviser | Quotes for ‘UK Critical Illness Cover’

Our 5 Point Plan – To Help You

- Confidentially discuss your own personal situation & any concerns you may have.

- Assess your position given factors such as – health, age, personal & family history

- Compare your various critical illness insurance options – from a fair & personal analysis.

- Get a Competitive Critical Ill Insurance Quote from one of the UK’s leading Life Insurers.

- Then if you are happy to proceed & given an affordable budget – Help arrange your ideal critical illness cover.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'