Well Women Insurance Review. Broker help.

Well Women  Insurance UK

Insurance UK

Well Women & Critical Illness Insurance UK Review

There are around 150 women sadly diagnosed with breast cancer* every day in Great Britain. (*Breast Cancer UK)

A Well Woman Health Check can help you identify your own health risk factors and so catch early signs of some serious illnesses, particularly types of female Cancer.

As such, various health providers and companies also started to target this Well Woman marketplace.

From Women’s Wellness Clinic & Health Checks along to various Life Insurers Well Woman + Cancer Insurance & so targeting specifically Women’s wellness insurance or Women’s life insurance.

Note: These female cancer insurance uk plans concentrated just on main core female cancer conditions, so are targeted therefore at women and female wellness.

For comparison, there were also some specific male cancer branded critical insurance plans & covering male only conditions.

Well woman cancer insurance uk plans were aimed not just at the UK protection marketplace but at the USA & world markets.

Women Cancer Insurance

Some cancer types can also be hereditary or familial eg; breast cancer or ovarian cancer. Regular female well person checks are therefore essential for everyone.

Every well woman check done should therefore be unique. Each medical test analysis giving a specific MOT assessment of your own personal female health.

Critical Illness – Typical Key Features

- Designed to pay out on diagnosis & survival of a specified Critical Serious illness where benefits are currently paid out tax free upon claim

- Critical Illness Plans for Women usually now all include cover of these main 3 claims:- Cancer, Heart Attack & Stroke

- Insurers plan terms vary & may cover between 25-100+ different types of serious illness benefits

- As Cancer staging is graded from 0-4, (the higher the number, the larger the cancer tumor so the more it has spread to nearby tissues)

- So only the more aggressive invasive forms maybe covered by some Insurers. Some plans make partial or full payments based on their staging

- Plans are now gender neutral rates since 2012 ie; Well Person Insurance

- Can be setup in both sole or joint names

- Designed to pay out usually as a lump sum upon diagnosis of dread disease

- Medical evidence may be required & a well woman insurance medical examination for based amounts of cover or those with health issues

- Premiums may be fixed guaranteed or reviewable eg; reassure women’s cancer insurance premiums can be reviewable

- Waiver of Premium (where the Insurer waives/protects & covers your premiums after a deferred period of 4/8/13/26 weeks due to sickness or accident)

- To help avoid Inheritance Tax IHT issues on death (if combined with Life Insurance) a policy should be considered placing into a split trust to retain benefits on claim

Well Women & Female Cancer Insurance UK?

* Gender Neutral Stats : Vitality Life Insurance

Conclusion

As mentioned above, the 3 main critical illness specified claims paid out via most UK Insurers (female or male) are for types of Cancer, Heart Disease & Stroke ie; not just female cancer’s alone.

Typical Key Features

*Well Woman Insurance Plans – Standard | Premium | Gold | Plus

- Insurers older style plans included branded female cancer life insurance policy, which may protect 1/7 female cancers including first diagnosis of breast cancer.

- One or both ovaries, the cervix, uterus, vagina, vulva, or one or both Fallopian tubes

So if you’re diagnosed with one of the gender-specified invasive cancers, with the wellwomen insurance you may get:

- £25,000 on diagnosis via Standard Cover

- £50,000 on diagnosis via Premium Cover

- £75,000 on diagnosis via Gold Cover

- £100,000 on diagnosis with Plus Cover

- Plus include £1,000 for related early stage cancers which have not spread

- £50 per day spent in hospital during initial 90 days upto £4,500

- Female children were covered for the same organs as women

- Available upto 75 & any qualifying children to age 18

- Premiums were reviewable, meaning they increased when you moved into their next 5-yearly age bands

Conclusion

This typical older style well woman cancer insurance uk covered only 7 specific types of cancers. So, with this female cancer insurance cover plan if you were diagnosed with another cancer type or indeed any other type of critical illness, then no claim is made. Martin Lewis on critical illness cover comments don’t expect these insurance plans to typically cover all types of cancers.

Premiums for this type of well woman life insurance were not fixed, meaning they could get expensive as you got older. Likewise, these Women’s wellness insurance had no life cover element, meaning no claim unless you died of anything other their cancer related payouts.

WELL MEN & MALE CANCER INSURANCE Cover

Typical Key Features

*Well Man Insurance Plans

- Insurers plans included a similar Well Man male cancer life insurance policy, which protected specified male cancers including 4 male organs.

- Testicle/s, Prostate, Scrotum, Penis

- The policy like women’s one covered from £25,000 on diagnosis – plan dependant

- Male children are covered for the same organs as men.

- £50 per day spent in hospital

- Plus £1,000 for specified cancers that can be treated as day cases.

- Available upto 75 & child age 18

AIG American Life launched their specific female cancer insurance cover products over 10 years ago for both the UK and Ireland market like alico well woman insurance.

They were also sold direct and via various AIG affiliated companies, so these american life well woman insurance plans were bought mainly without advice.

Aimed at the insurance marketplace for well women and to reassure, AIG promoted their old aig wellwoman insurance product range with TV adverts using celebrities like Gaby Roslin.

Note: These cancer only style branded products are now mostly no longer available via AIG Direct UK (formerly Chartis)…

- All Cancer Cover

- Female Cancer & Male Cancer Cover ie; Well Women Insurance & Well Men Insurance plans

- Note: AIG Europe may still underwrite these cancer only product direct for Unison Protect Insurance & Coverwell. This may change in the future so check T&C’s

Women Wellness & Insurance Conclusion

So do you choose a Well Women Cancer only style plan? Or do you choose a comprehensive Insurers Critical Illness policy that covers a multitude of serious illness, including female cancer types?

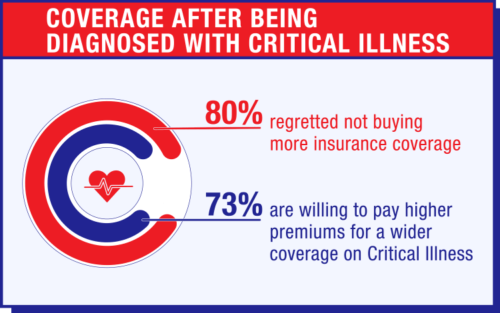

I believe that it makes good sense to cover as many bases as possible when taking out critical illness protection.

Each Insurers plans are different, so carefully examine their woman critical illness insurance policy wording before committing to one policy or indeed considering replacing another. I believe that as this is a complex area, I suggest you seek out professional advice from our life insurance broker.

Unlike Income Protection insurance, Critical Illness pays a tax free sum with either Lump Sums or Family Income Benefits options upon diagnosis. This cover is also known as dread disease insurance cover or serious illness cover.

Life Expectancy & Breast Cancer

Breast cancer is cancer that starts within the breast tissues. There are many types of breast cancer from invasive, lobular, inflamatory, ductal, angiosarcomas, triple negative or pagets are just some.

So the treatments you need will depend on the type you have, as well as your overall general health. Treatments include surgery, chemotherapy, hormone therapy, and radiotherapy.

- Stage 1: the cancer is small and only in the breast tissue, or it might be found in lymph nodes close to the breast

- Most women (around 98%) will survive their cancer for 5 years or more after diagnosis

- Stage 2: the cancer is either in the breast or in the nearby lymph nodes or both. It is an early stage breast cancer

- Around 90% will survive their cancer for 5 years or more after diagnosis

- Stage 3: the cancer has spread from the breast to lymph nodes close to the breast or to the skin of the breast or to the chest wall

- More than 70% will survive their cancer for 5 years or more after diagnosis

- Stage 4: the cancer has spread to other parts of the body

- Around 25% will survive their cancer for 5 years or more after they are diagnosed, but is not curable just treatable for some years

WELL WOMEN CLINIC | Why should you have a Mammogram?

Extensive medical research has shown that early Well Woman clinic detection rates – alongside routine/annual mammograms, can reassure you and improve a woman’s survival rate of 5 years by 100%. It is important to remember that women’s body cells are changing throughout one’s life.

Annual mammograms

- Aid in the early detection of cancers – which may respond well in a woman to treatment

- Annual screening mammography, particularly over the age of 40 yrs, may significantly increases survival and decreases morbidity from getting breast cancers

Women’s Wellness Clinics

These clinics specialize in Preventative Healthcare Screening for Women, as female health needs change constantly, as you are probably aware. Female changes in monthly cycle, mood swings and food cravings.

Did you know that the average GP appointment usually lasts less than 10 minutes ? You can’t fix all your female wellness concerns or address any concerns about female cancer types in 10 minutes.

Many Women’s Wellness Clinics are often staffed by female nurses, so they better understand your women’s wellness issues. These appointments are usually longer than 10 minutes.

The NHS have a useful Find a Women’s Wellness Clinic service local to you. Services like Breast Screening & Cervical cancer support. Gynaecology, Pregnancy, Menstrual & Menopause problems plus complementary medicines.

Note: most NHS Screening units usually do not offer a drop-in screening service, it’s on request only. Each year, more than 2 million women have breast cancer screening in the UK. The NHS Breast Screening Programme invites all women from the age of 50 to 70 for screening every 3 years.

In Wales, cervical screening has recently switched to 5 years. The extension from 3 to 5 years between screening has been recommended because the test used in cervical screening has changed.

This means that some women in the UK may not have certain screenings until they are 52 or 53 years. Invitations for screening are sent automatically to women up until their 71st birthday.

Perhaps due to Pandemic 2020’s, in some areas of the UK, worryingly surveys show the number of women using breast and cervical screening services has fallen. As one NHS Consultant importantly puts it, “every view counts”

Well Women | Cancer & Bling

Whilst writing this Well Women Female Cancer Insurance article review, I would also like to help promote a very uplifting and inspirational book called ‘Cancer & Bling’. This is a true life story which my cousin Russell Brenner helped complete about his darling late wife Lisa Brenner.

Lisa Brenner sadly but amazingly battled various types of Cancer 11 times over a period of 20+ years, until she passed away a few years ago. She was a successful business woman in her own right but managed to juggle both her busy career and her loving family, against a back drop of ongoing health issues.

Using her undoubted experiences to also campaign for better treatment, she raised awareness of the need for much earlier cancer diagnosis.

Lisa was also instrumental in successfully campaigning for the cancer drug Herceptin to be made available on the NHS. She even appeared on Sky TV News whilst having chemotherapy in 2000.

Russell and I have talked about how these difficult subjects have shaped his life….but in a positive way. My then teenage cousin & his 2 younger brothers had also shared grief & loss before. They sadly lost their loving Father (My late Uncle) in a tragic car accident, when they were all far too young & when still at school.

So Russell also then later faced more grief and loss for his lovely wife Lisa Brenner to cancer. Then the longer lasting impact that this had to both himself and his young son Marc.

He knows only too well the importance of having some Life Insurance, or Critical Illness, or Income Protection, or Private Medical Insurance – although these can never ever replace a loved one.

WELL WOMEN CANCER INSURANCE UK Broker FAQ

What if my health or lifestyle changes after I have taken out the policy?

Critical Illness Cancer Insurance cover is based on full disclosure at the time you took the policy out ie; being 100% as honest & accurate as possible. So any health or lifestyle changes since usually does not void your existing well woman cancer insurance uk policy, as it wasn’t relevant at that time of initial application.

Please check your original wellwoman insurance policy T&C’s if trying to get a well woman exam cost without insurance.

Are Critical Illness Insurance payments subject to UK tax?

Under current laws, these well woman insurance uk insurance payments are free of UK income tax. Other taxes can possibly apply if policy combined lifecover and critical illness, depending on your circumstances.

Are there Female Cancer Life Insurance plans that have more Comprehensive Critical Cover?

Female wellness or male only cover was a specific Cancer based plan. In the 2020’s, many insurers policies now cover over 40 types of critical illness including the most common types of cancer, heart disease, stroke, total disability and MS etc;

Assuming you are still fit and healthy, if this concerns you, it makes good sense to consider taking out more comprehensive cover critical illness cover than just a women cancer insurance.

Is Women Well Insurance Lump Sum or Income if diagnosed with cancer?

These types of female cancer insurance plans were designed to pay tax free lump sums, not an ongoing income. If this concerns you, then Income Protection PHI Insurance can also offer peace of mind of a tax free monthly income alongside your Well Woman policy.

There are also ASU short term policies, that can also cover with income if unable to work due to any accident, sickness or hospitalisation but these are not well woman plus insurance reassure you via lump sum payments.

Do Life Insurance Companies prove you’re a smoker or non-smoker?

How do Insurance Companies know if you smoke? On your doctors notes you declared yourself a smoker or non-smoker.

So on your underwritten insurance application, there is no point in lying when you apply, as your policy may not payout & you could waste the premiums and leave your family devastated.

Insurers may also do cotinine smokers health test. Or a death certificate indicates very likely cause is smoking related.

If you had legitimately quit smoking all nicotine (including vaping & e’cigarettes) for over 12 months at that time of original application, you may wish to advise the Insurers you have started smoking again.

This should not affect the original well woman cancer insurance uk policy terms which should still stand – you were being honest. Also, maybe suggest letting your GP know if this is the case.

Conclusion: Well Women Critical Illness Female Insurance

So we have examined various types of cover re women critical illness insurance policies. From basic female cancer cover only women’s critical illness insurance plans, to more comprehensive serious illness cover.

As they say, you pays your money and takes your own choice as to what you feel maybe best for you?

Unsure about women’s cancer insurance uk and comprehensive critical illness cover, speak to our life insurance broker specialists

Article on ‘Well Women Insurance’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best brands selling Critical Illness & Life Insurance in UK (inc NI)

| – |  | – |  | – |  |

NOTE: This generic article touches on various well women health and medical issues & information. The latest health guidance on this may change regularly re Covid 19, so any article comments may not always be accurate. However, we are not GP’s or health professionals so always seek medical advice & latest guidance via NHS if unsure

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'