Does Martin Lewis recommend Secured Loans?

MSE Review in: 01/2026

*5 Mins Read

Review: Calculate Secured Loans Martin Lewis Guide MSE

In this Martin Lewis Secured Loans Reviews & Money Saver Expert Guide we will look at these keys areas & more...🔸 Does Martin Lewis recommend secured loans v unsecured loans? 🔸 What other borrowing loan type options does he consider? 🔸 His Secured Loan MSE Top Tips & whom Best to Buy from...

What does Martin Lewis think of Secured Loans?

Looking to borrow against your property in 2026 - To perhaps cut the cost of existing payments or maybe after some additional funds?

Martin Lewis says taking out a Secured Loan is 💯 100% an option IF you're looking to either Consolidate Debts OR considering Home Improvements.

If so, in their various MSE Money Saving Expert best secured loans types review - they explain upfront their main Cons vs Pros (and Alternatives).

What's Martin Lewis say on Secured Loans popularity?

He says many people do tend to look at them because of 3 main things: They're often Easier to Get, Bigger Borrowing is Possible & You can often Borrow over a Longer Period.

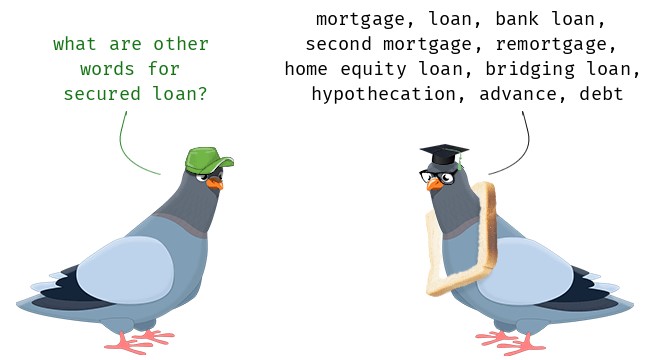

Indeed MSE remarks they are a bit like taking out a mortgage – because what is loan security, they’re often also known as 'second mortgages' or 'homeowner loans'.

Martin Lewis on HomeOwner Loan via Secured Loans Lenders

BUT Martin Lewis also reminds you that Secured Loans main characteristic warning means - you're putting up security for loans to borrow when taking out the finance ie; It's secured against your home.

The MoneySavingExpert points out, these loan finance types can for example help you manage your debts – but you need to be very careful and think clearly before taking one out.

MSE points out that you shouldn't get sucked in by their claims of "manageable payments" by those Secured Loans Lenders.

Yes, consolidating debts can reduce monthly repayments - but it does this by making you then borrow for longer periods, which he says can substantially increase the total interest then repaid.

So he explains therefore secured loans can give lenders more security when lending you the money, than if the borrowing was unsecured.

The most important thing to know upfront - as he reminds you cautiously is that secured meaning...what happens if you don't or can't pay back that homeowner loan on time?

Well, the bottom line is that the lender can repossess & sell your home to get back any money that's owed ie; their lending security.

Indeed as brokers we say that's exactly the same terms as having a main mortgage - but you could now have in essence 2 mortgages to repay.

He points out it is often far better to firstly consider various alternatives they layout in their guides - like making a budget & reduce your outgoings, remortgage, using savings, balance transfer, credit card shuffle or unsecured loan.

They remark that getting any secured loan is always an 'advised process' if this is still your chosen route.

So, this means you will need to speak with a Broker - who can help scan the marketplace for the cheapest deal.

Or, instead you've chosen to only go directly via one Lender - which they add may not be your optimal route, as you're not shopping around.

The adviser should also ideally tell you if there are more suitable finance solutions available for you (eg, a personal unsecured loan or maybe getting debt advice).

Money Saving Expert Secured Loans | Debts & Credit Cards

Martin Lewis on Secured Loans Meaning?

It seems that the cost of living crisis has not over time changed MSE meaning on this particular loan type - Instead maybe just their wording and overall advice guidelines.

Martin Lewis initially said ultimately IF you're 💯 100% determined to get Secured Loans...

*FOR Debts Consolidation ...Ideally if it means 'Paying Less for Your Debts' *FOR Home Improvements ...Then Ideally if it means 'Adding Value to Your Home'

Martin commented on the first point re debt consolidation, that your key aim should be to realistically cut the interest costs of your overall debt (whether that is on one loan or 22 of them) and then pay it all off as quickly as possible.

On that second point re home improvements, he says consider instead going down the Remortgage route as a cheaper option via your main mortgage lender, if you can.

However, they logically noted that IF you don't have a home to put up as security to back up the loan, you will not be eligible to get a 'homeowners loan'.

However as MSE states & for various reasons, secured loans Martin Lewis says that they can often be a more expensive form of borrowing, IF not dealt with properly.

In their 'Secured Loans Money Saving Expert' Martin Lewis guide overview, he therefore tries to give his usual balanced opinions on all pressing UK financial matters.

We explore more their strong thoughts and advice here further in their review, highlighting the Money Expert comments as to his main pointers & tips plus alternatives.

Martin Lewis on Secured Loans Alternatives?

If trying to cut the cost of existing debts - MSE offers up first various alternatives like...

- Use Savings

- Balance Transfers

- Credit Card Shuffle

- Unsecured Personal Loans

- Remortgage

- Budgeting to Reduce Outgoings

- Get Debt Advice

He offers these alternatives to consider firstly - before considering this particular type of personal borrowing.

Generally, unsecured personal loans in 2026 are available upto £25,000 (or maybe upto £50,000 for some existing bank loan customers).

As you can pay back secured loans often over longer terms, this means your initial monthly repayments can be lower than with other forms of credit he points out.

Also, they do come with the additional risks of being secured usually against your main home or property by using the equity or collateral available.

Therefore, the risks of losing your home like a main mortgage (as they are a 'secured' loan v 'unsecured' loan Martin Lewis points out).

MoneySavingExpert points out it's worth knowing that IF you're still ![]() '99.9% looking for a secured loan' MSE advises you almost always need to 'SPEAK TO A SECURED LOANS BROKER'... Someone who'll best match you with Secured Lenders who may try to help you.

'99.9% looking for a secured loan' MSE advises you almost always need to 'SPEAK TO A SECURED LOANS BROKER'... Someone who'll best match you with Secured Lenders who may try to help you.

He acknowledges you don't need a perfect credit score to get one. You can usually borrow more & for longer periods than a unsecured personal loan.

He comments that those considering secured loans against their property just for say new borrowing vanity purchases, should simply NOT do it.

So instead Martin focuses on 2 main reasons WHY you may wish to get a secured loan:-

Secured loans may only fit - if those alternatives he's suggested so far don't work for your situation.

*Loans for Debt Consolidation

On the first point about Debt Consolidation Loans - MSE rightly says only take one out IF it then means you're paying less interest costs on your hefty debts.

Then he comments to get rid ASAP ie; pay off those high interest rate loans & credit cards etc; Noting, the secured loan lender usually pays off your cards or loans directly.

For some people, these can be useful tools for both managing and re-organising your debts. Whereby it's now all just in one place but the lenders now have security for their loan protection.

Therefore, you know exactly how much you owe, what your monthly payments & the interest rates are. BUT he says avoid borrowing again - otherwise your situation could be worse financially.

Please contact us >> Best Broker Deal Loans >> Debt Consolidation

Secured Loans for Debt Consolidation?

*Loans for Home Improvement

On the second point on Home Improvement Loans - MSE sensibly remarks IF this means it 'Adds Value to Your Home' ie; typically a new kitchen, bathroom or conversion. Or maybe due to accessibility modifications.

Martin says it can be an effective way to budget for those big projects you can't afford to pay for in full up-front towards your renovation dreams. However he says plan wisely, carefully budget and plan your borrowing & not to 'spend willy-nilly'.

To sum so far Martin Lewis says secured loans are definitely an option for some (provided you manage the loan correctly & have looked at those alternatives) - but it's one not to be taken lightly he remarks.

Please contact us >> Best Broker Deal Loans >> Home Improvements

Given those circumstances as he has pointed out - people do take them out because :-

- They are easier to get than unsecured loans

- Don't need a perfect credit score to get one

- Higher borrowing is possible

- Reduces your monthly repayments

- But it does this by making you borrow for longer

- Interest rates maybe cheaper on secured vs unsecured loan

So for Best Homeowner Loans Martin Lewis comments that there are 2 main ways to apply:-

- Via a Secured Loans Broker (who can shop around the market for your best deals & access broker only rates)

- Directly via the Lender only

Because getting a secured loan is always an advised process, he points out you will need to therefore speak with either a broker or that lender’s mortgage adviser - before you get the loan anyway. MSE give you suggestions here finding to consider.

The MoneySavingExpert doesn't go into other reasons for say business borrowing or other assets which you may own for the lender to then use as security for a home loan eg; secured against cars, jewellery etc;

So taking out a secured loan he says is rarely a good 1'st move (consider those alternatives) - especially if you don't need to borrow larger amounts than required.

As a general rule, MSE points out that you can borrow larger amounts via Secured Loans in UK - if you secure the loan against your home than you can with a personal unsecured loan - Because it's less risky for the secured personal loan lenders.

MSE rule of thumb suggests that those with reasonable credit scores should firstly look at those alternatives - maybe consider an unsecured personal loan, cheaper credit card deals, even extending their mortgage advance or a remortgage instead.

As finance brokers, we respect their view here re the 'money saving expert secured loan' comments & why they can be useful for some people or those who may wish to have access to that larger borrowing amount.

Those people who for whatever reason can't easily remortgage or get a further advance - finance areas which they explain further in their MSE Secured Loan Top Tips.

Martin Lewis Best Secured Loans Tip in 2026 then here is...Do not get sucked in by their claims of 'manageable payments'.

He clearly belies the fact that some Loan Providers may encourage you to consolidate all your debts. They tempt you with their promises of 'one manageable monthly payment'.

Although this type of secured finance maybe available, Martin Lewis comments they should only be considered the lending of last resort for approval to cover any family debts.

In short, as the ever practical money saving website upfront advises and feedback from MSE forums... that for some people they are a financial nightmare and should best avoided. So as mentioned, MSE always says first explores your financial alternatives before considering them.

He says that 'yes' consolidating can reduce your monthly repayments...BUT it does this by usually making you borrow for longer, which can substantially increase the total interest repaid.

As brokers we would add that given the ongoing cost of living crisis, plus interest rate rises, many people are having to now also take their main domestic mortgages out over a longer period ie; which can also increase the overall interest repaid. This aspect is not commented on in their review.

So, in their Money Saving Expert secured loans review 2026, they initially focused their guide instead on helping you to find some cheaper borrowing alternatives rather than shifting debts to your mortgage.

If researching 'Martin Lewis loans for bad credit' advice instead, MoneySavingExpert rightly says - maybe consider first seeking help if in debt.

Likewise MSE warns strongly that however bad things might seem to get - ALWAYS avoid using a loan shark as an alternative loan source.

MoneySavingExpert points out that they are unlicensed, may break the law and often go knocking door-to-door.

Then at worst they may use horrific methods to get their money repaid ie; including violence, threats of violence against the borrower, their family or children.

Secured Loans are therefore only useful in more limited circumstances, and which they go onto explore in their Money Saving Expert secured loans review.

In terms of the large range of Secured Loan products available, Money Saving Expert are fully impartial with all their best buy reviews. As you maybe aware, neither Martin nor MSE never endorse products.

Note: Yes, they mention individual products & services on MSE site, but they make it very clear don't 'support' them.

Therefore to also make it clear, this is our own independant broker review on MSE Martin Lewis' Guide to Secured Loans. With our own professional FCA Regulated Advisers commenting on aspects of their overall review.

As many people respect & follow their Money Saving Expert opinions, they always say if sure (or unsure & need advice) you speak to a qualified Broker.

'Martin Lewis Loans' Secured Review

Money Saving Expert Martin Lewis on Loans - Review

Background: Who is Martin Lewis OBE & CBE? He is one the UK's most respected Financial Experts and a successful Reporter. Martin Lewis is also the well known founder of the online website Money Saving Expert (MSE), of which he remains executive chairman.

Martin Lewis is often seen on TV also as he has his own regular current affairs TV Money Show, usually on ITV. These shows may include money savings expert Martin Lewis Secured Loans advice and other Finance aspects, were all initially broadcast after the London Olympics back in 2012.

Martin Lewis is now often seen or heard on his Podcast commenting on all different UK and world current financial matters. Or appearing on daytime TV, Martin Lewis Money advice on This Morning is often watched, being the popular go to person for sound financial advice.

In 2012, his popular Money Saving Expert (MSE) website was reportedly also sold to The Money Supermarket.Com group for £87 million.

*Is Martin Lewis a Financial Advisor also?

Having been seen regularly on our TV's for many years now - Some people may also ask, is the Martin Lewis also a fully qualified finance adviser? The short answer is that 'No he isn't'.

But interestingly, many people often do turn to Martin's overall advice more than a real finance expert.

However, he often does stress the various information he provides is not fully regulated financial advice.

Martin Lewis in these challenging 2020’s is therefore our all round UK Consumer Champion for his respected finance opinions.

However, his undoubted success today in 2026 hides a very sad story from his past, which he emotionally & honestly explains further in this BBC Podcast.

*Martin Lewis - What happened to him as a Child?

Martin Lewis as mentioned above sadly told of his own life story, where at only aged 11 he unfortunately lost his late Mother Susan Lewis, in a tragic road accident.

What happened to Martin Lewis as a Child then reportedly left him emotionally unable to sometimes leave his own house - for upto 6 years (Times Newspaper Article).

Except for going to school, this emotional impact left him he said looking back with both extreme anxiety & trauma.

As such, Martin Lewis illness mentally as a teenager back then & during some darker days says he sometimes “struggled to even get out of bed”.

The tragedy on the longer term impact of someone losing a parent so young into their lives, whether this be financial, psychological or both. A very similar background history happened in our family.

As such today he points out 'Financial problems and mental health issues are often locked together — it’s about time treatments were linked too', urges Money and Mental Health Policy Institute & its chair founder Martin Lewis.

This then means that he can also speak now with some authority around the subject of mental health & where he also explores the link with finances and money management.

Some of these Martin Lewis' Money Management books shown below are all therefore well worth a read, especially in this ongoing cost of living crisis.

Important Note: This overview on MoneySavingExpert Martin Lewis on Secured Loans is not a scam fake advert re Martin Lewis recommending our own broker services (which they don't). As you may be aware he & MSE are impartial. Therefore he does not endorse any particular products & services. Any 'loans Martin Lewis' Money video's shown may have some out of date information on them - due to the ongoing cost of living crisis. Often these secured loans MoneySavingExpert articles may no longer be personally updated or written by Martin Lewis himself. MSE do state he oversees site content, especially the MSE weekly email. Naturally, although MSE is an independant website finance allows no advertising nor subscription, it may receive a revenue via 'affiliate links' to the top products (which we aren't mentioned)

Let us now have a look at MSE and more key questions & answers as to What is Martin Lewis advice on Secured Loans?

Martin Lewis Credit Score Advice & Tips

What are Secured Loans Martin Lewis asks?

A secured loan or second-charge mortgage is a loan only available to property owners (or mortgage holders) - whereby you put up some kind of security (usually your own home) to enable you to then take out the finance against its equity.

This is why they are also often known as home owner loans. As brokers, we may also call it a second mortgage or 2nd charge loan.

Note: MSE points out that if you do not already therefore have a home to put up as 'security' to back this type of secured loan, then you will not be eligible to get one.

The word SECURITY sounds good, Martin has remarked? However, secured loans give the lender this security (not you). He says it is far better to take a normal unsecured personal loan if you can, rather than one secured against your property.

MSE clearly points out that the most important thing to know is ....what happens if you do not or cannot pay the secured loan back on time?

You get the opposite of security MSE advises, as IF you have problems paying back, the lender can repossess your home to get its money back if you can't repay.

Bottom line is here, Martin Lewis Secured Loans advice is that your provider could then apply for a court order to forcibly sell your home to get back any money it is owed.

MSE doesn't mention that this would be the same case anyway if you already had a mortgage Martin Lewis could have said in essence the risk wordings are similar ie; Your property may be repossessed if you do not keep up repayments on your mortgage or any other debts secured on it.

As brokers, we would also comment that any forms of secured or unsecured borrowing has its risks, which Money Saving Expert second mortgage & forums don't state in their review.

If you defaulted on any unsecured credit cards or loans, then firstly your credit score can be damaged. As such, it would then become more difficult for you to borrow again in the future.

Moreover, those secured personal loan lenders may then take legal support to make you pay them back if badly in arrears. You may then receive a County Court Judgement (CCJ), a hot topic discussed in MSE forums, asking you to legally repay the lender.

Worst case scenario is... with any legally unpaid borrowings, you could now be made bankrupt above £5,000 anyway. Watch Martin Lewis credit score advice re his ditch the debt - credit cards video

Unsure here, then Please contact us about Homeowner Loans >

Martin Lewis on Money and Mental Health

Why would you want a Secured Loan Martin Lewis asks?

MSE you may have gathered from their secured loans review so far, they think should anyone want or get one of these loan types then consider alternatives firstly.

Martin Lewis says Secured Loans isn't something to be taken lightly. However, MSE say people do get them for several reasons because:

- They are easier to get than unsecured loans (Secured loan lenders maybe easier to borrow from with security if you have poor credit)

- Higher borrowing is possible (Max unsecured loan maybe £25,000 > £50,000 but secured loans £50,000 > £100,000+ all subject to loan to value)

- You may borrow over longer periods (Secured lenders prefer loans to last longer to help offset their hefty set-up costs, usually from 5>20 years+)

MSE re-states that consolidating via secured loans can reduce monthly repayments...but it does this by often making you borrow for longer periods, which can substantially increase the total interest you repay.

This means secured loan lenders can offer lower monthly payments. This maybe especially tempting for those already struggling with loan & credit card repayments. However, they point out the impact on your finances of this by giving an example of borrowing £10,000 at 10% (see below chart)

To make the borrowing points they make clearer than MSE have, we have as secured loan brokers also increased the impact clarity of borrowing over 15 years & 25 years. This shows you both the lower monthly payments v higher total interest costs v loan term periods.

Those secured personal loan lenders that do offer loans with longer terms, typically is because the loan amount is very high ie; to assist regular affordability like a main mortgage.

This is why MSE points out contrary to their glossy TV ads, secured loans are not an easy option for those with heavy debts. Your home is not something to gamble with - as they rightly point out.

We would also point out that their secured loans article review is regularly updated re say the ongoing cost of living crisis.

This means that perhaps more people were looking to see what Martin Lewis says about secured loans re all their finance options. Please contact us about Finance >

The effect of longer borrowing on total interest: £10,000 loan at 10%

| Loan Term | Monthly repayments | Total repayment | Total interest costs |

| 5 years | *£212pm | £12,720 | £2,720 |

| 10 years | *£132pm | £15,840 | £5,840 |

| 15 years | *£104pm | £18,871 | £8,871 |

| 20 years | *£96pm | £23,040 | £13,040 |

| 25 years | *£87pm | £26,354 | £16,354 |

'Martin Lewis Loans' Guide

MSE on Secured Personal Loan vs Unsecured?

Most 'un-secured loans' are high street lender personal loans. MSE says confusingly or annoyingly, that sounds like a bad thing. However, as Martin Lewis Money Saving Expert on Loans states...it is not.

The alternative to personal unsecured loans are secured loans...and the kind you more often see advertised on TV as consolidation loans. Here is how they compare:

| Loans 'Key Facts' | Secured Home Loan | Personal Unsecured Loan |

| Is your Home Safe IF you can't make repayments? | X | |

| Are Rates fixed so you know What you'll pay monthly? | Often Variable? | |

| Are Terms commonly 5 years or less? | X |

Alternatives to try before you take out a Secured Loan?

MSE Tips & Alternatives to consider - than a secured loan...

- Using any Savings (Savings Interest often < less than Borrowing Interest. So repaying debts with savings makes sense. They disagree with traditional "emergency cash fund" logic)

- Do a Balance Transfer (Cut the debt costs by transferring your debt to a new credit card which charges 0% interest)

- Credit Card Shuffle (Many cards allow existing customers to move other debts to them at special rates. Credit card balance shifts & prioritize repaying expensive debts first = substantial savings)

- Unsecured Personal Loans (Cheaper & less risky 'for those who can get them'. You may use them like a secured loan to pay off other credit)

- Further Advance (Don't assume your lender will automatically let you add debts accrued onto your further advance mortgage request)

- Remortgage (Warning: Don't ditch a good product with early repayment costs just to get additional borrowing. Check your sums carefully to ensure a Remortgage is the best move for you)

Use their Money Saving Expert Loan Eligibility Calculator which they says uses a ‘soft search’ to find your acceptance chances. As such, unlike applying MSE advises it doesn’t impact your credit score.

They will then show you usually unsecured loans offered via their Providers direct via Moneysupermarket.com.

Money Saving Expert Loan Eligibility & Debts

In a Debt crisis? Don't Borrow more...Martin Lewis says instead seek & consider getting some FREE Debt help.

These 4 options above can help you MSE comments ...but they are not right for everybody. So they ask instead - 3 key questions that are worth questioning yourself and about your own debts...

- Do you struggle monthly to meet payments (minimum monthly repayments)

- Does your total debt exceed one years' salary (excluding mortgages & student loans)

- Do you have sleepless nights or depression / anxiety (over your personal debts)

If you have said YES to any of these 3 key questions, Martin Lewis categorically advises - then Do Not Borrow Anymore via new finance (and especially not on a secured loan).

Instead get some free, one-to-one debt counselling help from say National Debtline | Citizens Advice | or StepChange. And if you need emotional support, instead try CAP.

As Finance Brokers we would say & see that over the last few years, many ordinary people have had their finances battered due to say Brexit, Pandemic, Cost of Living crisis, Russia Ukraine war etc;

Martin Lewis points out that all these people are there to help & counsel you ....not judge you.

Martin Lewis Money Saving Expert Secured Loan & Other Debt Problems

Need additional borrowing?

Instead of borrowing more via secured loans against property Money Saving Expert suggests firstly consider...

- Budget & Reduce your Outgoings (Do Money Makeover to check up your spending & Budget Planning. Big savings are possible. Use income freed up - instead of borrowing)

- Check if you can get a Personal loan (cheaper & less risky than secured loans for those who can get them loan for additional borrowing)

- Remortgage (Home improvements eg; extension or new kitchen. Borrow via your existing mortgage, or remortgage to a cheaper deal are valid options, as rates are usually much cheaper than those on secured loans)

If you are intent on borrowing for any other reasons, Money Saving Expert says DON'T secure any borrowing on your home - whether on a mortgage or a secured loan.

ie; you do not repay, you could potentially lose your home. ...so it is always better to get a personal loan (if you can) he suggests.

We would also add as brokers that sometimes you maybe be unable or not wish to remortgage eg; locked into a good fixed long term interest rate or have high exit penalties.

But he doesn't ask, what happens if you do want to borrow more?

Please contact us about best Secured Loan Finance >

'Martin Lewis Best Secured Loans' TOP TIPS

Martin Lewis advice on finding best Secured Loans deals?

MSE do explain how to find a cheap deal, various pro's & cons, if a secured loan is still your chosen option. Plus Martin Lewis best secured loans tips, typical FAQ & alternatives.

If you are still determined to get a secured loan Martin Lewis - then maybe only do it to Consolidate Debts OR Home Improvements ie; Valid Reasons.

He says only take one out IF it means you are then paying less overall (those considering secure loans for new borrowing with heavy debts should simply not do it.)

SO the key aim here he says specifically on any home loan for DEBT CONSOLIDATION (if now chosen above a personal loan route as he's recommended) - is to cut those overall interest costs of any existing hefty debts into one big payment, over a shortest time period & importantly NOT start borrowing even more.

BUT then get rid ASAP eg; bad credit loans (Whether that is on one debt or multiple debts such as loans, credit cards and overdrafts AND pay it all off as quickly as possible).

OR Martin says if it's Secured Loans for HOME IMPROVEMENTS ...Then Ideally if it means 'Adding Value to Your Home.' eg; secured loans for a new kitchen or extension. Planning carefully that your home improvement loan money - will realistically increase the value of your property.

Therefore as a general rule of thumb, Money Saving Expert points out that YES you can borrow larger amounts with Secured Loans against your property than you can with a personal unsecured loan - Because it's less risky for the lenders.

But like any debt, potentially riskier for the borrower if you don't make those regular payments or start to borrow more again - causing future financial problems.

Ultimately Martin points out, only consider this second mortgage option - if you are sure you can make those ongoing monthly repayments, you've checked alternatives and you can minimize how long you borrow for, ensuring the interest doesn't rack up.

Money Saving Expert Best Secured Loans *Top Tips

Martin Lewis secured loan advice says that if you not going direct to lender 💯 100% you almost always need to speak to a secured loans finance broker, who will look to match you with a lender who can help you.

As this is always an advised process - naturally, if you've chosen to only go directly via one Lender (which MSE often add re financial matters - may not always be your optimal route here) as you're not shopping around the marketplace for the best advice, rates & deals.

Note: Also our brokers can sometimes access and get special finance deals on secured loans - unavailable off those high street lenders or you've going direct, having maybe seen an advertised rate - that's perhaps not applicable to your own circumstances.

Calculator - Secured Loan Finance Rates >>

[securedloan]

Given that - MSE says these now apply if you are considering getting a secured loan - whether that's for DEBT CONSOLIDATION Home Loan OR HOME IMPROVEMENTS. If so, then Martin has recommended in the past these 6 KEY STEPS to follow...

- Find out the Best Secured Loan Deal you could get (re-check if it's lower than your current interest rates on any debts)

- Get a grip on ALL existing debts first (list these all down on your ipad, computer, mobile or piece of paper)

- 'Debts Consolidation' - Only use loan to pay off higher interest debts (work backwards from highest to lowest interest rates v secured loan)

- 'Home Improvements' - Borrow the correct amount as needed (plan and budget carefully)

- Repay the Loan as quickly as possible & NOT take on more debt (check does the loan have early repayment charges)

- Many people repay secured loans - when they next Remortgage (provided the mortgage interest rate is lower than the secured loan rate - they usually are)

- He points out that IF you do have bad credit already, then you will probably find it hard to access those cheapest loans – and any that you can access are likely to be VERY expensive.

The Money Expert doesn't go into any other reasons why people may wish to get secured loans eg; those self employed needing finance for start-up business purposes & who maybe unable to access an unsecured loan for larger amounts.

As getting any secured loan is always an advised process, this means Martin says you will need to therefore speak with either a broker to shop around the market. Or if just going direct, via that lender’s mortgage adviser - before you get the loan anyway.

To sum up on these points discussed so far - Martin Lewis says for a few, secured loans are an option but not to be taken lightly. However, as he has pointed out people do take them out because :-

- They are easier to get than unsecured loans

- Don't need a perfect credit score to get one

- Higher borrowing is possible

- Reduces your monthly repayments

- But it does this by making you borrow for longer

- Interest rates maybe cheaper on secured vs unsecured loan

For Best Homeowner Loans Martin Lewis reminds you that there are 2 main ways to apply:-

- Via a Secured Loans Broker (who can shop around the market for your best finance deals & access those broker only rates)

- Directly via the Lender only (no shopping around)

As getting a secured loan is always an advised process, this means Martin says you will need to therefore speak with either a broker or the lender’s mortgage adviser - before you get the loan anyway.

Those best secured loan terms will be calculated MSE says by the following criteria....

1) Credit Score

2) Affordability Score (which, crucially, includes your income)

3) Market Conditions

Note: MSE says that IF you've taken out a debt consolidation with home loan, then the lenders usually will pay off directly your cards and loans ie; That means, in general, you won't be seeing much or all of that secured loan cash directly into your bank account at any time (eg; won't use that money to run up other debts back alongside it).

This applies for both your existing credit cards or loans; As such, you will probably need to have given the lender or broker details of these during your application.

Either way, we would add, don't forget it will show up on a credit search report.

Always ask the broker what their fees are upfront Martin advises. This can vary per secured loan comparison with lenders that they work with, and so ensures that you know what you are agreeing to. As Finance brokers we would agree with all this and maybe dependant on the amount of work involved.

MSE also has said in the past maybe go and seek advice from an IFA if looking into secured loans - rather than secured loan finance broker or secured loans direct lenders.

We are not sure whether this is the best route here re their second mortgage money saving expert pointers ... plus they may charge an advice fee upfront.

Many generalist IFA's are not specialists in this secured lending secured lending arena, instead perhaps concentrating their time on investments, savings & pensions instead.

So a secured loan he says may either help provide a way out of paying higher interest payments on all your debts. Or alternatively, it allows you to add to the value of your home (ALL provided you manage the loan correctly).

Please contact us - Best Broker Only - Secured Loan Finance Deals >>

Please contact us about Best Secured Loans Finance Deals >

MSE on Secured Loans against Property

Martin Lewis Secured Loans Guide 'Pros & Cons'

MAIN PROS of Secured Lending:

- Don't need a perfect credit score to get one: Secured loans are less risky to lenders, so they are more willing to lend to those with adverse credit histories.

- You can borrow more: Secured loans can be larger ie; £100,000's dependant on the equity value in your home & how much it's worth. Unsecured personal loans tend to be limited to amounts up to £25/£50,000.

- Borrow over a long period: Secured loans tend to last between 5/20 years. This means the monthly repayments can be lower than other forms of borrowing (although you'll likely repay more overall).

MAIN CONS of Secured Lending:

- Your home's at risk: The lender can apply for a court order to sell your home to get back any money it's owed, if you don't/can't pay the loan back on time.

- Pay extra fees: Secured loans have additional fees on top of the loan amount & interest eg; arrangement, valuation and broker fees plus early repayment charges.

- Expensive: Repayments over longer periods means you're likely to pay more interest overall compared to secured personal loans. MSE suggests you consider the total cost of borrowing, and what you want to buy: is it worth the amount PLUS the interest & fees you'll pay?

- Monthly amounts can change: Secured loans may have variable interest rates ie; amounts you pay each month can go up or down dependant on the lender's own policies & Bank of England base rates.

*Does getting a Secured Loan ever Save you Money?

MSE says Yes a Secured Loan can Save you Money ...BUT only IF you Managed it Correctly.

However, again they caveat this by saying personal loans often tend to be cheaper & a much less risky proposition. So they should always be your initial port of call if you are getting say a debt consolidation home loan ie; to repay your other debts.

Like for like, MSE say that secured loans are not always easy to compare. They can often have variable interest rates for some or all of their term.

These variable loan rates they rightly point out often shift both with UK base rates & also for the lenders' own commercial reasons (check the Lenders secured loan terms to see if or how your rates could potentially vary over time).

*APRC Explained

The rate wording you are looking out for is the 'APRC' or 'APR'. This stands for "Annual Percentage Rate for Comparison" APRC is a rate that encompasses both the interest you will be paying plus all the lender's fees (eg; any broker fees, valuation & valuation fees).

To make the point clearer, MSE describe clearly how much of a difference different APRC's can make to the cost of borrowing on an example £18,000 loan. Then how that secured loan may compare to paying credit card interest on that same amount. Money Saving Expert also have a useful credit card minimum repayments calculator to illustrate their points.

However, at the point of reviewing their article we could not confirm their latest APR rates as they vary. As such, we have reworked their tables to perhaps better re-illustrate their point & included also a personal loan unsecured example.

Example APRC | Credit Card Debts v Secured & Unsecured Loans

| Borrowing Types | Monthly Repayment | Borrowing Term | Total Interest (exc fees) | Savings (Interest & Payments) |

| Credit cards 21% (If variable rates) | £460pm (maximum you can afford) | 5 years & 3 mths | £10.5k | N/A |

| Secured loan 13.2% (If fixed for term) | £404pm | 5 years | £6.2k | |

| Secured loan 6.9% (If fixed for term) | £353pm | 5 years | £3.7k | |

| Unsecured loan 4.9% (If fixed for term) | £337pm | 5 years | £2.2k |

What's Average UK Family Debt?

According to The Money Charity, UK household debts continue to mount up and unfortunately from every direction.

Their concerns are that these reportable UK headline figures may only be the tip of the iceberg re cost of living crisis, according to the 2023 Money Statistics.

Nationally, overall bill debts for the average UK’s households has reached £22 billion estimate. They state that there is around 1 in 4 (27%) people stating they are behind on at least one of their bills.

Looking overall, their study shows the average uk family debt per household (including mortgages) stands at over £65,000 and per adult at over £34,000, the equivalent of around 100% of average earnings.

As such, you can see why some people are maybe searching online for - Does Martin Lewis recommend Secured Loans?

Second Mortgage Money Saving Expert Review 2026

* 'Martin Lewis Loans Eligibility' for Home Owners?

Check Martin Lewis loans eligibility for homeowners, using their Money Saving Expert Credit Scores guide helps and lets you see typically what lenders are looking for.

If getting a loan is your choice, then at a minimum you'll need:

- Identification documents proof (money laundering)

- Confirmation of home address (money laundering)

- Payslips or SA302's if self employed (lender checks affordability)

- Recent bank statements (lender checks affordability)

- Credit risk checks (lender checks if good or bad credit risk)

*How do Lenders decide whether or not to lend to you?

Uk lenders use the your information given in your application form about your overall financial situation and income. The information it then gets on you from a credit check will then decide if it wants to lend to you.

Making a loan application will leave a mark on your credit report. So, even if you are unfortunately declined this could then impact your ability to get a loan or other credit in future via another lender.

Essentially, the information & documentation you need re 'Martin Lewis loan eligibility' would point out (to get any secured loan or unsecured personal loan approval), is very similar to what you may need to apply for a mortgage.

Martin Lewis on Types of Secured Loans?

As you maybe aware, there are several types of secured loans available, which are all borrowing against your property (but some lenders do accept other high-value asset types too).

- Debt Consolidation loans - Martin Lewis discussed only aiming for this secured loan type IF it saves you & to lower debt interest rates

- Equity Release - Martin Lewis on equity release says its for those struggling for cash or want a more comfortable retirement

- 2nd Charge Mortgage - Martin Lewis means a loan against property via a different lender than a main mortgage

- Bridging Loans - Martin Lewis points out most commonly used to raise finance short term & 'bridge the gap' when buying property

- Home Equity loans - Martin Lewis says people do this for various reasons to maybe raise a deposit to buy a 2nd home

- Home Improvement loans - Martin Lewis only recommends you borrow for home improvements IF it add values to your home

Martin Lewis sums up here on secured loan types by saying, that if what you are borrowing the money for may possibly not add any value to your home, then NEVER secure any borrowing on your home.

So that's his thoughts on Home Improvement Loans - which reasons it's adding value into your home. But what about a homeowner consolidation loans?

Well if it's for Loans for Debt Consolidation alone - He says the key aim here is always to cut those overall high interest costs on your hefty debts.... Then get rid ASAP.

Ultimately, then avoid borrowing more afterwards Martin comments - otherwise your financial situation may worsen & by running up further debts again.

MSE points out your credit history (good or bad) will thus determine the interest rate paid on that secured loan deal.

As brokers, please note upon applying - you must tell the Providers truthfully what the reason for the secured loan actually is.

For example, if you say to them it's for Home Improvements ....but really it's Homeowner consolidation loans - the Providers will clearly see off your credit record what's owing and to whom.

So don't lie because they may approve refinancing of your current debts more easily - than letting you get further into debt.

Plus they could ask to see quotes for whatever building works you are doing on your home or queried at a RCIS valuation on your property.

As whole market finance brokers all credit status is considered:

So please enquire re: home loan for debt consolidation > | loans for home improvements >

*Secured Loan Martin Lewis asks Easier to Get?

- Martin Lewis on secured loans notes they can sometimes be easier to get than personal unsecured loans in their review

- We would disagree to some extent, as MSE does not answer the fact that 'easier' to get, does not mean 'quicker' to get

- The reason he puts is simply because you are putting up your home or business as security for the loan

- As brokers we would say that the initial lending process is typically abit longer at 2-4 weeks because it will involve legal charges being applied

- Also your home will need to be surveyed as suitable for the loan against property - so we recommend you check everything is in order for that important visit

*'Martin Lewis Credit Score Check' Tips?

Martin Lewis credit score check observes that when you apply for any loan secured or not, the lenders will look at your existing credit report at one or more of the UK's three main credit reference agencies (before deciding to lend).

Each credit reference agency has data on any of your recent applications, existing credit accounts and how much you owe. Then more importantly, whether or not you have repaid other credit on time.

MSE says the Lenders then use all this information to try to predict your future finance repayment status. Then, each time you apply for a new loan, it will be marked up on your credit file.

Use their free MSE Martin Lewis credit checker report as a useful tool to also find out where you are now in 2026 credit status terms.

*How do they calculate the Interest Rate?

MonetSavingExpert say that if you have now decided a secured loan is still right for you, you naturally need to know how much you could end up repaying each month & in total.

Work out your maximum realistic monthly amount you can afford monthly (their Budget Planner can help).

Underestimate = takes you longer to repay & costing more interest. Overestimate = overstretch yourself or risk your home. Careful planning is crucial.

However, how much secured loans money saving expert say could cost you, will depend on the interest rate you get from the Lenders.

Money Saving Expert useful & free how to check your credit reports, will see how lenders might see you.

Your secured loan interest rate can vary depending on these 4 factors:

- How much you borrow (Borrow as little as possible. Never borrow more than you need. Pay it all off as quickly as possible)

- How long you borrow over (Try to minimise how long you borrow for. Longer loans may have smaller repayments, but overall you are charged more interest)

- Your credit history files (Shows how good (or bad) your past credit records. Long history of full payments made on time = likely get lower interest rate)

- Your home equity (Loan to value LTV = difference between your property value & any mortgage amounts owing. Higher LTV = may get lower interest rate)

Generally on Martin Lewis best secured loans rate deals available, says these can vary by as much as 10% APR. These will all depends on those 4 factors above.

Always make sure you compare total costs, and then try to find the cheapest secured loan you can get he suggests.

For example; You may need to raise money towards paying for a big expensive Family Wedding (which MSE says the average cost is £23,250).

*Can I repay the Secured Loan earlier?

- YES you often can pay off your loan and repay it earlier

- BUT there are also often "early exit repayment charges" associated with doing this

- For loans of upto < £25,000, early repayment charges are now legally restricted to only 2 months' worth of loan interest

- Yet larger amounts they currently have no maximum limit

- Their penalties can be much heftier

- Many large loans have big early settlement figures of up to 6 months interest for the initial few years

- Then exit fees on a sliding scale after this

He suggests that you may wish to then talk to your main mortgage lender (or a mortgage broker) to see if you can borrow via that route ie; remortgage to clear the secured loan.

Elsewhere on their website, they also comment that a good mortgage broker MSE says maybe sometimes worth their weight in gold here if unsure & shopping around.

*Martin Lewis Loan Eligibility Calculator?

So they say before jumping in, consider using their MSE Martin Lewis loan eligibility calculator. It will allow you to check how likely you are to get any loans, without affecting your ability to get credit in the future.

It lets you potentially check which loan types you are most likely to be accepted for. Their quick 2 minute loan eligibility calculator they say uses a ‘soft search’ to find out your acceptance chances.

As such, unlike actually applying, MSE says it does not impact your credit score. Being brokers, we think this is a good first step if taking any type of borrowing finance is your chosen route here.

*Un Secured Loans Calculator UK

You may find it helpful if comparing loan terms their MSE Un Secured Loans Calculator UK loans tools useful here also ie; those you are more likely to be accepted for so protecting your credit score.

Homeowner Loans Martin Lewis Review (2026)

*What happens if you miss a Secured Loan repayment?

If you miss any loan repayment, secured or not then you could be charged extra interest or fees by your lenders, which can then increase the overall cost of borrowing.

When you have a secured loan Martin Lewis says continued missed regular payments could then put your house at risk as well...hence Martin Lewis second mortgage view.

Should you continue to miss secured loan repayments, your lender will then also report it to UK credit referencing agencies. This may then impact your main 1st mortgage

It will go onto your credit files MSE claims it's currently for 6 years, potentially impacting your chances of being accepted for other credit in that time (eg; other loans, credit cards or mortgages).

Finally...Don't forget Home Loans Insurance?

One of things MSE don't mention in their 'secured loans money saving expert' article...is also considering life insurance for home loans? Whether that is protection for life insurance, critical illness or income protection Martin Lewis reviews.

As life insurance brokers comparing the average cost of uk life insurance also, we were surprised by this omission whether term vs whole of life policy.

MSE do stress in their review that you could lose your home with any secured borrowing, whether that is a home owner loan or the mortgage.

The correct insurance could ensure that if you or partner died or were critically ill, then the secured loan debts could be repaid also. Ensure that the loan protection insurance plan is placed into trust to avoid both inheritance tax & probate.

You could also choose seperate income protection if off work through an accident or sickness, to help fully cover the existing mortgage plus the new secured loan?

The various secure home loan lenders may also offer you their loan protection ASU accident,sickness & unemployment cover. So whatever age you are...in your 40's, 50's or over 60 life insurance should be considered to help protect your home loan risk.

State retirement ages for both men & women is now over 65 - so also consider your secured loan insurance once fully retired on a pension.

For more information on the Money Saving Expert thoughts about getting suitable mortgage protection cover, check out our broker Martin's money tips MSE on Life Insurance review also.

Conclusion: Martin Lewis on Secured Loans

Well as brokers we found their various secured loans on property review & general thoughts here very useful.

So if you have not gathered by now re MSE views here after reading this article review upon their general opinions...Martin Lewis loans advice overall is only borrow IF you need to, you have Budgeted for it AND you are sure you can Repay.

Putting your debts onto a lower mortgage rate Martin Lewis comments sounds sensible....but could also actually end up costing more they say, risking your home, or even putting you in DREADED negative equity.

Whether the additional borrowing's is to pay off your debts or home improvements for a brand new kitchen or property extension

MSE says your using your home and borrowing against should not necessarily be your first port of call ie; Try Alternatives.

The problem is not that it is wrong per se, but the issue Martin Lewis remarks is that many people may see it as a 'one stop no-brainer solution'...

Money Saving Expert 'Martin Lewis Loans' Secured v Unsecured Personal Loans recommends therefore these main tips...

- Check First if a Loan is Right for You: Only borrow if it is for something you need to do, and you can afford those repayments

- If in Doubt, DON'T Borrow: And if you are struggling with debt, read MSE Debt help guide

- Borrow as Little as Possible. Repay as Quickly as Possible: It is cheaper as you may pay less overall

- Credit Cards could be Cheaper: 0% money transfer & 0% spending cards may undercut some loans for smaller amounts

So, only he says secured loans & second mortgages should they be considered as a last resort for these 2 reasons.....only to consolidate debts & only if it means overall you are paying less for your debts. OR home improvements if it then ideally adds value onto your property.

As brokers we would say that consider you are not clearing your debts, just re-organizing them - to ensure that they are hopefully all cleared in the future.

MSE also suggests here best loans money saving expert utilising websites via say Loan.co.uk or any special deals via moneysupermarket etc;

However, he does point out to be aware that some finance broker fees on some secured loans can sometimes be as high as 12.5%. This could mean you may be paying £1000's in fees & which adds even more cost to your existing debt.

So, whether you wish to go direct, having read the secured loans money saving expert guidance overview. Or instead, prefer to speak to our professional brokers. You pay’s your money & takes your choice.

Compare Best Brokers Secured Loan Deals

![]() Latest Market Rates + Access Best Lenders + Exclusive Broker Deals

Latest Market Rates + Access Best Lenders + Exclusive Broker Deals

UK Secured Loans Broker Finance Enquiry

Borrow from £10k / £3m+

Borrow from £10k / £3m+

NOTE: YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE OR ANY OTHER DEBTS SECURED ON IT.

*Compare Whole Market Broker Deals - Best Secured Loans - via Leading 2nd Charge Lenders - All Credit Status Considered

| INTER BRIDGE | EQUI FINANCE | MT FINANCE |

| PEPPER MONEY | TANDEM BANK | PRECISE MORTGAGE |

| UNITED TRUST BANK | SPRING FINANCE | MAST HAVEN FINANCE |

| TOGETHER MONEY | SHAW BROOK BANK | SELINA FINANCE |

Myself

Myself My

My My Income

My Income

'There is...ONLY 1 YOU'

'There is...ONLY 1 YOU'