Article on: Life Assurance Policies MSE

LIFE ASSURANCE POLICY = PEACE OF MIND £££

If you Die or Diagnosed Terminally ill…

If you Die or Diagnosed Terminally ill…

How to choose the right ‘Life Insurance Policy’?

A Life Assurance policy is designed to financially help those left behind – cope with the day to day money worries & stress that may happen when losing a loved one.

We all may think we are Invincible 😇…..But

There are many different types of life assurance policies set up to suit all different sorts of needs. A Lump sum or Income ? Level or Increasing ? Single or Joint Life?

From whole lifecover, term life insurance, mortgage protection, family income benefit types of policies. Unsure how to choose the right “life insurance policy”? We can help you arrange your ideal cover.

‘Is Life Insurance worth it’?

So Is life insurance worth it? This is a question you need to seriously ask yourself. This is often a common issue now due to the cost of living crisis 2020’s and people trying to save money on their outgoings.

We would say…consider those loved ones that totally rely on you & your income if you sadly died prematurely. Those regular monthly bills are not going to stop.

Are you working still or perhaps retired on a pension? Would your family be entitled to any ongoing benefits from any employer? Do you have joint liabilities?

Nobody says to you what age to buy life insurance is best but it is often influenced by your personal circumstances eg; New mortgage, having children, health changes or a death in the family etc;

According to the Association of British Insurance ABI, around 25% of ‘breadwinners’ in the UK don’t have life assurance in place, which would potentially leave their families open to financial problems if they died.

This equates to approximately 8.5 million UK adults and leaves a protection cover gap of £263bn! Studies have shown that although people know what a life insurance is and say they do understand the importance of it…. the number that have actually taken a life insurance policy out is very low.

3 TOP Reasons – Why to get Life Insurance?

3 TOP Reasons – Why to get Life Insurance?

As Life Insurance Brokers, this simple top ‘3 reasons formula‘ you may wish to consider in an ideal world as why to get life insurance.

- LUMP SUM – repay a Mortgage / Loan / Debts – Often your largest outgoings

- INCOME – provide for your Family – To help cover ongoing monthly bills / lifestyle / holidays

- LUMP SUM – help cover Final Expenses or leave a Legacy – Monetary Costs

Martin Lewis on Life Insurance formula instead suggests just covering 10 x annual salary of main breadwinner – after payment of mortgage & debts until at least the kids leave education.

As such, should you choose this Martin Lewis life insurance option then please use our free online UK Life Insurance Calculator > and compare best deals for 10 x your salary on insurance policy for life cover.

Compare best broker ‘Term Assurance Policies’ and get online ‘term assurance quotes’ >

|

| Life Assurance Policy – Hacks & Hints |

What’s Martin Lewis Life Insurance Policy?

MSE says ‘Thinking about how your family may cope financially if you were to die isn’t a very cheerful topic, BUT it is an Important One’.

The MoneySavingExpert Martin Lewis comments that he does 💯 ‘100% recommend Life Insurance’, especially if you have any dependants.

So Martin Lewis agrees life insurance is important if anyone is reliant on your Income & would struggle financially without you around ie; an insurable financial interest.

Martin Lewis life insurance policy says YES it’s a cheap financial lifeline but the ultimate monthly costs choice risk is always yours.

He also discusses the value in other insurance plans if you were off sick, like income protection & critical illness.

Martin Lewis for a good rule of thumb in 2024, his Best Life Insurance formula is ‘THE 10 x RULE’ ie; aim to cover 10 x the Annual income of the highest earner & the main breadwinner until at least any kids have finished their full-time education or other dependants.

To help you calculate a figure that works for you, Martin Lewis Life Insurance policy says it’s worth ensuring any life insurance policies cover:

- Outstanding Debts: that need to be paid off eg; mortgage unless covered by a separate plan

- Immediate Outgoings: regular bills dependants would need to pay

- Future Spending: you may have wished to make eg; university fees

- Additional Expenses: a death may trigger eg; funeral costs

Martin Lewis also suggests being the Money Expert – that you should “NEVER BLINDLY BUY DIRECT” expensive policy offers either via your Bank or One Insurer ie; Shop around or use a Broker.

Lastly, MoneySavingExpert also said generally remember, not all insurers plans are featured on insurance comparison sites. As brokers, we would also agree here – so let us help you shop around for your best broker deals.

In terms of the large range of Life Insurance policies available, Money Saving Expert are fully impartial with all their best buy reviews. As you maybe aware, neither Martin nor MSE never endorse products.

Note: Yes, they mention individual products & services on MSE site, but they make it very clear don’t ‘support’ them.

‘How many Life Insurance can I have’?

We are sometimes asked as brokers, ‘how many life insurance policies can I have’? This is a good question.

Well, you potentially could have several plans eg; 1] life policy to cover a mortgage 2] life policy to cover the family 3] life policy to cover a business loan etc;

Noting that you may probably have already different insurers for your car, home, pet, breakdowns, phone insurances etc;

What are the 3 main types of Life Insurance?

What are the 3 main types of Life Insurance available in the UK marketplace: The 3 Types Life Insurance can be bought are…

- Term Life Insurance – Guaranteed

- Whole Life Insurance – Guaranteed

- Life Insurance – Reviewable

Note: The life insurance policy monthly payment is affected whether the plan premiums are guaranteed or reviewable.

3 Types of ‘Term Assurance Policies’

Then what are the three types of life insurance can then be set up as either of the following 3 ways;

- Single Life

- Joint Life 1st death

- Joint Life 2nd death

As whole of market brokers, we are able to deal with most life insurance policy types. Compare online broker ‘term assurance quotes’ >

Life Insurance Policy Term

‘Term Assurance Quotes’ vs Whole Life Insurance Cover?

- Both cover is underwritten insurance so Insurers will ask you medical & lifestyle questions eg; blood pressure or cholesterol issues before offering rates

- A Life Insurance term life will offer cover but just for a fixed period of time or ‘term’. eg; 20/30/40/50 years until retirement or a child is independant

- They are simple policies to operate; if you die within the ‘term’, your family will receive the set life insurance death payment.

- Because it runs a set term, a ‘Term Assurance Quote’ may have more affordable premiums [so you may live out that nominated term]

- Unlike a Whole life Insurance however as it runs indefinately (as does the premiums) ie; not any set plan term but continuous coverage

- Whole life is an Insurance Policy for Life – as it will always payout ‘whenever death occurs’ eg; Even if you were age 195

- Note: You can take out a ‘long term insurance’ policy often upto the age of 90

CONCLUSION: ‘Whole life’ is more expensive than life insurance term life as the risk’s higher

‘Life Insurance vs Mortgage Insurance’ | ‘What’s Decreasing Term Life Insurance’?

- ‘Life Insurance vs Mortgage Insurance’ so ‘What’s Decreasing Term Life Insurance’?

- Mortgage Decreasing term life insurance will reduce over the plan term – but the premiums remain level

- It is designed to usually help repay your mortgage, loan or other debt – where that amount owing will reduce over the term

- Decreasing ‘Term Assurance Quotes’ are usually cheaper than a Level ‘Term Assurance Quote’ as the cover reduces

- You can set the % at which the policy reduces at outset eg; If you bank loan is fixed at say 5% for 15 years, then so could the policy

- Life Insurance vs Mortgage Protection. Level term policy may suit for an interest-only mortgage or loan ie; the amount owing stays the same.

CONCLUSION: Life Insurance vs Mortgage Insurance. ‘Mortgage Protection’ can help protect Repayment Mortgages

Family Income Benefit vs Lump Sum Term Assurance Quotes?

- A Family Income Benefits [FIB] term life policy pays on death a set regular income

- The monthly income upon a death claim is then just paid for the remaining fixed term of the plan

- Example: £1,500pm FIB policy benefit over 15 years. A death claim comes in year 9

- So it then pays £1,500pm for upto 6 years upon a death claim and then the policy ends

- This means you could setup new life insurance until say children are independant or upto retirement

- Like decreasing term life cover, the amount owing on death reduces over the term

- eg; FIB used to protect child maintenance fees upto say age 21

- FIB is designed to avoid complications & stress of how best to invest a lump sum for income

- Some Insurers do allow FIB to be commuted to Lump Sums option upon claim

CONCLUSION: Family Income benefit is a decreasing plan, so only pays any balance left

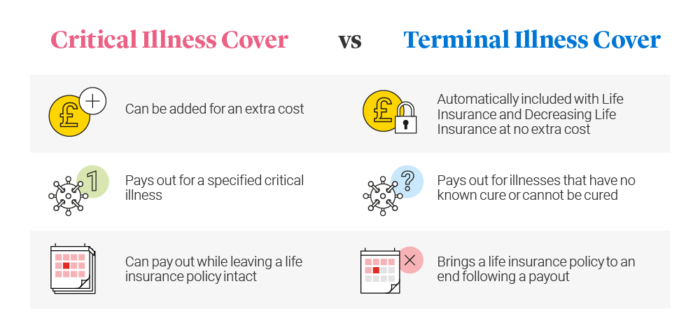

Is Terminal Illness the same as Critical Illness?

- NO is the answer. Terminal Illness on a Life Assurance Policy – means you sadly have less than 12 months to live

- Terminal Illness is often included for free as part of your life assurance policy benefits

- Once agreed, the Insurers claim team will then payout a private life insurance death ‘claim’ earlier in advance ie; incurable illness

- Critical Illness however is ‘paid for’ benefit, claimed upon survival & recovery. It often covers a large range of benefits

- Benefits for lifecover and critical illness payouts may include types of cancer, heart disease, stroke, multiple sclerosis, diabetes, parkinsons etc;

CONCLUSION: Confused between Critical Illness & Terminal Illness wording

‘UK Life Insurance Calculator’

- Use our free online ‘UK Life Insurance Calculator’ >

- Calculate in 15 secs best broker UK Life Insurance deals

- Compare multiple’s of your salary for average life insurance cover

- Or calculate and work out cover for your mortgage

- Check T&C’s on best ‘life insurance uk calculator’ policies

CONCLUSION: Use our FREE online Life Insurance Cost Calculator UK

AD&D and Life Insurance

- AD&D and Life Insurance death – means an accidental death only & dismemberment policy

- It pays only if your death is either accidental or you suffer a severe injury

- AD&D and Life Insurance plans are generally not medically underwritten at application

- ie; The chances of this happening are far less likely than a natural causes claim

- Term & Whole Life Insurance death policies both cover accidental death

CONCLUSION: Accidents do happen but AD&D and Life Insurance are poor value

What is Waiver of Premium on a ‘Life Insurance Policy’?

- Waiver of premium helps protect your policy premiums if off work re accident, sickness or hospitalisation

- Some Insurers may also waiver your premium if off work through pregnancy or redundancy for 6 months

- Premiums are usually waived after deferral period of 4/8/13/26 weeks

- The Insurers then pay your premium until you get back to work or potentially until a claim to plan end

- Many Insurers may charge you extra for this benefit, however for some its standard

- The cost for this benefit is often small, in relation to help protecting the large amount of life insurance

CONCLUSION: Valuable benefit. Don’t risk your plan cancelling & maybe never get cover again

‘Personal Life Insurance’ for Individual?

- Personal Life Insurance for individual policy is setup just on the sole personal life & death of a policyholder

- ie; like an death in service cover it only insures that individual employee or person

- A joint life 1’st death insurance policy may pay out on the death or claim on that 1’st policyholder. Then it ends.

- Joint life insurance death ‘2nd only life’ policy pays on last death eg; This may usually be used for Inheritance Tax IHT cover

- Insurers may setup a joint term life insurance plan to repay a joint mortgage

- Family life Insurance cover may be setup either joint life 1’st death or 2 x single policies or ‘dual life’

CONCLUSION: 2 x personal life insurance for individual are often more costly, as they may payout twice

Life Insurance Tax Benefit

- Life insurance death tax benefit in the UK is paid out income tax free upon claim

- But once the payout is made it may then be subject to inheritance tax (see trust section below)

- There is no tax relief on premiums re new personal policy re life insurance tax benefit

- Certain older pension term insurance policy once offered a life insurance tax benefit relief

- Relevant Life Insurance business life cover offers a tax deductable life insurance tax benefit

CONCLUSION: No personal Life Insurance Death Tax Benefit on purchase but at claim

What does putting a ‘Life Assurance Policy’ Into Trust mean?

- Putting the policy into ‘trust’ may help to avoid both probate delays & inheritance tax by falling outside your estate

- Ensures it should go direct to you nominated beneficiaries via the trustees

- Benefits of life insurance policy trusts still applies even if you have made a valid will

- Without a trust the policy could fall back into your estate and this could be both costly re probate fees & IHT

- Inheritance IHT tax is currently 40%. So it could be for larger estates, the life insurance death payout is then reduced by this amount

- Most Insurers do supply free a good range of generic life insurance trusts, ideal for many client situations

CONCLUSION: Insurers can help setup a generic trust. If in doubt, we suggest you seek legal advice

Death Benefit Life Insurance | Level or Increasing?

- Death benefit life insurance can be started as level or increasing life insurance death policy

- Level term policies always stay at that fixed amount & so may the premium

- Increasing cover may adjust annually – to help offset increasing yearly living costs & rising bills

- This cover increase maybe via retail price index RPI; annual earnings AEI; a fixed amount eg; 5%

- Another benefit of increasing cover is – Insurers may usually increase cover without further medical evidence.

CONCLUSION: Choose from outset a Level or Increasing Death Benefit Life Insurance Policy

Is Suicide covered by Life Policy Insurance?

- Is suicide covered by Life Insurance? ‘No’ during the first 12 months but ‘Yes’ thereafter

- Standard 12 months initial exclusion apply on most life insurance policy terms re suicide

- This sadly is also in place to prevent any incentive for financial gain upon suicide

- Thereafter this 12 months period you are fully covered for suicide & this exclusion does not apply

- Insurers will then assess all life assurance policy claims for suicide as per any other death claim

- Note; If you do have a history of mental health, drink or drugs issues you must correctly disclose this on your application

- Insurers will then assess the severity of these above issues on your application before considering offering terms

CONCLUSION: If you are having suicide thoughts please speak to the Samaritans for help

Check for Insurance Policy for Life Exclusions

- Suicide as mentioned applies usually for initial 12 months

- Intentional & self-inflicted injuries

- Any misuse of drugs and/or alcohol

- Reckless activities, sports & pastimes

- Deliberate non-disclosures & misrepresentations will usually be excluded

- Terminal illness claims in last 12 months applies to some term life insurance policies

- Listed life insurance exclusions applied to your policy re any pre-existing issues by Insurers eg; thyroid exclusion on premium waiver

CONCLUSION: Check for Insurance Policy for Life T&C’s re Life Insurance Exclusions

Covid-19 & ‘Insurance Policy for Life’

- Insurers will ask in the last few months have tested positive or had recent contact with anyone with symptoms

- If so you may have to await your full recovery and be fully OK before you can re-apply

- Standard rates will apply after any self-isolation period & assuming no other health issues

- Any refusal to be vaccinated, will not affect consideration payment of a claim

- Receiving a COVID-19 vaccination or side effects will also not impact on your personal life insurance quotes

- ABI death claim stats show average 97% payouts on life insurance policies for around £80,000

CONCLUSION: Should Covid 19 lead to death, Insurers will approach any claim as normal

Online Life Insurance Payment?

- Most policies allow monthly or annual premium online life insurance payment

- Many insurers will also give you access to their customer portal re online life insurance payment

- This is important if you for example you swop banks or wish to amend bank account details

- As whole of market brokers we give advice on all online life insurance payment terms

CONCLUSION: Most Insurers are flexible about any online life insurance payment

Life Insurance cost Monthly?

- Life insurance cost monthly usually start from as low as £4pm

- To calculate life insurance policy costs Insurers will factor in variables…

- Amount of cover, Age, BMI kg, Personal & Family Health lifestyle

- Smoking & Drinking habits, Occupation & Income

- Hazardous Pastimes, Amount of insurance already in place

CONCLUSION: Life Insurance policy quotes will be based upon full underwriting

Which is the Best ‘Life Insurance Policy’?

- There is no set answer to this question, as the devil is really in the ‘life insurance policy quote’ detail.

- What type of policy is actually required ie; cover for your Mortgage, Family, Funeral Costs, Inheritance Tax etc ;

- Or if you have health issues, your job or pastimes are all considered high risk then each Insurer may cost this differently

- So the cheapest policy quote isn’t necessarily the best, as it may have age costed annually reviewed increasing premiums

- Ignore advertised Life Insurance with Free Gifts deals, as they generally could be £1,000’s more lifetime expensive

- Likewise the most expensive policy isn’t always the best, it could be unsuitable to your individual case circumstances or budget

CONCLUSION: Speak to our Brokers for your Best Life Policy Insurance in your situation

Buying Life Insurance?

If looking to ‘buy life insurance online’, then how much cover should you consider if buying life insurance? Where do you start to assess what you should need, rather than guess.

For example, our typical life insurance policy uk quote we see many people do online is usually *£100,000 insurance policy for life cover quote over 20 years term. Is that amount really enough?

It is fairly easy to buy life insurance online nowadays and without any advice. However, as brokers we ask is that best way how to buy life insurance cover that properly fits all your needs?

Speak to a professional, and let them help guide you through the maze of taking out the correct personal life insurance uk policy that is right for your family and circumstances. Compare online ‘term assurance quotes’ >

‘Term Insurance Life’ Policy Conclusion

Whatever type of term insurance life policy or whole of life you are after, we can help you.

From level, increasing or decreasing cover policies. From lump sum to family income benefit style plans, we have it covered.

Get a free online quote & then discuss your best options with one of our whole of market Uk life insurance agents.

Article on ‘Life Assurance Policy‘ by Martyn Spencer Financial Adviser (2024)

For reassurance re health for men & women – we review many of the best brands selling policies for Life Insurance in UK (inc NI)

Unsure ? Complete our no obligation quote form & speak with a Professional Financial Adviser – about your ideal Life Assurance Policy.

Our 5 Point Plan – To help you

- Confidentially discuss your own personal situation & any concerns you may have.

- Assess your position given factors such as – health, age, personal & family history

- Compare your various life insurance options – from a fair & personal analysis.

- Get a Competitive Quote Online for an insurance policy for lifecover from one of the UK’s leading Life Insurers.

- Then if you are happy to proceed – given an affordable budget – Help arrange your ideal life assurance plan or plans.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'