Life Insurance for a Parent. Compare Leading Insurers Quotes Online in 15 Secs.

Can you get Life Insurance for a Parent ?

“Life Insurance for a Parent”

Parent’s Life Insurance

Can I buy Life Insurance Policy for a Parent?

Yes – but UK Insurance rules state there must be an ‘insurable interest’ between the 2 parties involved.

Example: You & your Parent take out a joint £150,000 mortgage together. In this instance, you could arrange a joint £150,000 life insurance policy to cover this joint £150,000 debt.

The reason being, if that parent sadly died first, there would now be a £150,000 financial debt that would be passed onto you, as you were jointly liable.

Also, both parties must consent to this arrangement. You can’t take out a life insurance for a parent, without their knowledge, whether it is joint policy or single life ie; get life insurance on my dad.

Note: we mention a joint life policy with one parent only. Not a joint policy with 2 parents, otherwise there would be 3 people all covered under one plan, which is not technically possible with life insurance.

Life Insurance & Insurable Interest

Insurable interest means that ‘you could be adversely affected financially (not emotionally) if that person who are insured died’.

The reasoning behind insurable interest, is so that the death of an insured person may not create personal financial gain (rather than loss) for a policyholder.

So can I buy life insurance for my dad or ex-husband, if I am going to be worse of financially if he died as I am still dependent on him? No, not if he is unaware of it (even if he probably should do).

However, with the rise of the internet insurance website there maybe some people who have inadvertently taken out life insurance on father, and some done this without them being aware.

The issue may come out at the point of claim regarding the life insurers view at that point & if this matter is raised.

We will go onto explore here the different types of life insurance for a parent that are available, in different situations.

We will look at 4 different types of Parent’s Life Insurance; New Parents, Single Parents, Foster Parents or Elderly Parents.

Financial Planning for New Parents

Having a new child is both exciting & scary, with regards to your finances & budget. It’s going to be an extra mouth or mouth’s to now feed, to love, take care of, change nappies, look after and educate.

Check out these Top Tips for financial Planning for New Parents…

10 Top Tips

- Organise & prepare finances now as if living on just ‘One Salary’

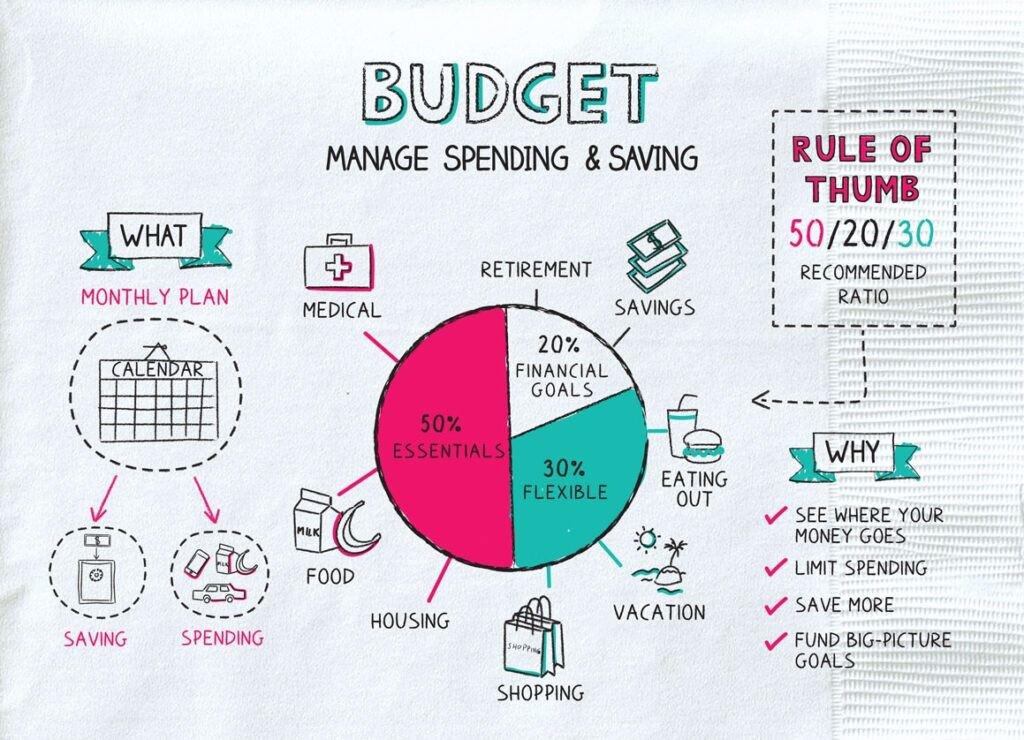

- Prepare a Strict Monthly Budget

- Reduce your Outgoings = Balance Increase in Costs

- Check out any State Benefits

- Maternity Allowance

- Statutory Paternity Leave and Pay

- Start to look & calculate Baby Childcare Costs now

- Setup a tax efficient savings plan just for your Children

- Plan ahead for maybe having to move somewhere bigger

- A Newborn baby life insurance policy should also be high up in your priorities.

Childcare Costs help for Working Parents

You can get Government help paying for ‘approved childcare,’ if it’s provided by a registered childcare provider. You may be able to get upto 30 hours free childcare if you live in England & your child is 3/4 years old. Different rules apply for Scotland, Wales & N.Ireland.

The Government do offer Families a top-up worth upto £2,000 a year towards the cost of your childcare via Tax-Free Childcare.

However, longer term it could be you will have to finance these child care costs yourself. The Bank of MUM & DAD as future grandparents maybe useful?

Child Life Insurance UK

Legally, nowadays you cannot specifically insure your child with life insurance, whether son or daughter until they reach age of majority. Most UK Insurers may start cover from someone aged 17 and above. The reason being that as mentioned above, there is no ‘insurable interest’ via the element of financial loss for life insurance, rather than emotional grief loss.

Certain child tax exempt savings plans, usually offered by various popular UK friendly societies, may contain a small lifecover element.

Note: Critical Illness Lifecover policies (taken out by the Parent) may also include a small child life insurance death benefit, usually around £5,000.

Life Insurance when Pregnant?

What about life insurance when pregnant? If pregnant life insurance is perhaps not at the top of your list of concerns currently but it may well be.

UK Insurers will consider life insurance when pregnant usually to be no different to applying at any other time of your life. However, it could be you now have some side effects suddenly develop eg; gestational diabetes. or raised blood pressure.

As such, your life insurance for pregnant mother terms could now vary from any standard priced quotes seen. Note: an insurer cannot decide that your pregnancy alone is a reason to increase their premiums or decline to offer cover when buying life insurance while pregnant.

Unsure about who maybe best terms for getting life insurance pregnancy uk deals or does life insurance cover pregnancy?

Speak to our professional brokers to see is life insurance more expensive when pregnant for yourself.

Life Insurance for Single Parent

Being a Single Parent probably also means one Single Income. Monthly outgoings are now balanced against your salary. Budgets in Pandemic 2020’s are being squeezed from all sides.

But if you have children, then they are reliant on YOU to help protect them, both physically and probably financially. Wether you are a Single Parent Mum or Single Parent Dad, it can be tough.

A Life Insurance for Single Parents might not be at the top of your to do list, or to add to your usual monthly outgoings ?

But if you are reading this because it is, then you can get life insurance parent cover here from Leading UK Life Insurers. We also offer helpful advice & guidance.

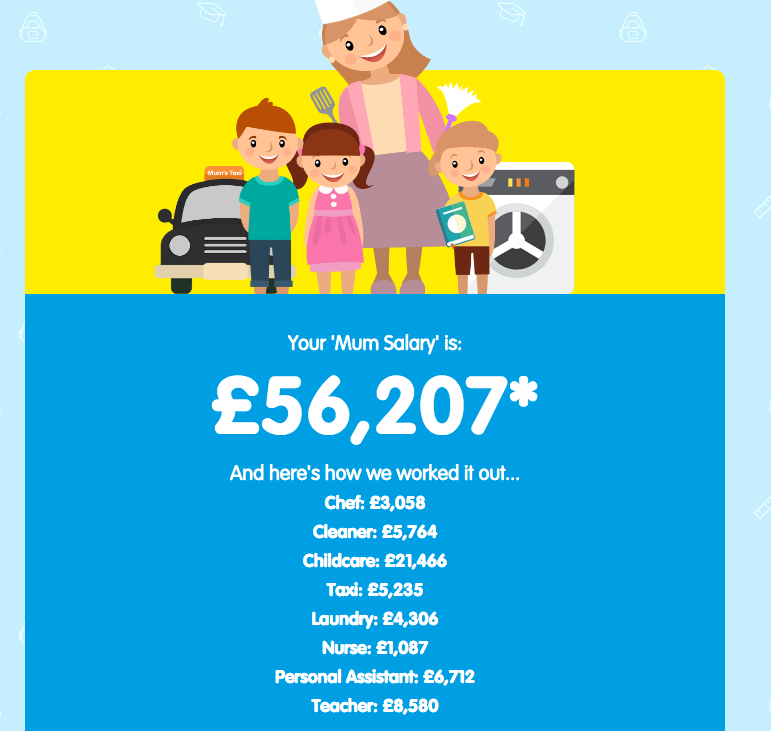

Example: How do you value Life Insurance for a Parent for a ‘Stay at Home Mum’ if calculating women’s life insurance ie; What’s a ‘Mum Salary’ worth ? Sun Life Insurance came up with £56,207pa*

Dads Life Insurance

So having looked at what’s a mum salary worth, lets now look at life insurance for dad.

A life insurance for dads will cost the same as for Mum, since 2012 EU gender neutral insurance price rates came into force. However, the best life insurance for dads may not be exactly the same as for mums’.

As brokers, we could recommend different insurers for the 2 parents. Note: when we talk about dads & parents, we don’t mean can I take out life insurance on my dad or get life insurance policy for my dad.

As mentioned above can I buy life insurance for my dad

How much Life Insurance Parents cover do I need?

As Life Insurance Brokers in an ideal world – we suggest this simple formula.

- LUMP SUM > Repay any mortgage & debts, cover funeral costs

- INCOME > Help cover your monthly bills

- LUMP SUM > Back up for holidays, education, emergencies

Martin Lewis Best Life Insurance formula is to aim to cover 10 x the Annual Income of the Highest Parent Earner or Main Breadwinner until any kids have finished full-time education.

Using that principle, if you earned £25,000pa gross, Martin Lewis says you should maybe consider insuring yourself (after any mortgage, loans & debts are repaid) for £250,000 life insurance (ie; 10 x the annual gross income).

Interestingly, he simply recommends insuring your gross income of £25,000pa – but not bother with net after tax income in this Martin Lewis 10 x rule parents life insurance example.

Following on from this simple Martin Lewis example formula above, if you then worked for the next 40 years until state retirement, you could potentially earn over £1 million gross ie; £25,000pa x 40 years = £1 million [or more with any future inflationary wage rises].

As such, unlike the 10 x £25,000 gross salary life insurance example above – you could instead protect your family with either;

- Income = £2,083pm or £25,000pa family income benefit lifecover policy

- Lump sum = £1 million level term life insurance policy [if invested @2.5% = £25,000pa]

- Or a mixture of the 2 policy types over the next 40 years – all dependant on your family circumstances

Neither takes into account repaying any mortgages, loans or debts.

- You can decide wether you want the cover to be level or inflation linked

- 2 x seperate plans | or Joint life insurance 1’st claim

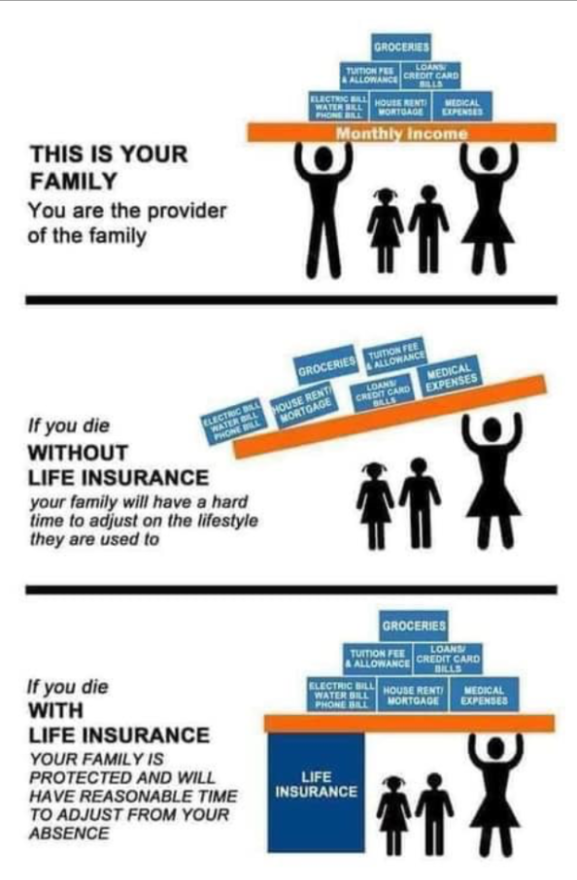

Apart from losing a loved one, this real hidden income threat is what could be lost if the main Parent breadwinner died prematurely.

Main Life Insurance Types

There are 2 main types of Life Insurance for Parents in the UK Protection marketplace:

Term Life Insurance is a simple plan that pays out a cash sum if you die during the fixed time period your policy runs for. The sum paid out on death stays level for family lifecover or decreasing for mortgage protection. The premiums remain level whether you are near the policy beginning or end. Most plans also include free ‘terminal illness’ cover. You can choose options of Lump Sums or Family Income Benefits & also if you may want your cover to be inflation proofed.

The longer the level term insurance runs, then the more expensive it costs ie; 40 years term maybe double or more the cost than 20 years, as the insurance risks are higher as you get older. You can take a term insurance plan upto age 90.

Whole of Life Insurance policy, always pays out if you die ie; whenever (as long as you’re kept up with monthly payments). For someone with health lifestyle issues, this maybe the most expensive compared to term insurance, as it will always payout.

Note:Over 50’s Lifecover asks no medical questions, so could always be a choice if you maybe unable to get cover or have other bad health issues.

Consider placing the policy into trust to help avoid probate or Inheritance Tax IHT issues.

How much does this all cost?

- Often average prices can start from as low as £5pm (for 1 product)

- But your monthly or annual cost will vary in a few ways

- Premiums will depend on your age, health, lifestyle, amount of cover, policy term and type

- It could be you are offered standard costs or have to pay abit extra re underwritten insurance risk

- For example you have health issues for raised BMI kg, blood pressure & cholesterol

- Any paid for extra features (like lifecover and critical illness) you want will also affect the cost

- Is the cover to remain level or increasing to offset inflation ?

- Remember cheaper here, doesn’t necessarily mean better

Add Critical Illness Cover?

Critical Illness insurance is a policy that pays out a tax-free sum to protect you (or children) should you become critically ill during the policy term. The 3 main claims in today’s world, relate to types of cancer, heart disease & stroke. The chances of a claim are fairly high in working lifetime.![]() As a single parent, this additional benefit is well worth considering.

As a single parent, this additional benefit is well worth considering.

- Some Policies may also include valuable child critical illness cover for free

- A child benefit claim (usually a lower % amount) won’t affect the main adult policy benefits

- These may often cover children upto age 21 or into higher education

- Insurers may also payout a lump sum upon the death of a child

- Some Insurers allow you to enhance the child critical illness cover

- Also if a child was critically ill, then if covered under 2 x single adult policies both would payout

We recommend also that a Single Parents Life Insurance policy is put into a Trust from outset (especially if you have not yet made a will).

This means simply when a ‘life policy is in trust’, the payouts could go direct to your kids or family and with potentially less complications, if you sadly died. Most life insurers provide free protection trust forms.

Free | New Parent Life Insurance

To also help assist you, some Insurers are offering Free Parent Life Cover BUT for just 1 year eg; Aviva. They offers £15,000 of cover for each new parent, for each child, completely free. They won’t even ask for your banking direct debit details.

Each Parent can each take out a separate policy for all your children. This free parent life insurance policy starts from their birth & upto their 4’th birthday. So, couples could potentially get life insurance worth £30,000 for each eligible child if both parents apply from each Insurer. It’s a good Freebie Start ![]()

Can my Parents be a Life Insurance Beneficiary?

Yes, they can if you wish to. You may be concerned who would look after your children if you died suddenly. Please chat to your parents about this possibility first.

The best way is to put the policy into trust. Consider however, if you just left all the life insurance money only to your children as sole beneficiaries, then would your Parents also be the children’s Guardians? If not, then how would the Guardian’s get access to the money to now look after them?

It is a balancing act re beneficiaries, as your children will likely be minors, so cannot access the money. It is normally best to maybe leave a ‘letter of wishes’ alongside the trust. This gives guidance to those trustees or child guardians managing your estate, on how you’d like your assets or life cover proceeds to be ideally dealt with.

Can my Parents also be a Trustee on my Life Policy?

Yes, absolutely. Either they can be sole Trustee’s, or as they are older than you, have 2 or more Trustees. Ideally having your 2 Parents as Trustees or more is better. Should one Parent sadly die, meaning you would then have no trustees left.

Note: if both your Parents sadly died whilst the life Insurance is still running, this may cause issues with the Insurers, having to undue the trust arrangement. It may then require additional legal costs by you seeking specialist advice at that stage.

Life Insurance in Divorce

Life insurance in divorce is another question sadly some parents have to look at. Or wish to perhaps ask upfront before firstly taking out any cover.

In the event of a divorce or a separation, your current life insurance policy will not automatically stop or change unless you notify the Insurers of your wishes.

‘Life insurance after divorce’ can be a difficult discussion. So much depends on what type of life insurance you have ie; 2 x single plans or joint cover re divorce and life insurance uk policy.

If single lifecover, was the policy setup into trust? If so, was your ex-partner also the trustee and beneficiary? That could make things harder (especially if you are not communicating with each other).

If you have joint life insurance policy after divorce, it may be possible with some Insurers re your divorce life insurance legal agreement terms to help separate it into 2 x seperate policies.

This could also be especially important if since taking out the joint life insurance after divorce, either persons’ health has now changed for the worse, making it harder or more expensive to get new life insurance during divorce.

So re divorce life insurance policy discussions may or may not be a straightforwards eg; Changing life insurance beneficiary during divorce.

Life insurance and divorce settlements can be contentious for some naturally. Alternatively, others ask what about life insurance on ex spouse divorce is finalised, is that still possible?

Well if there is insurable interest still eg; One parent is now looking after all the children & financially all parties would be worse off if they then died…then Yes can you keep life insurance on a divorced spouse.

However, if separated but not divorced life insurance legally is still valid unless you advise Insurers this is not what each party now wants.

For example, you still have a joint family lifecover but no dependants now, as the children have all left home. This policy was meant now to get paid to each other if either died. You both feel that is not what you now want to happen.

We suggest you contact your existing Insurers & legal experts if unsure what your best options are for keeping life insurance after divorce.

Life Insurance for Parents Fostering vs Adopting

Fostering or adopting a child is a wonderful thing, so thank you ![]() . It may also give a reason to look at Financial Planning for New Parents.

. It may also give a reason to look at Financial Planning for New Parents.

Adoptive parents should start to consider family life insurance should something unexpected happen. Also how does adoption vs fostering change things legally ?

- Adopted children maybe eligible to inherit from their birth parents

- Birth children & adopted child inheritance rights are virtually identical

- A Foster parent however is only a temporary guardian fostering vs adopting

- The Fosterer doesn’t have any rights as to the child’s well being, unless they adopt that child.

How much does Foster Parents get paid?

So the differences between fostering and adoption apart from helping out the child, Foster Parents also get paid a Fostering allowance. These may vary depending on the age & the needs of that child. How much does a Foster Parent get paid can be from £130pw to £235pw or much more, dependant on where you live in the UK.

As well as receiving income to look after the child, foster carers may benefit from special tax rules ie; earn upto £10,000 from ‘fostering vs adopting’ before you have to pay tax.

However, consider if one Foster Parent died, the impact on your family living standards. Would the child now have to go back into care as the surviving parent now could not cope financially? Fostering or adoption, life insurance is a valuable back up plan.

Parent Types

What Kind of Parent Type are You, Were You or Going to Be?

There is no schooling about how best to parent ie; There’s no one “right” way. BUT do you recognize any features in these 4 Parent Types?

Authoritative Parent: Do not shy away from conflict or difficulty. They try to be both kind, supportive & unconditionally loving. Offer clear expectations or also firm rules and boundaries if needed on parental discipline, only intervening as necessary. Deliver up on all their parental promises. Is this your parent type model?

Authoritarian Parent: May intervene frequently, over controlling, with threats, emotional abuse, criticisms & commands. They may issue the odd praise, but infrequently. It’s a cold, unemotional, disciplined & demanding, not warm or loving parent style. More concerned about their own parental needs, than their own child’s needs, they are often unsupportive. Children are expected to follow their parents lead without explanation… “Do as do, not as I say.” They make the child feel bad with their often overly high expectations. In the worst case, they may resort to physical violence, which can cause lasting psychological damage so at risk of maybe becoming abusive parents themselves. Is this your parent type model?

Permissive Parent: May shy away from conflict or difficulty. They try to be kindly & loving but also abit lax on parent discipline. Have low expectations, set few clear child boundaries by responding to their child’s every unreasonable whim, even if probably wrong. The child appears to have their parents under their thumb. If their child wants to stay up late, a permissive parent maybe unwilling to upset them by enforcing their parental guidelines. Is this your parent type model?

Uninvolved Parent: Can be so laid-back, that they cannot act as a good role model for their child. They may set very few or no boundaries, because they don’t really care. Neither warm, kind & loving. Neither firm either, they just sit on the fence, uninvolved & not monitoring their children offering little support. Their child could be anywhere, anytime doing anything…Whatever. Is this your parent type model?

Conclusion

How you may now parent, can also depend on how you were raised, good or bad & your cultural background? Or, alternatively how you have viewed friends or family parenting skills & tips. Are you now even sounding like your parents, when you talk to your own children?

Either way, it’s an interesting subject as to wether you feel taking out parents life insurance is important or not, to your own families ongoing well being.

Life Insurance for an Elderly Parent

When looking for Best Life Insurance for an Elderly Parent, there are 3 main types. All will depend on why they need the cover, or perhaps why you believe, they need the lifecover?

Insurers will also look to their existing or past medical health & lifestyle, as to which are maybe their best available options.

- Help toward Final Expenses costs

- Insure against potential UK Inheritance Tax liabilities

- Or a Life Insurance to age 90 as ‘bills back up plan’ instead

- Senior Life Insurance to always payout whenever that maybe

- Continuous No Future Health Issues whole life expectancy

3 Main Types

- Whole of life assurance (YES > Medical & lifestyle evidence)

- Term life insurance to age 90 (YES > Medical & lifestyle evidence)

- Over 50 life insurance (NO > Medical or lifestyle evidence)

When looking for Life Insurance, Parents may think you are unnecessarily pressuring them, especially if they never had it before? It could be, they have not even made a will as yet?

Maybe they are just considering a Prepaid Funeral Plan instead, so why bother getting a special Life Insurance for a Parent as well?

Over 60% of the UK population has still not made a will as yet. It seems we are Nation of Procrastinators. The average life expectancy in the UK is 81.

How much Power of Attorney | Best Parent’s Life Insurance?

Losing capacity is not something most elderly people tend to think about, or plan in advance.

A Power of Attorney is a legal document in which a parent can give their child or another chosen person, the powers to act on their behalf.

Capacity legally refers to a parents ability to make their own choices, decisions & communicate their wishes. A Power of Attorney document forms may need to be signed by a solicitor or GP, certifying that at that time your parent had capacity.

More importantly, only those with capacity can put a Power of Attorney in place or indeed setup a Life Insurance. So if you are thinking about one thing for a parent, then best think about the other. Also, make sure they make a valid will.

It is too late to consider some Life Insurance for an Elderly Parent, if they lose capacity, as the Insurers would state they did not understand what they were signing.

Also, their mental health could mean Insurers would decline to offer terms when asking health questions.

Note: Over 50’s Life Insurance usually offers guaranteed acceptance, with no medicals or tests needed. Their questions however, do ask if the client themselves was fully aware at the time of their decision to apply (not your decision on their behalf, to buy life insurance for a parent).

Unfortunately, as things like dementia and alzheimer’s can affect the elderly quite early on, we often find clients approach this situation far too late to act![]()

Conclusion

Whatever type of Parent you are, as brokers we can help give advice & guidance as to which is maybe your Best “Life Insurance for a Parent”.

Article on ‘Life Insurance for a Parent’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Parents Life Insurance in United Kingdom (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'