Pre Pay Funeral Plan

REVIEW FUNERAL FEES > July 2025

Pre Pay Funeral Plans & Insure Tomorrow

Compare Funeral Plans & Funeral Insurance Cover

‘Compare Funeral Plans’ & Plan Ahead

What is a ‘Pre Pay Funeral Plan’?

What is a ‘Pre Pay Funeral Plan’?

A ‘Pre Pay Funeral Plan’ is a specific policy arranged via a Funeral Plan Provider, that lets you pay upfront for your funeral in advance in 2025 and at today’s price.

Funeral Cover Plans are designed to help cover the costs and services of a funeral director & some 3rd parties including the transport & care of the deceased. Then a choice of coffin and other ancillary services.

Are prepaid funeral plans a good idea? Yes, if you are concerned about ensuring the family do not have to think about what to do, your final wishes or whom to contact at time of need.

*What are ‘Funeral Insurances’ Cover?

‘Funeral Insurance’ is a policy that can help provide a sum of money towards the costs of a funeral plus any associated bills ie; it may not address specifically any funeral requests or arrangements.

Is Funeral Insurance the same as Life Insurance? Yes, funeral insurance can also be arranged by a UK Life Insurance Company & maybe marketed accordingly.

So is Funeral Insurance worth it versus Prepaid Funeral Plans? Or does your family just rely on any savings & investments you may have at time of need?

In this review we will therefore look at what are Pre paid Funeral plans and what does Funeral Insurance cover. Also what happens if you died & probate issues – even if you did have funds set aside.

We will overview what are funeral costs in the UK, how does Funeral Insurance work and then Funeral Insurance compare against Prepaid Funeral plans.

10 P’s – Reasons for a Pre Paid Funeral Plan UK

- Protection against rising funeral inflation costs

- Pre pay Funeral Director future charges but fixed at today’s rates

- Provide instructions to help arrange and conduct your burial or cremation

- Payment option flexibility – Lump sum or monthly funeral policies

- Providers that adhere to FCA registered standards

- Professional arrangements for your specific funeral wishes made in advance

- Plans are Exempt from Inheritance tax or Care Home assessment costs

- Purchase in your own time when you are calm & rational about the decision

- Peace of Mind of knowing you have helped your family at a distressing time

- Probate delays avoided as not paid into an estate

Note: We advise on Whole Life Assurance or other funeral insurance cover for providing funds to help cover the cost of you and / your partner’s funeral. We do not give advice on specific Pre Pay Funeral Plans but may introduce you to 3’rd party providers.

Martin Lewis Money Saving Expert also has views on prepaid funeral plans, which we have commented on in our funeral policies uk review.

Note: The list also includes Companies some who may NOT be FCA regulated from 2022 | OR may no longer trade & offer new customers a Pre Pay Funeral Plan. (Click on links to see Providers latest updates).

‘Pre Pay Funeral Plan’ UK Providers | ‘Funeral Plans Compare’

Best Pre Paid Funeral Plans UK Compare as Plenty of choice…So shop around

Maybe included | Very basic Funeral plan?

- Unattended and untimed service

- Providers nominate a Funeral Director ie; no choice

- Funeral Director’s fees and costs covered

- Simple coffin usually for cremation only

- No family or friends allowed

Conclusion: Basic means Basic. Ideal for those who sadly have no close family or cannot afford

Maybe included Standard | Upgraded plan?

- Funeral Director’s fees and services paid plus Doctor’s Medical certification fees as needed

- Fees for death certificates & Fees charged for the cremation process

- Minister’s or celebrant’s fees

- 24 hour transfer of the body to a funeral home or chapel of rest anywhere in the UK

- Viewing of the deceased / chapel visits

- Return of the ashes to a designated individual, anywhere in the UK

- Choice of coffins in this funeral plan comparison

- A choice of hearse & pall bearers

- Time of funeral agreed mutually between funeral director and family

- Organised service at either crematorium or cemetery

- Limousines for family/mourners

- Funeral procession from home/funeral home to a chosen location

- The deceased transported directly to the cemetery or crematorium on the day of the funeral

- Co-ordination of any tributes or flowers

- Managing collection and payments of any charitable donations

- Listing your requirements for Memorials or a headstone, flowers, catering/wake, Embalming

- Costs for removing artificial limbs or any mechanisms eg; pacemakers

- Associated costs with any changes in UK regulations, tax or laws

- Joint life 1’st claim pre pay funeral plan means at least 1 person can benefit from the policy

- Ability to switch persons within policy to allow another family member to use the plan

- Upgraded Plan

- Greater choice of quality coffins

- More following limousines [ quality of vehicles will usually vary between funeral directors ]

Conclusion: Funeral Plan compare then you do get what you pay for. If a plan’s much cheaper then there is usually a reason

‘Pre Pay Funeral Plan’ | Pros & Cons

‘May not’ be included on Funeral Plan Market?

- Burial plot costs vary between residency (eg; it can be over £10,000 in parts of London)

- Plots maybe £100’s or £1,000’s dependant where you live between cities, towns or rural areas

- 1 Plan usually covers 1 person only so don’t assume 2 people can therefore jointly claim

- 3rd party charges & disbursements often not listed in a plan

- Flowers & tributes

- Catering or any other costs for a wake

- A headstone or memorial

- Funeral notices & Order sheets

- Embalming

- Repatriation costs to UK if needed from outside mainland UK eg; you die abroad

- Changing Funeral Directors may charge extra fees

- Check the terms of your funeral plan market cover carefully before buying

Conclusion: These extra costs can be expensive & are often forgotten by the bereaved family

‘Pre Pay Funeral Plan’ Covid 19 Coronavirus

- Funeral directors remain committed to help but naturally faced increased demand during the pandemic 2020s

- At the time some may have had to wait longer for their deceased to be buried

- Family members were maybe limited to attendance at the funeral

- Government guidelines meant some benefits sold in pre pay funeral plans were not all available

- Some Churches or Crematoria helped arrange Zoom meetings to those unable to attend

- Everything involved at time of need was based around risks of infection & safety rules

Conclusion: If someone died from Covid 19 Funeral firms can decide to change their usual protocol

Moving Home – What happens?

When buying a pre pay funeral plan, often you may have the option of telling the provider which local funeral director you want to arrange your funeral with. If not, they will automatically choose someone suitable as already used by the Provider.

The issue comes if you then move from the area you initially registered to your plan eg; you move from Portsmouth to York to be closer to your family. At that stage, you must check if you can also change funeral directors. It could be you have also paid for a family burial plot back in Portsmouth. In that instance, there could be extra costs to move a deceased person from York back to Portsmouth.

Whether you can depends on if the plan provider works with funeral directors in the geographical area you may move to. Many best prepaid funeral plans uk coverage varies with the main funeral plan providers uk.

Conclusion: If you move home don’t automatically assume you can freely move Funeral Directors

How far will a Funeral director travel?

- These funeral plan quotes also may specify how far away a funeral director will go to collect a body of the deceased

- The mileage limit can vary, but what counts is whether there is a funeral director willing to take on your plan

- Some providers collection mileage is limited to 25 miles, others will go up to 50 miles

- If you die overseas, some Providers can pay a sum equivalent to an overseas funeral director

- However, they won’t guarantee this will fully cover all the overseas funeral director’s fees

Conclusion: Transport costs mileage is charged at the Funeral Director’s standard rate at the time

How much does a ‘Pre pay Funeral plan’ usually cost?

Typical UK funeral plan comparison:

- Very Basic pre pay Funeral Plans cost from £1500+

- Standard Plans may cost from £2,800+

- Comprehensive upgraded plans cost from £4,000+

Pre pay Funeral plan

How much do funeral cost?

‘Pre Paid Funeral Plan’ Payment options?

- All in one go: A popular option if you or a partner each have a lump sum available of say £3,000 +

- Deposit plus monthly payments: You may only be able to afford say £750 deposit down. It means you will still have ongoing monthly payments. If not, your family may have to make up the balance if you die before you’ve finished paying for the pre pay funeral plan.

- Pay over 1 | 2 | 3 | 4 | 5 |10 + years: This is an option if you don’t have either the full lump sum or large deposit. Some pre pay funeral plans allow shorter repayment on an interest free basis. Others will charge interest for longer term eg; 3 years or more.

- NOTE: If you die and haven’t finished paying off the plan, your family will usually still be asked for the remaining balance. If they don’t pay, your prepay funeral plan could be cancelled. Then any money you’ve paid is returned into your estate, minus any cancellation charge fees which could be as much £750+. Check T&C’s

Conclusion: The quicker you pay for the ‘pre pay funeral plan’ the less problems at time of need

FAQ: What is the claims process upon death?

To process the claim, you will need to contact your pre pay funeral plan provider immediately once the person dies

- The name, address and date of birth of the deceased policyholder

- ‘Pre pay funeral plan’ policy number or Funeral Planning number

- Any UK Funeral Insurance documents

- The original death certificate

- Sometimes a copy of the Policyholder’s Will if there is one

- Name of the person making the claim and evidence of their entitlement to any Policy proceeds

- Cash Sum: With some Providers you can decide to maybe receive a cash sum, instead of funeral services. However, if you do this then you may get less back than was paid in by the policyholder. The cash sum may also be subject to Inheritance Tax

- Note: Sometimes a pre pay plan is found amongst paperwork after a funeral has already gone ahead & been paid for

- In this instance, some providers may allow a free switch to allow another family member the unused pre pay funeral plan

It is always a good idea to have your own copy and then ensure everyone knows where it is when the time does come. ‘Don’t keep it a secret’ !

However, if you don’t notify anyone & your family believed you had a plan, all is not lost. The Funeral Planning Authority FPA does have a useful trace your funeral plan facility on its website.

Your funeral plan provider will also keep a copy of everything you have requested, as part of your pre pay funeral plan. As long as your family know who the funeral plan provider is, then they don’t have to track down any specific documents.

Conclusion: Rest assured most providers do operate a helpful and efficient claims process

‘Pre Paid Funeral Plan’ Is your Money kept safe?

- When you buy a ‘pre paid funeral plan’ the providers should put your money directly into a Plan Trust

- The trust should be operated independently by a Trust Corporation Ltd with trust accounts produced and audited annually

- The money for your funeral plan in the Trust Fund is ring-fenced, so not accessible by Provider or any Funeral Director until required

- Likewise the trust fund is not lent to any organisation or individual other than to meet the obligation to all Planholder’s

- The actuary will perform an annual valuation to ensure there are sufficient assets to help meet the future payments to funeral directors

Conclusion: Should the Providers cease trading, it may still require other Providers to step in & help

Which ‘Pre pay Funeral plan’ do Funeral Directors use?

- Most Funeral Directors are tied agents ie; they only use 1 pre paid Funeral Plan provider

- The COOP Funeral directors naturally use the COOP Funeral Plan and arrangements

- Likewise Dignity Funeral directors only use their Dignity Funeral Plan

- Apart from these 2 tied funeral directors check which best pre paid funeral plans uk you’re dealing with

Conclusion: Shop around for your Prepaid Funeral Plan if you want a choice

Who are the Funeral Planning Authority FPA v FCA?

- The FPA was set up by pre pay funeral plan industry to regulate UK funeral plan companies

- Their aim was to ensure providers operated in a compliant manner to exceed statutory requirements

- This ensured it may result in customers getting the funeral they have paid for when it is needed

- They check that all registered providers abide by a set of Rules and a Code of Practice

- It was not an official regulator like the FCA but it set the guidelines by which they should operate

- From summer 2022 the funeral plan industry was then regulated via the Financial Conduct authority FCA

- This meant the FPA was then disbanded regulating pre paid funeral expenses plans

Conclusion: The Prepaid Plan industry is FCA regulated & re funeral insurance for seniors

Paying Funeral Expenses from Deceased Bank Account UK?

What happens if someone had savings or funeral insurance (but not setup into trust) how do you go about paying funeral expenses from deceased bank account uk held?

Typically, when a person dies, their sole bank or building society accounts are frozen by their bank (but not joint accounts). The same applies to any sole funds held in savings, investments, national savings, ISA’s etc;.

However, even if their bank or building society account has been frozen following their death, it may be possible to have some funds released upon showing a valid registered original or copy death certificate and any funeral invoices.

What happens if their funds to pay the funeral expenses cannot be easily accessed? All these assets then will remain tied up until the legal executors or family representative apply for & then receive a grant of probate, allowing them to fully administer the will (if there is one).

So how do you go about paying funeral expenses before probate uk is granted. Bearing in mind probate can take upto 6 months, and may sometimes take upto 12 months.

Here are a few options to consider claiming for funeral expenses or how to pay for funeral expenses before probate is granted…

- Request the funeral directors to bill the estate directly to be reimbursed once probate is granted

- Executors or Family member helps pay these costs upfront & legally bill request against the estate

- Request the bank, building society to help cover & deduct funeral expenses from any balance of funds held (usually then funeral directors deal directly)

- Ask Insurance company to help cover & deduct funeral expenses from any life insurance not held in trust (usually then funeral directors deal directly)

- Take out funeral loans, finance or bank overdraft and then legally bill request this charge & interest is against the estate

- Any joint account now becomes sole account – so if sufficient funds pay and then legally bill request & any interest against the estate

- Ensure any life insurance funeral expenses plans are written into a suitable trust from outset

Remember, most Funeral Directors are used to this upfront financing issue, so please ask their advice re best way to claim funeral expenses.

They will also help guide what funeral expenses can be deducted from an estate and any general financial guidance dealing with someone who has died.

Also what are reasonable funeral expenses uk claimants can make & funeral expenses probate likely hints & tips.

Note: Do not request a Funeral that the Estate or Yourself cannot afford to pay for.

Funeral Expenses Payment | Funeral Support Payment

You maybe able to claim & get a Government Funeral Expenses Payment (also called a Funeral Payment or Funeral Support payment in Scotland) if you get certain benefits and need help to pay for a funeral you’re arranging.

This Funeral Expenses Payment or Funeral Expenses Grant may then be deducted from any money you get from the deceased’s estate.

Their estate includes any money or property they had, but not a house or personal things left to their widow, widower or surviving civil partners.

This Government Funeral Payment may help pay for some of the costs of the following:

- burial fees for a particular plot

- cremation fees, including the costs of the doctor’s certificate

- travel to arrange or go to their funeral

- the cost of moving the body within the UK, if it has to be moved more than 50 miles

- death certificates or other documents

You may also get up to £1,000 for any other funeral expenses help from government, such as funeral director’s fees, flowers or the coffin.

Funeral Expense Help

Note: This funeral expense help payment will not usually cover all of the costs of the funeral. How much you get for funeral expenses help & How much is funeral expenses payment will all depend on your circumstances.

This Funeral Expenses Claim Form payment includes any other money that is available to help cover the costs, for example from deceased person’s insurance policy or their estate.

HMRC in their people also ask ‘Is a headstone part of funeral expenses uk’ states YES You should allow as a reasonable funeral expense the cost of a headstone that finishes off, describes and marks the grave.

However, they caveat this by deciding what is reasonable, you should take account of the deceased’s background and their profession.

You may need to distinguish between a gravestone re tax deduction funeral expenses and a memorial (which could just be a plaque inside a church or a memorial monument)

This is because they state that a memorial is not strictly allowable as a reasonable funeral expense, if also saving for funeral expenses.

‘Funeral Plan Comparison’ Review

‘Pre Paid Funeral Plans’ v ‘Funeral Insurances’

| Pre Pay Funeral Plan | Funeral Insurance Cover |

| Guaranteed acceptance with no medical or health lifestyle questions | Medical Questions Whole Lifecover or Over 50’s No Medical |

| Choice of schemes & costs from basic/standard/comprehensive | Choice of how much Life Insurance you want & cost |

| Your choice of Plan options upfront for either Cremation, Burial or Alternative | Your family can decide how to plan any funeral arrangements |

| Paid upfront or Deposit & Monthly Instalments until fully paid for & then payments end | Funeral Insurances pay premiums until death or age 90/95 |

| Can be paid for by someone else as long as usually over 18 | Insurable Interest applies but can be paid for by someone else |

| Price locked into funeral at today’s prices to help avoid funeral inflation | Cover options maybe level or index linked re funeral inflation |

| Choose what you may like re Funeral now eg; Coffin, Hearse, Limousines etc; | Your family may still need to plan all your funeral & services |

| One phone call will usually activate & set the plans into motion | Your family may still have to plan all your funeral & services |

| Some plans cover 3rd party fees ie; ministers, doctors, Cremation or burial | You have to cover costs for any 3rd party fees |

| Pre paid Funeral Plans may only be used towards funeral costs & arrangements | The money can be used for funeral & any other costs |

| May not cover everything eg; Burial Plot or Headstone costs | Can be used toward Burial Plot or Headstone costs |

| Funeral Directors may have travel mileage restrictions for deceased person | You will have to sort out any arrangements |

| If you died abroad family would have to finance repatriation | If you died abroad family would have to finance repatriation |

| Problems can come if you move house to another part of UK re some Providers | Life Insurance does not matter where you are UK located |

| No cash in values as plan designed to cover funerals | No cash in values unless investment backed plan |

| You maybe tied to a specific funeral director or company eg; Coop, Dignity | Option to choose or if Funeral Funding then tied |

| Only fully paid for – once fully paid for | Fully underwritten cover or 1/2 years initial exclusion |

| Paid to Funeral Directors so no IHT or probate delays | If not in trust maybe subject to IHT or probate delays |

Funeral Help Costs?

Funeral Help Costs benefit, also known as Funeral Funding Option or Funeral Benefit Cover with some Providers – is an optional feature added to many Over 50’s Life insurance plans. This means the Provider may add an additional £250/£300 onto their Over 50’s life policy BUT to their chosen Funeral directors.

This one off funeral help cost payment is made directly to that chosen funeral director at the time of settling the final bill, thus helping towards those costs of the funeral to be found up front.

If there is any money still remaining from the proceeds of your life policy, after all the costs of the funeral has been met, this will be then paid into the estate. Conversely, if there is any short fall, this will need to be made up by your next of kin.

Note: Funeral funding is only usually allowed on one Over 50’s Lifecover or Funeral Insurance policy, whether with one or another provider.

Funeral Help Cost Option – Example

Why can you not have the funeral help costs benefit feature added to all schemes?

Well, for example let’s say you were concerned about planning future funeral costs for the family, so you had taken out 4 policies.

You originally decided to take out a ‘Golden Leaves Funeral Plan’ – who use their network of approved funeral directors, who are usually independant but deal with Golden Leaves.

Having sorted this out, you then wanted to leave some extra funds, so you took out a £3,500 Legal & General Over 50’s lifecover – whose funeral funding option use Dignity funeral directors

Later on whilst shopping you sort out in the Post Office Over 50’s Life cover for £3,250 – who use the Coop funeral services as their funeral benefit cover.

Finally a year or so on, you then decided on One Family Over 50’s lifecover £2,750 – whose funeral funding use Golden Charter funeral services.

In other words, if you applied to have this funeral help costs benefit added to every policy you had, then which funeral directors are then arranging your funeral?

In this example situation, Golden Leaves would probably be the lead funeral provider. The other 3 x £300 funeral help cost benefits via Dignity, Coop, Golden Charter would not be applied, and just the Over 50’s lifecover would payout.

Also, with some Providers you cannot usually put their Over 50’s life policy into trust, as well as apply their funeral funding option re their life insurance to cover funeral costs.

The reason being is because at death the life policy proceeds would go firstly direct to their chosen funeral directors to help arrange the funeral, not the trustees. Any balance would be perhaps paid to the estate & under nominated beneficiaries.

‘Life Insurance to Cover Funeral Costs’

Best ‘Funeral Plans for over 50s’ v Over 50s Life Cover No Medical?

- Packaged products and both aimed at the Over 50’s marketplace

- Best Funeral Plans for Over 50s are usually the same as Providers normal ones

- Pre paid best funeral plans for over 50s only fully paid for…once fully paid for

- No medical over 50’s lifecover plans cover you typically after an initial exclusion period

- 1 or 2 years exclusion period before any natural causes death claims on Over 50s life cover

- Usually no in depth medical & lifestyle questions to qualify for Over 50 no medical life insurance

- Smoking or vaper status asked & so may affect over 50 funeral insurance rates

- Accidental death claims only for initial exclusion period on life insurance uk over 50 plans

- Refund of premiums only if you die of natural causes during this exclusion period

- Insurers may stop taking premiums from age 90/95 but maintain your funeral insurance for over 50s

- Whole of life means indefinate life insurance cover funeral expenses for over 50s

- Over 50’s Lifecover Providers may offer a Funeral funding benefit option making it hybrid ‘Funeral Plan over 50’

- This option allows you to top up £250 | £300 for their nominated Funeral directors eg; Dignity or COOP

Conclusion: ‘Best funeral plans for Over 50s’ or Over 50s Lifecover may help pay for funeral expenses

‘Funeral Insurance Cover’ v ‘Pre Paid Funeral Plans’?

- Medically underwritten Whole life Insurance can offer lump sums on death toward funeral cover

- However, these do ask underwritten insurance health lifestyle questions eg; diagnosed diabetes, high blood pressure or cholesterol

- Once fully underwritten, they may offer immediate full life cover protection but ongoing premiums until death

- Some Insurers apply a minimum starting £10,000 level of cover for their whole life assurance plans

- Or if a no medical over 50’s plan after initial exclusion period of 1 / 2 years if using as ‘funeral plans for over 50’

- No investment cash in plan surrender values with non investment backed funeral insurance schemes

- BUT unlike any Funeral Life Insurance – Pre Paid Funeral Plan cover is only fully paid for…once fully paid for

- You must keep paying for life insurance as T&C’s unlike ‘pre pay funeral plan’

- Unless inflation linked then average cost of life insurance may not keep pace with funeral inflation

- Pre pay funeral plans allows you to choose exactly what type of funeral you want to specify

- ‘UK Funeral Insurance’ & Funeral plans are now both FCA regulated

Conclusion: You pays your money & takes your funeral plan cost choices. Both can be suitable products

Funeral Insurance Under 50?

Typically any funeral insurance under 50 can also be accessed either through many Insurers plans via their whole life assurance, which is full end of life ongoing protection cover.

Or alternatively instead some Insurers do offer term life insurance policy upto age 90 (but note your lifecover then ends) So, it may not be suitable if you lived past this ripe old age & if solely being using towards funeral costs.

However being under 50, it could be you still have a mortgage? If so, then please make sure that you do have adequate mortgage protection insurance, especially if you remortgaged and borrowed more.

Otherwise apart from just covering & focusing on funeral insurance policies, you could then leave your family in financial difficulties.

Likewise, what if your family rely on your sole earnings as the main breadwinner & you are paying rent? If so, then consider either affordable family income benefit lifecover to help pay your ongoing bills or an alternative lump sum cover, rather than just any funeral insurance plans uk schemes.

For example, you maybe considering a ‘funeral plan under 50’ and earning a reasonable salary of £50,000pa gross – which works out at over £3,150pa net after tax.

If you then worked for the next 20 years on a similar salary, you could earn over £1 million gross ie; £50,000pa salary x 20 years. This is a typical hidden income threat we see as brokers & when people only also ask us about just funeral insurance costs or funeral expenses insurance.

So please consider this firstly (even when looking for funeral cover for over 50) especially if you still have any dependants financially, whether old or young.

Furthermore, if you also have any other debts, loans or credit cards (especially if held jointly) – that these are adequately insured as well ie; you are jointly liable for joint debts if both considering funeral cover under 50

Note: Some providers do offer their own specific white labelled and marketed funeral insurance plan uk schemes. Check their T&C’s re cost of funeral insurance cover.

‘Insurance for Funeral Expenses’

UK Funeral Insurance & unusual Burial Choices?

So you are looking at getting ‘Funeral Insurance’ or a prepaid funeral plan to help cover those final expenses costs but you have not really thought beyond that?

Apart from the traditional grave plot burial, urn or scattering …..here are some more interesting choices to check out to ‘where will the funeral be’…

Conclusion: Dependant on what unusual burial is chosen this could be very expensive

Why do people wear black at a Funeral?

Historians believe the traditions of people wearing black at a loved ones funeral, dates back to the times of the Roman Empire. The ancient Romans would wear a dark toga to mourn.

Queen Victoria was known for wearing black to funerals to show her dignity and respect for those families in mourning. Likewise the hearses are mainly all painted black in the west, unlike at weddings where all is usually white.

While black is the traditional color of mourning in the West, many other countries around the world have different customs. People in China & India, for example, their traditional color of mourning is white because it’s the color of purity.

In some African countries like Ghana, red is often worn to funerals. In Iran they wear blue, yellow for Myanmar and in Thailand they wear purple.

Types of Funeral Services

- Memorial service:

Unlike a funeral service, the body of the deceased is not present at a memorial service so it can be held at any time after the death, from days, weeks to a year. The memorial service can be more of a celebrated memory of the life of your loved one, as opposed that final goodbye ie; once the initial impact and feelings of grief have subsided. In the Jewish religion they have usually 1 year later after someones death a Stone setting memorial service.

- Funeral service:

A formal burial (not cremation) style ceremony based on the culture or religion of the deceased. The ceremony is for celebrating & remembering the life of a person who has died. The deceased’s remains are moved to a church, synagogue or mosque burial grounds chapel etc; where a ceremony continues with scripture readings, hymns, sermon and maybe a eulogy. Then moved by procession to the cemetery for the burial or to the crematorium for a cremation.

- Viewing and visitation:

A viewing can be organized if you choosing to have an open casket funeral to provide an opportunity to actually see the person who has died for last time and say goodbye. Alternatively a visitation is an event that gives family, friends, and loved ones the opportunity to express sympathy to the family of the deceased.

- Committal or Graveside service:

A committal service is often just a brief ritual maybe often involving prayers. It takes place at the graveside following a funeral, or in the case of cremation, in the cremation chapel.

- Funeral reception:

A funeral reception is often held after any formal services. It provides guests and family members the opportunity to help remember the person they have lost in a more casual based setting. Funeral receptions are often held at deceased family’s home, local halls, restaurants, or other venues. Catering for Food and drinks maybe usually served.

Conclusion re Funeral Services:

All 5 types of services enable Family and Loved ones to share memories of the deceased. They can discuss the persons loss with friends and family. Find comfort in being around people who are going through the same distress and sorrow they are also. Dependant on the types of service may then determine any funeral expenses insurance costs.

‘Planning a Funeral’

Plan a Funeral Checklist

Here is our quick guide to help ‘Plan a Funeral Checklist‘ or ‘Plan a Funeral Service’ – simple funeral arrangements checklist uk.

- FUNERAL INSTRUCTIONS

- Any funeral instructions in the will?

- FAMILY MEMBERS

- Speak to family members & friends for any advice

- Do they want to be involved in the process?

- PAYMENT

- Savings or investments?

- Life insurance?

- Prepaid funeral plans?

- FUNERAL DIRECTORS

- They’re responsible for helping arrange all part of the funeral process ie; the coffin, ceremony, burial, cremation or direct cremation

- Hire one via recommendation or locally online

- Already listed in prepaid funeral plan?

- LIST OF FUNERAL EXPENSES, COSTS & FEES

- The funeral director’s fees

- Doctor’s fees

- Clergy or officiate fees

- Types of coffin ie; cheap or expensive

- Transport of the deceased person to the funeral director’s offices

- Care of the deceased which may also include washing & dressing until the funeral

- A hearse and/or limousine

- Unusual vehicle and classic or vintage cars

- Burial or crematorium fee

- Burial Plot

- Headstone

- Dedication bench, feature or plaque

- ARRANGEMENTS

- Flowers

- Organist

- Religious type of service

- Extra cars

- Embalming

- Memorial service

- Catering

- Wake

- TYPE OF FUNERAL & SERVICE

- Religious

- Cremation

- Woodlands

- Humanist civic funeral

- Burial at sea or into space

- VENUE DATE & TIME

- Church

- Chapel

- Synagogue

- Mosque

- Other places of worship or village halls

- MUSIC & READINGS

- Opportunity to make the service more personal

- Choose their favourite hymns & bible passages

- Favourite songs to welcome people in or say goodbye

- Readings by family & friends are a great way of commemorating the loved ones

- Poems may sum up that person & the impact they had those around them

- ORDER OF SERVICE

- Contain all the readings

- Hymns & prayers

- Commendations & farewells

- Memorabilia photographs

- Anything else you felt important

- Details of any wake after service drinks so attendees know where to go next

- THE WAKE & AFTER SERVICE

- How do you want to celebrate their lives?

- Held at relative’s own home?

- Hire Social Club, Pub or Hotel?

- Check if catering included in the venue hire?

- Or hire in caterers?

- Save money by making the food yourself?

- Let people know where this is being held & whose welcome to come

- You may wish to keep this a private event or open to anyone who would like to come

Some of these items on this ‘funeral plan checklist’ will be allowable paying funeral expenses from estate & some may not be an available reimbursement of funeral expenses from estate.

Check with the Funeral Directors & help avoiding funeral expenses unnecessarily.

How long Funeral after Death?

How long funeral after death is typically one to two weeks, given all arrangements can be made within that time.

However, this may also depend on that persons religion & their funeral arrangements. For example, for Muslims & Jewish people it may only be a few days after death.

Some religions may also have their own internal arrangements whereby paying membership of the local mosque or synagogue may then also entitle you directly to their funeral burial rites & traditions.

Upcoming Funeral Services

Some large funeral providers like Dignity & COOP upcoming funeral services list them on their website. Others maybe listed in local press, national papers.

Let’s now look at what is the cost of average funeral uk, which seems to be slowly increasing over the last 10/20 years.

Cost of Average Funeral UK

What is Average Funeral Costs in UK?

You can see from our general planning a funeral checklist above – that all these associated costs are not cheap for a uk average cost funeral.

How much do a funeral cost varies. People do underestimate this when enquiring & as these average funeral costs in UK may vary from funeral costs London to Manchester, or your local town or village.

As life insurance brokers, we may often get initially asked for funeral insurance cover of say £3,000 as the average price for funeral.

However, they are perhaps just thinking about these basic costs only today, not what everything else may all cost into the future re any funeral cover insurance.

The ‘Average Cost of Funeral’ question is only just one part of the overall cost of dying ie; how much does a funeral cost on average is only part of the total cost equation on death.

When you also take into account all those professional services involved plus final send-off costs, those average starting prices can now climb considerably higher with all those add ons.

See the below infographic, to interestingly compare average funeral costs in the UK against those around the world, if checking our best prepaid funeral plans uk prices.

This funeral costs comparison states that it can be as low as £573 in Russia, and as high as £55,541 in Japan.

Compare How much do Funeral Costs in the UK v World

What’s Cost of Average Funeral UK?

When looking online, especially during the cost of living crisis, people may ask ….How much does funeral cost in UK?

So let’s see what various Providers say in their view what is the Cost of Average Funeral UK to arrange…

Well, Dignity says the average cost of funeral is £4,798. They say London averages around £8,000 as the most expensive & Wales the cheapest at £4,469.

Meanwhile, the Post Office says the average funeral price uk is £4,267 but caveat by saying this figure can go up depending on where you want to be buried.

Royal London alternatively states what is the average funeral cost in UK is £3,837 (but also then mentions it can be as high as £13,262 in London, to as low as £2,863 in Belfast).

However, Golden Charter says in their literature how much do funeral costs – that the uk average cost funeral was lower at £3,953.

In the above world funeral costs infographic, Finders states the ‘average funeral costs uk’ is £5,135 against some other world countries.

Whom to believe how much do funeral costs, as these average stats often shown by Providers may not include all those additional costs as maybe necessary & at time of need.

Therefore, as brokers we think for some people the more typical average funeral cost in UK if pre planning a funeral – Total final send off costs could be nearer £10,000 or more dependant on UK regions ie; including burial plots, headstones, memorials, catering, limousines, hiring a place for wakes, settling other final bills & expenses etc; See above example Plan a Funeral Checklist.

Average funeral prices & send off’s for loved ones will have an impact on us all during cost of living crisis 2020’s, if looking at funeral payment plans uk deals.

For reference, the late Queens funeral costs were reportedly around £162 million plus 10 days of mourning. No ‘funeral costs average’ here, as that send off was borne by the UK Government & tax payer.

People underestimate the total cost of a Funeral by focusing on the average cost. Rather like the average cost of a wedding, which is around £18,000pa in the UK. Or that total cost is even more….if you choose to get married several times.

So, it’s all dependant on how extravagant you or they wanted your ‘average funeral cost’ final send off all to be for yourself or loved one.

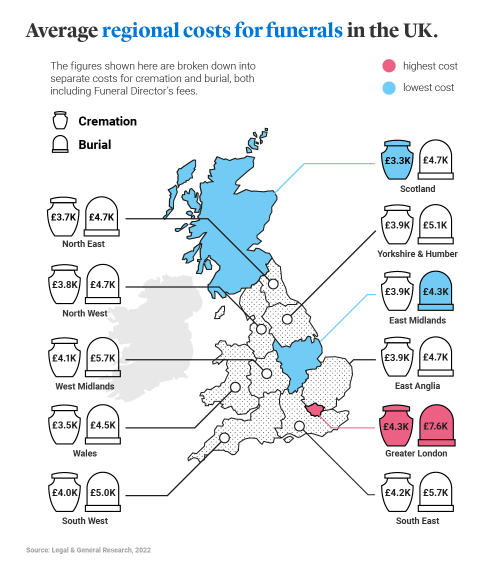

Average Funeral Plan Compare UK Regional Costs

Cost for Burial Plot

The cost for burial plot will naturally vary wherever you are in the UK. How much burial plot is may well depend on whether you are in a city, town or village and that local government council fees.

For example, a burial plot cost in parts of London can be as high as over £26,000 for some private graves, which you can lease off the council for 100 years. Or alternatively, it could be as low as around £3,000.

However, if we move to the North of England, you are now buried in Leeds area, that burial plot cost can start from around £1,700 if checking best prepaid funeral plans uk.

Remember with any burial plot cost uk fees, you are not only buying a burial plot – you are buying or utilising a piece of land that nobody else can then realistically use again.

If you are also asking can I buy a burial plot in advance, or how much is a double burial plot uk fees, then contact that plot owners directly for your preferred location or being buried near loved ones.

‘UK Funeral Plans’ & Average Funeral Cost for Cremation?

As we slowly run out of burial plots on our small island, the cost of living crisis, or people are becoming more environmental…cremation has become more popular.

Often considered cheaper ie; cheap funeral plans or cremation plans (as it doesn’t need to include any burial plot or land usage costs) what is the average funeral cost for cremation?

Well dependant on whom you ask, for example the Coop pre paid funeral plans review says on average the cost of a cremation is £3,765.

Competitor Dignity however say that the average cost of a cremation funeral is £3,986. Legal & General state the average cremation cost is £3,940.

Whom to believe again, as all these average stats often shown by the Providers may not include all those further additional costs as necessary & at time of need.

Factor this into any insurance for funeral expenses calculations re average cremation costs.

Conclusion re Funeral Insurance Costs & Prepay Funeral Plans

As you can see, there are choices to be made and expensive costs re funeral payments will be involved, even when we are sadly no longer here.

So is it a Funeral Insurance comparison or a Prepaid Funeral Insurance plan? Funeral plans compared but do you pay upfront or monthly?

Life Funeral Insurance Over 50’s no medical v whole life assurance medical underwritten? Cheap Funeral Plans UK cover for just those basic funeral costs or more comprehensive & also leave a legacy?

Questions, Questions…Questions you may wish to discuss first with your family & loved ones. Nobody plans to fail but often people fail to plan for this eventuality – one we all will face one day.

Have you made a valid will….. If not this is also an important part of the equation. Do not assume what you what to happen re not making a will & funeral cover insurance will happen.

Get an online funeral insurance quote or want to discuss your various funeral insurance cost options. Understand how funeral plans compare and review best funeral insurance uk deals?

We are here to help if you are after funeral cover quotes & professional advice on funeral cost insurance uk broker deals.

Article on ‘Pre Pay Funeral Plan’ UK by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we also review many of the best Life Insurers selling Life Insurance in UK (inc NI)

Quotes

QUOTE | UK Funeral Plan & Insurance Enquiry 2025

Note: We may advise on Whole Life Assurance or other funeral insurance cover for providing funds to help cover the cost of you and / your partner’s funeral. We do not give advice on specific Pre Pay Funeral Plans but may introduce you to 3’rd party providers.

*For products with any investment element we may introduce you to an FCA authorised adviser after any further review. We may also introduce you to other selected professional partners for other protection, finance (such as a whole of market mortgage broker) or legal products as deemed appropriate. By completing our enquiry form you ‘may be introduced to another lender/provider’.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'