“Couples Life Insurance”

Can I buy ‘Life Insurance for a Couple’?

Yes. However, we will review here first the legality for a couple actually having Life Insurance. Then the various different types of Life Insurance for a Couple that are available, from leading UK Life Insurers.

We will look at 5 different types:- New Couples, Unmarried Couples, Same Sex Couples, Adopting Couples or Married Couples.

‘Life Insurance for Couples’ & Insurable Interest

Insurable interest means that ‘you could be adversely affected financially (not emotionally) in your couple if the person who you are insured with died’.

The reasoning behind insurable interest, is so that the death of an insured person may not create personal financial gain (rather than loss) for a policyholder.

So, Yes you can take out a Life Insurance for Couples – but as mentioned rules state there must be an ‘insurable interest’ between the 2 parties involved.

So whether you are looking for a separate life insurance for girlfriend or life insurance for boyfriend, there must be this legal insurance interest.

Also you cannot take life insurance on someone else without their legal consent to do so and being aware of it.

With the rise of the internet, and direct purchase insurance websites sometimes this is harder to check on for the Insurers upfront. The issue could come at the point of claim.

‘Couples Life Insurance’ | 3 Examples

Let’s look at 3 example cases. The first few, where taking out a couples life insurance policy is valid. Then, lastly an example where it probably isn’t.

Example 1: As a young couple, you & your other half have taken out a new joint £175,000 mortgage together. You both need to arrange a joint £175,000 mortgage life insurance policy to help cover this joint £175,000 mortgage debt.

The reason being, if as a couple one died first, there would now be a £175,000 financial debt that would be passed onto the other as you were held jointly liable.

Under the laws of insurable interest, both of you could be adversely affected financially if one died re the mortgage debt. The survivor (who may also not be the main breadwinner), could then be in financial trouble.

Also, both parties must consent to this arrangement. You can’t take out a life insurance for a couple (online or not) without either knowledge, whether it is joint policy or single life.

Example 2: You are a young unmarried couple, renting a property and have just had a new baby together. The mum is currently on maternity leave but hopes to go back to work part time afterwards.

Because of your new baby, you are now both looking to take out one joint life insurance couples policy. You would prefer this, rather than maybe the other option. being unmarried, to take out instead 2 x separate plans.

Under the laws of insurable interest, both of you could be adversely affected financially if either of the couple, who you are insured with died. The survivor (who may also not be the main breadwinner) along with your new baby, could be in financial trouble.

Example 3: You are a young couple, both who still each live separately at your own parent’s homes. You have been together for over a year & are now thinking of getting engaged.

Once engaged, you would still intend to live separately at each of your parents home. Your reason behind this is due to high rental living costs. Instead you will each start to save money up to hopefully buy a house together sometime in the future. You are looking to take out a joint life insurance policy, as you both would be devastated if the other died, so enquire about taking out lifecover.

At this stage, you would NOT be adversely affected financially (but certainly emotionally affected) if either of the young couple, who you are insured with died. Technically, right now, you should not be taking out a joint life insurance policy. Being young anyway, life insurance should not be a priority yet (maybe critical illness that includes some lifecover or income protection insurance instead) but your situation can be reviewed. Your circumstances may change.

What makes a Good Couple Relationship?

‘Life Insurance COUPLE‘

Before we dive into looking at taking out Couples Life Insurance, let’s stop. Let’s instead ask ‘What makes a Good Couple’?

Things which can make a healthy relationship will naturally vary. For every relationship, it is very important that to make it work well, then it takes both time & effort.

Both couples need to input that energy & sincerity, to be rewarded with a strong and healthy outcome. It is not easy. Living with anybody never is. There are good times & bad.

‘Relationships are like Insurance policies against loneliness & difficulties. They need to be renewed with regular premiums paid by communication, feelings, love and care‘.

Below are what the website ‘twosome‘ thinks are many of the major characteristics that makes upto a good couple. What do you think?

| Great Chemistry | Effective Communication | Do Stuff Together | Respect Each Other |

| Spend Quality Time | Love Gestures | Time Apart | Appreciation |

| Self-Improvement | Emotional Closeness | Smiles + Laughs | Physical Closeness |

| Apologize | Know Limits | Rules 4 Tech | Intimacy |

| Open Trust | Empathy | Affection | Sense of Humour |

| Make Time | Discuss Dreams | Speak Up | Put Plan to Action |

| Dedication | Enjoy the Moment | Be Honest | Shared Interests |

| Best Friends | Prioritize Each Other | Money Trust | Maturity |

Looking to take out life insurance for a couple, because right now you are in love with each other? Then a good combination of all these factors, could point to a strong union of mind & body. Good Luck. ![]()

Top 5 Reasons Most Couples Argue About?

What do most couples fight & argue about? Here are supposedly the 5 most common issues:

- Money

- Own Free Time

- Housework

- Physical Intimacy

- Extended Family

New Couples | Unmarried Couples Life Insurance

Whether you are a new or unmarried couple, you are hopefully in for both wonderful and happy times together. No #Friends Zone situation here, a #Couple Bubble instead ?

So what do you need a life insurance for a unmarried couple policy for? Here are some typical examples.

- You are going to have a baby

- Engaged to be married

- Repay joint debts & loans

- Cover joint monthly rent & ongoing bills

- Insure new joint mortgage & bills

Note: You don’t have to take out a joint life policy at this stage. You could consider 2 x seperate plans instead. The best time to take out any life insurance unmarried couple cover, is when you are both fit and healthy. So consider also life cover and critical illness plus income protection.

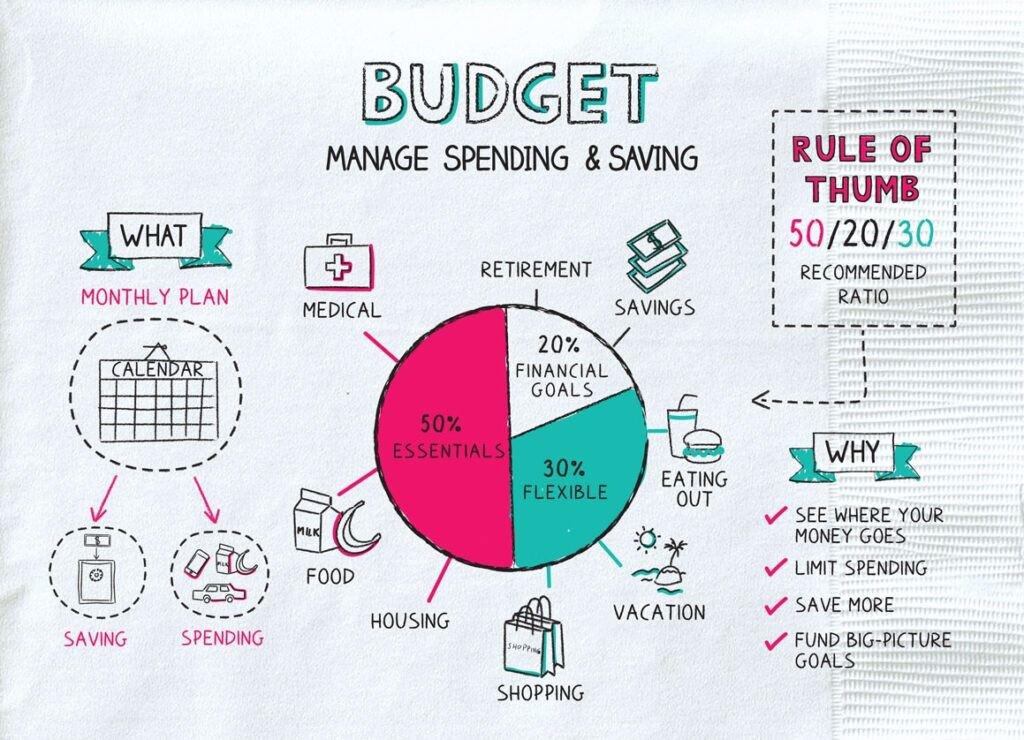

Financial Planning for New Couples

- Organise & Record your Couples Finances

- Prepare a strict Monthly Budget

- What benefits does your work employment provide

- Only consider joint bank accounts if the time feels right

- Check out any available State Benefits if on low incomes

- Setup tax efficient savings plans & pensions

- Budget for Life Insurance, Critical Illness, Income Protection

2 main types of Couples Life Insurance Cover

- Term Insurance

- Whole of Life Cover

Term Life Cover

Term insurance is a specific type of cover that pays out a cash sum BUT usually only if one of you died during the time your policy runs for.

This sum upon death is paid out tax free on claim and also usually has no cash in surrender values. This means that there is no investment savings element.

The term policy can be chosen as couple’s life insurance level cover. The premiums & cover remains level or the same through out the whole term.

Or, if worried about rising costs post pandemic 2020’s, then consider instead term life cover index linked. The premiums & life cover will increase yearly to offset inflation.

NOTE: You can take out term life insurance that lasts up to age 90. However, the longer the term life policy runs, then the more expensive it is ie; you are more likely to claim on the policy before age 89, than before age 49?

As a general rule of thumb, a ‘married couple life insurance’ policy for a 40 years term, maybe more than double the cost than a policy for 20 years.

There are several sub types of term life cover – either being paid out as Lump Sums or Family Income Benefits options. They can typically protect the needs for either family or mortgages ie; you can take out more than 1 policy.

- Level Term > Family

- Increasing > Family

- Decreasing > Mortgages

- Income > Family

Whole Life Cover

Whole of life cover as the name implies continues the whole of life ie; whenever the insured person dies, stops paying premiums, or cashes in early. It tends to be generally taken out by older people.

So it will pay out a lump sum upon death, tax free on claim, to your family whenever you die eg; died age 190. This is unlike term life insurance, which only pays out if you died during the set term the policy runs for.

Generally whole life cover plans are much more expensive than term cover, as they offer much less cover pound for pound, as it will payout. Consider carefully if you really do need life cover beyond age 90?

How much Couples Life Insurance?

As Life Insurance Brokers in an ideal world – we suggest this simple formula.

- LUMP SUM > Repay any mortgage & debts, cover funeral costs

- INCOME > Help cover your monthly bills

- LUMP SUM > Back up for holidays, education, emergencies

Martin Lewis Best Life Insurance formula is to aim to cover 10 x the Annual Income of the Highest Earner or Main Breadwinner until any kids have finished full-time education.

Using that principle, if you earned £25,000pa gross, Martin Lewis says you should maybe consider insuring yourself (after any mortgage, loans, credit card debts are repaid) for £250,000 life insurance (ie; 10 x the annual gross income).

Interestingly, he simply recommends insuring your gross income of £25,000pa – but not net after tax income in this Martin Lewis 10 x rule couples life insurance example.

Following on from this simple Martin Lewis example formula above, if you then worked for the next 40 years until state retirement, you could potentially earn over £1 million gross ie; £25,000pa x 40 years = £1 million [or more with any future inflationary wage rises].

As such, unlike the 10 x £25,000 gross salary life insurance example above – you could instead protect each other with either;

- Income = £2,083pm or £25,000pa family income benefit lifecover policy

- Lump sum = £1 million level term life insurance policy [if invested @2.5% = £25,000pa]

- Or a mixture of the 2 policy types over the next 40 years – all dependant on your family circumstances

Neither above ‘married couple life insurance’ options takes into account repaying any mortgages, loans or debts.

- You can decide wether you want the cover to be level or inflation linked

- 2 x seperate plans | or ‘joint life insurance policy’ 1’st claim

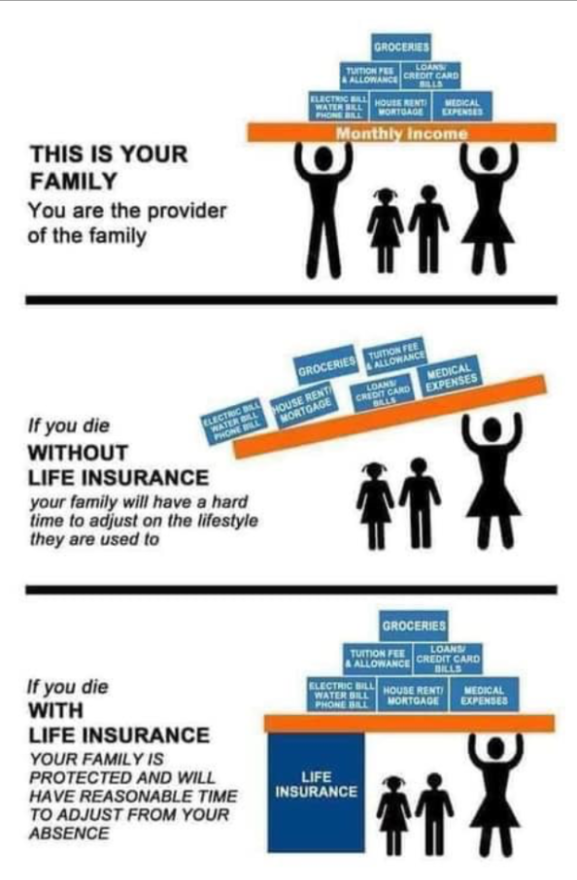

Apart from losing a loved one, this real hidden income threat is what could be lost if one of a couples main breadwinner died prematurely.

How much does this all cost?

- Often average prices can start from as low as £5pm (for 1 product)

- But your ‘couples life insurance’ monthly or annual cost will vary in a few ways

- Premiums will depend on your ages, health, lifestyle, amount of cover, policy term and type

- It could be you are offered standard costs or have to pay abit extra insurance price risk

- Any paid for extra features (like critical illness) you want will also affect the cost

- Do you consider a ‘joint life insurance policy’ or perhaps at a little extra cost 2 x single plans?

- Is the cover to remain level or increasing to offset inflation?

- Remember cheaper here, doesn’t necessarily mean better

Add Critical Illness Cover?

Critical Illness insurance is a policy that pays out a tax-free sum to protect you (or children) should you become critically ill during the policy term. The 3 main claims in today’s world, relate to types of cancer, heart disease & stroke. The chances of a claim are fairly high in working lifetime.![]() This additional critical illness benefit is well worth considering. However, if this is added to a joint policy, it means upon the 1’st to claim, the whole policy may then end.

This additional critical illness benefit is well worth considering. However, if this is added to a joint policy, it means upon the 1’st to claim, the whole policy may then end.

- Some Policies may also include valuable new baby / child critical illness cover for free

- A child benefit claim (usually a lower % amount) won’t affect the main adult policy benefits

- These may often cover children upto age 21 or into higher education

- Insurers may also payout a lump sum upon the death of a child

- Some Insurers allow you to enhance the child critical illness cover

- Also if a child was critically ill, then if covered under 2 x single adult policies both would payout

We recommend also that any individual Couples Life Insurance policy is put into a Trust from outset (especially if you have not yet made a will).

This means simply when a ‘life policy is in trust’, the payouts could go direct to your intended beneficiaries and with potentially less complications, if you sadly died. Most life insurers provide free protection trust forms. Note: If you should ever split up, dependant on the type of trust used, it may require all the trustees to then agree to any changes made.

Same Sex Couples Life Insurance

The UK Marriage Equality Act gives same sex couples life insurance (wether male or female) the same rights as heterosexual couples. However, it does not apply to anyone living with someone, but neither yet married (even if engaged) nor yet official legal civil partners.

Getting same sex life insurance therefore in the 2020’s, fortunately can be hopefully no different from standard life insurance rates. However, the rules of insurable interest still apply (as mentioned above).

Financially, if one of the couple died prematurely, could the survivor help then cover their ongoing bills & costs? The reasons for a ‘life insurance couple’ policy could be….

- Repay joint debts & loans

- Cover joint monthly rent & ongoing bills

- Insure new joint mortgage & bills

Adopting Couples Life Insurance

Adopting a child is a wonderful thing, so a big thank you. It may also give a reason, being new parents, to look at Financial Planning for a Couple.

Adoptive parents should start to now consider family life insurance should something unexpected happen. Also how does adoption change things legally ?

- Adopted children maybe eligible to inherit from their birth parents

- Birth children & adopted child inheritance rights are virtually identical

This helpful adoption website – explains the general rules for any couples adopting wether Gay, Lesbian, Bisexual or Trans:

- The Adoption and Children Act 2002 gave unmarried couples, including those of same sex, the right to adopt. This all became law in 2005

- If you are a same sex couple you don’t have to be in a Civil Partnership or married to adopt

- You must show instead that you are living together in a strong lasting relationship

- Single adopters are welcomed whatever their sexual orientation.

- Must be aged 21 or over. No upper age limit, as long as you are fit enough to cope with the trials of parenting

- Be able logically to see children through to early adulthood

- You should not experience discrimination on grounds of sexual orientation

- Most agencies say they are committed to equal treatment of all potential adopters

‘Life Insurance for a Married Couple’

Part of the marriage ceremony vows is often legally stating… you will both stay together as a couple “Til Death Do Us Part”.

At some stage, once life has calmed down abit, you will both start discussing about having joint financial products together eg; joint bank accounts, maybe joint savings, investments & mortgage.

Likewise, seeing as you both probably legally said these actual words at your wedding, about discussing again that dreadful word death. So, now is a good a time as any to also talk about ‘life insurance for a married couple’. It could start by seeing an advert on TV, Website or Radio.

The best life insurance for married couples with marriage insurance benefits can help ensure that you…

- Continue to live in your home

- Make ongoing mortgage or rental payments

- Plan for your future

So, the same way you just discussed joint bank accounts & savings, perhaps you should now discuss life insurance married couple cover at a similar time. Ideally, we suggest you discuss this in the same ‘matter of fact’ manner. Remember, you probably said these exact words at your wedding.

Life Insurance for Couples Over 50

Your priorities may or may not have changed once your over 50. Maybe the mortgage is a bit lower now, or maybe nearly repaid?

When looking for Best Life Insurance for Couples of Over 50, there are 3 main types. All will depend on why you need the lifecover?

- Help toward Final Expenses costs

- Insure against potential UK Inheritance Tax liabilities

- Or a Life Insurance to age 90 as ‘bills back up plan’ instead

- Senior Life Insurance to always payout whenever that maybe

- Continuous No Future Health Issues whole life expectancy

Our brokers will also look to existing or past medical health & lifestyle, as to which are maybe your best available options for your spouse life insurance.

3 Main Types

- Whole of life assurance (YES > Medical & lifestyle evidence)

- Term life insurance to age 90 (YES > Medical & lifestyle evidence)

- Over 50 life insurance (NO > Medical or lifestyle evidence)

When looking for Life Insurance Couples over 50, is it you or your other half who is pressuring the situation, especially if you have never had ‘life insurance for married couple’ before? It could be, you have not even made a will?

Over 60% of the UK population has still not made a will as yet. It seems we are Nation of Procrastinators. The average life expectancy in the UK is 81.

‘Couples Life Insurance’ Broker FAQ

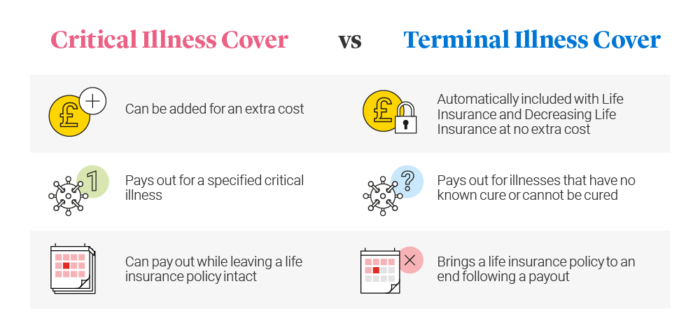

Critical Illness vs Terminal Illness Cover

Critical Illness is an underwritten insurance policy, that helps protect you if you are diagnosed critically ill (as specified by Insurers) during the policy term. The top 3 benefits most Uk Insurers cover are for types of cancer, heart disease & stroke* ABI.

It pays out a tax-free sum that you can use, however. To help repay the mortgage, cover monthly expenses, health-related costs, lost income while you recover (although income protection maybe a better longer term policy in that respect).

- Critical Illness as explained, may pay out claims crucially upon ‘diagnosis and survival of the specified illness’

- So Critical Illness means you may live, survive & claim

- Critical Illness cover may also provide some cover for your children

- Terminal Illness is often included for ‘free’ as part of a life cover

- It usually means a medical consultant has sadly advised you could have less than 12 months to live

- Terminal Illness means you will not survive long term after a claim ie; incurable illness

- Once agreed by Insurers, they may then payout this policy death claim but in advance

- Note:lifecover and critical illness plans are often combined anyway

What does putting a Life Policy Into Trust mean?

- It tells the Insurance Company who you want to get the money if you sadly died

- Ensures it should go direct to your nominated beneficiaries via the trustees

- Putting your policy into ‘trust’ may also help to avoid probate delays & inheritance tax

- Without a trust the policy could fall back into your estate (This applies even if you have made a valid will)

- Most Insurers do supply free a good range of generic life insurance trusts, ideal for many client situations

Importance of Disclosure & Claims

All Insurers are in business to protect, insure & payout. Therefore any life insurance quotes for married couple is based on your full disclosure at the time you take the original policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying.

The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless manner when applying. If so, it may not payout ! eg; If you vape, then you must tell them you are still smoking or a familial history of blood pressure or cholesterol (even if it costs more).

Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details.

They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details on that life insurance policy for wife.

If you look at most Insurers recent claims payout, you will see that it is Good (but like most Insurers – not 100%).

What if health or lifestyle changes after starting the Couples Life Insurance?

Any health or lifestyle changes since, usually does not void your existing married couple life insurance policy, if it wasn’t relevant at that time of initial underwritten insurance application. It maybe the Insurers request GP reports when you originally apply, to check any health details disclosed. Likewise they may not.

So take care to doubly re-check on your couples life insurance policy application what you initially disclosed to the Insurers, as this information then stands now and in the future. Please check your original T&C’s.

‘Couples Life Insurance’ Conclusion

So whether married or co-habiting, I hope that gives a brief financial & legal background as to what is a life insurance for a couple and why you should take one out. Please check out & Compare Online Broker only deals here.

If family members are also dependant on you both as a couple, then you know it makes good sense ![]()

Article on ‘Life Insurance for a Couple’ by Martyn Spencer Financial Adviser (2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Couples Life Insurance in UK (inc NI)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'