Martin Lewis Best Life Insurance for Over 65?

MSE Review: 01/2026

*5 Mins Read

Article: MSE Money Saving Expert Martin Lewis on Over 65 Life Insurance Guide

In this "Over 65 Life Insurance Martin Lewis" MSE guide we'll review these areas 🔸 Money Saving Expert on which Life Insurance Over 65 is worth it? 🔸 How much Insurance cover you need? 🔸 Broker Top Tips re Over 65 Life Insurance MSE views

If Over 65 does Martin Lewis recommend Life Insurance?

Well firstly YES, Money Saving Expert Martin Lewis does overall '💯 100% recommend Life Insurance', especially if you still have any dependant's reliant upon you financially (whether they are old or young).

On the main 'Money Saving Expert Life Insurance' website section, Martin Lewis is then generally asked How much life insurance do I need? He doesn't put any age limits caveat upon this ie; whether a 65 year old or over after life insurance cover etc;

In their MSE review, we will therefore look at their overall guide on best Over 65 Life Insurance from several perspectives. Firstly, IF you still have "Financial Dependents".

Alternatively, perhaps any large debts that you wished help covering - like say Mortgage Protection still or an Equity Release lifetime mortgages, or for Inheritance Tax IHT? OR lastly, you perhaps only just want to provide a lump sum towards any final expenses costs?

*What Does Martin Lewis say on Over 65 Life Insurance?

Looking for advice to help get the best Over 65 Life Insurance in 2026? If so, you do have a choice of seniors life protection options that Money Saving Expert have reviewed.

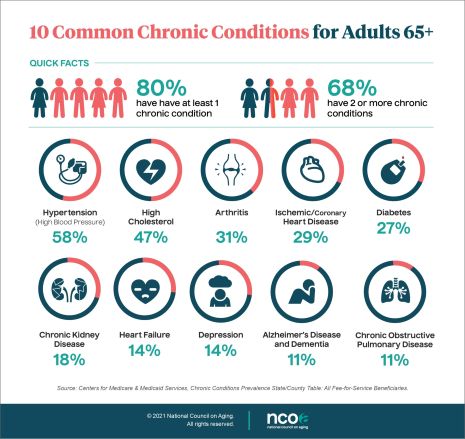

Firstly, from those over sixties british seniors being in overall good health still, then to those who have unfortunately poor health issues & so maybe reduced life expectancy.

Some UK Life Insurers in the last few years have therefore started to approach 💯 100% the Over 65 guaranteed life insurance marketplace, as the UK population are now living overall for longer.

Interestingly, the Money Saving Expert on over 65 life insurance Martin Lewis hasn't commented yet on specific age-related or branded over sixties life insurance products.

MSE in depth reviews are instead mainly focused on the very similar 'no medicals' Over-50's life insurance cover, which generally are more heavily marketed plans.

Or, they have provided guides instead on various term life insurance types, or basic reviews on whole of life insurance policy options.

All life cover products that are available to those Over 65 are designed to helping protect yourself, or those who are still financially dependant upon you.

The Money Expert says YES "Life Insurance is a Cheap Financial Lifeline" SO the ultimate choice is always yours, if the monthly cost's worth it to you & your family.

*MSE Guaranteed Over 65 Life Insurance No Medicals

Previously there was no UK life cover no medical questions products marketed specifically for the Over Sixty Life Insurance marketplace. But as mentioned, times are changing for Insurers looking to target both those over 65 silver surfers.

So several Providers & Banks are now therefore offering to relevant customers direct, their Guaranteed Sixty-Plus Life Insurance deals.

These are promoted as an 'easy, low-cost way to guarantee a cash lump sum when you die' with 'No medical questions and no examination required'.

Targeting those who for whatever reasons, don't want any hassle in getting their life insurance in their sixties...

Note: These seniors Over 65 life insurance guaranteed plans are often just re-branded Over 50's lifecover - of which Martin Lewis is a 💯 '100% Fan...IF You've Poor Health & Life Expectancy' BUT not so, IF you have Good Health.

Martin Lewis on Over 65 Life Insurance

SO many of these no medical over sixties seniors plans are usually sold direct, meaning therefore no advice as to whether it is or isn't the best life insurance deal for you (ie; dependant on your overall health & lifestyle).

MoneySavingExpert doesn't really go in depth review into alternative Over 65 insurance cover options like fully underwritten whole of life assurance, other than to say these plans are often (but not always) investment-linked life policies.

Mainly MSE says underwritten (ie; asks medical questions) whole life cover policies are used to mainly help mitigate inheritance tax IHT - as the policy runs out when you die, instead of after a fixed time frame.

Which as brokers we would only agree to some extent, as they can have far more uses than just that eg; leave a legacy, help to cover funeral costs, or maybe protect those with interest only style mortgages etc;

Due to this, the Money Saving Expert website does point out generally whole of life cover plans are usually a more expensive option, which we will touch on further.

As such, as we get older there are still plenty of people always looking for any Martin Lewis over 65 life cover advice here. So this is also an active topic in the Money Saving Expert website forum discussions.

We will look here therefore at some of your main Over Sixty insurance options. Then combine their various MSE life insurance guides & website tips, in this Martin Lewis best life insurance for over 65 review.

Martin Lewis on Life Insurance generally says for a good 100% rule of thumb in 2026, his Best Formula is "NEVER BLINDLY BUY DIRECT" expensive policy offers via your Bank or one Insurer direct ie; Shop around or use a Broker.

Who's Martin Lewis - Money Saving Expert?

Background: Who is the highly respected Martin Lewis Lewis OBE & CBE? He is a very successful Financial Reporter & Money Expert, and the founder of the well known UK consumer website Money Saving Expert.

He also has his own current affairs TV Money Show on ITV. This was all initially broadcast after all the London Olympics back in autumn 2012.

Martin Lewis is now often seen on TV commenting on current financial matters & affairs. Or daytime TV like This Morning Martin Lewis being the popular go to person for sound advice.

In 2012, his popular Money Saving Expert website was sold to The Money Supermarket.Com group for reportedly £87 million. Since 2015, Martin Lewis remains executive chairman and in these challenging 2020's all round UK Consumer Champion & Finance Guru.

*Is Martin Lewis a Qualified Financial Adviser?

Having been regularly on our TV's for many years now - Some people may also ask, is the Martin Lewis a qualified financial adviser? The short answer is 'No he isn't'.

But interestingly, many people often turn to Martin's advice more than a real IFA. However, he often does stress the various information he provides - is not fully regulated financial advice.

Important Note: This overview on Money Saving Expert Martin Lewis on Over 65 Life Insurance blog is not a scam fake advert re Martin Lewis recommending our own broker services. As you may be aware he & MSE are fully impartial. Therefore, he does not endorse or support any particular products or providers. Any Martin Lewis Money video's or images shown may also have some out of date information on them - due to the ongoing cost of living crisis. Often these life insurance MoneySavingExpert articles may no longer be personally updated or written by Martin Lewis himself. MSE do state he oversees site content, especially the MSE weekly email. Naturally, although MSE is an independant website finance allows no advertising nor subscription, it may receive a revenue via 'affiliate links' to the top products or providers (which we aren't mentioned)

How much over 65 Life Insurance Martin Lewis?

Martin Lewis suggests for a good rule of thumb in 2026, his Best Life Insurance formula is using 'THE 10 x RULE' ie; aim to cover 10 x the Annual income of the highest earner or the main breadwinner until at least any kids have finished their full-time education or other financial dependants.

We would add IF retired and Over 65, consider also the financial impact on any younger partner and therefore subsequent loss of pension income etc;

What does Martin Lewis say on Over 65 Life Insurance?

'The 10 x RULE' = Formula For Success

However, MSE also suggests that to better help you to calculate a figure that may best work for you & your family based on your affordable monthly budget, it is worth ensuring any life policy should also help to cover these following 4 main finance items:

- Any Outstanding Debts that would need to be paid off eg; include any mortgage loans, unless covered by a separate life policy already

- Immediate Outgoings ie; what your dependants could need to regularly pay

- Future Spending you may have wish to make eg; further education & university fees

- Any Additional Expenses that your death may then trigger eg; funeral & final expenses costs

Note however; this MSE formula doesn't distinguish between does Martin Lewis recommend over 65 life insurance (or whatever age you are) but mainly seems to look logically at those with younger dependant children.

MoneySavingExpert do point out that this 10 x the highest earners annual income may seem a high amount, but they say it is likely to then leave enough money (after the impact of rising inflation) to help cover any increases MSE says for mortgage rate loan repayments, expenses or any ongoing childcare costs.

MSE states it could also go some way to help supplement the incomes of those left behind if they had to unfortunately then leave employment eg; to care for any dependant children or relatives.

Martin Lewis has sadly his own personal family history tragedy here to tell, when he lost his mum at only aged 11. This he has reportedly said it left him unable to leave his home for upto 6 years due to extreme social anxiety as he was growing up ie; he is perhaps commenting here on life insurance from some of his own personal experience background story.

Types of Senior Life Insurance for Over 65?

Yes, all the main UK providers offer similar life insurance cover policies to those 65 plus, so don't worry here.

Even when you are over 65, the need for some form of life insurance protection is perhaps always there. There are currently 3 main types of Over 65 Life Insurance Martin Lewis discusses in their various guides.

Over 65 Life Insurance - 3 Main Options

Over 65 Life Insurance - 3 Main Options

- Over 65 Whole of Life Assurance (Yes > Medical & lifestyle evidence)

- Over 65 Guaranteed Life Cover (No > medical or lifestyle evidence)

- Term Life Insurance Over 65 (Yes > Medical & lifestyle evidence)

*Over 65 Whole Life Assurance (Medical Evidence)

General Key Features

- Whole of Life Assurance means you covered - even if you live until 125

- Policy is underwritten insurance Insurers ask medical lifestyle questions before offering terms

- Terminal Illness is often included for free on whole of life assurance plans

- This means you have 12 months to live, so pays out earlier 'death insurance claim' in advance

- Could involve GP reports & medical tests before agreeing underwriting terms

- Best deals usually available for those who have no adverse health or lifestyle issues

- Age at entry available up to late 80's dependant on Insurers

- If you have medical issues eg; high blood pressure or cholesterol Insurers may still offer cover

- Immediate coverage then with no initial exclusion periods before a whole of life insurance claim

- Suicide exclusion clauses may initially apply on whole life insurance for those over 65

- Own life, dual life or joint over 65 life insurance rates paid upon death or terminal illness

- Plan options for fixed or reviewable premiums & must be paid for rest of life ie; until a claim

- Premiums maybe investment-backed ie; reviewable or guaranteed fixed

*Over 65 Whole Life Assurance (No Medical Evidence)

General Key Features

- 1 / 2 years exclusion periods before any natural causes death claims

- Usually no in depth medical & lifestyle questions to qualify

- Smoking status affects life insurance for over 65 smokers

- Accidental death claims only for initial exclusion periods

- Refund of premiums only if you died of natural causes during this exclusion period

- Insurers may stop taking premiums from age 90/95 but maintain your over 65+ lifecover

- This Guaranteed Over 65 life insurance is whole of life meaning indefinate cover

- Age at entry usually upto 80 dependant on Insurers on a single life basis only

- Providers may limit fixed premiums per plan or total amount of Lifecover per person

- No investment cash in plan surrender values

- Lower life insurance levels generally offered versus other Over 65's plans

- Many use no medical plans instead of a prepay funeral plan

- Funeral funding benefit options with some plans

*Over 65 Term Life Insurance (Medical Evidence)

General Key Features

- Term Over 65 Life Insurance is 'underwritten' BUT for a fixed period ie; max available upto age 90

- Unlike whole life assurance you may live out that term period leaving no lifecover after

- Terminal Illness is also included for free on over 65 term life insurance plans

- May have much more affordable costs than whole life assurance as plan runs a defined term

- Age at entry available usually up to 85 dependant on Insurers

- Once underwritten, this life insurance policy has no initial exclusion period before claim

- Suicide exclusion clauses apply on term life insurance for the over 65

- Premiums usually fixed and have to be paid for life of the policy term with no cash value

- Options of life insurance for those over 65 via own life or joint life policies

- Life Insurance upto age 90 as a 'bills back up plan' instead

Conclusion:

Many of the various Pro's and Con's Life Insurance features MSE comments on, will apply for those types of no medicals Over 65 life cover plans Martin Lewis also reviews on no medical Over 50’s life insurance.

Check out our > Broker Over 65 policies comparison charts...

Is Over 65 Life Insurance enough cover?

Being over 65, you could now be in your most senior position at your UK company? Let's say you typically earned around £50,000pa gross average salary. You are re-married & the main breadwinner.

You intend to carry on working until at least age 70 or upto age 75, as your youngest child may finish university or further education then.

By using that Money Saving Expert principle formula therefore above (ie; 10 x the annual gross income), MSE re life insurance Over 65 says you should maybe consider insuring yourself (assuming after any mortgage, loans & debts are fully repaid) for £500,000 or £1/2 million life insurance.

Interestingly, Money Saving Expert 'people also ask' here simply recommends insuring your gross income of £50,000pa & not net after tax income in this Over 65 Life Insurance Money Saving Expert 10 x rule example.

Following on from this simple Life Insurance Martin Lewis example formula above, if you then actually worked for the next 10 years from aged 65 until your intended retirement age 75, you could potentially earn over £1/2 million gross ie; £50,000pa salary x 10 years [or more with any future inflation wage rises].

As such, like the 10 x £50,000 gross salary Martin Lewis life insurance example - you could therefore alternatively protect your family and dependants with either;

- Income = £4,166pm or £50,000pa family income benefit FIB lifecover policy

- Lump sum = £1/2 million level term life insurance policy

- Or a mixture of the 2 policy types over the next 10 years - all dependant on your family circumstances

Neither of these examples also takes into account repaying any say mortgages, loans or debts. So factor those in as well into any over 65 life insurance calculator uk deals.

- You can decide wether you want the cover to be level or inflation linked

- Single plan | 2 x seperate plans | Joint life insurance 1'st claim | Lump Sums or Family Income Benefits options

What's Martin Lewis Over 65 Life Insurance policy?

What does Martin Lewis say concerning Over 65 Life Insurance and does Martin Lewis recommend Over 65 life insurance?

Well MSE recommends when considering any Life Insurance protection cover generally, he suggests these '7 helpful pointers' and need to knows for your family:

'Life Insurance Money Saving Expert' - 7 Main Need to Knows

- Go for Guaranteed Fixed Premiums NOT Reviewable Plan Premiums

- Disclose all Health Conditions & Risks to help avoid any potential non-valid claims

- 2 x single policies may sometimes be better than a joint 1'st claim policy

- Write your life cover policy into trust helps avoid the taxman & probate delays

- Switch & Save on existing cover eg; now quit smoking or health improved

- Your protected under FSCS if the Insurance Broker or an Insurer goes bust

- Over 65 Life Insurance Martin Lewis advice recommends you seek Professional Advice if unsure

Follow this advice & 'Martin Lewis How to save money' on life insurance tips with their MoneySavingExpert '7 Life Insurance Need to Knows'.

*No Dependants (So you don't need Life Insurance)?

MoneySavingExpert on life insurance says if there is no one you would want the money to go to, then don't bother.

Equally, they also say if you do have dependants' (but there would be little financial impact if you died), then you still might not need any life policy cover.

But if your income (or indeed pension) helps pay the regular bills, mortgage loans, food shopping and more would be a struggle, then life insurance is often a cheap way to solve that.

We would comment as financial advisers, that although you maybe aged 65 plus and single or have no immediate dependants currently, you could still have a mortgage loan or various ongoing debts & unpaid bills.

If you sadly died with current financial commitments, this means it could then leave your wider family struggling to cope with all the financial burdens you have now left them.

More importantly for us all...even paying for a proper funeral for yourself to now be dealt with. Where are these immediate final costs funds coming from?

Martin Lewis on prepaid funeral plans comments typically funeral costs could total around £10,000 including burial plots and headstones & rising.

Then further stress re creditor claims against the estate from the either the mortgage company, credit card or loan company etc; You may then ask that (even if you are single) is that fair & what you would want for your wider family?

*Poor Health = Life Insurance Over 65 No Medical Exam?

Martin Lewis remarks in his reviews that he spent most of the Money Saving Expert Over 50's guide ranting on about the dangers of these no medical style life insurance policies.

However he also points out... don't think every over-50s' (or similarly over 65) no medical lifecover plans are a nightmare for every type of customer.

For example, MSE says if you have an already diagnosed serious medical conditions & shortened life expectancy, these no medicals life cover plans can be a good gamble.

The reason being is because MSE comments you do not need any medicals or health questions... other than smoker status to qualify (even though your life expectancy will be substantially lower).

Martin Lewis advises if you understand what you are doing, plus you have weighed up the risk pros and cons, you can win the no medical questions over 65 life insurance Martin Lewis remarks.

MoneySavingExpert give an example where they take someone with poorer health (non-smoker) who at 65 is likely to live maybe another 5 years until age 70.

They say an Over Sixty person could take a typical advertised no medicals plan for less than £75 per month plan, which would pay out over £14,000 on death after the initial waiting periods (whilst they would only have paid in less than £4,500 .

In other words, MSE say they would get a whopping gain of over £10,000. If they died during year three, they say you would still just get back over five times what they have paid. Not a sum to be sniffed at.

Naturally, as brokers we would add that these figures are of less value if you lived longer 10 years plus. Also, as mentioned by us if you are of average to good health, no medical style Over plans are not good value.

As brokers we would advise please don't confuse all these no medicals whole life type schemes - with other whole life plans available that say no medicals are needed...(but then they go on to ask you various medical health questions - to pre-qualify if you would get covered).

So let's look at the Pro's and Cons generally of over 65 insurance policies available with no medical questions versus those asking medical questions...

Life Insurance for Over 65 Uk

'NO Medical Questions' versus 'YES Medical Questions'

Over 65 Life Insurance 'NO MEDICAL' Info (Key Features) 'NO MEDICAL' Info (Key Features) | Over 65 Life Insurance 'YES MEDICAL' Info (Key Features) 'YES MEDICAL' Info (Key Features) |

| * Poor value if fit & healthy | Ideal if fit & healthy |

| * Wait first 1/2 years before fully insured | Fully insured once terms agreed |

| * Some may include Terminal Illness | Terminal illness benefit included |

| * Accidental death only first 1/2 years | Fully insured once deal agreed |

| * Low lifecover levels available | Higher lifecover levels available |

| * No medical questions | No GP health check | Medical questions | Maybe GP health check |

| * Smoking / Vaping rates affects pricing | Smoking / Vaping rates affects pricing |

| * Short application process | Longer application process |

| * Good value if unfit & unhealthy | Lesser value if unfit & unhealthy |

| * Whole Lifecover | Whole or Term Lifecover |

| * Don't want any advice | Don't mind getting advice |

| * Funeral Funding Options | No Funeral Funding |

| * Miss premiums & plan may end | Miss premiums & plan may end |

| * Restricted premiums | No premium restrictions |

| * No investment risks | No investment risks on guaranteed plans |

| * Inflationary risks if level cover | Option to index your lifecover |

| * 1 provider only choice | Choice of Brokers marketplace |

| * Advertised by a Celebrity | Usually not Celebrity advertised |

| * May get a Free Gift or Pen | May not get a Free Gift or Pen |

| * Could pay in more than premiums | Less likely to pay in more than premiums |

| * No premiums after ages 90/95 | Premiums paid for whole of plan |

Your 65th birthday like your 60th is usually always a cause for a Big Birthday celebration milestone. Hopefully, you have many more active years left & in good health, even though you could be approaching UK state retirement age.

Those in their mid 60's could still be in full-time employment, which is useful given the costs of living crisis 2020's affecting us all. Maybe you have no intention of retirement for many years yet?

Therefore, given the rising costs of living, you could still need to consider life insurance to help protect any lost ongoing income or help cover loss of pension rights?

However, apart from looking after their own kids financially growing up, The Bank of Mum and Dad or indeed Grandma & Grandpa - may still need help to pay-off their own existing mortgage payments, outstanding debts or credit cards.

MSE - How to buy Over 65 Life Insurance?

The Money Saving Expert Martin Lewis website is always advising about how to save costs & getting the best value deals.

Whilst this may seem true, the Over 65 life insurance marketplace is more confusing, as it isn't as highly advertised and so focuses instead more on those heavily branded Over 50's lifecover plans.

As such therefore sometimes buying what appears to be the cheapest whole of life assurance for example, often could work out the most expensive, in more ways than one.

People in the UK look therefore for his money saving expert advice, searching online to get his Martin Lewis best life insurance for over 65 wisdom & tips.

Noting that as he is not a financial adviser, so he does not personally give advice, just cover the main issues and problem areas.

So firstly for any life insurance over 65 money saving expert hints, let's look at the 3 main ways you can buy life insurance.

1] Execution Only Sales

Money Saving Expert attempts to educate people about many types of financial matters. The normal best advice is to always shop around & if unsure always seek professional advice.

Apart from going direct either online or old fashioned paperwork to the various Insurers for their life insurance offerings (which as mentioned - they don't recommend), they suggest the cheapest life insurance option is instead via an online 'execution only' discount broker.

Note: MSE point out that here, you must pay a fee first to that Provider to access their services. For example MSE recommend either using Cavendish online, Moneyworld, Moneyminder.

However, note cheapest here means you also won't get any advice or be speaking to anyone ie; No comeback if what was chosen by yourself, direct via their website, was appropriate to your ongoing situation. For example, you do not include waiver of premium on your protection policy to cover your plan being self employed.

2] Non-Advised Guidance

Then there are other life insurance sales agents they mention who may operate as FCA regulated brokers but via non-advised sales'. Now this part gets abit more confusing.

Although you are now speaking to someone about your life insurance enquiry this time, actually again you won't be getting any advice. You only just get information & guidance from their Sales Agent for you (not them) to make a more informed decision on the policies available you have then chosen to take out

In other words, No real comeback if your chosen Over 65 life insurance plan was later found inappropriate to your longer term care needs.

For example, you take out a life policy upto age 90, which you think is the same as over whole life cover you have also read about, and the insurers will pay your premiums after that age. You died at age 91 in a care home, and your family are surprised there is no life insurance payout.

There are plenty of large Life Insurance Brokers online offering 'information guidance only' eg; Reassured, Lifesure & Protect Line, mainly operate via non-advised sales.

3] Advice

Finally, there are 'advised brokers or financial advisers', who as the name implies give advice. The Financial Adviser will fully assess your own personal situation, then document this to you in your demands & needs report. They will advise you after their research why they recommended the particular Insurers plans & benefits.

They can either cover & address every aspect of protection needs or alternatively just look at a few particular areas eg; you just wanted to discuss your own life insurance needs for now. Later down the line, your adviser could then re-look into any highlighted other protection shortfalls for say Inheritance Tax or your partner for example.

There are plenty of Life Insurance Brokers online offering advice. MSE Over 65 Life Insurance Martin Lewis would recommend several that also may offer incentives & vouchers like either Activequote, Howden, Lifesearch.

Over 65 Life Insurance MSE Top Tips:

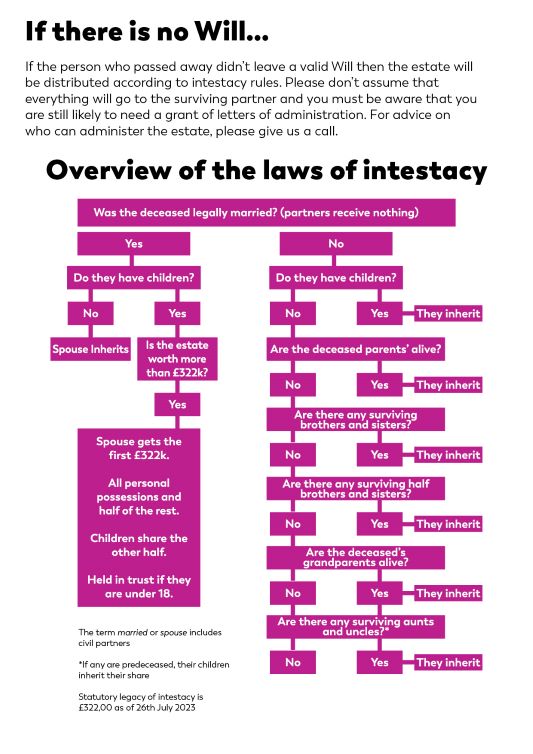

What you think may happen Legally & Financially if someone dies whether in their 60's or not - Could be entirely different in reality...

- Over 65 Life Insurance Martin Lewis agrees may help alleviate financial distress

- MSE says writing 'life insurance into a trust' helps avoid IHT & probate delays

- Although married, 'not making a will' can create real financial issues upon death

- 'State bereavement benefits are limited' for widows and widowers

- The surviving partner could still live on for another say 20+ years

- Have to then 'cope emotionally and financially' on your own

- Sole 'bank account & savings on death locked' - direct access problems

- Your surviving partner may 'not get some or any pension benefits on death'

- 'Powers of Attorney are useful' as you get older to protect yourself legally

Martin Lewis advice on any life insurance & ours is apart from sadly losing a loved one & breadwinner, this real hidden income threat is what could be lost if the main earner died prematurely and their affairs are not in order.

Over 65 Life Insurance Martin Lewis?

If you are looking into taking out Over 65 Life Insurance Martin Lewis specifically doesn't really explore the reasons behind you for looking at getting life cover, mainly just the best deals available.

For example, you maybe just want a small lump sum to just pay towards your funeral or small legacy? So this lifecover must payout 'whenever you die.'

Insurers will therefore charge accordingly for this 'unknown time frame' offering for their whole of life assurance policies.

However for others over 65, they may already have a funeral plan or suitable investments set aside? Instead, they now just want to help provide their partner & family with a larger backup plan fund and which ideally runs well into their retirement.

Some UK Insurers could maybe still provide you an alternative life insurance value proposition. Those who would just like their life insurance cover to last well into their retirement, to help protect their ongoing lifestyle and joint bills.

For anyone after over 65 life insurance Martin Lewis does not comment here, so as brokers we are often requested for a range of cost effective alternatives...

Term Life Insurance Over 65 Money Saving Expert?

In their main guide to Life Insurance Money Saving Expert focuses on either term life insurance types mainly for younger families with dependant children or those no medical life cover plans for say funerals.

But what happens if you don't have younger dependants, who may decide to leave home in say 10 years time? You want cover to something that will run well into retirement & that is affordable when being on pensions

A Term life insurance upto age 90 - sometimes could be as much as 1/2 the cost of a whole life insurance comparison.

The reason being that 'it may not payout' - as you could outlive the known plan time frame. eg; You live to age 95.

Many UK Life Insurers offer life insurance terms upto to age 90, others may stop at age 85 or sooner dependant on their deals.

Note: That average life expectancy in the UK is currently around age 80. Women however statistically live longer than men. However, life insurance rates are the same for both due to EU gender neutral rates applied since 2012.

As long as you feel that a term life policy ''backup plan" realistically is not needed after these ages, then this could be a different over 65+ life insurance alternative to whole of life assurance?

Contact us for a Comparison Term Life Quote >>

Over 65 - So Should I Cancel my Over 50's Plan?

Now you are into your 60's (as you may read this) you could already have had running for several years or more a no medical over 50's life cover policy?

For Martin Lewis on life insurance over 50 plans being cancelled, he points out that the answer isn't that simple, especially if you have read his pro's and con's.

As he points out you are locked in, so if you stop paying now, or miss a payment all your past contributions will likely be lost. Some life insurance companies have adjusted their philosophy here during the Covid Pandemic.

Note; Most of these Over 50 life insurance no medical schemes have no cash in values if you stop premium payments - unlike some old fashioned endowment policies.

Many Insurers Over 50's plan premiums may only usually stop being taken after say age 90 (see their policy T&C's).

Indeed, any regular payment contracts MSE may have recommended via their Over 50's switching tips to save you money. (but that is often the same principle whenever you replace most insurances).

He also says this often is dependant on your health. If you've got poorer health now, you can play the odds, and so your existing over-50s' no medical questions plans can still provide valuable cover into your 60's onwards.

Alternatively, as brokers we do come across clients in their mid 60's, whose existing life policies may end say in a few years time.

They are unsure whether to keep them going to the end...and then start a new policy. Or concerned should their health change interim (so struggle to then get affordable life cover), start up a new over 65 life insurance policy now.

We would add that as you are also probably some years older now since you took out the cover, the price of any new underwritten life insurance does increase alot more into your sixties.

Unsure - Contact us for a Comparison Over 65 Life Insurance Quote >>

Martin Lewis Life Insurance for Over 65s & Complaints

Should you wish to complain about your over 65 life insurance company MSE have given you a free complaints tool link to a website called Resolver.

Their tool they say helps you to manage your complaint, should you have one and need to monitor it.

Money Saving Expert do say if the insurance company doesn't play ball, it can also help if you wish to escalate your complaint then contact for the free Financial Ombudsman Service.

'Over 65 Life Insurance Martin Lewis' Conclusion

As mentioned already therefore, re those looking for Martin Lewis general life insurance advice if 65, he is not a big fan of the packaged no medical style of life insurance.

Check the above Pro’s and Cons chart for our own Martin Lewis Over 65 life insurance comparison analysis. No medical lifecover plans are as MSE mentions maybe only ideal for people who do have serious health issues thus a shortened life expectancy.

Alternatively, some who don’t want to answer any lifestyle questions or maybe just like the idea of a free gift?

Martin Lewis best life insurance for over 65s again should note that most no medical lifecover plans may usually have upto initial 1/2 years waiting period before any full death claim.

This means if you did die of natural causes during this ''initial period', the Insurers will not payout fully (other than usually return premiums plus interest) unless if died due to an accident.

Any full medical questions underwritten lifecover will alternatively potentially offer you cover immediately, without this 1/2 years waiting periods.

These other life insurance plans usually also will offer much higher lifecover amounts but for a similar monthly cost. They are also often used for those concerned about Funeral Costs, Family Protection & Inheritance Tax Planning.

Ultimately though, you pay’s your money and takes your choice of perhaps one or all product over 65 insurance life cover combinations. How much can you afford to set aside each week to help protect yourself, family and loved ones ?

If you can afford it, my own thoughts aside from what does Martin Lewis say about life insurance for those insurers offering plans for those over sixty, are ideally following these same principles as mentioned above.

- Lump Sum > Repay any mortgage loan & debts, funeral costs

- Income > Help cover your ongoing monthly bills & expenses

- Lump Sum > Back up for holidays, education, emergencies

Take care of Yourself, Family and Loved Ones.

Article on 'Over 65 Life Insurance Martin Lewis' Guide by Martyn Spencer Financial Adviser January 2026

For reassurance re health for men & women – we review many of the best Life Insurers selling Over 65 Life Insurance in UK (inc NI)

*Any comments & views expressed on this Over 65 Life Insurance Martin Lewis Money Saving Expert review are for generic information only. They are not personalized advice or necessarily reflect MSE views.

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'