‘Quote for Life Insurance’ & UK Financial Services 🚩(2025)

Quote for Life Insurance. Compare Broker deals online in 15 secs.

Top UK Insurers Quotes

Top UK Insurers Quotes

*Life Insurance *Critical Illness *Income Protection

Compare Best Broker Deals Online >> 15 Secs*

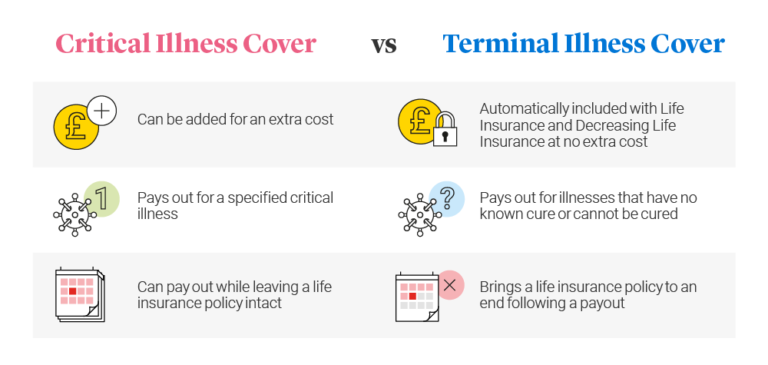

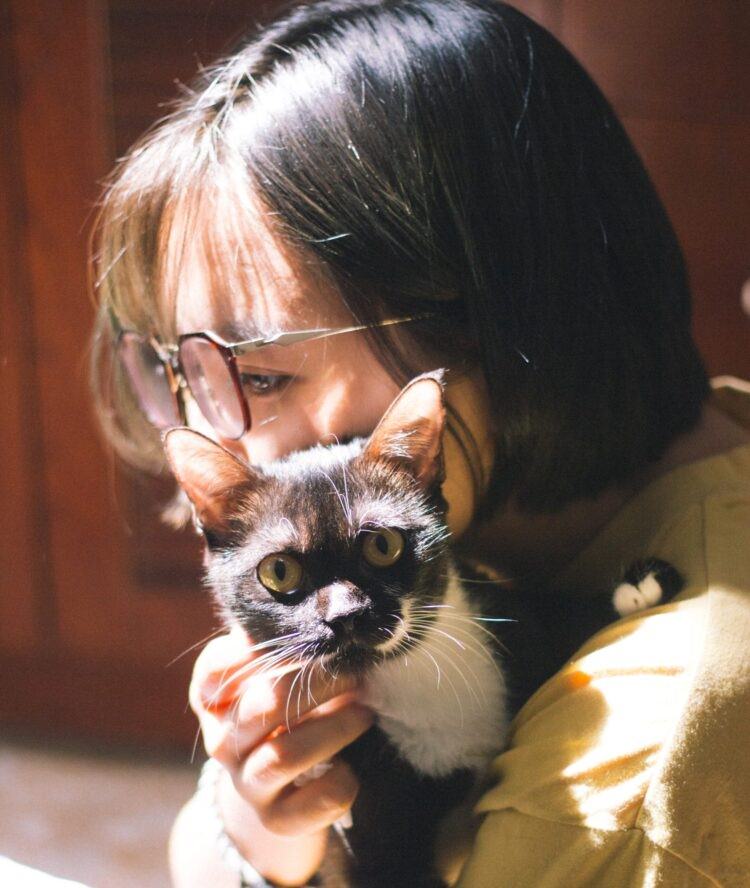

* ‘Life Insurance Quote’ Price Warnings | ‘CRITICAL ILLNESS’ *No obligation quote financial services – after you ‘Compare Life Insurance Quote’ – you maybe contacted by an FCA Regulated Broker The reason being that the chances of any person making a critical illness policy claim or an income protection claim payment before retirement are statistically much much higher than life cover only (see below infographics). eg; 1/2 people will get cancer in their lifetime | Every 12 mins someone has a stroke | Every 7 mins someone has a heart attack | 1/3 claim on critical illness | 1/4 claim on income protection | 1/10 claim on life cover | 1/20 claim on total & permanent disablement etc; Note: Most Life Insurance policies do however include free ‘Terminal Illness cover’ benefit. It sounds the same but this means a death claim will be paid in advance. It applies usually if you have less than 12 months to live ie; terminally ill. Compare Life Insurance Quote Cost Note: If you do include optional critical illness cover quote (whether quoting for intergrated or more expensive additional benefits) then the far higher monthly premium quote will reflect this than lifecover alone. On a budget? Then requote broker deals for just life insurance cover with terminal illness only. Both critical Illness or quotes for income protection are roughly 4 x the price of a ‘life insurance quote’ alone (Unsure what each benefit is, then please check out our explanations. Then get another free quote life insurance broker deal). An average critical illness policy could cover you for over 50 different types of illness but most claims relate to the Top 3 types of Cancer, Heart Disease or Stroke ie; AIG state over 80% of their main 3 adult claims relate to these. Our broker UK ‘Life Insurance Quote Comparison’ allows you to compare online in 15 secs, best deals for family life insurance, critical illness, mortgage protection & quotes for income protection. Use this to do a FREE Life Insurance Quote Comparison based on any multiple of insurance comparison quote options. Note: You may not be able to do a term life quote if you are aged over 70. The maximum term plan runs upto age 90. In this instance, please complete our no obligation insurance compare quotes broker enquiry form for either term or whole life options. Get a life insurance quote compare broker deal & help. Yes. Absolutely, it is legal to have several life insurance policies eg; You could have cover for your mortgage in the event of death or serious critical illness coverage claim plus another separate lifecover to help protect the main family breadwinner’s income. Many people also have life insurance benefits through their employer, which usually runs until you retire. So, you may choose to compare quotes on life insurance for 1 policy that runs upto retirement & another policy alongside that runs well into retirement ie; you are not left without cover then at retirement, if that concerns you. Bear in mind, you may sometimes also get a better quote about life insurance, by sticking with one provider if they offer any broker discounts for taking out multi-cover. This may also have the benefit at a claim, of just dealing with 1 provider’s paperwork? Feel free to compare life insurance quote broker deals. You can take out multiple policies with more than one life insurance company. Again, there is no UK law to prohibit this. For example, the cheapest deal for a mortgage insurance quote life policy is with Provider A, so you apply to them. But that same insurer for a family income benefits policy is now alot more expensive. So you get a quote for life cover and then apply to Provider B for this instead. Note, most insurers will ask in their application forms the total amount of cover types you maybe applying for across all Providers. You can potentially claim on as many valid life insurance plans as needed, when doing quotation or quotes about life insurance. Under a joint life policy, it means both parties are insured for the same amount. However, if a claim is made then the benefit is paid out upon that 1’st claim only, the joint plan then ends. This makes sense for example if you are a married couple covering a joint mortgage with life insurance upon 1’st death only. It is also usually cheaper than taking out 2 x individual policies, as the Insurer only has to payout once. However, sometimes it makes sense instead to do say a family quote on life insurance for 2 x separate plans [also known as dual life insurance]. This could be because you are not married but still have young dependent children. You are both therefore concerned if one dies or has a critical illness then the other still has cover. Martin Lewis on Life Insurance always says, if unsure then seek professional advice what maybe best for your personal or business situation. If you have quit smoking cigarettes or used any ‘replacement products’ within the past year, most insurers will still classify you as a Smoker ie; this includes the use of vapes, e-cigarettes, nicotine patches and gum. As a result, an applicant who smokes 10 cigarettes a day, maybe charged the same quotation or quote for life insurance premium, as someone who vapes. You may feel different and should be offered insurance rates that reflect that it is maybe less harmful than smoking. Note, If some Providers charge less for vapers then check if their prices are competitive and ‘Compare Life Insurance Quote’ here. However, note Insurers do look to medical science who still feels there are adverse health side effects of vaping without nicotine. Here is a typical Insurers Application Question re smoking status. So, if you do vape eliquids but wrongly state that you are a non smoker, it could invalidate your policy and sadly result in an unsuccessful claim. An insurer has the right to request your medical records either at outset (or upon claim) to clarify your medical history. So ensure when you are doing your insurance quote life cover, you tick your correct smoker status. When you do a “Quote for Life Insurance”, at that stage you have probably only advised the most basic information, to just get a comparison quote. A full application is still needed. In your application, most Insurers will ask lots of personal and family health & lifestyle questions to underwrite your cover. From this full disclosure, Insurers can then work out if the quote on life insurance price you did still stands. Or maybe costs a little more due to adverse insurance risks eg; raised BMI calculation or diabetic. All Insurers are in business to protect, insure & payout. Insurance cover is therefore based on your full disclosure at the time you took the original underwritten insurance policy out ie; being 100% as honest & accurate as possible. It is not always easy to remember all your historic health details when applying. The Consumer Insurance Act 2013 says you must not be acting careless, deliberate or reckless when applying. It is easy to sometimes make mistakes and rush when filling in any forms, so as the saying goes be careful to ‘tell the truth, the whole truth & nothing but the truth’ eg; Not disclose if you familial history of raised blood pressure or cholesterol (even if it costs more). If so, it may not payout ! Should you make a claim, your Insurers will send you a claim form for you to complete. Once received back, they will usually contact your GP to confirm any health details. They will then assess if your insurance claim is valid and cross check if you originally disclosed all the correct details. If you look any Life Insurers UK and their recent claims payout, you will see that it maybe very good at around 98/99% (but like most Insurers – probably not 100%). Get a free quote life insurance deal here. When you first do a ‘quote on life insurance’, you are probably not thinking about the legal and financial consequences at point of claim, to your loved ones? You are just after the best value deal, when you say ok google life insurance. However, if a life insurance policy isn’t written into trust, this means the Insurance Company is now unaware whom the benefits should be paid to on a death claim. If you made a will, it can be paid to the executors of the deceased’s estate. They will handle the administration, known as probate in N Ireland, England, Wales and confirmation in Scotland. If you have not made a will, the life insurance benefits will fall into your estate if you died prematurely. So as such, If you have not made a will this can then cause further complications with the correct distribution & speed of payout of the life insurance monies. Until probate is fully granted, no monies can be paid out to those named in the will. On average, this can take upto 6 months. By not placing the life insurance plan into trust, this may then also swell up the total estate values, leading to potentially Inheritance Tax IHT issues. So placing a policy in trust can help to ensure that the death insurance policy proceeds go to the correct beneficiaries you decide to nominate at that stage. It can also help avoid possible probate delays & UK Government IHT costs. Ask the Insurers to kindly provide their available standard trust form wordings & seek legal advice if unsure. Speak to a broker who has the professional experience here, after you compare your ‘life quote insurance’ deal. ‘It’s getting expensive for me-ow…I have ‘9’ lives. You only need to Insure ‘One’. ‘Life Insurance is a combination of Caring, Commitment & Common Sense’ Howard Wight ‘If there is anyone dependent on your income, like your partner or children, then you need life insurance’ Suze Orman ‘If I had my way, I would write the word ‘insure‘ upon the door of every cottage and upon the blotting book of every public man, because I am convinced, for sacrifices so small, families and estates can be protected against catastrophes which would otherwise smash them up forever’ Winston Churchill ‘A policy of life insurance is the cheapest and safest mode of making a certain provision for one’s family’ Benjamin Franklin ‘Please don’t tell me my Mum & Dad left no life insurance’ ‘You can’t put a value on a human life, but my wife’s life insurance company made a pretty fair offer’ ‘Great. I have just saved our family £25pm…. I cancelled our £250,000 life insurance policy’ ‘Insure My Car against Accidents ‘Insure ME also against Accidents & Breakdowns’ ‘I can’t talk yet…but I heard Mummy & Daddy talk about getting Life Insurance’ ‘In Good Health? Now is The Best Time to take out Life Insurance’ ‘Life Insurance could be one of the most valuable purchases you ever make for both yourself & loved ones‘. From our wide choice of Leading UK Insurers – Get ‘Quotes for Life Insurance’ We look forward to helping you (Best Broker Deals: 7/11/2025)

![]() ‘TERMINAL ILLNESS’

‘TERMINAL ILLNESS’

7 x BROKER FAQ | ‘Compare Life Insurance Quote’ (11/2025)

7 x BROKER FAQ | ‘Compare Life Insurance Quote’ (11/2025)*Why is optional ‘Critical Illness’ more expensive vs ‘Terminal Illness’?

stats changing re Pandemic

stats changing re Pandemic

UK Life Insurance Quote Comparison

*Can 1 person have 2 or more Life policies?

*Can you have Life Insurance with several Companies?

*2 x Single Plans or Joint ‘Quotes on Life Insurance’?

*Is Vaping still Smoking on a ‘Quote for Life Insurance’?

Is Vaping still a Smoker Quote about Insurance?

*Importance of Disclosure & Claims?

*Should I put my policy into Trust?

‘Quotes on Life Insurance’

‘Quotes on Life Insurance’

“Quotes on Life Insurance > 15 secs”

www.uklifeinsurancequotes.co.uk

‘Quotes for Insurance’ | UK Life Insurance Quote

Compare Quotes about Insurance

www.uklifeinsurancequotes.co.uk

What’s Life Quote

Compare ‘Quotes Life Insurance’

www.uklifeinsurancequotes.co.uk

‘Quotes about Insurance’ | UK Life Insurance Quote

Compare Quote for Life Insurance

www.uklifeinsurancequotes.co.uk

‘Quotes about Insurance’

Compare Life Insurance Quotes

www.uklifeinsurancequotes.co.uk

‘Quote about Insurance’

Compare UK Life Insurance Quote

www.uklifeinsurancequotes.co.uk

‘Insurance Quote Life’

Compare Quotes of Life Insurance

www.uklifeinsurancequotes.co.uk

Quotes for about Life | UK Life Insurance Quote

Compare Insurance Quote Life

www.uklifeinsurancequotes.co.uk

Quote for Life | UK ‘Quotes Life Insurance’

![]() Insure My Car against Breakdowns’

Insure My Car against Breakdowns’![]()

![]()

![]()

“Quotes about Life Insurance” > 15 secs

www.uklifeinsurancequotes.co.uk

Quotation about Life | UK Life Insurance Quote

“Quote about Life Insurance” > 15 secs

www.uklifeinsurancequotes.co.uk

Quotation on Life | UK Life Ins Quote | Ok Google Life Insurance

“Quotes for Life Insurance” > 15 secs

www.uklifeinsurancequotes.co.uk

Quotation on Life | Google Life Insurance benefits

Quotes About Life Insurance

Conclusion ‘Quotes About Life Insurance‘

![]()

Article Martyn Spencer Financial Adviser Life Insurance Quotes compared (7/11/2025)

For reassurance re health for men & women – we review many of the best Life Insurers selling Life Insurance in UK (inc NI)

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'