'What are the Benefits of Stopping Smoking'?

Article on: The Benefits of Quit Smoking

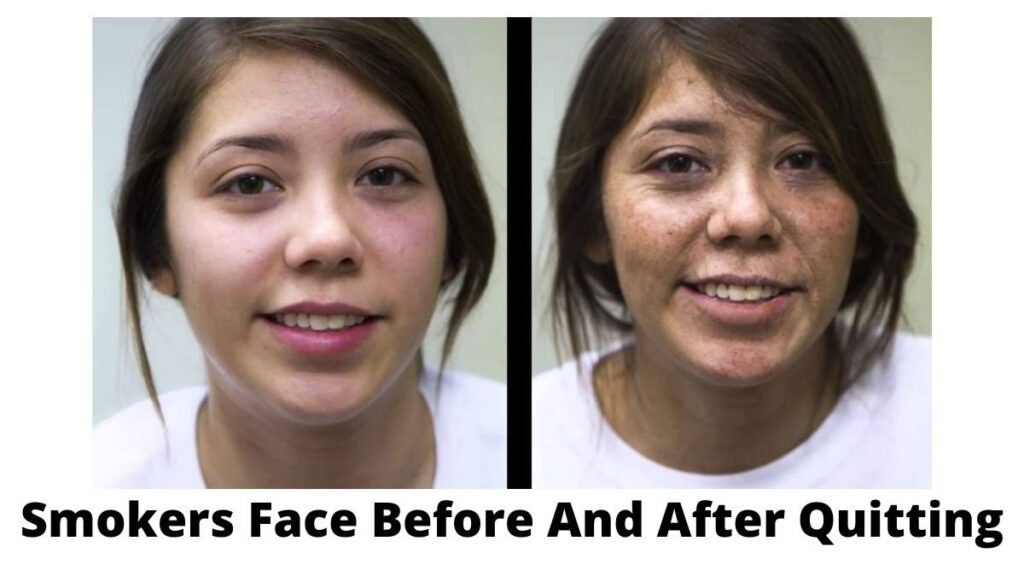

'Smokers Face Before & After Quitting'🚬Visible Benefit

Why do people start Smoking?

Initially though, let's ask instead Why do people start smoking or vaping in the actual first place & where did it all first start for you? Or in other words - what's your 'start smoking story'.

It could have started with peer pressures when you were much younger. Or perhaps both your parents & other close family were smokers or vapers?

Or maybe it first started when you viewed what you thought were cool looking people smoking on films & TV programs.

You may call yourself just an occasional or 'social smoker'. Or perhaps you have told people you are trying to give up...but later on sneak outside for a crafty fag or vape.

'Benefits to Quit Smoking'

Since the millenium in the UK, many places have made it harder to smoke when out and about, by legally banning it indoors ie; pubs, restaurants, cinemas, public transport, workplace etc;

This situation may also get harder if all types of smoking outdoors in all UK public places in the future, is also legally banned.

Let's not kid ourselves, once started smoking, it can be a very difficult addiction to break from ie; the regular habit forming drug of nicotine tobacco & holding a cigarette or vaping stick.

The main reason that people continue to smoke is because they become addicted to that nicotine tobacco.

However, the benefits of stopping smoking are many, that may make your struggles worthwhile.

In this article let's examine some of the 6 key reasons - both visible, physical, mental, emotional, sexual & financial effects give up on smoking, so benefits of quitting can have for you.

Then finally how these may all affect terms for life insurance, critical illness, income protection & private health insurance cover.

6 Key 'Benefits to Quit Smoking'

1] Repair & Increase Lung Capacity | Cough Less

Everybody needs to breathe air to live on this planet earth. One of the key quit smoking benefit, is that your air breathing lung capacity improves dramatically within 9 months *NHS. You may avoid developing asthma or COPD.

When you stop smoking, you give your lungs the chance to slowly repair the damage caused. You may then start to breathe better after 3 days. You will also start to cough or wheeze less.

A human's lung capacity reduces with age. So smoking stop benefits include ability to potentially physical exercise more easily ie; running, cycling, swimming, even walking or gardening.

As you age, good lung breathing capacity becomes more vital, as your muscle mass reduces. This is vital if you have raised BMI kg. You start to operate abit slower.

So the longer term smoking quit benefits, may hopefully include having a more active & healthy future. Overall a better YOU.

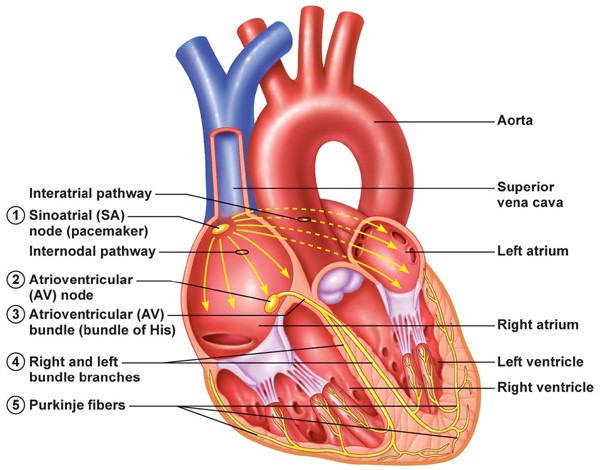

2] Energy Boost | Healthier Heart & Circulation

Within 2 >12 weeks of stopping, another of the benifits of quiting smoking are your heart circulation, blood pressures & cholesterol will all begin to improve. Smoking strangulates your blood circulation.

Smoking also makes your LDL bad cholesterol 'stickier' ie; it clings more to your artery walls clogging them up. It also lowers your levels of HDL good cholesterol, which normally takes cholesterol away from the artery walls.

One cigarette can potentially shut down the vessels in your feet and toes for several hours, depriving your skin of life giving oxygen and nourishment. Smoking also can cause foot pain.

You'll also give a boost to your bodies immune system. It makes it easier to fight off those colds, viruses or flu. The increase in oxygen in the body can also reduce tiredness and the reduce likelihood of headaches or migraines.

One of the major health issues caused by smoking is cardiovascular disease of the heart. Smoking causes your heart blood vessels to narrow and become blocked.

It also causes arteriosclerosis - a build-up of fatty deposits in the vessels and loss of elasticity of the vessel walls. If the blood cannot flow freely through the vessels, then it can then block it and lead to partial or total loss of circulation.

This could ultimately result in feet and limb disorders, sores, ulceration, psoriasis, gangrene and worst case amputation.

Blood vessels become weaker and expand. This is called a brain aneurysm, which may burst. This is all potentially life threatening.

3] Sex, Stress & Stamina | Libido & Fertility

Men who attempt to quit smoking benefits from potentially performing better. For Women, they may find they become aroused more easily ie; stopping smoking improves sensitivity & the body's blood flow.

It's also been found in various studies that non-smokers are potentially more appealing to prospective partners than smokers.

Further smoking benefits of quitting include some women who may find it easier getting pregnant, or it reduces the likelihood of a miscarriage. ie; improves the womb lining & men's sperm more potent.

Your stress levels will also gradually reduce over time, although you may initially feel that it is smoking that helps reduces your mental stress and anxiety? But quitting smoking longer term will slowly readjust your brain to understand the difference.

Non-smoking also increases chances of conceiving through IVF. More relevant, it improves the chances of having a healthy baby.

4] Healthier Skin | Sweeter Breath, Taste & Whiter Teeth

Many visible benifits of quiting smoking, include slowing facial ageing and hence delay the appearance of wrinkles. Smoking causes skin pigmentation as it restricts oxygen flow to your skin cells. It also leaves stains on your fingers.

A non-smokers skin gets more nutrients, more oxygen. It can also help reverse those lined or sallow smokers complexion. Smokers generally have a harder time healing skin wounds.

Stops your white teeth becoming dark and stained. Plus, you will have fresher breath and regain a better sense of taste & smell. You are less likely to get gum disease or prematurely lose your teeth.

5] Life Expectancy Yours | Your Families

Sadly, 50% of smokers may die early from smoking-related causes, including heart disease, lung cancer, thyroid issues like graves disease or chronic bronchitis.

Men who quit smoking benefits by the age of 30 may add 10 years to their average life expectancy.

Breathing in 2'nd hand smoke increases the risks of your family getting lung cancer, heart disease & stroke eg; sitting in the car whilst you smoke.

People who stop smoking before age 60, may potentially add 3 years onto their life.

In children, it doubles the risk of them getting chest illnesses, including pneumonia, ear infections, wheezing and child asthma.

Children are also have 3 x the risk of getting lung cancer into later life, compared with children who may live with non-smokers.

6] Cheaper Life Insurance | Smokers Life Insurance Quotes

Let's first look at how much more expensive Smokers Life Insurance Quotes are ie; how much does smoking increase life insurance?

*How much does Smoking increase Life Insurance?

Well let's have a look at a few examples covering both life insurance and smokers v non smokers and also critical illness cover as well.

People who on average have now given up all forms of smoking for 12 months plus.

Example: person aged 40 with a monthly budget of £40-45pm: Compare Smokers v Non Smoker typical premium 'life insurance' rates:

- SMOKERS: A typical broker quote = £250,000 life insurance over 25 years

- NONE SMOKERS: Same typical broker quote = £600,000 life insurance over 25 years

- So benefits to quit smoking on typical life insurance = extra £350,000 life insurance

Let's now look at smoking impact on Critical Illness Insurance for life insurance for smokers vs non-smokers.

Due to the much higher chances of a critical illness claim claim here, how much more do smokers pay for life insurance can be clearly seen.

Example: person aged 30 with a monthly budget of £40-45pm: Compare Life Insurance Smoking v Non Smoker typical premium 'critical illness insurance' rates:

- SMOKERS: A typical broker quote = £100,000 critical illness insurance over 30 years

- NONE SMOKERS: Same typical broker quote = £150,000 critical illness insurance over 30 years

- Benefits to quit smoking on typical critical illness insurance = extra £50,000 critical illness

So you can see if checking the average cost of life insurance for smoker, how much more is life insurance for smokers and also critical illness.

Do an insurance quote yourself and compare the financial differences of how much is life insurance for a smoker and the benefits of quitting smoking.

*What is considered a Smoker for Life Insurance?

People sometimes ask us as brokers what is considered a smoker for life insurance as it can be confusing for some. Especially also if they vape non-nicotine products or use water pipes (so some don't see that also as smoking).

Here is a typical life insurance smoking question asked on an Insurers application, to better understand non smoker definition for life insurance.

It all revolves around the various 5 years time periods, but more especially for many Insurers - the last 12 months re smokers life insurance rates.

Note: Most providers still may offer life insurance for smokers no medical exam, if you have no other associated health risks eg; no personal or family history risks.

*Life Insurance Smoking Question?

- During the last 12 months have you smoked any cigarettes, cigars, pipe, e-cigarettes (whether or not they contain nicotine) or used nicotine replacements?

- A simple medical test may be required to check your answer.

- Or *Given 12 months plus *Given up 3 years plus *Given up 5 years plus.

- Have you have ever smoked? YES/NO

*How long after Quitting Smoking Life Insurance?

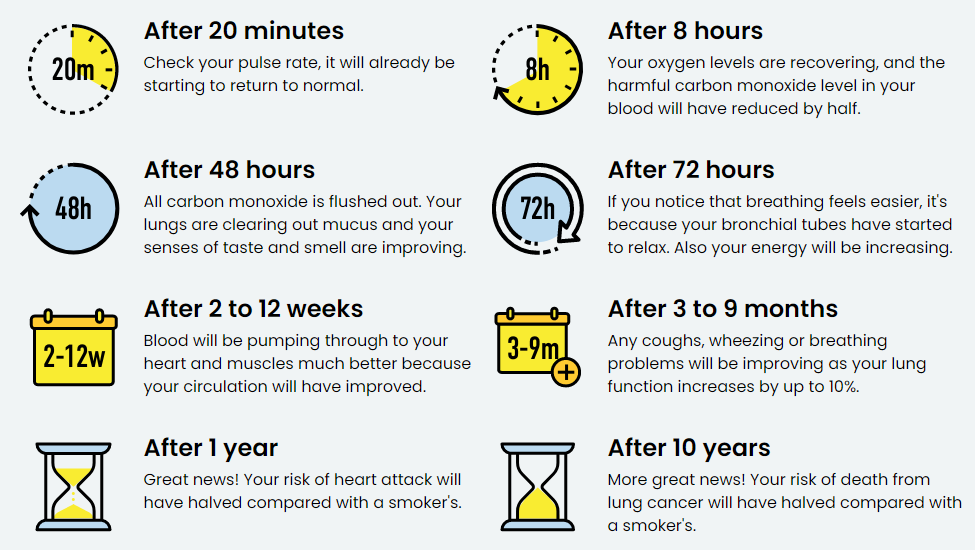

Note: If you look at the 'benefits of quitting smoking timeline' below, you will better understand why that 12 months period counts for your health and getting affordable life insurance for smokers.

This 12 month period, then affects how long after quitting smoking life insurance rates could be lowered (but still not standard) and so is pivotal for most life insurance for smokers via Uk Life Insurers.

'Can you get Life Insurance if you Smoke' alot?

Can you get life insurance if you smoke alot ie; more than a packet a day?

Yes you can, but as mentioned UK Insurers want to know whether someone is currently smoking now & the amounts they do smoke, whether a little or alot.

The reason being is because this then relates directly to their increased life insurance and smoking risks.

How much someone smokes is therefore the key indicators here. Someone who smokes say one cigarette a day would still be charged smoker rates (but they wouldn’t be deemed as big a risk - as someone who smokes 20 or more cigarettes a day).

The problem is often people say to us as brokers they ONLY smoke 5 to 10 cigarettes per day or 15 to 20 per day. The issue for insurers is you cannot put down these 2 parameters, it must be one single average figure.

The other application questions that have relevance for smokers relate to their overall health and so Insurers link these two together.

So can you get life insurance if you smoke but then also have a condition that already puts you at higher risk of getting a lung related condition or cancer?

Insurers will look at the combined risks, instead of each risk in isolation. So what if somebody who has reasonably significant heart disease or has suffered a stroke but continues to smoke.

Or if they have say moderate to severe COPD or asthma and also therefore need to take regular steroids or hospital treatment but they are still smoking. The warnings signs for Insurers are there.

In this instance, many Insurers would potentially be unable to offer life insurance cover here, especially when their doctor’s records may also show that they have been told to stop because of the negative effects upon their overall health.

*How do Life Insurance know if you Smoke?

How do life insurance companies know if you smoke? Some Insurers may request a cotinine test to check out your smoker status and as such, do not lie on your application if comparing life insurance quotes for smokers.

Why? well a death certificate & prior medical notes may clearly indicate that you did smoke.

Life Insurance Smoking Test

This life insurance smoking test uk assessment is used to detect the presence of and/or measure the quantity of nicotine or cotinine in blood, urine, saliva, or sometimes hair.

It determines whether someone uses tobacco or even has been exposed to secondhand smoke for their life insurance smoking policy. This also applies re cigar smoking life insurance test.

They can then decide after this life insurance smoking blood test your smoker vs non smoker life insurance status. From this they may offer you appropriate best life insurance rates for smokers or not.

*Is How Long a Person has Given Up Smoking Relevant?

Insurers may often ask how long a customer has or had last smoked for on their insurance application ie; when did you first start smoking.

This maybe sometimes picked that up in any GP reports or medical evidence tests for life insurance smoking history.

However, if the person had stopped smoking for example over age 40, they would often ask now 'when they stopped'?

In other words Insurers are now trying to assess their risk of offering life insurance for smokers over 40 or life insurance for smokers under 50 claims payouts.

*When can you get Life Insurance if you Smoke but then stop?

If they have stopped in the last 12 months, Insurers would still be charged smoker rates. However, if it was in the last 1 to 5 years, some Providers would still then charge you health rated ex-smoker rates.

After that 5 years period, for some Insurers you would qualify for full non-smoker rates. Although Insurers state you are typically still at an increased risk of certain conditions for say 10 to 15 years or more after fully stopping smoking.

The Insurers state that if they are looking across stats for ex-smokers who had smoked for a long time & those who had say only smoked for a few years, then they feel 5 years to be a fair compromise.

If someone had started smoking back in their teenage years and they are now in their 50s or 60s, Insurers could view them as at greater risk of certain conditions e.g. lung cancer, due to the length of time they smoked for.

The Benefit of Quit Smoking | 'Smokers Life Insurance' Types

There are 2 main types of Life Insurance for a Smoker in the UK Protection Marketplace:

1] Term Life Insurance

Term Life Insurance is a simple plan that pays out a cash sum if you die during the fixed time period your policy runs for. The sum paid out for death insurance stays level for family life cover or decreasing for mortgage protection.

The premiums however will remain level, whether you are near the policy beginning or end re term life insurance for smoker deals.

Most plans also include free 'terminal illness' cover. You can choose options on life insurance quotes for smokers of Lump Sums or Family Income Benefits & also if you want your cover to be inflation proofed.

The longer the level term insurance runs, then the more expensive it costs ie; 40 years term maybe double or more the cost than 20 years, as the smoker life insurance risks are higher as you get older. You can take smokers term life insurance rates upto age 90.

2] Whole of Life Assurance

Whole of Life Insurance policy, always pays out if you die ie; whenever (as long as you’re kept up with monthly payments and their T&C).

For a smoker, this maybe the most expensive policy compared to term insurance, as it will always payout ie; full life policy is life insurance more expensive for smokers against term life.

Consider placing your 'life insurance for smokers' policy into trust to help avoid probate or Inheritance Tax IHT issues.

Life Insurance for Smokers Over 50

Some no medical Over 50's Lifecover plans still ask your smoker status & some others don't if comparing best life insurance for smokers for over 50 or life insurance for smokers over 60.

So, if looking for this type of life insurance for over 50 smoker but no other medical questions, this could always be a choice if you do have poor health issue risks eg; heart or lung problems.

If otherwise fit and healthy, then medically underwritten whole life insurance rates for smokers is a better option.

*Life Insurance Occasional Smoker | Social Smoking Life Insurance

So as explained, even if you occasionally smoke or only socially smoke, then note.... there is no such thing as occasional smoker life insurance or social smoking life insurance.

The effects on your body and pocket maybe less for a 1 cigarette per day smoker, than a packet of 20 per day smoker. So what do insurers think about that. Will they then offer you their cheapest life insurance for smoker of the odd cigarette or charge non smoker rates instead? No, they will say one per day = 365 per year or even one per week = 52 per year.

Well UK Insurers do factor in all the medical evidence and will still charge their standard 'Occasional Smoker Life Insurance' premiums accordingly for say life insurance for smokers under 40, who just have the odd social cigarette.

*Heavy Smoker Life Insurance

It could be you smoke more than a packet of 20 per day? This means for some insurers you are a classed as a really heavy smoker but be aware that for life insurance smoking lying here could void your policy. So, appreciate then these insurers may charge accordingly more expensive heavy smoker life insurance rates.

Unsure and who maybe the best life insurance for smokers uk deals here, then please contact us.

*Ex Smoker Life Insurance | Benefits of Quit Smoking Life Insurance?

Life Insurance cover is therefore based on your original life insurance for smokers uk status answers given when you first applied. So, as long as the original information was correct at that time, irrespective if you restart smoking later on, your premiums will usually remain the same.

Conversely: If you do give up smoking for over 12 months+, then some Life Insurers may reconsider your original smokers life insurance application now onto cheaper ex-smoker life insurance rates. Get Professional Broker advice here for best life insurance ex smoker deals & financial benefits of quit smoking.

Note: An Insurer classes an ex-smoker as somebody who last smoked cigarettes or cigars, used a pipe or any other form of tobacco or nicotine products, including e-cigarettes or nicotine replacement products (over 12 months ago but less than 5 years ago). Contact us for best life insurance for ex smokers.

Alternatively, Insurers class a non-smoker as somebody who last smoked cigarettes or cigars, used a pipe or any other form of tobacco or nicotine products, including e-cigarettes or nicotine replacement products (more than 5 years ago).

Importance of Insurance Disclosure & Claims re 'Life Insurance and Smokers'

When you do a smoking life insurance quote, at that stage you have probably only advised the most basic information (for life insurance and smokers status) to just get a comparison quote.

A full application is still needed. In your application, most Insurers will ask lots more personal and family health & lifestyle questions, to fully underwrite your cover.

It is easy to sometimes make mistakes and rush when filling in any forms, so as the saying goes be careful to 'tell the truth, the whole truth & nothing but the truth'. The risk is more to your family if you lie to the Insurers, to try to save money. If so, it may not payout ! eg; If you smoke or vape, then you must tell them you are smoker...even if it costs more or you get less cover. All the more reason to hopefully consider benefits to quit smoking.

From this full disclosure, Insurers can then work out if the priced quote you did still stands. Or, maybe costs a little more due to any adverse insurance risks eg; raised BMI calculation or diabetic type 2.

All Insurers are in business to protect, insure & payout. Insurance cover is therefore based on your full disclosure at the time you took the original policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying.

The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying, so be aware that for life insurance smoking lying here could void your policy.

Should you make a claim, your Insurers will send out a claim form to complete. Once received back, they will usually contact your GP to confirm any health details, like smoker status.

They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details against clear evidence from say a death certificate ie; life insurance claim denied smoking related causes.

*Can I be denied Life Insurance for smoking pot?

As brokers we have been asked before, can I be denied life insurance for smoking pot? Well the answer is not a clear 'No', as it always depends upon the insurers stance here.

Some Insurers may view smoking pot symptomatic with other mental or physical health related conditions, so take this disclosure re cannabis more seriously than others.

As mentioned above, although you maybe apprehensive about this smoking Pot life insurance disclosure (if for example your own GP is unaware) you must do so.

Likewise, if you did not tell the Insurers in say last few years you had actually taken pot, but now quit smoking life insurance terms then offered.

So this is important here re your smoking pot they are aware ie; does smoking void a life insurance policy at claim. Yes, it may well do if they were unaware.

*Re-Start Smoking again for Life Insurance'?

Some people ask us if they have given up smoking for over 12 months, what if you tried hard the benefits of quit smoking but then start smoking after life insurance has started?

As long as honestly at the time of application you were not smoking for their noted timescales, and this was advised correctly back then, should you re-start again you do not have to advise insurers.

However, we would suggest as brokers you do write them a letter explaining that you have re-started smoking again and perhaps any reasons etc; This may help to avoid any claim issues what happens if you start smoking after life insurance.

*Is Vaping still Smokers Life Insurance Quotes?

If you have smoked or used any 'replacement products' within the past year, an insurer will still classify you as a Smoker ie; this includes the use of vapes, e-cigarettes, nicotine patches and gum.

As a result, an applicant who smokes 10 cigarettes a day, maybe charged the same smoking life insurance premium quote, as someone who vapes.

You may feel different and should be offered underwritten insurance rates that you may feel reflect that you believe it is maybe less harmful than smoking.

Note, some Providers do charge less for vapers but check if their life insurance for smokers prices are competitive ie; Are they offering 'cheap life insurance for smokers'.

Dangers of Vaping | Life Insurance

Insurers will look at what does vaping do to your lungs. Besides some containing nicotine, dangers of vaping e-cigarettes can also contain potentially harmful ingredients, such as:

- ultra-fine particles that can be inhaled deep into your lungs & thus damaging them

- flavorants eg; diacetyl, a chemical linked to getting serious lung disease

- heavy metals, such as tin, nickel, lead & volatile organic compounds

Insurers therefore look to medical science who still feels there are adverse health side effects of vaping without nicotine.

Some people it seems who perhaps wouldn’t smoke cigarettes, are possibly taking up vaping instead as it's seen as cool. However, Insurers may ask what is that doing to a teenager whose lungs and brain are still developing?

So the benefits when quitting smoking re life insurance and smokers - largely apply to both cigarette smokers or vaping for life insurance. Note however the insurers quitting timescales re any cheap life insurance for smoker quotes.

8 Side effects of Vaping

Let's look at why Insurers class it as dangerous - due to the numerous side effects of vaping...

- Headaches

- Heart palpitations

- Shortness of breath

- Dizziness

- Dry/sore mouth and throat

- Burning or scratchy feeling in mouth, lips & throat

- Cough

- Tiredness

So benefits for quitting smoking & vaping on your health whether young or old - are clear.

The 'Benefits of Quitting Smoking Timeline' | 10 Milestones

If you wish to start off on this journey, or are already on it.... Here are your marathon milestones on benefits of quit smoking timeline. Good Luck in your race to quit.

- 20 Minutes - pulse returns to normal

- 8 hours - Oxygen levels & Carbon Monoxide recovering

- 48 hours - Carbon Monoxide flushed out. Taste & smell improves

- 72 hours - Easier breathing, Energy increasing

- 2/12 weeks - Circulation improves. Blood pumps heart & muscles

- 3/9 months - Lung function up 10%

- 12 Months - Heart attack risk is now 50% less

- 5 Years - Risk of Throat, Mouth & Bladder cancers 50% less

- 10 Years - Risk of lung cancer is now 50% less

- 15 Years - Heart disease risk is same as none smoker

Within 4 weeks of smoking quit timeline, the many nicotine receptors within your brain will slowly return to normal, breaking the cycle of addiction.

Smoking Quit Timeline

The Benefits of Quit Smoking | Chemicals in Cigarettes

The chemicals in cigarettes are many & varied ie; @ 600 ingredients in cigarettes

When lit and burned, cigarettes create more than @ 7,000 chemicals* Lung Association

- Acetone—found in nail polish remover

- Acetic acid—an ingredient in hair dye

- Ammonia—a common household cleaner

- Arsenic—used in rat poison

- Benzene—found in rubber cement and gasoline

- Butane—used in lighter fluid

- Cadmium—active component in battery acid

- Carbon monoxide—released in car exhaust fumes

- Formaldehyde—embalming fluid

- Hexamine—found in barbecue lighter fluid

- Lead—used in batteries

- Naphthalene—an ingredient in mothballs

- Methanol—a main component in rocket fuel

- Nicotine—used as an insecticide

- Tar—material for paving roads

- Toluene—used to manufacture paint

At least 69 of these chemicals in cigarettes are known to cause cancer, and many are toxic. But they are blended in a way as to become addictive.

Side effects of stop smoking | Top 10

Well, nobody said this was going to be easy - as smoking affects every system in your body! So as they say, in no particular order....

- Headaches & nausea

- Tingling in hands, toes & feet

- Coughing & a sore throat

- Increased appetite

- Associated weight gain

- Intense cravings for nicotine

- Irritability, frustration & anger

- Constipation

- Anxiety, depression

- Insomnia

All these withdrawal symptoms are the side effects of stop smoking that you could experience within your smoking quit timeline. Good luck.

Asthma & Smoking

The benefits of quit smoking may also lower your asthma risks dramatically. This may apply whatever your age & however long you have been smoking. Asthma smoking common symptoms are more coughing, wheezing, breathlessness, plus producing more mucus or phlegm than usual.

Smoking increases your risk of getting asthma symptoms and causes you having dangerous asthma attacks.

Smokers may also need higher doses of various steroid preventative medications to help keep down the inflammation in your lungs & airways.

This can then mean your asthma smoking combination becomes harder to manage on an everyday basis. Smoking increases your likelihood of symptoms like wheezing, breathlessness, coughing and a tight chest.

In the longer term, if you continue to smoke and your asthma continues to be difficult to manage, you may be more at risk of developing other serious lung conditions like COPD (Chronic Obstructive Pulmonary Disease).

The Benefits of Quit Smoking COPD

COPD Chronic obstructive pulmonary disease is a serious health condition where the lungs become more inflamed & narrowed than just asthma alone (so your airflow is obstructed).

COPD is a common condition that mainly affects middle-aged or older adults who smoke or have smoked. Smoking COPD overlaps can start to happen if you have lots of asthma attacks because your asthma isn’t well managed.

Chronic means it’s a long-term condition & so does not go away. Obstructive means your airways become narrowed, so it is harder for you to breathe out quickly. Air gets trapped in your chest. Pulmonary means it affects your lungs. Disease means it is a serious medical condition.

Smoking plus long-term exposure to fumes, air pollution, viruses, bacteria and dust from the environment or your workplace are all increasing risk factors for you having COPD.

The benefits of quit smoking may help you to avoid an overlap of starting off with having asthma causes, then developing into getting COPD.

Best Ways to Stop Smoking

Most people cannot give up 'just like that'. Like any addiction, it often takes time and so may require additional professional support & help. Talk to your GP about 'the benefits of stopping smoking'

Type in your postcode to find your LOCAL STOP SMOKING SERVICES (LSSS) >

LSSS is one of the best ways to stop smoking. It was developed by experts and also ex-smokers. Their service is delivered by professionals provide free expert advice, support and encouragement to help you stop smoking for good.

Their trained advisers are on hand to offer you support, either one to one or in a group, along with stop smoking medicines (prescription charges may be payable).

Their sessions usually start a few weeks before you quit. Sessions are usually held once a week (for 4 weeks) after your last cigarette.

The LSSS services can also be done via phone or video call, if you can't attend in person. Their evidence shows that it's best ways to stop smoking and that people who manage to quit for 28 days are more likely to quit for good.

How Stop Smoking | NHS help

The main reason as mentioned at the start of this article, is that people continue to smoke is they become addicted to their nicotine tobacco. So professional help maybe needed to give up.

Apart from using Local Stop Smoking Services, you may just wish to visit your GP first off into your best how stop smoking journey.

The NHS often prescribe various medications but these are 2 main methods - both with GP help, support & advice to give up all together.

1] Nicotine replacement patches NRT

NRT is a medication that provides you with lower levels of nicotine but without the tar, carbon monoxide plus other poisonous chemicals present within tobacco smoke.

It is available as ....

- chewing gum

- inhalators (look like plastic cigarettes)

- skin patches

- tablets

- oral strips

- lozenges

- nasal spray

- mouth spray

It is designed to ween you slowly off nicotine. NRT treatments may usually last 8-12 weeks, before you gradually reduce the dosage. However, it still requires you to make that final push and to totally 100% give up and 'quit smoking'.

2] Bupropion (Zyban)

This is a medicine originally used to treat depression, but NHS state it has since been found to help people have 'the benefits of stopping smoking'.

It's not clear exactly how it works, but it's thought to have an effect on the parts of the brain involved in addictive behaviour.

Conclusion on 'The Benefits of Quitting Smoking'

In conclusion, apart from the visible, physical, mental and emotional effects of give up on smoking - there is also the financial £££.

In today's expensive 2020's with bills rising, that must be another big reason to stamp it out? At around £10 average per packet for 20 cigarettes. That could be saving of around £300pm on your 20 per day. GOOD LUCK !

Compare Broker deals on most affordable life insurance for smokers. Check here online 'Life Insurance Smoking' rates v Non Smokers Life Insurance.

Sorting out your ideal life insurance cover may seem a difficult task, so don’t do it alone. It’s a good idea to get professional advice from an expert – we’re here to help.

Article 'The Benefits of Quiting Smoking' by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling smokers Life Insurance in UK (inc NI)

NOTE: This generic article touches on various medical issues & information on the 'benefits of quitting smoking'. The latest health guidance on this may change regularly re Covid 19, so any article comments may not always be accurate. However, we are not GP's or health professionals so always seek medical advice & latest guidance via NHS if unsure.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'