Do Orlistat Weight Loss Drugs

Affect Life Insurance Quotes?

Orlistat Weight Loss Drugs Life Insurance Review: 01/2026

Does taking Orlistat affect Life Insurance?

Can you get life insurance if you're on Orlistat pills?

YES it means 💯 100% for Orlistat Weight Loss Medication and Life Insurance potentially for many people in 2026 - relook at getting better Insurers terms & maybe saving some money into the process...

The increasing availability of weight loss management medications - such as Orlistat weight loss have all changed the playing field - for those looking to dramatically reduce weight in the UK and the world.

So will taking Orlistat weight loss drugs affect your life insurance deal & if so how?

For example, they previously bought a life cover policy with health risks from raised BMI plus those associated medical issues - like diabetes, raised blood pressure and cholesterol.

As such, they then had a 'health rating' applied ie; their premium was increased to reflect those Insurers risks at the time - maybe for the lifetime of their policy.

Or alternatively, some insurance exclusions were then applied. Worst case scenario - they were even declined so unable to get any lifecover at all.

So we say as brokers - it could well be worth a revisit here. This applies whether you are considering re-applying for either Life Insurance, Critical illness or Income Protection plans.

Does Orlistat Void Life Insurance Terms?

The UK insurance industry are well aware there maybe well over 1.5 million people currently accessing various weight loss medications.

From this figure, perhaps over 200,000 patients are expected to receive weight loss medications like Orlistat (also known as Xenical or Alli) over the next 3 years via the NHS, as many GPs can begin to prescribe these weight loss drugs for the first time.

Although most Insurance Providers will require that you always have an official 'legit' prescription. This may have been prescribed through a specialist weight loss service or via private prescription.

However, not just any cheap Orlistat cost uk randomly bought online or from the bloke down the road - Which for some Insurers may then automatically lead to an immediate decline.

A standard Life Insurance company application still asks for both your height and weight - plus many also ask waist or dress sizes as well.

Will my Life Insurance go down if I lose weight with Orlistat?

Some UK Providers may offer an insurance deal with pricing rates ALL now based upon your current BMI - as provided upfront which could be advantageous.

Others may ask your 'starting weight' before beginning the treatment - AND their 'current weight' if they are taking the weight loss medication.

Insurers could look at how long you have been on Orlistat and those effects (i.e. how much weight you've lost so far) AND if they're maintaining their weight and the source. You maybe then assessed on a case-by-case basis.

Some may take that figure BUT then average 50% of any weight regain - and so will often refer into insurers manual underwriting to be checked before any new terms offered.

Typical insurers questions here on Orlistat Weight Loss Medication Life Insurance application asks "Are you on any medication or treatment that's lasted 4 weeks or more"?

You must answer this honestly and advise them as requested your Orlistat dose for weight loss. Plus if you have any Orlistat weight loss side effects?

Also, for some Providers IF you have just started taking Orlistat weight loss drugs in the last 3 months - they may not allow that application to proceed again - until month 6.

Others may do a Lifestyle review on your existing policy and ask how much weight has been lost? Dependant upon those answers & time frames, they may then reduce your premiums accordingly.

As brokers we therefore say - please ask us for advice on the best Insurers here for their stance on Orlistat Weight Loss Drugs for Life Insurance | Critical illness | Income Protection | Health Insurance.

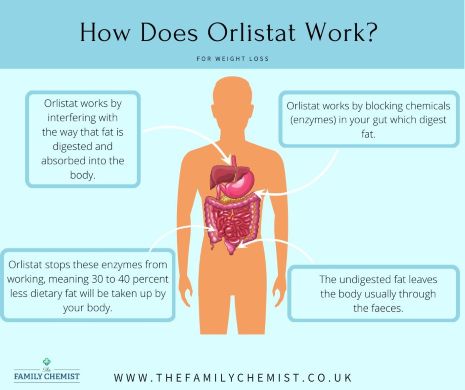

How does Orlistat Weight Loss work?

Orlistat weight loss drug mimics the actions of our 2 digestive hormones - because it contains active ingredients Naltrexone and bupropion.

By attaching to our brain receptors, Orlistat works to control both your hunger and blood sugar levels; It therefore helps to firstly reduce your food and calories intake.

Secondly, it slows down gastric emptying ie; the time it takes for food to pass through your stomach and so keeps you feeling fuller after eating.

As such, it decreases both insulin & glucose production - to now make it a very effective weight loss medication.

Orlistat weight loss drug is a regular 'self-administered' prescription-only medication - that has been medically licensed for both weight loss and also type 2 diabetes within the UK.

Raised BMI Orlistat & Life Insurance?

Although some may disagree - BMI is still a common measurement used by UK Insurers for their life insurance application assessment & other protection policies like critical illness & income protection.

- less than < 18.5 = Underweight

- 18.5 > 25 = Healthy Weight

- 25 > 30 = Overweight

- 30 > 40 = Obese

- > 40+ = Severely obese

A higher BMI according to the NHS all increases those chances of developing long-term conditions like; Type 2 Diabetes, Raised Blood Pressure & Cholesterol and Heart Disease .

Your BMI calculation is just one measure of your health BUT it cannot tell the differences between your muscle and fat.

For example, if you have a lot of muscle and work out, you may be classed as overweight or obese - despite having a low body fat.

So Insurers also balance this out - by some asking for your waist measurements.

Most Life insurers do factor and an use your BMI calculation into their overall life insurance risk assessment.

So simply put - a raised BMI insurers factor as higher risks in when determining = raising your premiums.

Orlistat helps to reduce BMI - which means potentially better insurance terms as well = lowering your premiums.

Orlistat Weight Loss Side Effects & Life Insurance?

Orlistat weight loss medication, can cause various side effects in some people. However, like most medicines - these may vary from person to person.

These side effects may get worse or even come back when increasing your Orlistat dosage.

This is caused by your body needed to adjust to and get used to those higher doses of medication - with those side effects lessening hopefully over time as your body adjusts to the new dose.

These typical side effects could also be caused by / worsen if you may suffer typically from say Diabetes - and are taking medications like insulin, which can adversely interact with the Orlistat drug.

- Nausea or Sickness

- Constipation or Diarrhoea

- Stomach ache or Heartburn

- Excess wind or Burping

- Rash or Itch

- Lower Blood Pressure

- Hair Loss

- Dizziness or Confusion

- Tiredness or Weakness

- Irritability or Anxiety

- Increased Heartbeat or Sweating

- Hunger

BUT for insurance purposes - It's important you disclose to the Insurers IF you are suffering any serious side effects.

Finally, there is also evidence that if you stop the Orlistat medications, then weight is often regained unless people have also undertaken some dietary and lifestyle measures.

Insurers are aware of all this, even though research is all still relatively new ie; unsure as yet as to the real longer term effects of weight loss drugs like Orlistat over say 10/15 or 20 years plus for insurance purposes.

Orlistat Medication: UK Life Expectancy?

Weight-loss drugs like Orlistat are all poised to revolutionise healthcare - by helping slow down the ageing process, allowing people to hopefully live for longer & in better health.

This is the opinion of leading scientists studies from the European Society of Cardiology Conference.

However, it focused on the reduced the risk of death in people - who were previously obese or overweight and had cardiovascular heart disease.

People who took these drugs reportedly died at a lower rate from all natural causes, not just from cardiovascular causes, researchers discovered.

Orlistat Weight Loss Review Insurance Pricing?

Orlistat Weight Loss Drugs and Life Insurance

The Insurer Royal London for example offers a specific diabetic life insurance plan that are reviewable yearly, meaning that if you lose weight & your HBA1c readings officially improve due to weight-loss drugs like Orlistat - then they their policy premiums will reduce.

As such, these weight loss medications are already affecting their sums on people’s health or average life expectancy in the UK.

They have decided it may affect the pricing of its various insurance policies - Or set aside extra money in the event that people suddenly start living longer.

Some other providers view like the Insurer L&G - their overall view is that....

- Taking a weight loss drug like Orlistat for those already into their 70's (the years of damage has been done - if previously obese)

- If those overweight for say last 10, 15 or 20 years already (the damage has already been done)

- Insurers already factored in that many younger people nowadays generally have a much healthier lifestyle (so have already adjusted risks and premiums)

Importantly - The rise of medications that control weight loss like Orlistat, have also introduced a further pricing challenges for Insurers.

The reason being there is the potential for policies to be mispriced if anyone's weight then rebounds strongly - So are not properly factored in during insurance underwriting especially for fixed premium plans.

As such, some Providers have simply taken the approach that your current BMI figure has 50% re-applied (being on Orlistat weight loss drugs) when applying for life insurance.

This means they calculated an average 50% of any weight regain ie; should you discontinue the medications for whatever reason into the future.

Orlistat Price UK?

Naturally the cost of Orlistat prices - will all vary either dependant on either dosage amounts purchased ie; 2.5mg / 5mg / 7.5mg etc; and various Providers online or their local Pharmacy.

Typically, these weight loss tablet capsule prices may start from between £100pm - £200pm+ OR maybe lower if prescribed directly via your GP.

Likewise some insurers like Vitality has announced some of its health insurance members will have access to these weight-loss medications.

They say it's available to those who meet certain criteria. Importantly they add it will be provided in conjunction with their lifestyle support and one-to-one coaching with an approved dietitian assistance.

As always be aware, if you're offered a Orlistat price - that seems much too cheap ie; it's a fake weight loss injection.

Note: Insurers will only offer insurance terms on genuine weight loss drugs and legally prescribed.

For some people fortunately however - it maybe available soon also via their local NHS approved medical GP.

Is Orlistat on UK NHS?

Orlistat tablet capsules or similarly weight loss injections - are slowly becoming available via the NHS in the UK. BUT they have said it's only for a limited number of people AND with specific criteria.

The NHS have also said it's being rolled out in phases. They are prioritizing they say those with the highest clinical needs for treatment.

To be eligible, they have said patients generally will have a BMI of 40 or more (or a lower 37.5 for some ethnic groups) and an associated number of weight-related health conditions.

The NHS have said people will also get "wrap-around" care ie; include regular follow-ups, help & support with exercising plus advice on eating more healthily.

But prescriptions for weight loss drugs like Orlistat will not necessarily be available from all local GPs. In some cases, they will come from other primary care.

Privately though - Orlistat and similar weight loss drugs are flying off the shelves - with some of these manufacturers, becoming one of Europe's most valuable listed companies.

Their logic behind this growing UK obesity crisis - is it may cost more to the NHS and the country into the longer term for increasing demands on their health services.

Orlistat Weight Loss Before and After Pictures

Orlistat medication has clearly become an important lifeline for those looking to continue to lose weight, into their long term future.

As you clearly see from the above Orlistat Weight Loss Before and After picture - it can work for those determined to succeed.

Orlistat Weight Loss Benefits re Life Insurance?

Orlistat Weight Loss Drug Benefits & Life Insurance

According to insurance actuaries - weight loss drugs such as Orlistat have associated benefits that could mean better outcomes for obtaining life insurance.

They have listed 10 potential health benefits that may possibly result from long term use of these weight loss drugs and therefore also associated with chronic obesity.

Likewise, for life insurance purposes is that many people regain alot of their weight lost IF they discontinue the medication ie; Insurers are aware & may adjust their terms accordingly.

So Orlistat medication they say should be viewed as a long term personal medical maintenance from these top 10 benefits and for both your health & life insurance deals.

Top 10 Health Benefits

- Reduced (BMI)

- Blood Pressure

- Cholesterol

- Cardiovascular disease

- Cancers

- Type 2 diabetes

- Liver & Kidney disease

- Alzheimers & Parkinsons

- Asthma & COPD

- Sleep Apnoea

Orlistat & Critical Illness Cover Insurance

These typical stats above of the chances of making a claim on critical illness cover insurance are high AND maybe inflated if you are obese or have pre-existing health issues.

The top 3 claims most Insurers payout for a critical serious illness claim are for cancer, heart disease & stroke.

Orlistat naturally may help as you lose weight and therefore may become healthier and able to get a critical illness policy if perhaps declined before re say raised BMI.

But although these weight loss drugs are working for the insurance industry not against it - They also comes with its own safety risks of being critically ill.

For example - You take the wrong Orlistat dose for weight loss. OR probably will not be able to use Orlistat if you are allergic to any of the ingredients its made of.

Orlistat for weight loss may also cause more serious side effects including:-

- Pancreatitis (inflamed pancreas)

- Severe Stomach problems (gastroparesis)

- Gallstones

- Severe allergic reactions

- Gastrointestinal issues

Orlistat & Income Protection Insurance

An Income Protection Insurance policy provides a 💯 100% Tax Free Income to help protect your salary IF you are unable to work through accident, illness or injury to help cover your regular bills & outgoings.

Income protection will usually pay a proportion of your salary, for example two-thirds, so that essential spending is covered.

It generally includes a greater range of illnesses in comparison to critical illness cover - so it can also be more expensive.

The chances of an insurance claim are higher therefore - if you are generally less fit & healthy or have an adverse reactions to Orlistat.

So with these quick weight loss drugs, Insurers are also being careful re their approach to underwriting applications for insurance plans like income protection.

Currently, many UK Insurers don't specifically ask the question 'Are you on weight loss medications?' - which may change as time goes on as the market develops.

So, please answer the question accurately from outset & advise the broker of your own weight loss situation - otherwise it may mean a future claim is refused or policy cancelled.

Conclusion: Orlistat Weight Loss Drugs and Life Insurance

Insurers will be very interested in whether you are taking Orlistat weight loss drugs (or any other manufacturers like Mounjaro, Wegovy or Ozempic).

Most life insurance applications will usually include a broad question about any medications you have taken in the last say 3 or 6 months Or longer term.

Quite rightly, many Insurers are appraising these popular fast weight loss drugs and its impact on all types of insurance protection.

They will all therefore adjust their premiums accordingly and some from standard premium quotes - because the science says the weight may usually come back when the medication ends (you may disagree)...So you need to chose wisely here.

As such, please contact our Brokers to determine Best UK Insurance Providers Deals if on Orlistat Weight Loss medication 01/2026 + Compare Quotes Online :-

Life Insurance > | Critical Illness > | Income Protection > | Private Health Cover >

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'