"Martin Lewis Mortgage Protection Insurance" Advice?

MSE Review & Top Tips: 01/2026

*5 Mins Read

mortgage protection insurance money saving expert martin lewis review

In this Martin Lewis Money Saving Expert review we will look at these keys areas & more 🔸 What's MSE views on Mortgage Protection? 🔸 Types Available? 🔸 How much Insurance Protection Martin Lewis recommends?🔸Average Costs £££? 🔸 Whom Best to Buy from?

The Money Saving Expert

"Mortgage Protection Insurance Martin Lewis" | Guide: Insurance Types

What's Martin Lewis view on Mortgage Protection Insurance?

Firstly, Martin Lewis on Mortgage Protection says IF you were to die before your mortgage is repaid, your loved ones may 💯 100% have to pick up the mortgage repayments.

Alternatively if critically ill, had an accident or redundancy - ALL meaning possibly unable to now make those regular mortgage payments.

If you are a homeowner therefore, it's not just the bricks and mortar that keeps the roof over your head, but MSE says is your ability to repay the mortgage.

So should anything unfortunately happen - Falling behind on mortgage repayments means he says you are now 'in arrears' – something that puts you at higher risk of losing your home or 'repossession'.

Worst case and the bottom line is Martin sadly remarks - then be forced to sell-up to repay the Mortgage Lender.

Whilst he points out that, for example, mortgage life insurance is not a compulsory purchase - he has countered 'don't be surprised if your mortgage provider also insists you have a policy in place - before they release any mortgage funds'.

The Money Saving Expert explains - it gives those lenders comfort knowing some financial protection is in place if you were to die.

OR if No Cover is taken at all - in other words by not having any specific mortgage insurance, MSE assumes you must be then taking onboard therefore - all those mortgage protection risks & financial responsibilities yourself.

And will just utilise for example instead, any company death in service benefits & sickpay - or if self employed, then have to dip into your savings as necessary (if you have any).

The Money Expert remarks here that YES "Insurance is a Cheap Financial Lifeline" BUT the ultimate choice is yours, IF the monthly cost's worth it to your family.

Their various Mortgage & Protection guides takes you through what MSE points out are those main mortgage insurance protection types available - Then recommends what best to watch out for.

Plus pointers on how to best buy a mortgage insurance policy to help keep that roof over your head – and importantly Martin says those various reasons why you 'DON'T need to Buy it Direct' from your Mortgage Lender, Bank or Building Society.

MSE: 5 Key Mortgage Protection Insurance Policies

What types of Insurance are most suitable for UK Mortgage Protection? Well, we've identified '5 Key Mortgage Protection Insurance Areas' that Money Saving Expert website have all touched upon in their different reviews.

- Decreasing Life Insurance (death/terminal = repayment mortgage)

- Level Term Insurance (death/terminal = interest only mortgage)

- Critical Illness Lifecover (critical illness & death/terminal = help repay mortgages)

- Mortgage Income Protection Insurance (accident or serious illness = cover mortgage payments & salary - full mortgage term)

- Mortgage Payment Protection Insurance MPPI / ASU (accident, sickness or unemployment = cover mortgage payments & bills - short term)

We find that many people often come to us as Mortgage Protection Insurance brokers - having read what Martin Lewis and the MSE Team have to say on this subject.

BUT they then just ask us questions like - "What does Mortgage Protection Insurance cover?" or "How long does Mortgage Protection pay out for?"

So we actually find it could mean to them, they are just after any '1' of the above 5 Mortgage Protection Insurance areas Martin has reviewed OR maybe several of them...

For example they may tell us; "We would like Mortgage Protection to protect our Joint Mortgage and insure it's repaid if we both Died or were Critically Ill" OR "We'd both like 2 x seperate Mortgage Protection plans, because we're not married yet" OR "We only want Mortgage Protection to cover our Mortgage Payments & Bills on the main breadwinner if they had an Accident, Illness or made Redundant".

Let's have a look at what MoneySavingExpert Martin says on each of these different types of Mortgage Protection Insurance.

Noting, most of these protection for mortgage insurance applications do then ask health + lifestyle questions - plus including family history.

As such, re any pre-existing conditions Insurers may either exclude or health-rate your premiums after underwriting - which could involve GP reports & perhaps a nurse medical.

And then also if looking at Mortgage with Life Insurance - how much Family Insurance you should also consider having & that MSE recommends for overall protection.

Is Martin Lewis Life Insurance for Mortgage Protection?

Martin Lewis on Mortgage Life Insurance - he points out this is also sometimes referred to as either mortgage protection or decreasing term insurance.

This policy MSE says is designed to cover the balance on your repayment style mortgage - as it decreases in line with your mortgage debt - IF you were to die during the term ie; before you finished paying off the mortgage.

Plus most Insurers also include free terminal illness insurance cover (not to be confused he says with critical illness) within their mortgage protection life insurance plans.

This typically means an advance payment of the life cover - if diagnosed less than 12 months to live ie; help repay the mortgage early (the plan then ends).

Also, we would add some Insurers have free inclusive 'waiver of premium' - which helps protect those Mortgage Protection Insurance policy premiums if off work from sickness or accident.

In conclusion, some may ask is it compulsory to have a Mortgage Protection Insurance Policy & MSE suggests some lenders may insist.

But we would add others may not - and we've seen before as brokers sadly situations whereby there is no mortgage protection back-up plan in place.

Leaving the poor widow/widower even more stressed & worried that their Bank may have then diarised to commence repossession proceedings, not long after the funeral.

The bottom line Martin says - its main aim is to stop anyone you leave behind - then not worrying about how to make up those monthly mortgage repayments.

Or worst still - be forced to then sell the property and roof over your family head, to help repay any amounts that is still owed to the Lender.

So you must decide as they say IF that financial lifeline is worth it to your own situation. Unsure which Providers maybe best? Please Contact Us >>

*Martin Lewis Mortgage Life Insurance Pros Cons?

Martin Lewis then reminds you on a Mortgage Decreasing policy - that it is also worth bearing in mind what happens IF you do decide to take a mortgage payment holiday during the plan term (eg; lost your job or maternity/paternity leave).

Then that decreasing mortgage protection insurance payout amount - may now start to fall short of the remaining mortgage balance (which hasn't decreased).

We would add as brokers - this Decreasing Mortgage Protection Insurance policy type is initially setup with a fixed percentage % decreasing loan rate.

BUT if this percentage % was too low at outset eg; Setup to decrease at 5% BUT your mortgage loan rate increases to say 6.25% - then this could also leave a Mortgage Protection shortfall.

Martin also points out that this type of decreasing plan - would just help to repay that mortgage loan balance only and nothing else.

Alternatively, this type of decreasing loan protection maybe also ideal when MSE are reviewing secured loans or second mortgages - to help repay the debt.

So, therefore it's not ideal if you also wanted to leave any further lump sums or income for your dependants - to help cover other debts, loans and ongoing bills or spending.

We would add - Some cheaper Insurers 'waiver of premium' on their Mortgage Protection deals - doesn't even click into this benefit for a minimum 6 months wait period.

This won't help protect the Mortgage Protection Insurance policy premiums IF you've no savings or limited work sickpay.

Unsure which Providers maybe best? Please Contact Us >>

Martin Lewis Mortgage Protection & Life Insurance Types

Level Term Insurance Mortgage Protection MSE?

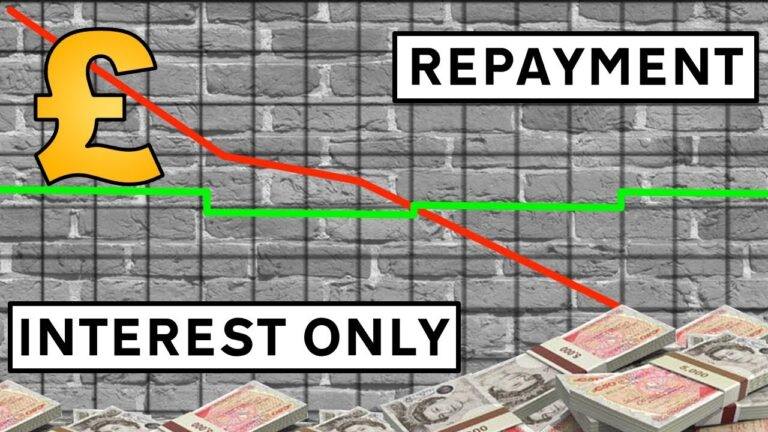

So Martin Lewis on life insurance for mortgage protection MSE reviews, concentrates mainly on protecting repayment style mortgages - whereby that cover decreases as the mortgage capital and balance is repaid.

He then says you may not specifically have 'mortgage insurance' for mortgage protection, but if you already have in place a level term life insurance policy - Won't this just give your dependents a lump sum if you died?

Yes he says - however they would naturally probably want to use all that level life insurance sum to now help pay off their mortgage.

So he therefore points out that you will need to ensure the lifecover amount you are covered for, exceeds the amounts you owe on the mortgage firstly.

AND secondly that the level term policy is in force for exactly as long as your mortgage repayment term.

As brokers, we find many people request us to quote for both mortgage protection decreasing & level term cover options.

But what happens if you have an interest only style mortgage? ie; the capital is not repaid, so the amount outstanding remains the same & therefore not reduces.

In that instance, Martin points out that 'Level Term' is the simplest type of life insurance. AND that name tells you all you need to know...

This means it remains 'level' – meaning it's fixed at that amount – for the duration of the policy. This plan type will also cost more than decreasing mortgage term insurance.

Put simply, it is a mortgage protection life policy that pays out a set sum assured if you were to die whilst it is in force - to help clear the full mortgage.

It's therefore an ideal mortgage protection for those with an interest only mortgage, whereby they are only paying the interest & so not reducing capital.

MSE says you can choose how many years you would want that style of level term policy to cover you for.

In this instance, you would need to decide when you intend to clear the mortgage eg; At retirement from a pension pot via large tax-free lump sum.

So you could run your level term mortgage protection plan over that time frame.

In their review on interest only mortgages to keep costs down - Martin suggests making overpayments from a money-saving perspective.

He recommends you should seriously consider paying off your interest-only mortgage (at least in part) and well before that mortgage 'term' or deal ends.

But if these overpayment amounts are sporadic & unpredictable over the years - it would not make sense to set up a decreasing mortgage protection plan, as it may not align with the moving mortgage balance.

Martin Lewis says you usually can't remain covered past the age of 80 with a level term plan; though this maximum age does vary by provider and we find is often upto age 90.

However - If you're after mortgage protection beyond age 90 eg; covering equity release lifetime mortgage loan protection - then you are looking possibly ideally at whole of life life insurance. Martin Lewis also reviews this policy type but mainly related to his IHT avoidance mitigation tips.

Unsure which Providers maybe best? Please Contact Us >>

Martin Lewis Mortgage Protection Critical Illness Cover?

What's Martin Lewis opinion on having Mortgage Protection with Critical Illness?

Well he says Critical Illness Cover is a 💯 '100% TAX FREE' Lump Sum payment AND you can use that Insurance Money for anything you like.

For example, MSE advises whether it’s to fully pay off your mortgage or alternatively help cover any health-related costs, lost income or any day-to-day expenses.

Many Critical Illness Cover policies are often taken out in a combination with life insurance also he points out - which we say could be important when looking to mortgage protection & ensure your family don't have 2 problems to deal with.

Most Critical Illness Insurance plans MoneySavingExpert states will typically cover you for certain major life-threatening conditions such as a heart attack, stroke or cancer types.

However, MSE comments that Insurers will generally cover between 20 and 60 critical illnesses in their insurance policies BUT watch out for any exclusions.

We would add some Insurers also payout a % percentage upon severity of illness and others full or partial claims.

Plus some have 'global cover' benefits - that allows you to have treatment privately abroad ie; every Insurers Mortgage Critical Illness Protection scheme is slightly different.

So critical illness mortgage protection is therefore designed to work and protect you IF you're diagnosed with a specific illness that the insurance policy lists he says ie; you do get a serious illness or injury but importantly could now afford to repay all or part of the mortgage - removing that threat to your home, livelihood and income whilst recovering.

Ultimately, they say you don't need to have critical illness cover, so you will need to weigh up whether the extra monthly cost overall is worth it for you.

We say as brokers, that having a mortgage critical illness cover policy may become that valuable lump sum financial lifeline - should the worst happen (like Martin Lewis says on life insurance).

Let's have a quick look at the 3 combinations of Mortgage Protection and Critical Illness cover you could have. This could be set up in several different ways, either as combined / integrated or additional cover. They explain that they work may differently in terms of how they pay out and what it costs:-

Critical Illness 100% Tax Free Sum

*Combined / Integrated Critical Illness Mortgage Protection

This critical illness mortgage protection lifecover combination will only pay out the once ie; upon the earlier claim if you are firstly diagnosed with a critical illness OR alternatively if you died say in an accident.

However, for the cheapest broker deals we would add that this is usually the most popular way to take out this mortgage protection insurance policy.

Having critical illness loan protection maybe also ideal to consider & when MSE are reviewing various unsecured or secured loans on property - to help repay that debt.

*Additional Critical Illness Mortgage Protection

This seperate Mortgage Critical Illness & Life Cover could pay out twice - if you are either diagnosed with a critical illness first and/or if you then died whilst the policy is still active.

Because it has the potential to pay out more than once, these additional life insurance and critical illness cover Martin Lewis remarks tend to be more expensive than cheaper combined covers.

As brokers, we note these are less popular for Mortgage Protection because of higher costs.

Also, some people can't see the benefit of getting paid out upon a critical illness and perhaps 100% repaying all their mortgage - but then left with a decreasing life cover policy.

Others can see the benefit of choosing not to repay all or part of their mortgage - as they need the monies to survive financially whilst recovering.

Therefore ensuring that the Mortgage Protection lifecover could still help protect the remaining mortgage balance.

*Stand-Alone Critical Illness Mortgage Protection

This means there is no life insurance payout here (perhaps an option if you are single with no dependants at the time of taking out the plan?) which Martin Lewis mentions.

However, even if this a little cheaper option of just critical illness cover standalone was used for say mortgage protection & died - this means the policy may not payout.

So their wider family could be left with that mortgage bill to settle OR more simply their property is likely repossessed and ensuing problems.

*Child Critical Illness Cover?

Even when looking at Mortgage Protection Critical Illness insurance - Money Saving Expert observes many do also include some cover for your children.

We would add this child cover can be either free inclusive OR a paid for option on critical illness cover and is usually a small % payout of the adult plan. Some insurers may also offer a version of child cover as a standalone option.

MSE remarks typically these plans pay out if your child is diagnosed with a specified critical illness it covers or they spend over a certain amount of time in hospital.

More importantly, they state if you do make any claims for a child first (upon that main adults policy), it should still stay active.

You would then be able to claim again if you were then diagnosed with an adult critical illness.

Martin Lewis Mortgage Income Protection vs Critical Illness?

If asking - Where can I find mortgage protection insurance that includes both Life and Income Protection?

Well Mortgage Income Protection Insurance (or PHI / IP) is a separate type of cover, that as it names sounds - pays you a monthly income payment tax free (rather than a lump sum) if you're unable to work either via an accident or longer term sickness (but not redundancy).

We say the policy ideally set-up via an 'own occupation' basis rather than 'any job' - covering most medical, or mental health reasons caused by an illness, accident or disability for any set period as chosen.

Martin Lewis says it’s always worth looking at all your options ie; comparing both Mortgage Income Protection Insurance alongside Mortgage Critical Illness cover - as they both payout 💯 100% tax free.

MSE sometimes says this is generally a year or two in claim BUT we would add as brokers as this is the cheaper budget option (They maybe referring to MPPI here).

PHI can be requested comprehensively for the full mortgage term ie; Martin says this IP Insurance pays out a pre-agreed amount based on your income in the event of accident or sickness, until you either return to work or reach retirement.

Martin comments that Income Protection will usually pay a proportion of your salary, for example two-thirds (rather than just say concentrating on the mortgage and those payments alone) so that most essential spending is covered.

Plus he says it generally includes a much greater range of illnesses than critical illness cover. BUT it can be more expensive he points out.

Some people MSE says also think that both these mortgage protection insurance policies MAY cover ALL & EVERY Critical Illness type?

...BUT Importantly Martin Lewis advice here clearly states Income Protection doesn't list out those various specified serious illnesses (Unlike Critical Illness ) - So you may wish to consider either or both for Mortgage Protection.

We would add, that Mortgage Income Protection also has a waiting or deferral period before you can claim and receive your monthly payout eg; 1/2/3 months.

This waiting or deferral period could either tie in with your savings or work sickpay - and noting the earlier you want it to kick in, the more expensive it is.

Note: Income Protection Insurers typically will not allow you to receive both work sickpay & receive your mortgage protection insurance claim at the same time ie; you could tie this waiting period around this.

When it comes to deciding between the 2 types of Mortgage Protection Insurance Martin Lewis recommends - that it could be worth quoting via a financial adviser about whether Mortgage Income Protection Insurance & Mortgage Critical Illness Insurance alongside works best for you.

We would add that sometimes we maybe suggesting your best overall flexible mortgage protection package is actually via several providers - rather than just 1 bundled Insurers offering the best coverage for your needs.

Martin Lewis MPPI Mortgage Payment Protection Insurance

Martin Lewis MPPI

Martin Lewis on MPPI - explains what is mortgage payment protection insurance (MPPI) and is it worth it - because this policy is designed to cover your mortgage repayments & related home costs (but not indefinately per claim).

MSE says it is set-up & tailored to cover mortgage loan repayments in claim - IF you can not work due to an accident, sickness, & sometimes unemployment eg; MPPI often is 1/2 years max in claim.

He notes if this is as a result of actual involuntary redundancy BUT it is not going to pay out - if you simply just decide to resign and without another job.

ALSO If you're in work for example and say self-employed but still struggling financially, MPPI won't help insure either re lack of business or work.

So they only touch upon those pros & cons of this shorter term in claim mortgage protection insurance plan - if struggling to make your mortgage payments and avoid arrears.

But we find that Mortgage Payment Protection Insurance focuses mainly on protecting on average upto 125% of your monthly mortgage payments ie; plus a few bills (so unlike Income protection which usually covers more at around 2/3rds of salary).

Some Insurers may limit their Mortgage Payment Protection Insurance from £1,500pm to £2,000pm max benefit at claim. But usually an unlimited number of MPPI claims - rather than just a 'one off'.

The policy benefits are then paid out per claim also over a shorter term eg; 1/2 years max per each claim (unlike Income protection - which could cover a whole mortgage term in claim ie; maybe unable to work again).

It is there in case you could be made involuntarily unemployed (unlike Income protection which doesn't cover redundancy) OR unable to work re an accident, hospitalization or illness (similar to Income protection).

Also, some Insurers may split up their MPPI schemes into 3 options;

- Redundancy Unemployment (Involuntary)

- Accident + Sickness

- Accident, Sickness + Redundancy

Accident, Sickness and Unemployment policies (ASU)

These ASU plans Martin comments pays out a pre-agreed amount usually based upon your earnings, so not your mortgage, and for up to two years.

The policy 'does as it says on the tin' MSE points out – but the amount is paid to you, so you can decide what to spend it on.

However, on either MPPI options - you’ll usually need to be off work for a specified number of days, before these policy types start paying out (known as the deferred period).

This waiting period, can range anywhere from 1 month upwards typically and in claim the Insurers can choose to pay the Mortgage Lender directly.

Unlike mortgage income protection that helps provides cover for both your mortgage protection, ongoing bills and your salary ie; higher coverage and longer term - this could be an alternative & maybe option?

If considering having both MPPI & PHI plans - we would add, check whether your Mortgage Income Protection Provider is aware of your Mortgage Payment Protection Insurance; Because some may disallow you receiving both amounts in their T&C's.

Or you could chose a comprehensive back-up plan. Having a MPPI paid for 1 year (Policy 1) - and then a PHI policy paid with a deferred period of 1 year - ie; full mortgage protection until it mortgage ends (Policy 2).

Note: MPPI sounds similar in principal to the unpopular PPI Martin Lewis reviews after £1000's of mis-selling claims so are MSE forums on MPPI queries.

As such, Insurers in 2026 are aware of this and the products and associated fees are structured differently; check their T&C's and note these plan types are often annually reviewable.

Do bear in mind they say again - there is no legal requirement to insure your mortgage payments. So it could be the case that you don't have any insurance to cover your mortgage payments.

MSE: MPPI Insurance Claims?

IF you need to make a MPPI claim - THEN you must get in touch with your insurance providers immediately Martin says ie; don't delay.

We would add - don't forget your Mortgage Lenders also IF needed ie; You may struggle to make your usual / next payments.

Should you be unable to cover your mortgage payments because you are unemployed involuntarily, MSE points out that you will likely have to proove to your Insurance MPPI Providers that you are actively looking for work.

Alternatively IF it is illness-related, you must then provide a full doctor's certification note.

The amount of MPPI you will then be paid will have all been agreed upon from the outset of the plan ie; when you first took out that policy (so check the paperwork if you're unsure).

Typically a policy like MPPI he reminds you - covers your mortgage costs for up to one or two years in claim ie; not for the whole mortgage.

Be mindful Martin remarks that it might take some time (possibly weeks) before the insurance starts paying out.

We would add, if you have for example a 4 week deferred period - and it takes say 8 weeks to finally settle the claim; then the Insurers will then normally backdate those claim payments made upto day one ie; from that 4 weeks wait.

Mortgage Protection Insurance 5 x Top FAQ

So Martin Lewis says IF you think having a mortgage protection insurance policy is therefore right for your mortgage situation, they've given 5 Top Tips to help you choose:-

1] Choose 'Guaranteed Premiums' = Monthly Costs are Fixed

Money Saving Expert says when you look to buy your Mortgage with life insurance policy - you will usually be given 2 choices of monthly premium payments.

- Reviewable

- Guaranteed

Reviewable premiums are cheaper (and so often cost less initially). BUT Martin says beware here = as your Insurers will hike up those 'low start' costs later on.

All meaning that great cheaper deal can now become more expensive as get older, as these plans can be age-costed ie; Your premiums could potentially double or more over time.

BUT if your premiums are Guaranteed (on the other hand) = your Insurers will never change their prices.

So you will always know what you will be paying over the term life insurance mortgage Money Saving Expert says (& we strongly agree here - and say buyer beware).

2] Disclose ALL Health & Risks = OR Insurers may NOT pay out

MoneySavingExpert rightly states that it's VERY important that you are both 'open & honest with any information' you provide to Insurers at application.

If you do not accurately share or misrepresent your medical history, the insurers will argue that HAD they known of these prior conditions, they may not have offered you insurance cover. The result is usually a rejection on the grounds of "non-disclosure".

So accurate disclosure here they advise - ensures that any mortgage policy that is set up is 100% 💯 fit for your needs. Importantly it will correctly cover you IF the worst were to happen and so you or your dependants needed to make a valid claim.

MSE says that the most likely things you will need to disclose when getting a quote for any Mortgage Insurance Protection policy will include;

- Age

- Smoker status

- Occupation

- BMI

- Health history both Personal / Family

- Lifestyle

The Insurers will then uses this information to help determine whether it will cover you firstly - and then an appropriate monthly premium.

We would then add this could adjusted to non-standard IF you have any adverse personal or family health disclosures or say you ride motorbikes, scooters etc;

Martin remarks also that it's very unlikely you would be covered for health problems you knew you had before you took out the insurance.

All previous medical complaints plus doctors' recommendations (including visits) must be disclosed, even if they seem unrelated Martin says. We would add each Insurers stance maybe different here regarding insurance risks.

If a policy does cover any existing medical conditions, this could make it cost more they comment PLUS there may also be extra conditions attached to the policy. Your insurer should make this clear to you before you buy it they point out.

We would agree with MSE - that if you are initially comparing quotes yourself via our own comparison broker site for example, you will only usually answer a few basic questions to see those initial standard prices.

BUT you will then have to disclose much more detailed information if you then go through to any insurers to apply (which could affect the price/the decision to insure you).

As each insurer has its own rules on pre-existing medical conditions, if you've a complicated medical history, Martin Lewis agrees it's worth getting advice before you buy via a broker.

This is helpful to us because Martin remarks we tend to know as brokers - which Providers may cover your condition(s), and also at those best rates.

For example, you have actually just been declined or 'health rated' your mortgage protection by a single Insurer eg; you are on weight loss injections + see those jabs are a lifestyle choice.

The question is, did you just initially approach that 1 single Insurer via say your Lender / Insurer / Estate Agents or Supermarket?

You maybe then thinking, are there any mortgage protection insurance products with no medical exam required or with guaranteed acceptance.

If so, then perhaps the better approach MoneySavingExpert often recommends is best seek >> specialist broker advice.

Joint Mortgage Protection Insurance vs 2 Singles?

3] Joint 1'st Death Policy = OR 2 x Singles?

Martin Lewis says Mortgage Protection Insurance policies can either be taken out to cover just you ie; single policy OR both yourself & your partner ie; joint policy.

A joint mortgage protection policy is often cheaper MSE points out BUT it only provides one payout (usually on the death of the 1'st policyholder) Or if it's critical illness (upon the 1'st to claim) when the cover then stops.

Martin remarks this is usually best suited if your partner is your only dependant AND you would have no one else to leave a 2'nd payout to.

Taking out 2 x single policies he comments is usually the more expensive option, but here you would get two payouts if you were both to die during each policy term.

Equally it covers you personally, so works independently to whether you are still together with your partner or not.

We say, you would have to decide for a joint mortgage if you then feel 2 x seperate decreasing mortgage protection insurance plans best suits your situation.

For example, if one partner died the other can repay their mortgage - but would then be left with a decreasing mortgage plan, which you could feel isn't a suitable option here?

However, MSE caveats that if you had a joint policy and were to later split with your partner, THEN you would need a new single policy, and this could be more expensive because it would be based on your older age and health.

We would add here that - many UK Insurers do allow a free seperation option - allowing parties to have new protection cover & some without health underwriting restrictions (subject to their T&C's).

4] Ditch & Switch Savings? = BUT Not Always Possible

On average MSE points out that Life insurance usually gets more expensive as you get older (so savings aren't always possible here).

The fact you're older, or if you've had health conditions since you got the policy, can mean new Mortgage Protection Insurance policies are more expensive than the one you have.

Yet Martin advises that there is no harm getting a quote, especially if any of the following 3 situations applies ie; your circumstances have changed:-

- You've Quit Smoking OR you no longer have a Risky Job:

MSE confirms that Non-Smokers pay a lot less than smokers, because they are a lot less likely to die during the mortgage insurance term.

BUT to count as a non-smoker for insurance purposes, you will need to have been genuinely nicotine-free or vape free etc; for at least 1 year.

We would then add that entitles you to get ex-smoker rates - and in some cases then up to five years before full non-smoker rates (so he says always check).

- You've Remortgaged / Changed Properties = Don't need as much Cover:

MSE gives the example that If you took out a Mortgage Protection policy to cover a £200,000 mortgage BUT have since either moved home, paid a lump sum off your mortgage or remortgaged AND you now owe much less than you were expecting, you could possibly find a new mortgage insurance policy covering the amount you now owe is cheaper - yet still meets your needs (and your new insurance cover will be for a shorter time period, which they say will help too).

We would add - that often you could just go back to the Insurers & request they either reduce the original cover or term - if you believe you don't need what you originally had no longer meets your needs.

This assumes your health has not changed interim meaning for example you had a critical illness + you could still be entitled to claim on your existing Mortgage Protection plan - even though you've paid off some or all of your mortgage. Check Insurers T&C's.

- Critical Illness vs Terminal Illness = Beware NOT the same:

Your existing Mortgage Protection includes 'Critical illness' benefit, which sounds the same as 'Terminal illness' benefit AND that plan is expensive .

As brokers we have seen people look online & see much cheaper premiums for a policy mentioning terminal illness, SO assume this has the same meaning. Therefore go ahead and cancel the old critical illness plan.

Only upon being diagnosed with a cancer, heart attack, MS or stroke - Do sadly find out that their old critical illness mortgage protection paperwork shows may then have actually paid out.

Your new plan may only payout if you are diagnosed terminally ill ie; have less than 12 months to live, so you receive no payment. Martin Lewis says these 2 benefits are not the same.

We note: Critical Illness mortgage protection is on average more than 4 x the price of Mortgage Life insurance with Terminal illness (usually included for free).

- Can I Cancel my Mortgage Protection Insurance?

If you are thinking how long do you need mortgage insurance and at what point do you no longer need mortgage insurance?

Well firstly, there is no UK laws that say its compulsory that you must have protection insurance on your mortgage as MSE points out (unlike some other types of insurance). Naturally, if you've repaid all your mortgage is one option.

Secondly as brokers, you might find that some mortgage providers require you to take it out (this is a rare scenario nowadays). But if you cancel it in this instance, then legally the lenders should be made aware.

Alternatively - If you've moved house & now need more cover (we say you could check your plan T&C's) if the Insurers have a guaranteed insurability benefit that may allow you without medical checks to increase your existing mortgage insurance protection.

But if this is not feasible or you now need it over a longer term - then as brokers we suggest you don't cancel anything until a suitable new mortgage protection plan is in place.

As Martin Lewis recommends if unsure eg; cancelling a mortgage critical illness cover - then best seek >> specialist broker advice.

5] A Policy direct via Lender / Insurer / Estate Agent? = NO !

Martin says going direct via your Lender / Insurer / Estate Agents or Supermarket is often THE most costly way to buy protection for Mortgage with insurance cover ie; no shopping around.

OR again (as mentioned above) worth reviewing IF your health is better now or large unchanged AND you purchased it originally direct via any of these above routes.

- DON'T settle for the first bank or insurer 'direct deal' you come across (we say ignore their free gift insurance deals).

- Research Multiple Provider Quotes but via a Broker Only Deal

- MSE doesn't compare specifically mortgage protection insurance offerings, coverage or reputations.

- We say always look for those providers with a strong track record

- Often people nowadays also check positive reviews from say Trustpilot, Feefo or Defacto ratings

- Best get advice if you have any pre-existing medical or family history

Note: He also points if buying any of these mortgage protection products but via a mortgage broker Martin Lewis remarks be aware MSE says this may also NOT be the cheapest route.

He comments that they may only deal with a more limited panel of Insurers OR even just one, So consider using a life insurance broker instead.

They also would add - don't be pressured into the Hard Sell by your Estate Agents to use their own adviser for mortgage insurance or indeed getting a mortgage.

Martin Lewis says Use a Broker for Best Deals for Mortgage Protection Cover & always Seek Professional Advice if you're unsure. Never just go Direct!

Average Mortgage Protection Costs Less via Broker vs Direct?

MSE: What's the average Mortgage Protection Insurance cost?

In answer to this question, the average mortgage protection insurance costs Martin Lewis comments will be affected by 'how you purchase it'.

Martin says getting any mortgage protection policy offered direct to you by your mortgage provider 💯 100% can make a dent in your pocket during the term of your policy.

For example: they quoted how much mortgage payment protection insurance typical average deals Direct via Provider vs Broker = around 50 -75% more expensive.

These direct only deals are often heavily inflated prices they say and you are under no obligation to take it.

Any mortgage protection insurance policy is completely separate from your mortgage agreement and lender. So always remember...

Their MSE 'rule of thumb' is in general, you'll often find those cheapest quotes by going via a broker ie; Never Direct via your Lender / Insurer / Estate Agents or Supermarket.

Yet unlike other insurances – such as car or home, the cheapest mortgage protection insurance prices are also NOT usually on those standard comparison sites.

- Usually best if you know exactly what you want

- Don't need those Mortgage with insurance policies explaining

- Want the absolute cheapest price

- Have medical conditions

- Not sure what kind of Mortgage with Insurance policy you need

- You want to speak to an expert

MSE give examples of various brokers you could access here - which we noticed seems to change over time and they may receive a referral payment fee for.

If they're advising you, they comment that you they will need to do a full check on both your financial and medical circumstances plus insurance needs before suggesting policies to you.

OR they're just giving you information about policies or answering your questions, that's fine, BUT here you shouldn't be pressured in to taking one policy over another.

Again the MoneySavingExpert says don't be pressured into any Hard Sell Tactics via your Estate Agents - to use their own in house advisers.

MSE Tips: Best Mortgage Protection Providers?

Money Saving Expert have given various financial hints & tips to help you find the best Mortgage with Insurance Protection key features for your needs.

So here are our Broker - *Top 15 Providers for Mortgage Insurance Protection:

- Aviva

- British Friendly

- Cirencester Friendly

- Exeter Friendly

- Guardian

- Holloway Friendly

- Legal & General

- LV=

- Met Life

- Royal London

- Scottish Widows

- Shepherds Friendly

- Vitality Life

- Wessex

- Zurich

*Those Insurers mortgage protection products may all vary from cheaper budget, or reviewable age-costed vs guaranteed, upto comprehensive full cover in claim.

Mortgage Critical Illness Insurance plans in the UK marketplace can also vary dramatically as discussed between - some Insurers just covering 4 main critical illness conditions upto 100+ and part claims.

Note: All these Providers used may offer top mortgage protection insurance policies that are recommended for first-time buyers, those self employed or wish to cover unemployment or job loss.

Martin Lewis says please use a Broker for Best Deals on Mortgage Protection & if you're unsure on Mortgage Insurance Money Saving Expert says always Seek Professional Advice;

MSE: Mortgage Protection vs Life Insurance?

MoneySavingExpert Martin's money tips - says life insurance is something every parent, partner, or person with any other type of financial dependant should need to consider.

If anybody is reliant upon your income and would struggle without you around - A suitable insurance protection policy can be a cheap way to ensure they have a financial lifeline when you are gone, were perhaps critically ill or had an accident or long term illness.

Ultimately, they concur that you don't need to have any cover - so you will need to weigh up whether that monthly cost is worth it for you:-

Here are MSE 10 x Top Tips to consider...

- Insure 10 x salary of the Main Breadwinner - MSE rule of thumb to protect your financial dependants

- Check if you've any cover via your employer – often a cost effective solution (though don't just rely on that)

- To help best calculate a figure - it's worth ensuring any life policy also covers...

- Any outstanding debts that need to be repaid (including mortgage &/or loan debt protection)

- Immediate outgoings - dependants would need to pay

- Future spending eg; ongoing bills / kids' university costs

- Upfront death expenses ie; funeral costs

- A Family policy should last until all kids are no longer reliant upon you/your partner

- Mortgage or Family Protection is not a legal requirement but most mortgage lenders insist instead that you do have Buildings Insurance in place - when you exchange contracts.

- If you don't have any dependants - you don't need life insurance?

You could take out either or both lump sum or income family protection plans - which MSE have reviewed several of those types.

*Write the Mortgage Protection in Trust?

Martin's top tip If taking out any type of protection insurance life policy is DON'T assume it will immediately or simply just go to your partner or loved ones if you died (perhaps if the mortgage is in joint names).

For example: If that sole mortgage protection life policy is not setup into a trust, it can still fall back into your estate eg; you held a joint mortgage so wish the benefits help repay it.

Simply put, the Insurers may have no legal direction from you whom to payout those proceeds to upon a claim, even if you've made a will.

It could still then be subject to probate delays and also inheritance tax (IHT) on the proceeds (currently 40%).

Most Insurers often provide standard life insurance trust forms for free to help avoid IHT, but again always seek professional advice for any complex personal legal & financial matters.

Some people also assume that if they have a life insurance in trust, they then don't need to also make a will.

These areas are all hot topics as discussed in MSE Forums and can all be a very expensive mistake and wrong.

*Mortgage Protection Credit Risks & Debts?

One of the benefits of these protection plans is they can also all potentially help & protect your credit file risks and to ensure it remains in good shape.

As brokers, we have often seen people advise us they had an accident, illness or made redundant several years back and had no insurance back-up plan.

Once they have get back on their feet again - Now they find they've ended up with additional £1,000's of debt and a poor credit file.

So, if you do or don't have mortgage protection Martin says - maybe you can claim Support for Mortgage Interest (SMI)?

He points out here, that some people now onto benefits are eligible for government help with their mortgage payments.

Turning to another point - Martin points out it's often commonly said that "when you die, all your debts die with you". But as he says, it can be a basic misconception for many, so it can be a little more tricky than that.

If your wife or partner are JOINTLY responsible for any debts (eg, a joint mortgage or secured loan), they'll have to make up the shortfall and become responsible for the WHOLE amount.

However, if you owed more than your assets are worth, your debts do die with you (ie; your beneficiaries will get nowt, they may lose everything including their home but they won't be asked to pay the rest of the debt).

Alternatively, if you owed less than your assets are worth, anything you owed has to be paid off first - before any assets can go to your beneficiaries.

These issues are all compounded if you have not made a will or getting divorced.

The bereavement advice centre is useful source of help they also point out.

MSE: Mortgage Arrears & Policy Changes?

The type of support a lender might offer you Martin says IF you are struggling with your mortgage payments - will all normally be dependant on your own particular circumstances and how much you're able to repay.

Therefore - MSE says you might need to provide your lender a full breakdown of your incomings and outgoings in order to establish this.

- Reducing your repayments: Payments Reduced lower from their usual monthly amounts = for a limited period of time.

- Taking a break from repayments: No Payments = will reduce to zero for a limited time.

- Switching temporarily to an Interest-only mortgage: Lower Payments made = But you are no longer paying off the actual loan itself, just the interest that is accruing.

- Extending the mortgage term: Payments lower = by lengthening the term eg; 25 upto 30 years ie; spreading your debts over a longer period.

However, for all mortgage protection purposes each action above Money Saving Expert comments may now potentially affect the existing mortgage insurance policy terms and/or effectiveness - and so may now all need to be reviewed.

For example; The existing decreasing mortgage lifecover is now perhaps insuring either/both:-

- The wrong mortgage term period?

- And/or also now insuring...

- The wrong mortgage amounts?

Martin Lewis as always says if you're unsure on what's best - then always Seek Professional Advice:-

Note: MSE strongly comments; Don't think that mortgage lenders are sitting there, licking their lips, waiting for the earliest opportunity to repossess your home.

Far from it – repossession is NOT in any lender's best interests Martin comments, in fact it's normally a last resort for them.

Importantly - Don't let the fear of repossession stop you from keeping in contact with your mortgage lender

ie; Even with or without mortgage protection insurance you should advise them of your situation.

MSE: Insurers Complaints?

The Money Saving Expert Martin Lewis is always about helping to look after consumers and their insurance rights. As FCA fully regulated brokers we also understand the importance of this.

In their various insurance guides, they usually finish off with information about how to complain if you have a problem with either your mortgage protection insurances and some things to look out for.

Firstly if your provider goes bust, the Financial Services Compensation Scheme (FSCS) will try to find another insurer to take over your policy or issue a substitute one.

They also remark, the insurance industry does not always have the best reputation sometimes for their customer services. Plus, while some UK Life Insurers may be good for some people, it can also be hell for others.

So if complaining about any mortgage insurance money saving expert MSE suggests common problems may include claims either not being paid out on time or at all, unfair charges, or exclusions being hidden away in the small print.

Should you have to unfortunately complain, Money Saving Expert contends it is always worth trying to call your provider first. However if not, then you can use their free complaints tool Resolver.

Their tool helps you manage your complaint if you had one on say life and mortgage protection insurance, and if the insurers does not play ball, it also then helps you escalate your complaint to the free Financial Ombudsman Service.

Who's Martin Lewis Money Saving Expert?

Background: Who is the highly respected Martin Lewis OBE & CBE? Well he is a very successful Financial Reporter & Money Expert, and the founder of the well known UK consumer website Money Saving Expert.

He also has his own current affairs TV Money Show on ITV. This was all initially broadcast after all the London Olympics back in autumn 2012.

Martin Lewis is now often seen on TV or Podcast commenting on current financial matters & affairs. Or daytime TV like This Morning Martin Lewis being the popular go to person for sound advice.

In 2012, his popular Money Saving Expert website was also sold to The Money Supermarket.Com group for reportedly around £87 million.

Since 2015, Martin Lewis remains executive chairman and in these challenging 2020's - all round UK Consumer Champion & Finance Guru.

*Is Martin Lewis a Mortgage Protection Advisor?

Some people may ask, is Martin Lewis a qualified mortgage protection adviser?

The short answer is "No he isn't" but naturally many people still look to the Martin Lewis website Money Saving Expert for their best overall advice.

Interestingly also, it seems in today's world many people turn to Martin Lewis on financial advice & more so than any real IFA.

Importantly, he often stresses that the various information MSE provides over a range of money related subjects like mortgage protection insurance, money saving expert is not giving fully any regulated financial advice.

However, his undoubted success today in 2026 hides a very sad story from his past, which he emotionally & honestly explains further in this BBC Podcast.

Important Note: This overview on Mortgage Protection Insurance re Martin Lewis the Money Saving Expert blog is not a scam fake advert re Martin Lewis recommending our own mortgage protection broker services (which he doesn't).

Martin Lewis - Sad Personal Family Story

Martin Lewis sadly told of his own life story whereby at only aged 11 - he unfortunately lost his late Mother Susan Lewis, in a tragic road accident.

What happened to Martin Lewis as a Child then reportedly left him emotionally unable to sometimes even leave his own house - for upto 6 years (Times Newspaper Article).

Except for going to school, this emotional impact from this personal accident tragically left him he said looking back with both extreme anxiety & trauma.

As such, Martin Lewis illness mentally as a teenager back then & during some darker days says he sometimes “struggled to even get out of bed”.

The tragedy on the longer term impact of someone losing a parent so young into their lives, whether this be financial, psychological or both.

A very similar background history happened in our family.

Over 120 newly bereaved children daily - lose a parent before they grow up *UK Child

Over 120 newly bereaved children daily - lose a parent before they grow up *UK Child

Except for going to school, the emotional impact left him he said with both extreme anxiety & trauma.

As such, he may be able to speak now with authority around the subject of the impact of losing a parent so young - being a parent himself.

Today he says 'Financial problems and mental health issues are locked together — it’s about time treatments were linked too', urges Money and Mental Health Policy Institute & its chair founder Martin Lewis.

This then means that he can also speak now with some authority around the subject of mental health & where he also explores the link with money management.

Martin says that discussing life insurance is a painful subject to raise to all parents the chance they'll die - especially whilst their little ones are still little.

Yet, he says whenever reviewing this topic again on mse mail that he's always steeling himself (having personally gone through this trauma - as indeed our wider family sadly also have).

MSE remarks that the bitter taste of even discussing this nightmare scenario - is nothing compared to the scarring financial impact of not having reviewed it, if the worst should happen.

Martin points outright exactly as it is...Would there be enough money to pay those bills, or would financial misery be heaped on top of the grief?

Therefore, whenever he discusses this difficult & emotional topic himself, he has to take a deep breath, usually saying "Let's be Blunt and Practical"...

Martin Lewis like my own family, grew up originally within the Manchester area.

Around a similar age then to Martin, my Uncle was also sadly killed in a tragic road accident. This then left my young devastated widowed Auntie with 3 young children to care for both emotionally & financially.

I remember my own Mother in tears on the phone back then as her younger sister telephoned her in the early hours to explain her terrible family news.

I woke up to hear my Mum crying. I was listening upstairs and looking through the banisters in confusion as Mum cried & cried. She just said 'Martyn go back to sleep and don’t worry'.

My Mum at that time, like all family would naturally do, asked her “is there anything I can do to help?”

Once reality settles in, the effects to the whole wider family unit are both highly psychologically stressful but then ultimately also become financial.

Unfortunately & all too often, only then once the worst has happened do more practical questions get asked, rather than the obligatory ‘When is his Funeral?’.

For my young and traumatised Auntie then it was more like - "What does a Funeral cost?" "Do we have Mortgage Protection?" "Do we have Life Insurance?" "Is there a Will?"

In today’s uncertain world, more and more people are seeking professional advice from people like Martin Lewis on the Best Mortgage Protection advice or similar financial answers to their questions.

Martin Lewis Mortgage Protection Insurance Guide: Conclusion

As brokers, we found those various Mortgage Protection Insurance Martin Lewis Money Saving Expert summaries very good, with their various informative and useful hints & tips.

However, we say remember that their MSE website aim is to help save you money BUT then nobody knows if something does happen, what impact (& for how long) that can have on your mortgage finances & bills.

To sum Martin Lewis view on Mortgage Protection Is It Worth It? Here are some of MSE 7 Top Reasons to help consider:-

- All depends on your situation - If your family relies on your income & they couldn’t make those payments alone, mortgage protection is recommended

- Pre-existing conditions may increase costs or be excluded - You must disclose all & everything to the Insurers or it could invalidate the plan

- Be-wary with policies sold Direct via Banks, Lenders, Insurers - As they have historically been poorer value & many use just one chosen Provider

- Avoids Mortgage Arrears - Plus helps protect your long term credit file

- Best broker deals on Mortgage Insurance Protection - Consider seperate schemes instead of bundled bank mortgage protection packages

- Use a FCA qualified Mortgage Protection Broker - If unsure to assess your needs and compare options

- Insurance Claim payout rates are high - we see as brokers that claims on mortgage protection life insurance are often around 98% for many UK Providers.

SO If you can afford it, our own thoughts aside from what does Martin Lewis recommend for mortgage protection, are ideally following these 3 principles:-

- Lump Sum > Repay Mortgage Loans, Debts, Funeral costs

- Income > Help cover your ongoing Mortgage, Bills & Expenses

- Lump Sum > Back up for Holidays, Education, Emergencies

How much can you afford to set aside each week in 2026 - to help protect the mortgage, family and loved ones if you died prematurely during the mortgage term, were critically ill, had an accident, illness or made redundant?

Ultimately though, re Martin Lewis comments on is 'it worth having mortgage protection insurance'? You pays your money and takes your choice of perhaps one or more mortgage protection product area combinations - with family cover alongside if this fits your situation.

Take care of yourself & Family and loved ones

Article on 'Martin Lewis on Mortgage Protection' Guide by Martyn Spencer Financial Adviser: 01/2026

For reassurance re health for men & women – we review best Insurers on UK Mortgage Protection (inc NI)

Martin Lewis on Protection Insurance ads & MSE Beware LIAR Fake Scam AI ads >

Martin Lewis is also a registered trade mark belonging to Martin S Lewis.

Important Note: This overview on Mortgage Protection Insurance Money Saving Expert blog is not a scam fake advert re Martin Lewis recommending our own broker services. As you may be aware he & MSE are fully impartial which means never putting his name or face / logo to anything. Yes, they mention individual products and services on their site, but they don't 'support' them. Any Martin Lewis Money video's or images shown may also have some out of date information on them - due to the ongoing cost of living crisis. Often these life insurance mortgage MoneySavingExpert articles may no longer be personally updated or written by Martin Lewis himself. MSE do state he oversees site content, especially the MSE weekly email. Naturally, although MSE is an independant website finance allows no advertising nor subscription, it may receive a revenue via 'affiliate links' to the top products or providers (which we aren't mentioned)

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'